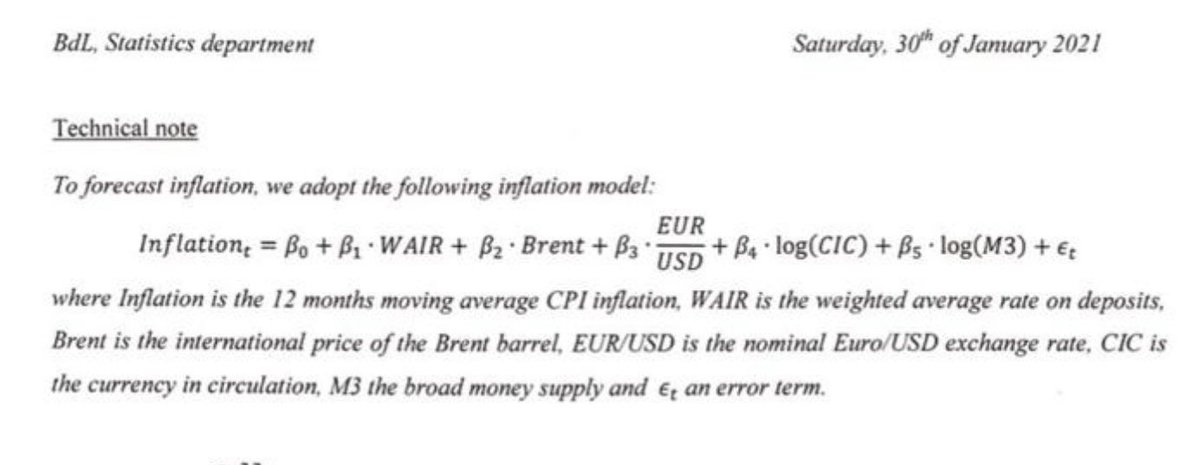

1/ This is the “inflation forecast” formula used by BDL to convince donor countries to sell dollars to it for 6,240 LBP and not higher. As @AndyKhalil1 says below, the methodology is flawed. Some observations from the two of us: https://twitter.com/andykhalil1/status/1357764762088701954

2/ You can’t forecast a time series like inflation using a linear regression model using variables that are non-stationary, meaning they exhibit trends or cycles or any such variability in the distribution over time. You have to make adjustments which this model doesn’t do.

3/ We had a clear structural shift in the Lebanese economy in 2019/2020. The historical data is not at all reflective of the reality now. You have to adjust your model to take this into account. This model doesn’t.

4/ Our inflation is caused by depreciation of the LBP. This is not properly reflected in this model. Dollar inflows, capital controls, economic collapse, volatility of money, all of these affect the exchange rate and thus inflation.

5/ M3 and CIC, two variables used in this model, are highly correlated. You can’t use two highly correlated variables in a linear regression otherwise the model can break. *Independent* variables in an OLS model have to be independent otherwise the regression is wrong.

6/ M3.... what exchange rate is being used? 1500? 9000? This matters. If they’re using 1500 it’s another flaw, a relic of pre crisis period.

7/ USD/EUR exchange rate is another variable being used. This suggests that this “model” was developed pre crisis when there was a peg still. But it was not updated to reflect the changing reality today.

8/ How is the fact that some goods are still subsidized at 1500/3900 but for many this rate is not available as of last year taken into account in the data/model? It’s not, but it is hugely important because it’s fundamental to much of the inflation we’ve experienced.

9/ This is not a real inflation forecast model. Its results cannot be relied upon and should not be used to make any policy decisions.

Read on Twitter

Read on Twitter