Assessing the historical performance of some of the global indices available on the @JSE_Group (in ZAR!)

[A thread]

@MSCI_Inc @iShares @blackrock @Kensho

[A thread]

@MSCI_Inc @iShares @blackrock @Kensho

Because most ETF's on the JSE are only a couple of years old, we only have a limited view of the performance of the underlying index, especially in ZAR terms!

I went digging to to see what their performance would have looked like over the longer term.

I went digging to to see what their performance would have looked like over the longer term.

The current strong #ZAR makes a good case for investing in some of these as part of your share portfolio, or in your #TFSA

These are of course just my opinions, and not investment advice

These are of course just my opinions, and not investment advice

Emerging Markets are looking for a strong recovery post-Covid

Look at the #STXEMG ETF and the new ESG-friendly version #STXEME from @SATRIX_SA

For a low cost S&P500 ETF, look at their #STX500, or otherwise the @sygnia #SYG500 ETF (just remember to reinvest your dividends!)

Look at the #STXEMG ETF and the new ESG-friendly version #STXEME from @SATRIX_SA

For a low cost S&P500 ETF, look at their #STX500, or otherwise the @sygnia #SYG500 ETF (just remember to reinvest your dividends!)

"Big Tech" is soooo much bigger than the Top 500 companies in the US.

Look at #ETF5IT from @1nvest_SA for pure exposure to these 70-odd tech companies.

The #STXNDX from @SATRIX_SA will give you exposure to the one of the best performing indexes in the world - the @Nasdaq 100

Look at #ETF5IT from @1nvest_SA for pure exposure to these 70-odd tech companies.

The #STXNDX from @SATRIX_SA will give you exposure to the one of the best performing indexes in the world - the @Nasdaq 100

The one to look for nowadays is the @sygnia 4th Industrial Revolution ETF #SYG4IR

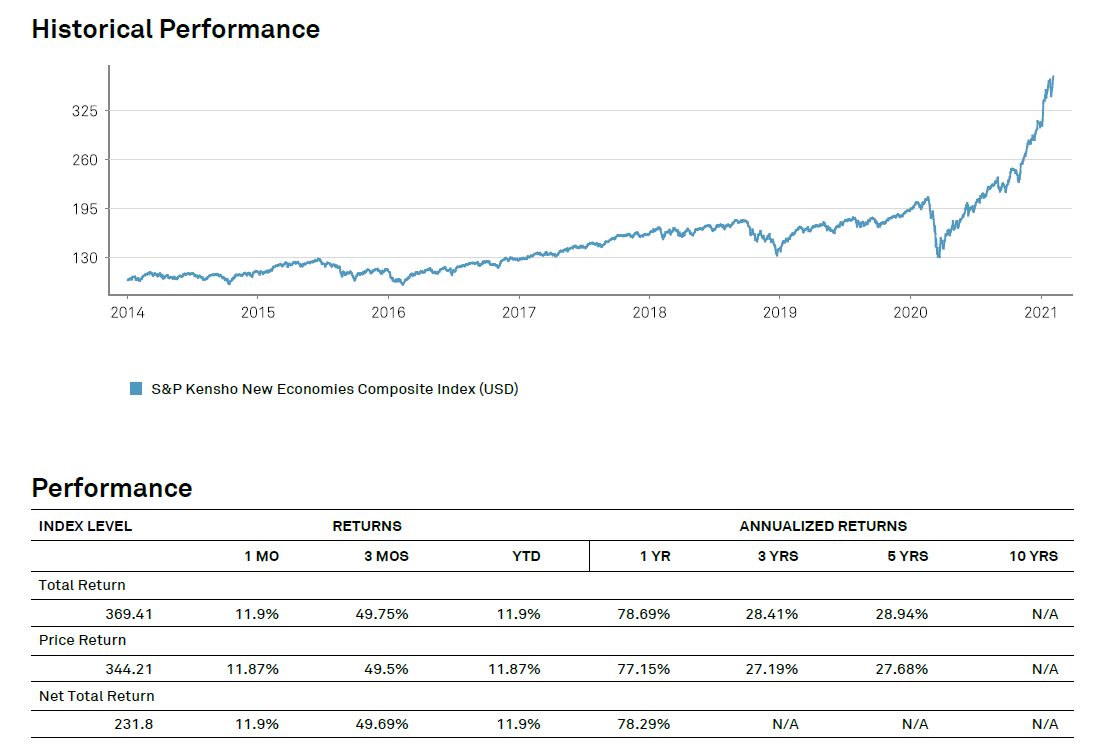

The underlying @Kensho composite index uses NLP to identify disruptive companies involved in "New Economies"

(continues...)

The underlying @Kensho composite index uses NLP to identify disruptive companies involved in "New Economies"

(continues...)

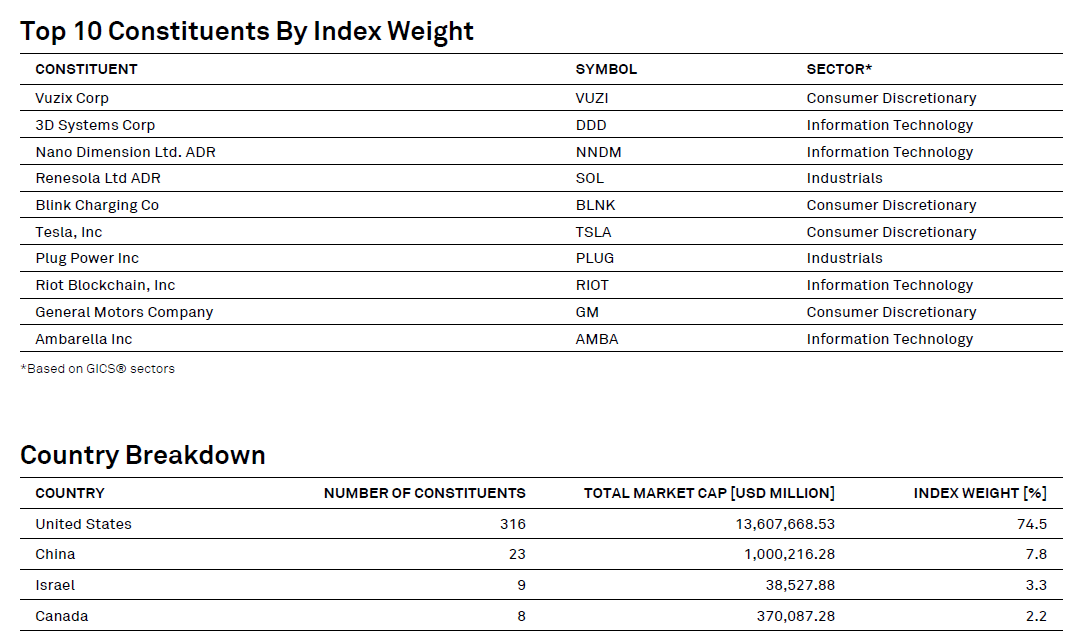

The index consists of about 400 companies, mostly out of the US, and has had explosive growth since Covid struck the world.

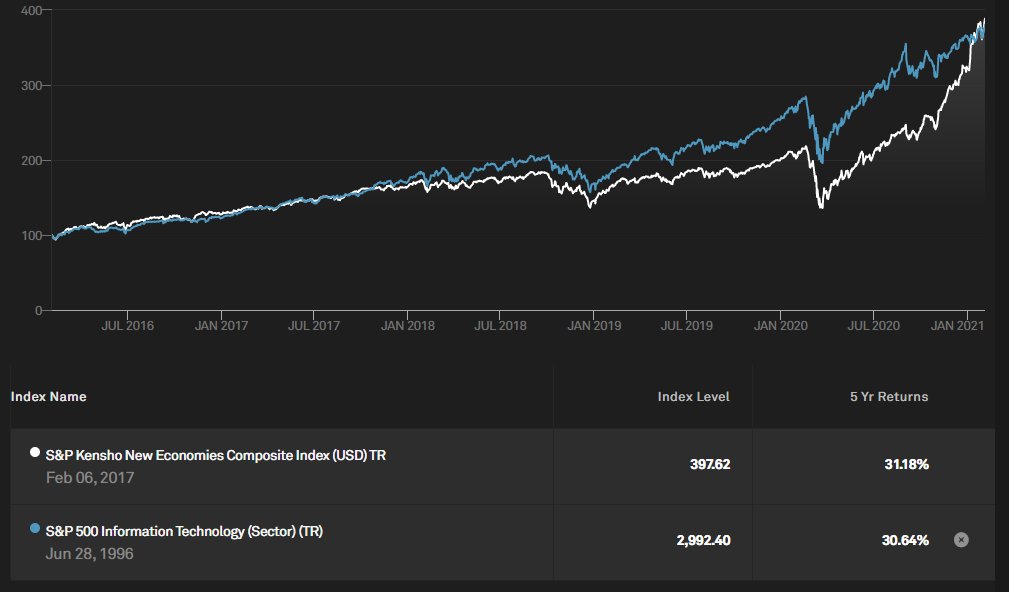

The index only launched in 2017, but "back tested" data pitches it against the Information Technology sector described earlier.

(continues...)

The index only launched in 2017, but "back tested" data pitches it against the Information Technology sector described earlier.

(continues...)

It's annual return is a staggering 31% in dollar terms, which will be slightly more in ZAR.

In a 5 year view, the total return is about 288%, compared to the powerhouse @Nasdaq's 255%

I'll be loading up on some #SYG4IR in my #tfsa at @EasyEquities

Cheers,

Dad

In a 5 year view, the total return is about 288%, compared to the powerhouse @Nasdaq's 255%

I'll be loading up on some #SYG4IR in my #tfsa at @EasyEquities

Cheers,

Dad

PS: Commodities are looking really interesting.

Look at @AbsaSouthAfrica's NewGold ETF #GLD to get some bullion.

Silver is only available as an ETN at #NEWSLV (make sure you understand the product)

Unfortunately neither of these are allowed in your Tax Free Savings Account

Look at @AbsaSouthAfrica's NewGold ETF #GLD to get some bullion.

Silver is only available as an ETN at #NEWSLV (make sure you understand the product)

Unfortunately neither of these are allowed in your Tax Free Savings Account

@threader_app compile

Read on Twitter

Read on Twitter