Lots of questions about #RomneyPlan. What exactly happens to the #EITC? #Romney's plan eliminates Head of Household status, so doesn't that equate to a tax increase for single parent households? And what about those who are not parents but file HOH?

Based on info available, I made hypothetical estimates of what #RomneyPlan could do vs. current law vs. Biden's expansion of #CTC. Again, need more info, but result is that many low-wage workers would experience a tax increase under Romney's plan.

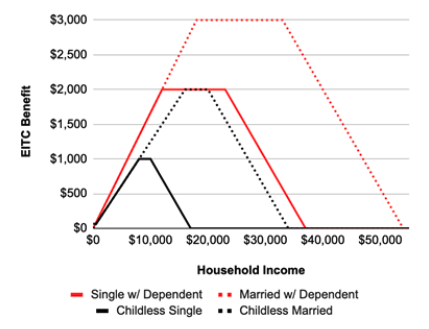

Currently, this is what we know about the proposed new #EITC under the Romney Plan. It is simplified, and I am assuming that this means that a single parent with children would receive a maximum $2,000 EITC.

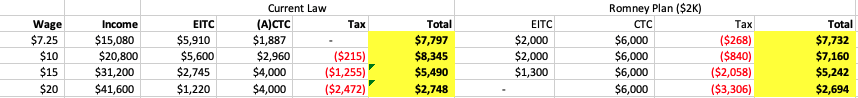

Four hypothetical situations based on full-time employment for a parent with two children. Under Romney's plan, minimum wage worker has a slight reduction in their EITC/CTC combined benefit, $10/hour wage worker fair pretty bad - they lose $1,185.

We don't currently have the actual phase-out of the EITC under Romney's plan, so I estimated a generous $1,300 EITC for a worker making a $15/hour wage. Also, because Romney's plan eliminates the HOH status, notice the tax increase. Workers with $15 and $20 wages fair worse off.

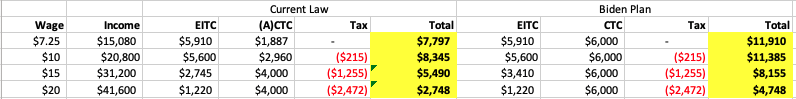

Meanwhile, under #Biden's #CTC expansion, all of these workers are much better off. Min wage workers are ahead by $4,113. Even workers making $20/hour are ahead by $2,000. Biden's plan does a lot of improve the economic well-being of working-class single parent families.

Yet, Biden's plan is temporary and currently is not paired with a source for revenue increase. Also, Romney's plan, because it is administered through the SSA may be more likely to reach parents with very low-wage earnings. Yet, how many more is an empirical question.

Lastly, a much less discussed issue is tax offsets, for debts, particularly student loans. While Treasury can garnish Social Security, it is typically a percentage. Tax offsets typically take the full tax refund. This could be changed in either proposal, but warrants attention.

Read on Twitter

Read on Twitter