Chicago Mercantile Exchange (CME) is a function of the global CME Group holding that became the first in North America(and 2nd in the world) to offer futures contracts.

Chicago Mercantile Exchange (CME) is a function of the global CME Group holding that became the first in North America(and 2nd in the world) to offer futures contracts.

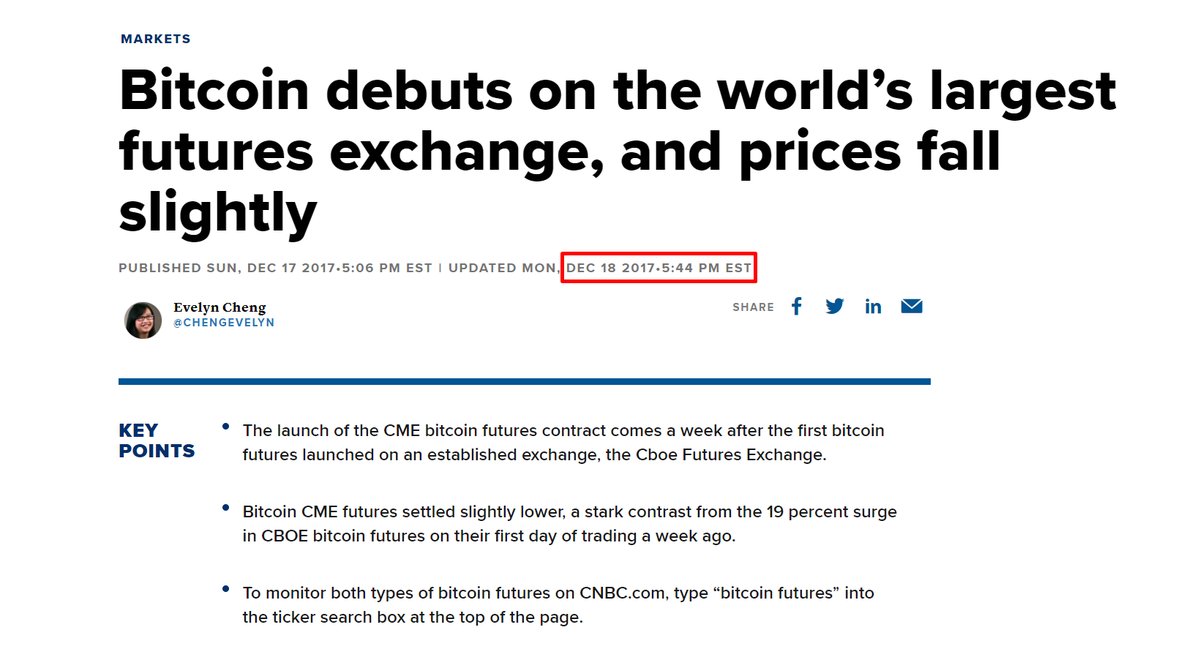

In 2017 CME began using cryptocurrency as an asset. The first Bitcoin futures were launched when the market was at its peak — #Bitcoin  has reached $20 000 on the 17th of December 2017.

has reached $20 000 on the 17th of December 2017.

has reached $20 000 on the 17th of December 2017.

has reached $20 000 on the 17th of December 2017.

The launch announcement poured gasoline into the fire, creating a blaze. Ever since that moment, Bitcoin continued to grow and find new historical maxima.

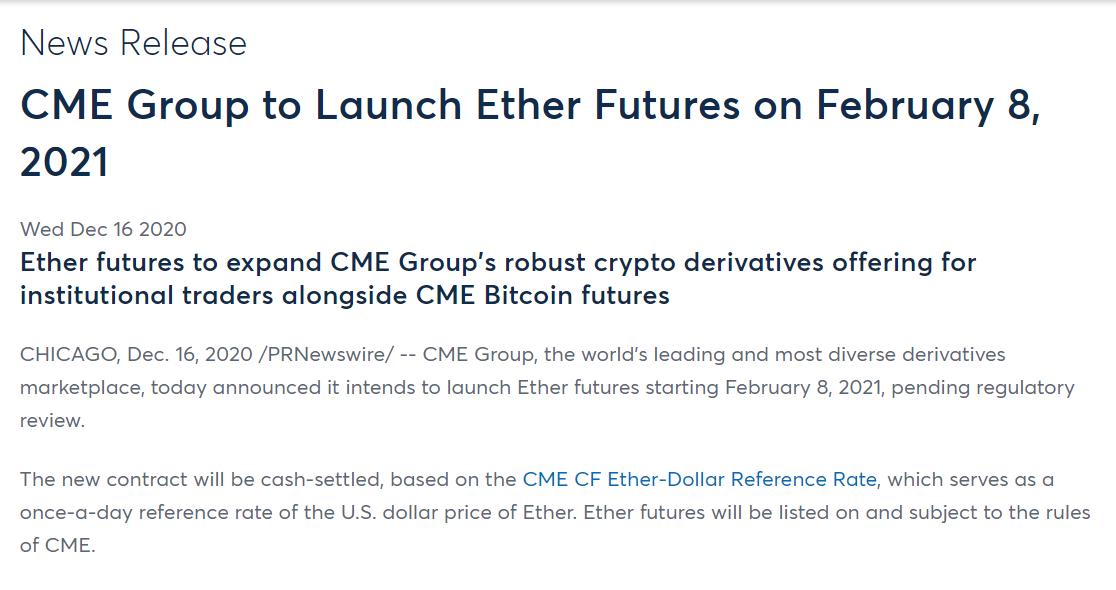

Three years later they are launching #Ethereum-futures.

This occasion is quite important in the industry, because CME is seen as one of the key players on the cryptocurrency market, able to manipulate the price of Bitcoin by means of using the large capital happily provided by investors. And now they will have their hands on Ethereum

According to the CME website, a single contract is priced at 50 ETH, meaning that at the current rates investors would have to pay a hefty sum of $86 000.

The head of CME Group @TimMcCourtCME states that the addition of futures to Ethereum will provide the clientele with a valuable instrument for trading and hedging of investments.

And, of course, news like that would not go unnoticed and the rate of the asset grew by 15% in a single day. This momentum had no intention of dissipating and now the asset is up by ~200%.

However, if we were to remember the Bitcoin situation, the rate in a similar fashion showed promising growth from the moment of the CME futures launch announcement in the end of October 2017.

Fueled by these news, Bitcoin was showing dynamic growth in anticipation of large hedge funds and institutional investors coming to the market and inflating another bubble.

Bitcoin capitalization has increased from $106 billion to $330 billion in just one and a half months. But then the day came when futures contract BTC trading on CME began and a prolonged fall followed.

Taking this into account, today I will place hard classical stop-losses on all positions in BE and on the weekend I will exit all of my positions in a 50/50 split of BTC/USD.

Read on Twitter

Read on Twitter