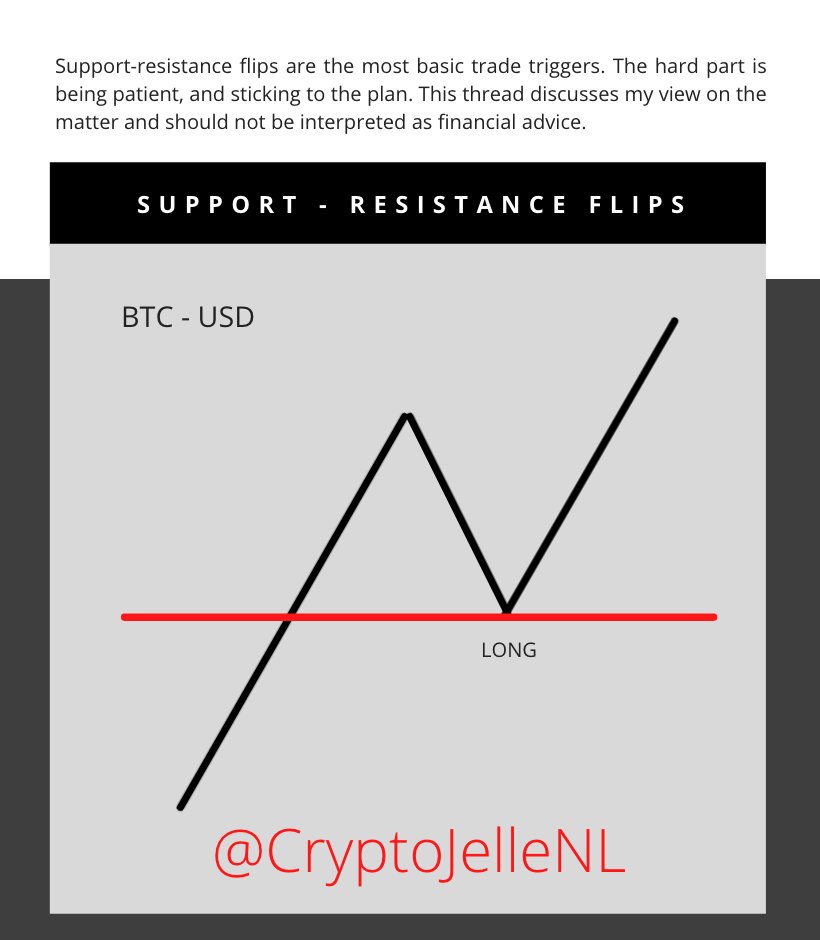

Here’s a little thread on my bread and butter in trading $ETH and $BTC. I base 80% of my trades around simple S/R flips.

Many traders and investors on here use all kinds of complicated methods, I use a few horizontal lines.

Many traders and investors on here use all kinds of complicated methods, I use a few horizontal lines.

In the past year, this has worked like a charm. The finest example of this happened in September 2020. The red zone acted as resistance for months on end until it finally gave in at the end of July.

As soon as a level breaks, your job is to look for retests into that level.

As soon as a level breaks, your job is to look for retests into that level.

In this case, the retest only came after 38 days of patience. In my opinion, it is the wait that makes trading S/R flips hard.

When the retest came, many people seemed to have forgotten about this major level and ended up dumping their bags into support.

When the retest came, many people seemed to have forgotten about this major level and ended up dumping their bags into support.

Another beautiful example of successful S/R flip trading is found in $XLM.

Resistances are broken and flipped support, on to the next one. Beautiful price action.

It requires patience, it requires attention, but the rewards are solid.

Resistances are broken and flipped support, on to the next one. Beautiful price action.

It requires patience, it requires attention, but the rewards are solid.

It's important to note levels can be violated before candle close, as long as they close above. I like to apply this concept on the higher timeframes, with bids quite uncomfortably deep below the level.

This way I buy the coins you panic sell, at a discount.

This way I buy the coins you panic sell, at a discount.

These retests occur across all timeframes and are more common than you think. The only problem is, this system doesn't work that well when assets enter price discovery.

(clearly demonstrated by BTC after the S/R flip)

(clearly demonstrated by BTC after the S/R flip)

So now what?

Well. Many USD pairs are in price discovery, but we still have $BTC and $ETH pairs to trade. This might be unpopular, but I've been printing money with the S/R flip on $ETHBTC.

Put short, the S/R flip still works.

Well. Many USD pairs are in price discovery, but we still have $BTC and $ETH pairs to trade. This might be unpopular, but I've been printing money with the S/R flip on $ETHBTC.

Put short, the S/R flip still works.

My point is, don't overcomplicate your analysis. I frequently see despair, fear and panic selling into support because you people forget the most basic concept. (Most recently at 30K)

Please, for the love of God. Stop. Shorting. Support. Or don't.

I'll buy your bags.

Please, for the love of God. Stop. Shorting. Support. Or don't.

I'll buy your bags.

Anyway, mark out those levels. If you're anything like me you'll have the key levels memorized in no time which makes things even easier.

Retests are for buying.

Don't forget.

Retests are for buying.

Don't forget.

Read on Twitter

Read on Twitter