2. Introduction

2.1. Sino Global Capital is excited to announce our investment in @MAPS_ME ( https://maps.me/ ). In this investment thesis, we will share our thoughts on MAPS potential to bring huge traffic volume to the...

2.1. Sino Global Capital is excited to announce our investment in @MAPS_ME ( https://maps.me/ ). In this investment thesis, we will share our thoughts on MAPS potential to bring huge traffic volume to the...

...DeFi industry by building a DeFi ecosystem on their existing, widely used, infrastructure.

2.2. First, let’s look at tourism and mobile payments, key drivers in future adoption of the http://MAPS.me wallet.

2.2. First, let’s look at tourism and mobile payments, key drivers in future adoption of the http://MAPS.me wallet.

3. Tourism and Mobile Payments

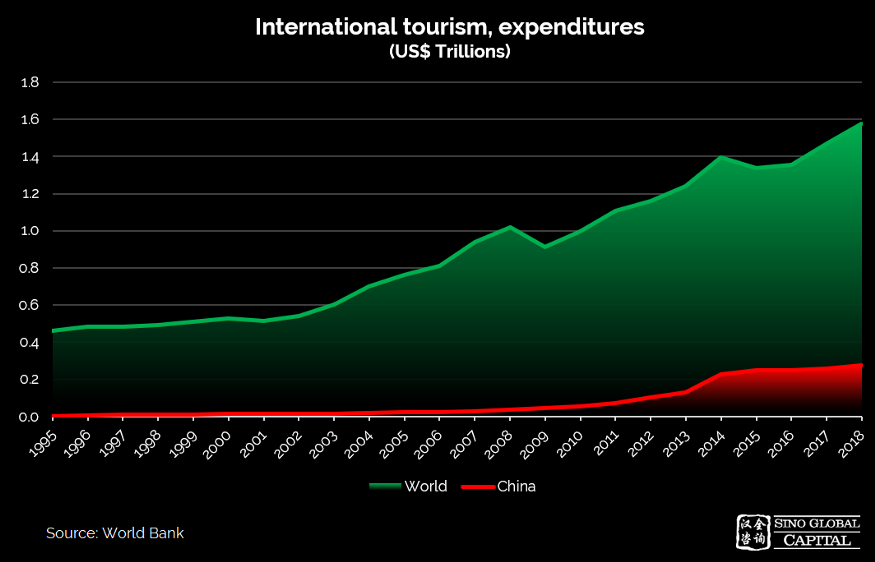

3.1. Pre-COVID, tourism saw a steady rise, with the Chinese middle class increasing their share of global international tourism expenditure.

3.1. Pre-COVID, tourism saw a steady rise, with the Chinese middle class increasing their share of global international tourism expenditure.

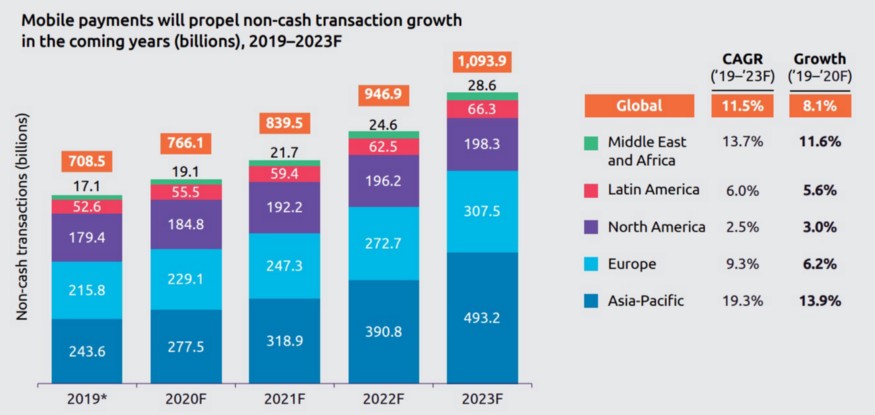

3.2. Post pandemic, global travel should return a little closer to normality and, over time, the growth trend should continue. This is also positive for Fintech companies, as mobile payments are also growing.

Source: Capgemini World Payments Report 2020 ( https://worldpaymentsreport.com/wp-content/uploads/sites/5/2020/10/World-Payments-Report-2020.pdf)

Source: Capgemini World Payments Report 2020 ( https://worldpaymentsreport.com/wp-content/uploads/sites/5/2020/10/World-Payments-Report-2020.pdf)

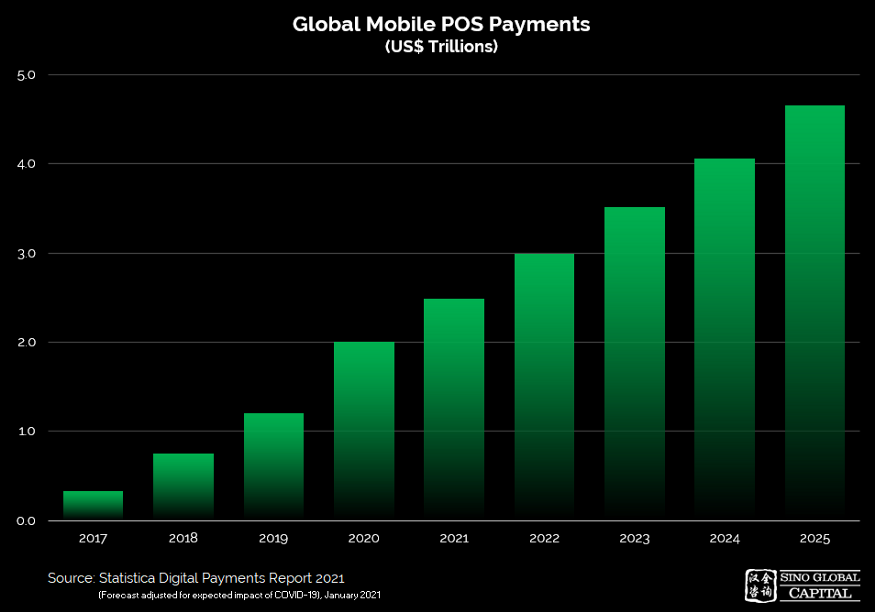

3.3. Mobile point-of-sale (POS) volume is also increasing which is useful for tourists using virtual credit cards and mobile wallets linked to their home bank accounts.

3.4. How will DeFi disrupt traditional mobile payments?

3.4. How will DeFi disrupt traditional mobile payments?

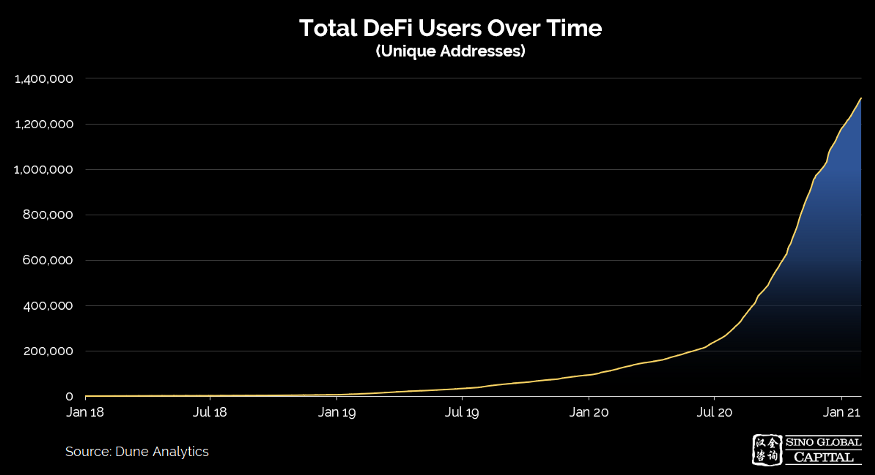

4. DeFi ecosystem growth

4.1. The DeFi ecosystem has been growing exponentially over the past year, leading to gradual evolution and maturity of product offerings, platforms and protocols. The infrastructure necessary to disrupt the traditional financial landscape is being...

4.1. The DeFi ecosystem has been growing exponentially over the past year, leading to gradual evolution and maturity of product offerings, platforms and protocols. The infrastructure necessary to disrupt the traditional financial landscape is being...

...built before our eyes. We are seeing a huge surge of interest for new DeFi protocols in various industries such as lending, insurance, derivatives, DEXes etc.

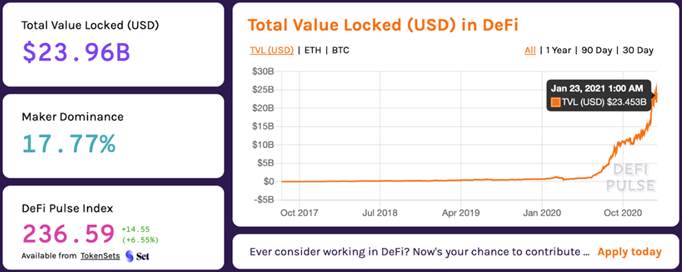

4.2. To illustrate this growth, we will review three key growth metrics: independent users, total value locked (TVL) and CEX vs DEX volume.

4.3. In Jan 2018, there were only a few hundred DeFi users recorded. Fast forward to Jan 2021 and that number has risen to almost 1.3M unique addresses. While a single user can create multiple addresses, the ~6,360x growth over a 3-year period is both astonishing and encouraging.

4.4. The total value locked (USD) on January 2, 2018 was $50.52M. We are currently (late January 2021) sitting on a total value locked amount of $23.45B. That’s a staggering growth of 46,317%. In other words, in...

...two years the money locked in DeFi, a proxy for usage and trust in decentralized financial applications, increased by a factor of 463.

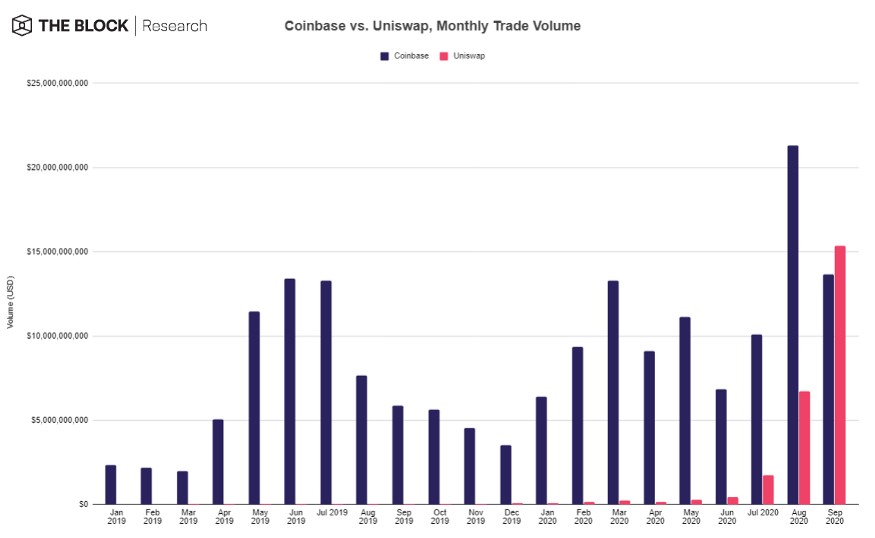

4.5. Another sign of a maturing DeFi industry and its appeal to a wider user base is the substantial increase in trading volume on DEXes such as Uniswap. In September 2020, Uniswap surpassed Coinbase in trading volume, recording...

...roughly $15.4 billion or ~65% of total DEX volume ($23.5 billion). The estimated trading volume for Coinbase in September 2020 was $13.6 billion.

4.6. Despite the growth of DeFi platforms and the increase in trading and TVL of decentralized alternatives to traditional finance, there is still plenty of room for improvement across speed, cost, UX/UI, etc. Lets look at traditional Fintech.

5. FinTech market

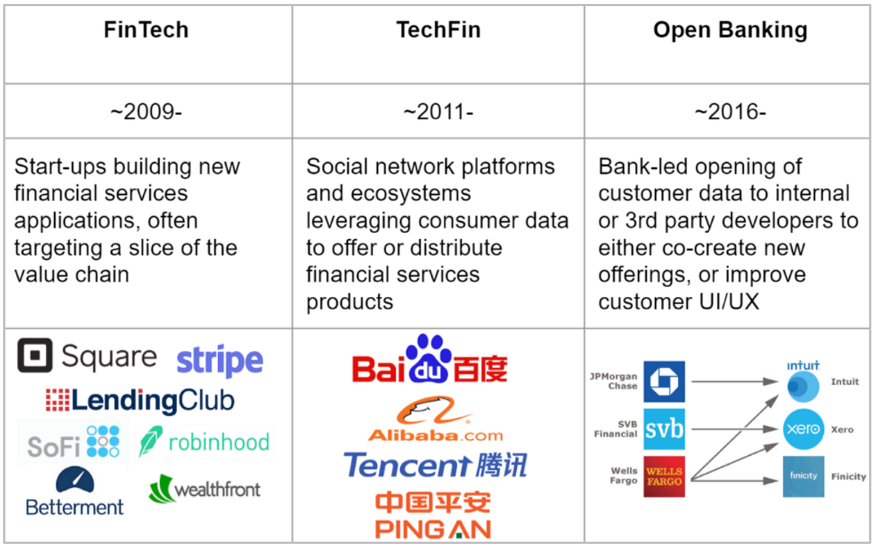

5.1. When framing the growth of DeFi, it is important to look at other forces disrupting trad. finance. Fintech companies are permeating throughout finance and new start-ups are entering the space to provide more effective and efficient financial solutions.

5.1. When framing the growth of DeFi, it is important to look at other forces disrupting trad. finance. Fintech companies are permeating throughout finance and new start-ups are entering the space to provide more effective and efficient financial solutions.

5.2. The Fintech community shares many of the same goals as DeFi, although decentralization is a key point of differentiation.

5.3. The increased popularity and adoption of Fintech solutions is a promising example for DeFi projects trying to bring their solutions to the mainstream. As mentioned above, DeFi and Fintech share some goals such as:

5.3.1. Banking the unbanked barrier to financial products and services - financial inclusion

5.3.2 Banking the unbanked

5.3.3. Providing the necessary alternatives to traditional finance and services

5.3.4. Providing the necessary alternatives to traditional finance

5.3.2 Banking the unbanked

5.3.3. Providing the necessary alternatives to traditional finance and services

5.3.4. Providing the necessary alternatives to traditional finance

5.4. If it is feasible to attract even a small fraction of Fintech users to DeFi, it will substantially boost the expansion of the DeFi movement.

6. Fintech evolving

6.1. Some numbers from the Fintech landscape:

6.1. Some numbers from the Fintech landscape:

6.1.1. In 2018, roughly 3 billion users across the globe accessed retail banking services through PCs, smartwatches, tablets and smartphones.

6.1.2. As retail users are already familiar with accessing and utilizing financial services via their digital devices, there is a huge opportunity to onboard some of these existing Fintech users to DeFi.

6.1.3. Another noteworthy finding is that 46% of customers exclusively use digital channels for personal banking. Improvements in banking services on online platforms eliminate the need to visit brick and mortar branches.

6.1.4. Fintech applications are popular among the younger generation in particular, mainly due to the rise of mobile payment alternatives.

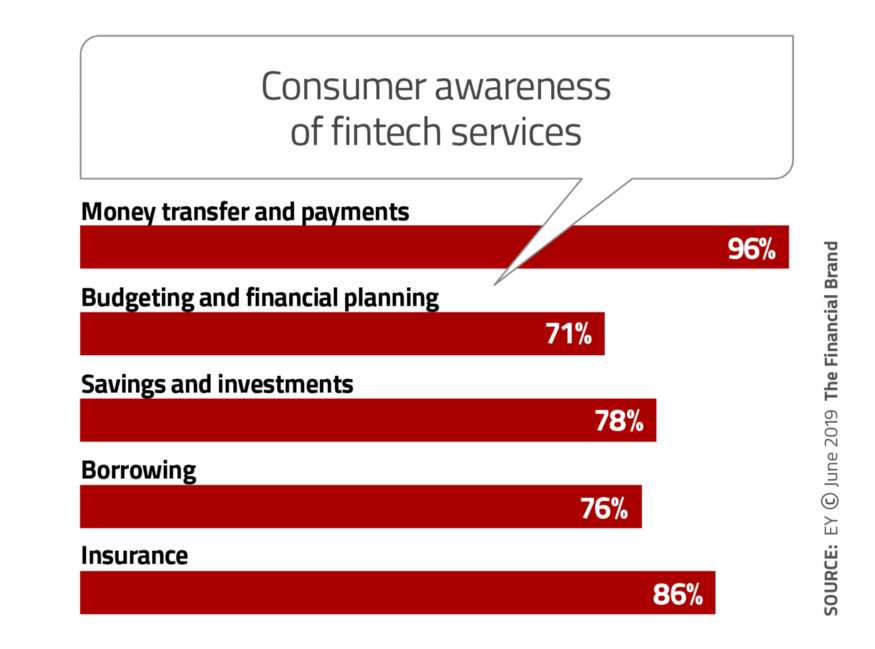

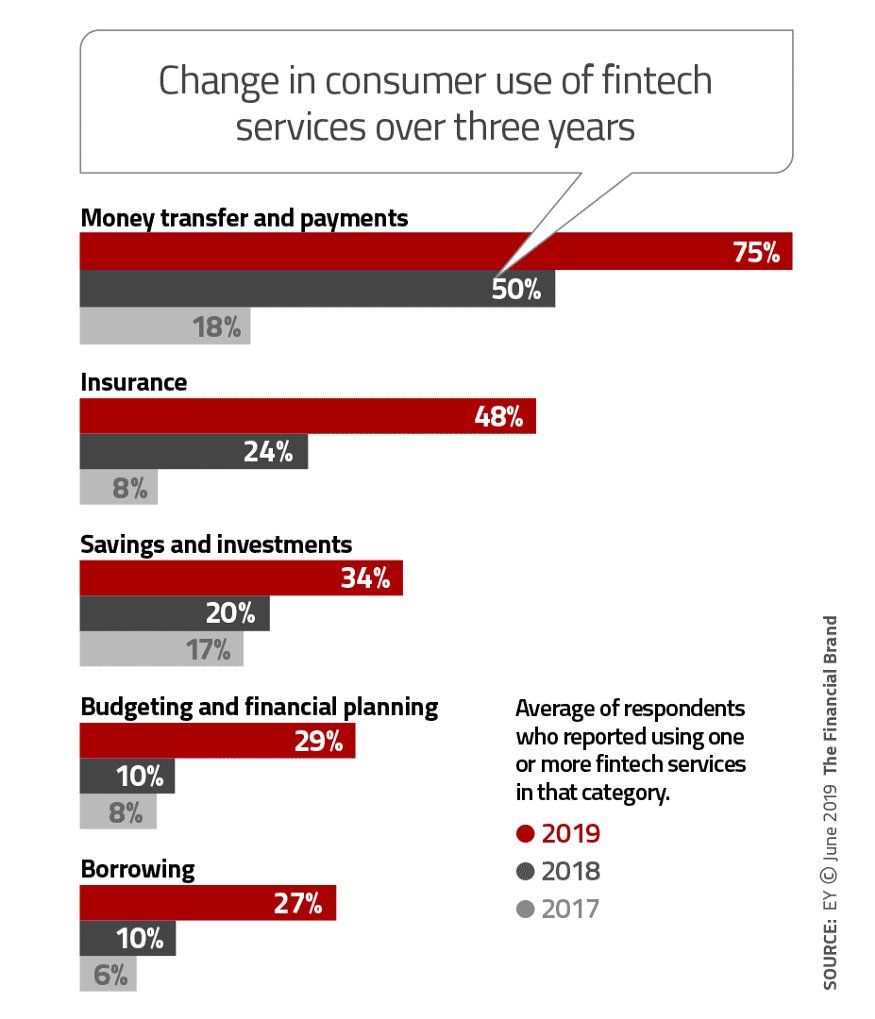

6.1.5. The consumer awareness of Fintech services is steadily increasing with 96% of respondents to an EY survey being aware of FT solutions in money transfers and payments. Remarkable is the high level of demand for insurance while savings and investments are also well-received:

6.1.6. This report goes on to outline the changes in awareness over time for each category from 2017 to 2019, clearly illustrating increasing awareness and likely usage in each:

6.1.7. For more info: https://thefinancialbrand.com/84474/consumer-fintechs-digital-banking-disrupter/

6.1.8. This shows how vital Fintech is becoming for mainstream users. By having this alternative, users have access to cheaper payment platforms, improved savings and investment strategies and diverse borrowing options.

6.2. As we have illustrated, the finance and Fintech industries are huge, with retail users looking for reliable financial alternatives. The majority of these users are not yet users of blockchain...

...or DeFi. However, if provided a differentiated experience and the opportunities that only cryptocurrencies and DeFi can offer, it is likely that new converts will be found.

6.3. This is where MAPS will be able to contribute to the onboarding of Fintech users into DeFi.

7.2. MAPS 2.0 can achieve global DeFi adoption as a Fintech mobile app, integrated with DeFi, bringing financial accessibility to 140 million users.

7.3. This navigation app with 9 years of history and a dedicated user base can fundamentally change how the mainstream interacts with finance. A new, innovative and enhanced wallet powered by Solana...

...will permit retail users to earn interest on their funds, exchange foreign currencies and transfer instantly and securely. MAPS 2.0 will enable cross border transactions in real-time.

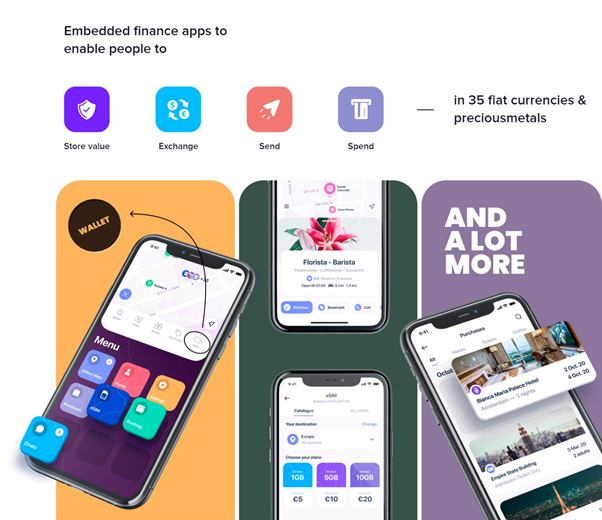

7.4. Let’s have a closer look at the services on MAPS 2.0:

7.4.1. Earning interest. Participants can have their funds flow to a borrow-lending protocol on the Solana blockchain, generating 8% in passive income.

7.4.1. Earning interest. Participants can have their funds flow to a borrow-lending protocol on the Solana blockchain, generating 8% in passive income.

7.4.2. Efficient FX. The http://Maps.me wallet can both hold and convert money across 35 currencies at the best rates and in a transparent way. Travelers no longer need to pay substantial fees for FX.

7.4.3. Direct payments. Pay merchants, hotels and restaurants directly. Users have the ability to get the best deals for hotels and restaurants, as well as pay merchants directly, with no hidden fees, from the MAPS wallet.

7.4.4. Real-time transfer. Send money to friends without the sky-high fees of traditional alternatives.

7.4.5. Trading services. In the future, the http://Maps.me wallet will enable trading services and offer investment opportunities; giving access to global markets, all powered by Serum DEX and Solana blockchain.

7.5. The http://Maps.me ecosystem will be powered by the MAPS utility token ( https://maps.me/token/ ). 100% of the generated net revenue will flow back to token holders. Aside from the token buy and burn...

...implementation, MAPS will serve as a loyalty program for users. MAPS users can stake MAPS to receive additional yield benefits.

7.6. Companies can utilize the MAPS token for advertisements to rank higher in search results.

7.7. Finally, every single MAPS token acts like a voting right, allowing token holders to partake in the governance system and have a voice in the development of the ecosystem.

7.7. Finally, every single MAPS token acts like a voting right, allowing token holders to partake in the governance system and have a voice in the development of the ecosystem.

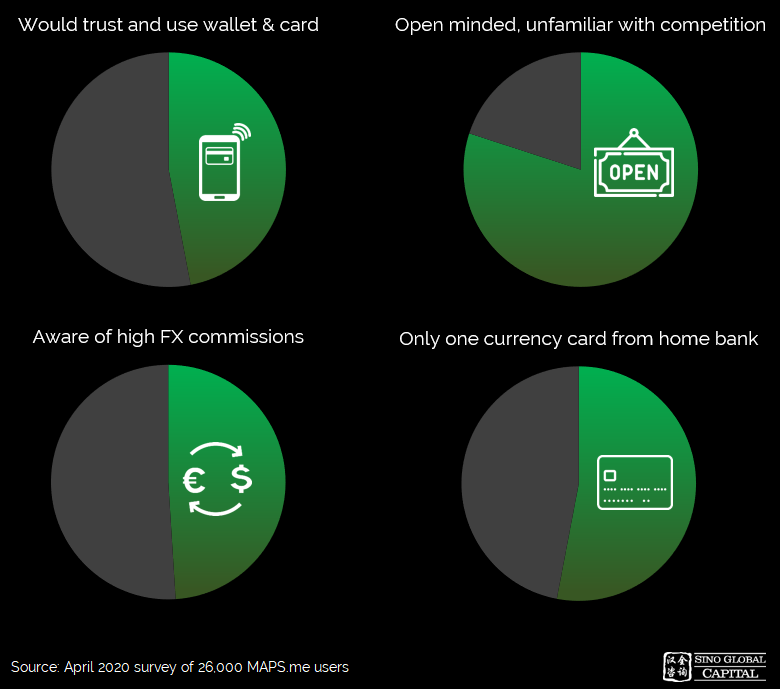

7.8. A survey of 26,000 http://Maps.me users conducted in April 2020 showed:

7.8.1. Trust in the http://Maps.me brand with 47% of respondents open to using its mobile wallet and card when available.

7.8.2. Users are cognizant of high FX commissions with 49% willing to use a multi-currency virtual card with low FX fees.

7.8.2. Users are cognizant of high FX commissions with 49% willing to use a multi-currency virtual card with low FX fees.

7.8.3. Low competitive threat to existing users. 80% of the respondents are unfamiliar with traditional Fintech competitors like Revolut, Transferwise etc.

7.8.4. Current limited options for users. 53% have only one currency card from their home bank.

7.8.4. Current limited options for users. 53% have only one currency card from their home bank.

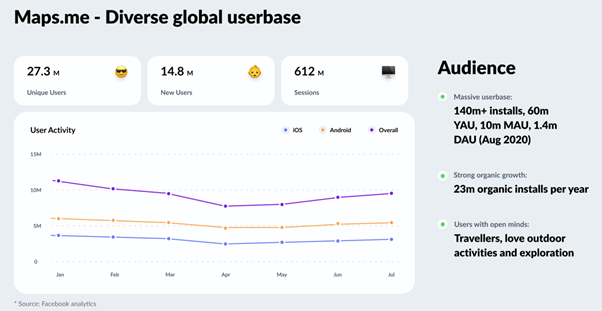

7.8.5. As of August 2020, http://Maps.me had over 140m installs, 27.3m unique users and 1.4m daily active users:

8. Potential Risks

8.1. Regulatory uncertainties as backend is integrated with Solana blockchain and Serum DEX.

8.2. Incumbent users fail to transition to DeFi if travelers ignore investment opportunities after being introduced to blockchain.

8.1. Regulatory uncertainties as backend is integrated with Solana blockchain and Serum DEX.

8.2. Incumbent users fail to transition to DeFi if travelers ignore investment opportunities after being introduced to blockchain.

8.3. High competition with existing BigTechs and new Fintech start-ups such as Revolut, Starling Bank, Robinhood, etc.

9. Opportunity & Future Thoughts

9.1 With the rise of the http://Maps.me wallet, users will be able to leverage an all-inclusive application serving both their travelling and financial needs. As http://Maps.me currently serves 140 million...

...global users (with over 58% coming from Europe and 70% aged between 18 to 40) there is great potential for Maps to serve as a Fintech to DeFi gateway. The MAPS team has extensive financial expertise and experience from some of the world’s largest...

...investment banks including Merrill Lynch and Goldman Sachs, as well as financial backing from Sam Bankman-Fried and FTX. We believe that MAPS, as a Fintech behemoth, will...

...be able to boost the growth of DeFi by opening more decentralized financial products and services to both the banked and unbanked.

Read on Twitter

Read on Twitter