Navigating NFT Twitter Hype.

The good, the bad, the ugly.

Let's explore how whales, traders and investors influence NFT markets.

Thread 1/

The good, the bad, the ugly.

Let's explore how whales, traders and investors influence NFT markets.

Thread 1/

2/ Not here to 'call out' or judge. Just bring trade tactics to light.

So newbies can navigate the madness.

Also, 'hype' sometimes happens naturally.

Mostly it's just the community passionately sharing progress and growth which gets accelerated due to crypto $.

So newbies can navigate the madness.

Also, 'hype' sometimes happens naturally.

Mostly it's just the community passionately sharing progress and growth which gets accelerated due to crypto $.

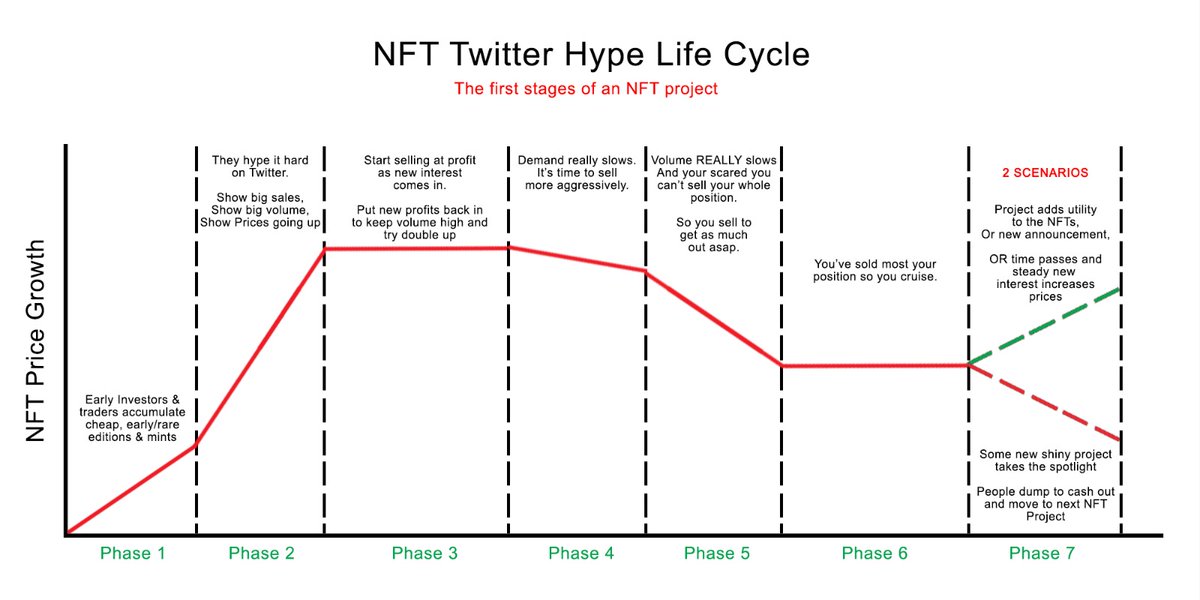

3/ This pattern ALWAYS repeats. (Usually by a small % of the community).

1 - Early Investors buy,

2 - They hype/promote

3 - They sell,

4 - They take profits elsewhere,

As long as there's liquidity they can continue the operation.

Truly understand this cycle

1 - Early Investors buy,

2 - They hype/promote

3 - They sell,

4 - They take profits elsewhere,

As long as there's liquidity they can continue the operation.

Truly understand this cycle

4/ Phase 1: Accumulation.

Early investors get in, they buy all the early editions, based on the project fundamentals may go aggressive.

They're sitting pretty.

All they need now is new investor interest which comes via the Project OR community marketing itself.

Early investors get in, they buy all the early editions, based on the project fundamentals may go aggressive.

They're sitting pretty.

All they need now is new investor interest which comes via the Project OR community marketing itself.

5/ Phase 2: Hype/Marketing.

Big sales/volume numbers. $100k, $500k, $1M.

News, media, articles gobble this up.

This $ is chum change for many.

There are people with 9-10 figures in this space who can single handedly create complete industries let alone drop $500k on an NFT.

Big sales/volume numbers. $100k, $500k, $1M.

News, media, articles gobble this up.

This $ is chum change for many.

There are people with 9-10 figures in this space who can single handedly create complete industries let alone drop $500k on an NFT.

6/ Phase 3-6: Exit the bulk if not all of your position.

If you're up 10x then selling becomes attractive.

You own all the early editions and are even a market maker at some point. So you sell slowly.

Numbers can't keep rocketing, sales slow down, people start to sell.

If you're up 10x then selling becomes attractive.

You own all the early editions and are even a market maker at some point. So you sell slowly.

Numbers can't keep rocketing, sales slow down, people start to sell.

7/ Phase 7: NFT Traders move on to the next shiny thing to repeat the above cycle.

UNLESS there's some utility to these NFTs.

eg, the project is growing and there's cooler things to do in the game, project.

If not, the next new shiny NFT project takes attention.

UNLESS there's some utility to these NFTs.

eg, the project is growing and there's cooler things to do in the game, project.

If not, the next new shiny NFT project takes attention.

8/ The above isn't 'wrong', it's the nature of marketplaces at hyper speed.

People throw money and influence around out of passion/hype.

They make money, then look for another early NFT project.

This has been much of the nature of money in crypto.

People throw money and influence around out of passion/hype.

They make money, then look for another early NFT project.

This has been much of the nature of money in crypto.

9/ So instead of asking WHAT you should invest in,

The question is WHEN should you invest.

If I miss phase 1, I'll get in at phase 7, if the project can prove it's here to stay.

I'll also negotiate my way into NFT portfolios because I know, what comes up, must come down.

The question is WHEN should you invest.

If I miss phase 1, I'll get in at phase 7, if the project can prove it's here to stay.

I'll also negotiate my way into NFT portfolios because I know, what comes up, must come down.

10/ Let's take some examples.

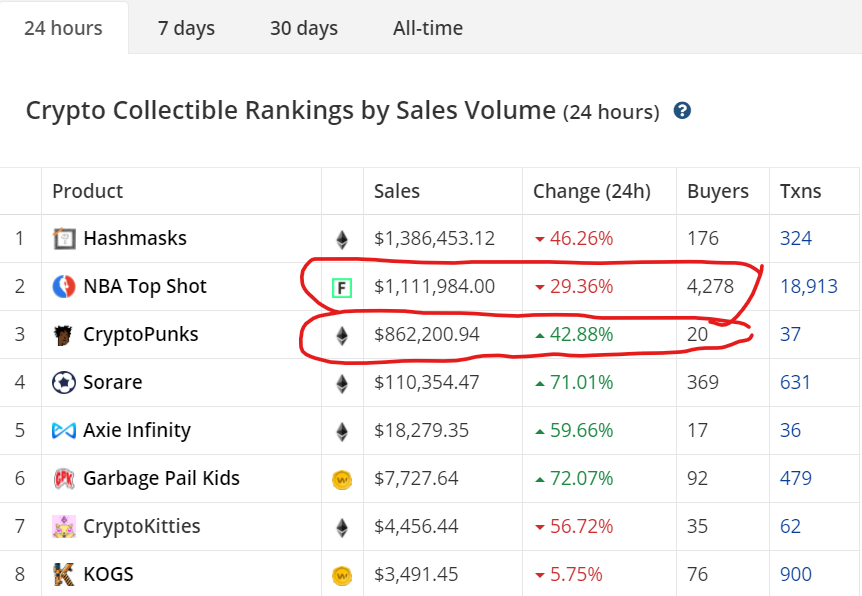

@nba_topshot - got nothing against the project but the marketplace is interesting.

Early people bought packs, talk about it on Twitter, NBA Top Shot start marketing and non-crypto people even jump in.

Suddenly a 'new' collectible project 10-30x's

@nba_topshot - got nothing against the project but the marketplace is interesting.

Early people bought packs, talk about it on Twitter, NBA Top Shot start marketing and non-crypto people even jump in.

Suddenly a 'new' collectible project 10-30x's

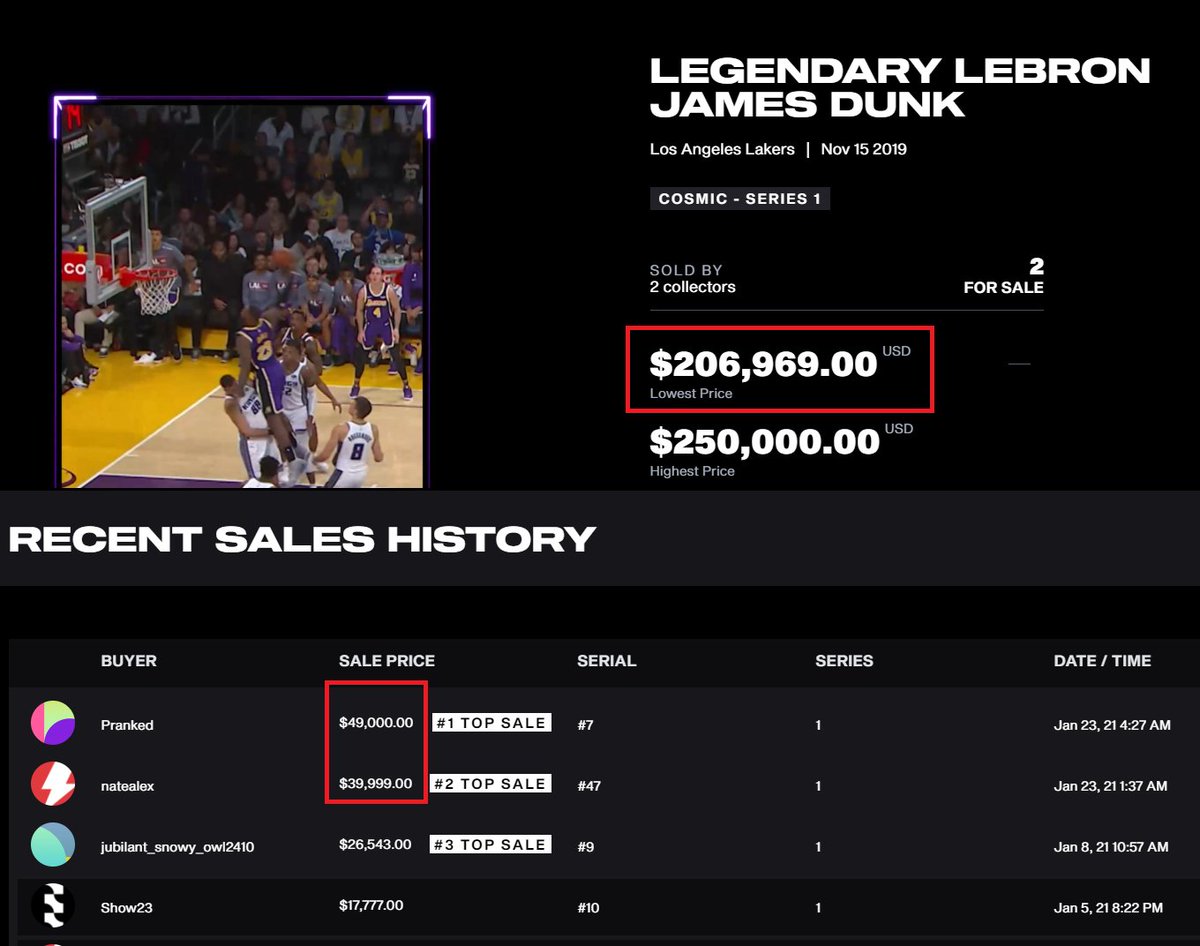

11/ But the portfolio estimates on https://intangible.market were based on 'cheapest listing' not 'recent sales'.

BIG ISSUE. This can be gamed.

The cheapest listing below is $206k BUT the recent sale is $50k.

What does the estimator pick up? $206k.

Hmm..

BIG ISSUE. This can be gamed.

The cheapest listing below is $206k BUT the recent sale is $50k.

What does the estimator pick up? $206k.

Hmm..

12/ So technically, if I own both those listings, I can just list for $5M?

Does that mean my portfolio is worth $10M? NO.

So portfolios with large value Top Shot moments were, imo, mega inflated due to the above.

Many TS community members did mention this.

Does that mean my portfolio is worth $10M? NO.

So portfolios with large value Top Shot moments were, imo, mega inflated due to the above.

Many TS community members did mention this.

13/ You can argue, the low serial numbers and new interest makes it ok.

Kind of, since new interest did sustain.

But still, you're adding speculation to an estimate. Bad idea.

Especially when there's low liquidity, which if dried up, will be very difficult for you to sell.

Kind of, since new interest did sustain.

But still, you're adding speculation to an estimate. Bad idea.

Especially when there's low liquidity, which if dried up, will be very difficult for you to sell.

14/ Also with NBA top shot, we saw a LOT of USD volume.

One of the reasons imo, was that people didn't want to KYC and wait 6-8 weeks so why not just re-invest profits?

Suddenly it's doing insane volume, portfolios are showing 6-7 figure estimates, etc.

One of the reasons imo, was that people didn't want to KYC and wait 6-8 weeks so why not just re-invest profits?

Suddenly it's doing insane volume, portfolios are showing 6-7 figure estimates, etc.

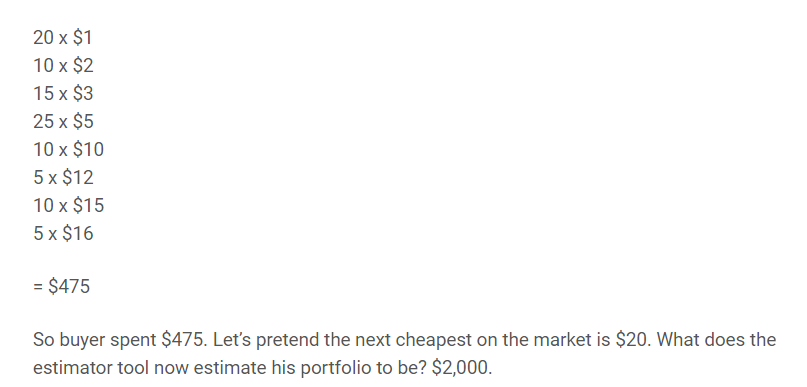

15/ The only thing clearly wrong imo about the above was the estimator could be gamed.

People could buy up the floor from $1 to $50 & their 'account valuation' would estimate using the next cheapest on market. et, $~60.

Which they could share on social media and show BIG gains.

People could buy up the floor from $1 to $50 & their 'account valuation' would estimate using the next cheapest on market. et, $~60.

Which they could share on social media and show BIG gains.

16/ So a buyer can spend $475 buying the cheapest 100 moments from $1 to $16.

And suddenly have the estimator tool give a $2,000 estimate because the next cheapest on market is $20.

See how categories can be hyper accelerated?

And suddenly have the estimator tool give a $2,000 estimate because the next cheapest on market is $20.

See how categories can be hyper accelerated?

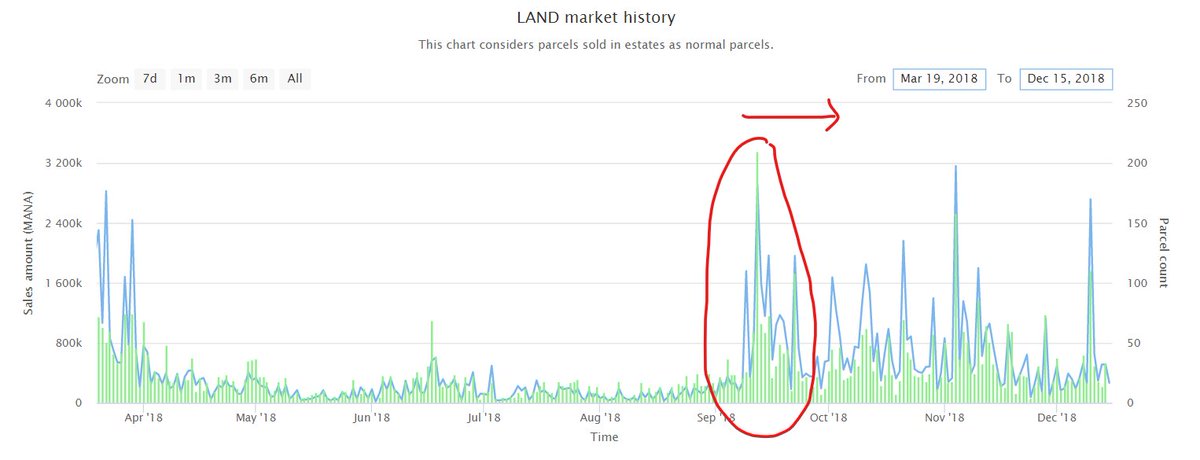

17/ This isn't a dig at Top Shot, we can use Decentraland as well.

When an anon whale bought up the floor from 7k MANA to 15k MANA in Sept 2018, everyone was over the moon.

This event permanently changed the trajectory of the marketplace.

When an anon whale bought up the floor from 7k MANA to 15k MANA in Sept 2018, everyone was over the moon.

This event permanently changed the trajectory of the marketplace.

18/ But then a few months later, he dumped them all back and squashed the prices from 15k MANA back down to 8k MANA.

An example of how whales can bring in $200k-$400k and 'control' the market.

That's why I look at the number of wallet holders and new buyers.

An example of how whales can bring in $200k-$400k and 'control' the market.

That's why I look at the number of wallet holders and new buyers.

19/ If new volume is just a handful, then you risked getting dumped on.

Example, cryptopunks does almost $1M in 24 hrs but has 20 buyers.

NBA topshot does $1M and has 4,278.

Which one shows stronger signs of community growth?

Example, cryptopunks does almost $1M in 24 hrs but has 20 buyers.

NBA topshot does $1M and has 4,278.

Which one shows stronger signs of community growth?

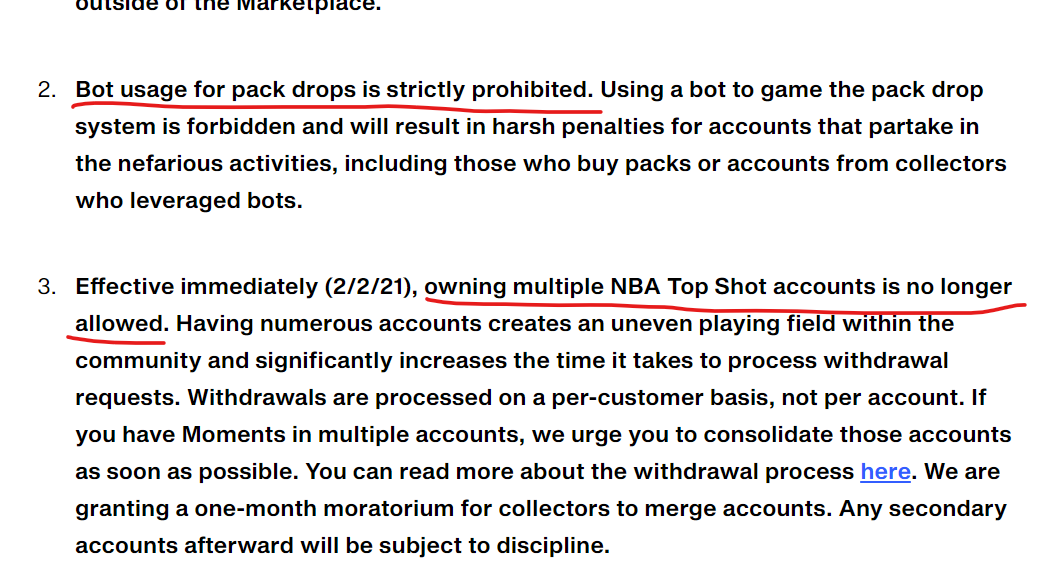

20/ BUT even this is an issue.

Maybe there's bot and multiple accounts at play as NBA Top shot mention in their marketplace 'code of conduct'

Also CryptoPunks has high value assets so I can understand low buyer counts.

STILL, this is important in terms of community growth.

Maybe there's bot and multiple accounts at play as NBA Top shot mention in their marketplace 'code of conduct'

Also CryptoPunks has high value assets so I can understand low buyer counts.

STILL, this is important in terms of community growth.

21/ Then there's the NFT Art market.

Where a new project/artist comes in, people jump and hype on Nifty Gateway, then another new artist comes in - repeat.

I've got my own rules for investing. Like I said before, when investing, I look for people who are here to stay.

Where a new project/artist comes in, people jump and hype on Nifty Gateway, then another new artist comes in - repeat.

I've got my own rules for investing. Like I said before, when investing, I look for people who are here to stay.

22/ @josiebellini runs a podcast and works with other projects to grow her brand between drops.

@Loopifyyy runs a blog and works with the Art community to keep discussions flowing,

Indicators of who's here to stay.

@Loopifyyy runs a blog and works with the Art community to keep discussions flowing,

Indicators of who's here to stay.

23/ I've said it before, there's going to be billions of NFTs out there, so I look for those that continue to grow in the space and their brand outreach.

Those that jump on the NG hype train, do a drop and disappear, I doubt will stay relevant 2-3 years from now.

(my opinion).

Those that jump on the NG hype train, do a drop and disappear, I doubt will stay relevant 2-3 years from now.

(my opinion).

24/ I can go on for another 100 comments in this thread.

But instead I wrote a blog post.

It's deeper and covers why Utility is needed to sustain collectibility hype over time.

More hype/marketplace tactics, etc. https://dclblogger.com/nft-marketplace-economics-nft-twitter-hype-exploring-pump-and-dumps-whale-moves-influencer-trader-investor-tactics/

But instead I wrote a blog post.

It's deeper and covers why Utility is needed to sustain collectibility hype over time.

More hype/marketplace tactics, etc. https://dclblogger.com/nft-marketplace-economics-nft-twitter-hype-exploring-pump-and-dumps-whale-moves-influencer-trader-investor-tactics/

25/ Again, I got no issues with the above projects.

They'll all prob continue.

But NFT trader/investor tactics need to be brought to light so newbies are at a level playing field.

Not here to judge, just explore.

Hope this helps!

YouTube Vid

They'll all prob continue.

But NFT trader/investor tactics need to be brought to light so newbies are at a level playing field.

Not here to judge, just explore.

Hope this helps!

YouTube Vid

26/ I strongly believe Collector NFTs that will last need Utility.

If we take @TheHashmasks for example, it brought a lot of collector attention which is great. But utility imo will keep it alive.

Like how @AvaStarsNFT is exploring NFTs as Metaverse ID's along with collecting.

If we take @TheHashmasks for example, it brought a lot of collector attention which is great. But utility imo will keep it alive.

Like how @AvaStarsNFT is exploring NFTs as Metaverse ID's along with collecting.

Read on Twitter

Read on Twitter