After yesterday's excitement around Romney's child allowance plan, I had a hard time sleeping, tormented by dreams of income and distribution tables yet-to-be-calculated.

So I woke up at the crack 'o dawn today to calculate them!

So I woke up at the crack 'o dawn today to calculate them!

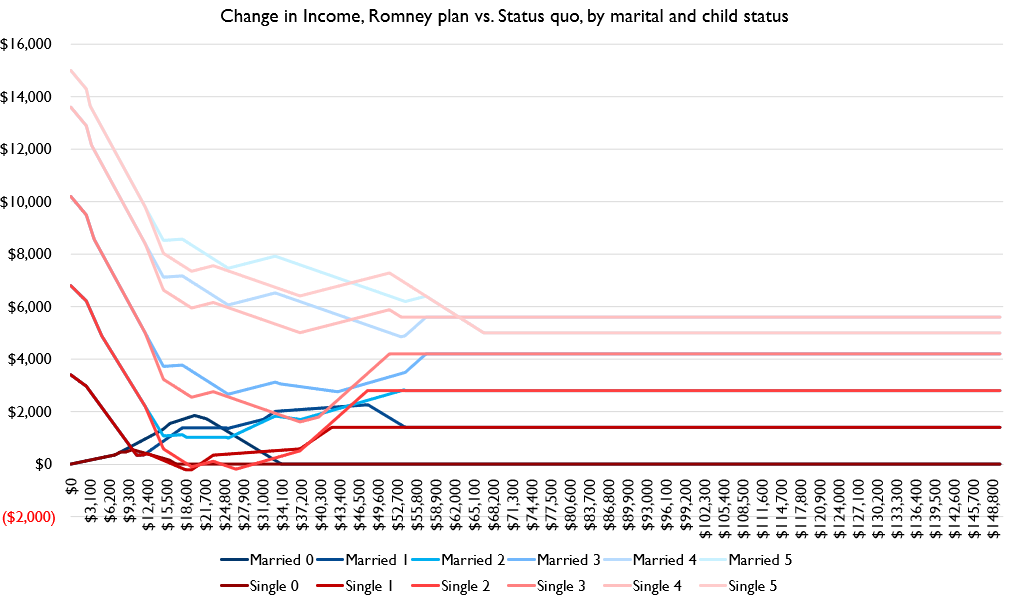

You might be wondering: who is helped by Romney's proposed changes to EITC/CTC? Who is hurt?

Note that I am **only** considering the EITC/CTC/allowance changes because the other changes add a lot of complexity that's harder to model.

Note that I am **only** considering the EITC/CTC/allowance changes because the other changes add a lot of complexity that's harder to model.

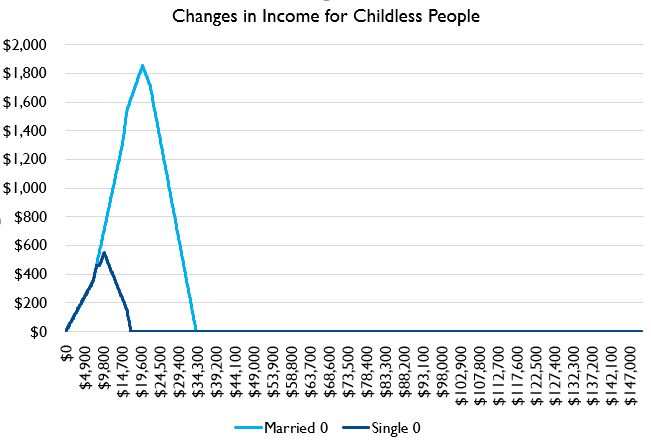

Let's start with childless people!

How would Romney's proposed changes impact them? They're childless, so not eligible for CTC/allowance. But there are big changes here to the EITC too!

And those changes hugely benefit poor childless folks!

How would Romney's proposed changes impact them? They're childless, so not eligible for CTC/allowance. But there are big changes here to the EITC too!

And those changes hugely benefit poor childless folks!

This is important.

The EITC as it formerly existed is a confused policy: it wants to encourage work! But not by targeting the people who most benefit from extra work effort, but rather by targeting people with the greatest deservingness under some heuristic.

The EITC as it formerly existed is a confused policy: it wants to encourage work! But not by targeting the people who most benefit from extra work effort, but rather by targeting people with the greatest deservingness under some heuristic.

Why do we provide more EITC benefits to single parents with kids?

Because they have the greatest *need for support*, NOT because those are the people who would most benefit society by being employed.

Because they have the greatest *need for support*, NOT because those are the people who would most benefit society by being employed.

My view is that the tradeoff between "low wage work" and "full time parent" for society is ambiguous at best.

But we AAAAAABSOLUTELY want poor childless people to have HUGE work incentives, because the alternative social activity is "do nothing at all." The old EITC misses this.

But we AAAAAABSOLUTELY want poor childless people to have HUGE work incentives, because the alternative social activity is "do nothing at all." The old EITC misses this.

So Romney's proposal changes the EITC from "special program for working poor single parents" to "generalized incentive to work."

Let me show that graph again.

People are focusing on Romney's child allowance, but his changes to the EITC may be even more momentous, and in my view good.

People are focusing on Romney's child allowance, but his changes to the EITC may be even more momentous, and in my view good.

Notice as well that married people get a bigger benefit.

That is NOT because there's a "marriage bonus" per se; it's because Romney's plan precisely doubles thresholds and benefit size for married people, in order to avoid *penalizing* the marriage of two workers.

That is NOT because there's a "marriage bonus" per se; it's because Romney's plan precisely doubles thresholds and benefit size for married people, in order to avoid *penalizing* the marriage of two workers.

But this also has the effect of being a big help to "breadwinner" style working-class households. The benefit is *designed* to avoid marriage penalties for two-worker households, but it has the *side effect* of helping out a lot of working class breadwinners (male or female).

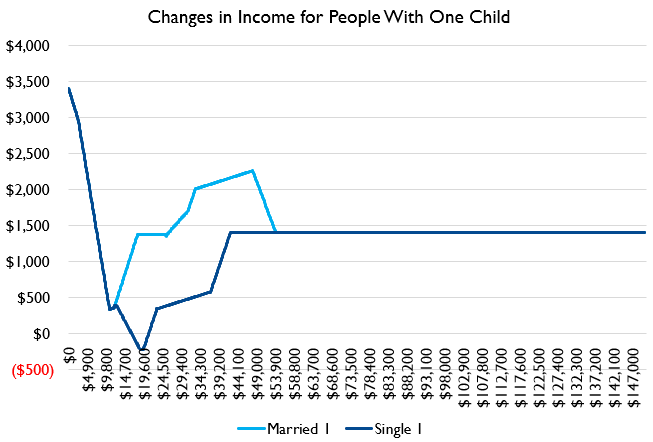

Next up, people with one child!

Here's how the EITC/CTC changes impact those families

Again, it's overwhelmingly positive. There's a *very* narrow income range where single parents lose out on a *little* bit of income but that's pretty trivial.

Here's how the EITC/CTC changes impact those families

Again, it's overwhelmingly positive. There's a *very* narrow income range where single parents lose out on a *little* bit of income but that's pretty trivial.

The big action a lot of poverty scholars will look at of course is the very low end there: Romney's plan hugely increases income for very-low-earners (more on them in a second).

But my big emphasis would be: it's a positive benefit throughout the ENTIRE middle class!

But my big emphasis would be: it's a positive benefit throughout the ENTIRE middle class!

In fact thanks to the CTC/EITC dynamics here, "single working class parents" are the *smallest* beneficiaries, while "married working class parents" are the really big winners.

This is undoing the colossal damage done by the EITC to working class marriage trends.

This is undoing the colossal damage done by the EITC to working class marriage trends.

Folks, the EITC does a good job encouraging work for single parents.

But at the same time it creates a huge tax on working class marriage.

Romney's proposal fixes that.

THAT IS AS IMPORTANT AS THE CHILD ALLOWANCE ITSELF.

But at the same time it creates a huge tax on working class marriage.

Romney's proposal fixes that.

THAT IS AS IMPORTANT AS THE CHILD ALLOWANCE ITSELF.

Now, about those extremely-poor people.

I know a lot of folks worry about people never working, creating cultures of dependency, etc.

I get that worry. But key to understand the vast majority of very-low-income individuals have that income level in just one year.

I know a lot of folks worry about people never working, creating cultures of dependency, etc.

I get that worry. But key to understand the vast majority of very-low-income individuals have that income level in just one year.

The vast majority of very low incomes reported are related to unemployment, and income the year before/after tend to be higher.

Durable poverty is a real problem. I'm concerned about it. But "very low labor income in one year" =/= "Durable poverty"

Durable poverty is a real problem. I'm concerned about it. But "very low labor income in one year" =/= "Durable poverty"

Most people in intergenerational poverty traps actually live in households that *do* have some labor income. $0 income households are 1) quite rare 2) disproportionately related to unemployment and business losses.

Okay lets look at families with two kids!

Similar pattern. Again, low- and middle-income parents do best. Working-class single parents do lose a bit.

But again, that's because the current system *is penalizing married people*.

Similar pattern. Again, low- and middle-income parents do best. Working-class single parents do lose a bit.

But again, that's because the current system *is penalizing married people*.

As I'll show shortly, even with that loss vs. baseline, those families still end up earning money from Romney's program mix.

Oh rats I didn't relabel the graph. It says one child but it's actually two.

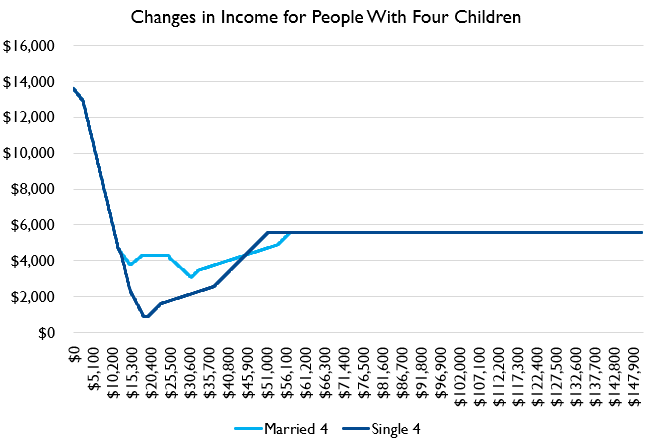

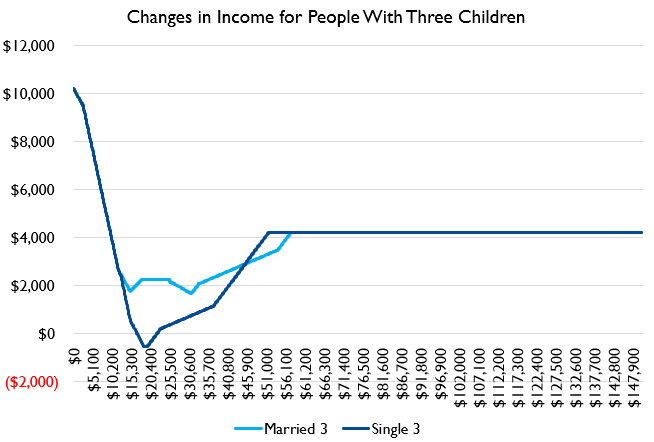

Here's the same graph for 3 kids and 4 kids. What you'll notice is that by the time we're at 3 kids it's basically net wins throughout.

But the same basic pattern of benefits holds up.

But the same basic pattern of benefits holds up.

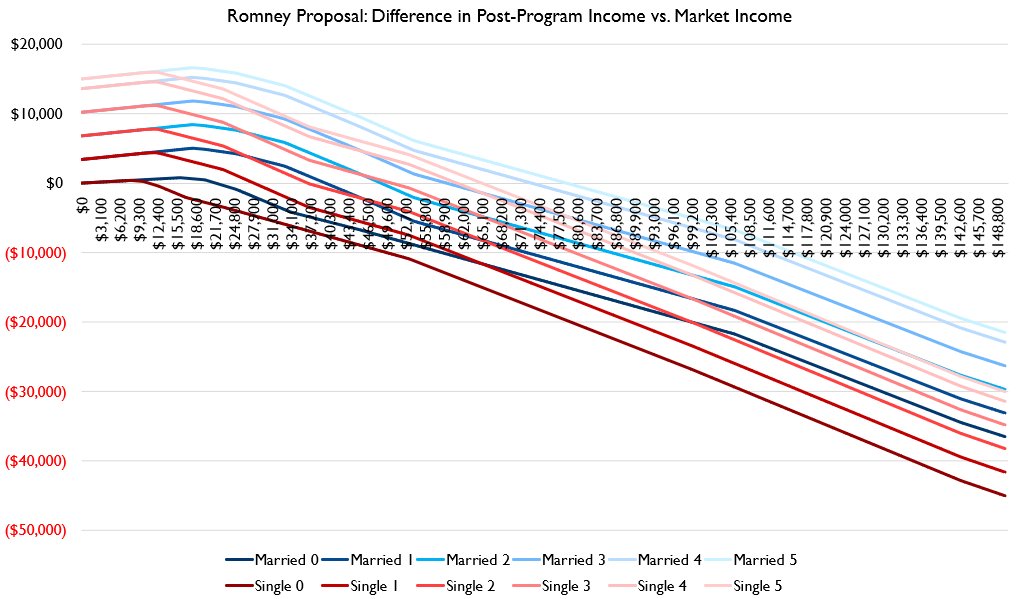

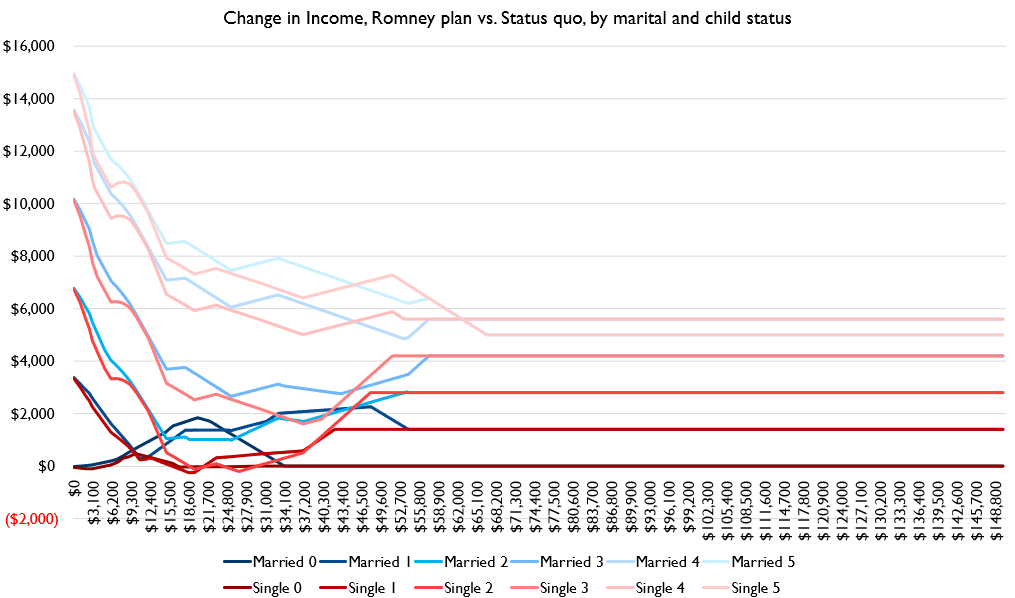

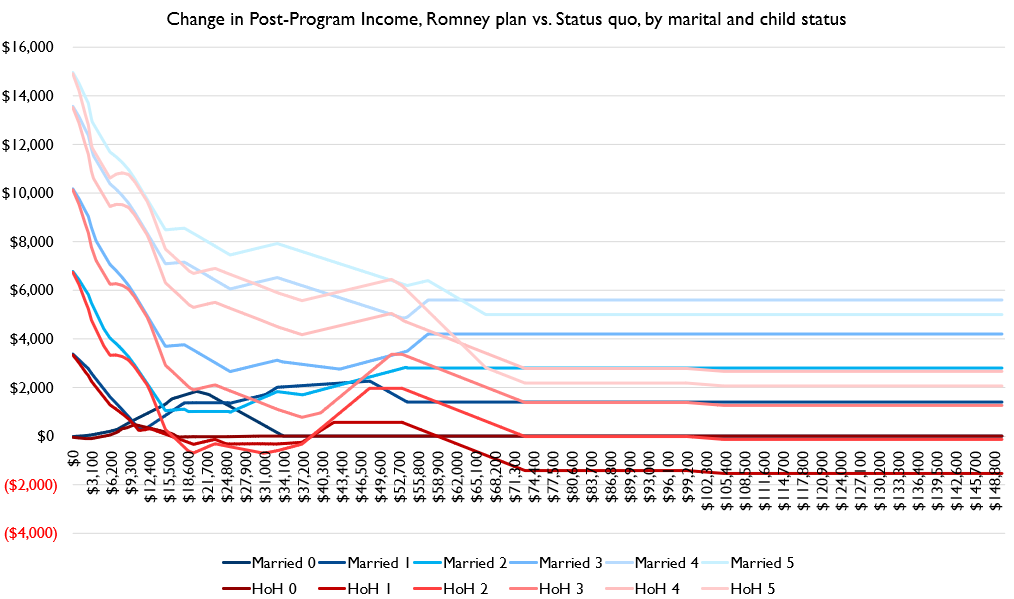

Okay, now let's look at not "changes due to the reform," but rather "how much higher or lower is a person's income after payroll and income taxes as well as CTC, allowance, and EITC."

This is way too busy to show pre- and post reform directly, so I'm just gonna focus on "who has positive/negative tax bills under Romney's proposed plan and under the old plan."

I'm using simplifying assumptions here: standard deduction, no treatment of SALT, no dealing with head of household. I'll discuss those a bit below.

But what I'd emphasize is two big differences:

1) Romney's plan clearly helps the "very poor" more

2) It shifts the point at which marriage becomes an unambiguous net income positive from about $28,000 to about $12,000.

1) Romney's plan clearly helps the "very poor" more

2) It shifts the point at which marriage becomes an unambiguous net income positive from about $28,000 to about $12,000.

Additionally, Romney's plan is ***more generous*** for middle-class households, but "maximum net benefit from taxes" is actually similar in the two plans.

That is to say, Romney's plan actually *does not* meaningfully increase the maximum potential amount of money a person could earn from their taxes and benefits!

This is important for dealing with the whole "this is basically a UBI" or "this will lead to welfare queens."

Romney changes how you get money, yes. But he doesn't really change the maximum potential benefit.

Romney changes how you get money, yes. But he doesn't really change the maximum potential benefit.

The difference is under the current system, you maximize your benefit by 1) staying single, 2) working 35 hours a week at a minimum wage job, 3) having 3 kids.

In Romney's plan, you maximize benefits by 1) getting married, 2) having 5 kids, 3) working 35 hours a week at min wage

In Romney's plan, you maximize benefits by 1) getting married, 2) having 5 kids, 3) working 35 hours a week at min wage

THIS IS IMPORTANT.

The actual change Romney's plan makes, in effect, is to make *marriage and childbearing* more lucrative than *staying single*.

That's the change. That's what the plan does.

The actual change Romney's plan makes, in effect, is to make *marriage and childbearing* more lucrative than *staying single*.

That's the change. That's what the plan does.

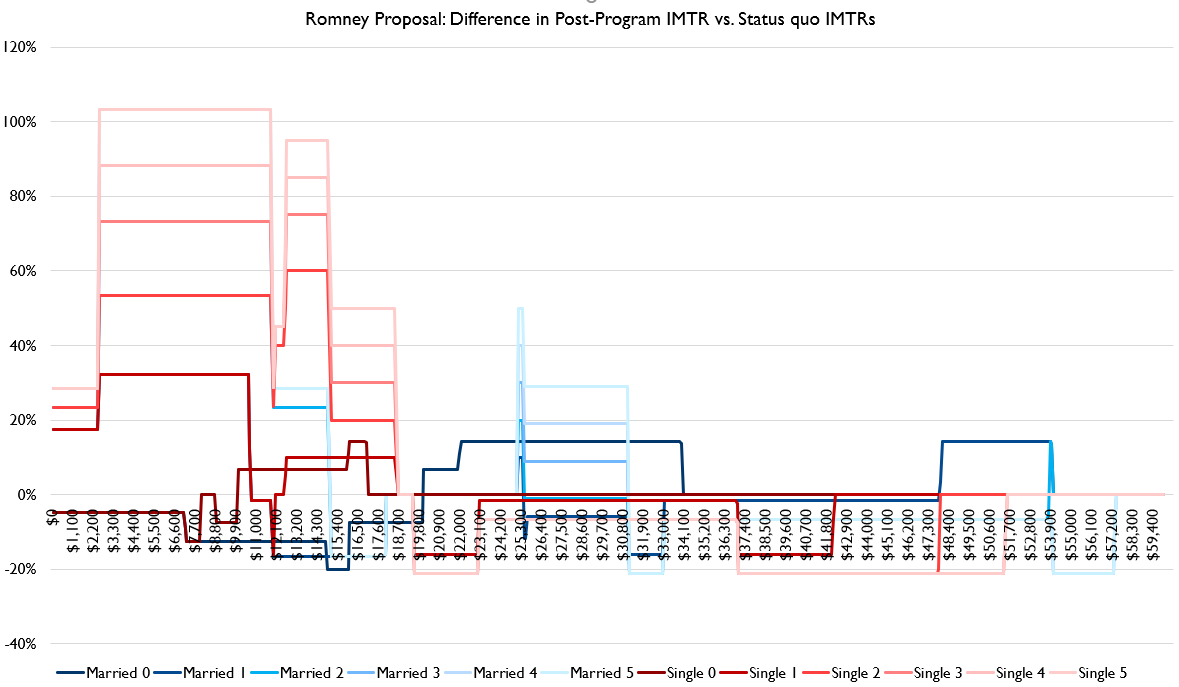

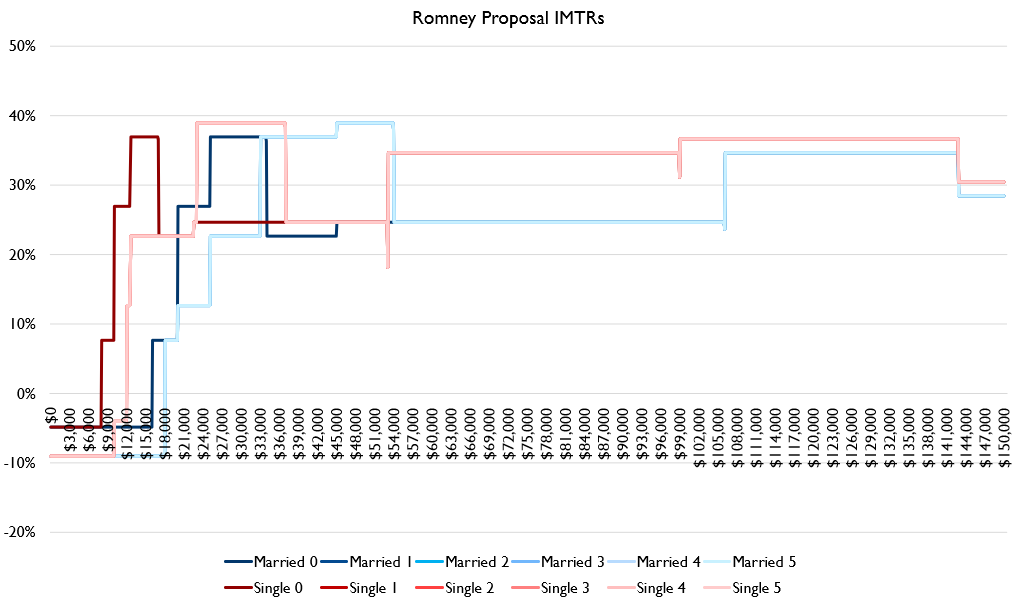

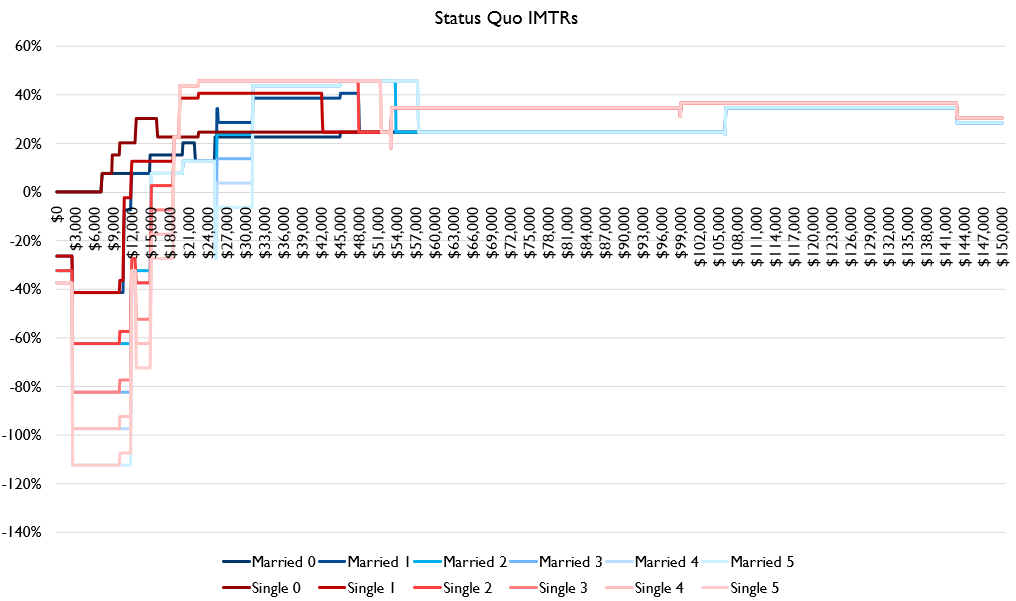

Okay, now, let's think about IMPLICIT MARGINAL TAX RATES (wooooo)

Implicit marginal tax rates are kind of a complicated thing for people to think about at first, but they end up making a lot of sense.

Basically, they ask, "Suppose your income rises by $1,000. After taxes and benefit calculations, how much does your income REALLY change?"

Basically, they ask, "Suppose your income rises by $1,000. After taxes and benefit calculations, how much does your income REALLY change?"

If the IMTR is HIGH, then it DISCOURAGES people from increasing their work: they will keep only a small share of their marginal earnings.

If it's low (or even NEGATIVE), then it ENCOURAGES work.

If it's low (or even NEGATIVE), then it ENCOURAGES work.

I'm not calculating ALL IMTRs here. You can calculate IMTRs for Section 8, for SNAP, for tons of programs. I'm only looking at IMTRs of income/payroll taxes, allowance, CTC, and EITC. I compare IMTRs under Romney's plan to the status quo.

RIGHT NOW, for working poor people with kids, we provide combined CTC + EITC benefits which create a larger than a -100% IMTR in some cases. That is, they can earn $220 when their income rises $100. That's a HUGE work incentive.

Folks, if I offer to DOUBLE your marginal income change on the back end, that should induce a LOT of labor supply!

And in practice, it does induce labor supply!

A bit!

And in practice, it does induce labor supply!

A bit!

The labor supply effects of the EITC are real, but there's no evidence that they scale even sublinearly when you drop the IMTR from -40% to -110%.

The reality is at that point you've already juiced labor supply all you're gonna get. I believe the EITC does good stuff, I do not believe that incidentally doubling a working-class person's wage increase via a child tax credit phase-in they *aren't even aware of* matters a lot.

And this is the issue, see: what share of people in the "work incentivizing" threshold have even the vaguest sense of their IMTR?

My though is: some, but many have no idea. Of those that DO know their IMTR, their views are set by big-ticket items like Section 8 and Medicaid.

My though is: some, but many have no idea. Of those that DO know their IMTR, their views are set by big-ticket items like Section 8 and Medicaid.

I do not see the point in worrying about the IMTRs we set through the CTC phase-in/phase-out when we create like 150% IMTRs with Section 8, Medicaid, SNAP, and other benefit programs.

This is all peanuts!

This is all peanuts!

Like try actually talking to a poor person someday. In all my years, I've OFTEN heard people talk about losing benefits if their income rises, but the benefit their talking about isn't tax credits y'all its HOUSING and FOOD and HEALTHCARE.

The idea that we can meaningfully correct "welfare cliffs" by denying the CTC to a handful of the poorest people in the country and that THIS is the solution to "welfare queens" is just so absurd it defies reason.

What makes this even more galling is that @marcorubio and @SenMikeLee seem to not even understand that Romney's plan is actually FIXING a huge welfare cliff: the massive penalty the EITC puts on working-class marriage!

When the @JECRepublicans invited me to testify before them ( @SenMikeLee chair!), I provided this written testimony: https://www.jec.senate.gov/public/_cache/files/dcc4a91e-b21c-4f8e-9bc5-1111c11d4563/lrs-testimony-9-10-2019.pdf

Which devoted like HALF of its length to documenting precisely the problem Romney is fixing!

Which devoted like HALF of its length to documenting precisely the problem Romney is fixing!

For Republicans who talk about the importance of supporting responsible family life (like @SenatorTimScott @SenMikeLee @marcorubio @HawleyMO @BenSasse @TomCottonAR for example), Romney's proposal is a perfect fit:

Deficit neutral

No increase in "welfare queens"

Pro-marriage

Deficit neutral

No increase in "welfare queens"

Pro-marriage

I cannot for the life of me comprehend why there would be any hesitancy at all in supporting a deficit neutral plan which fixes a massive marriage penalty and directly supports families.

Okay now, I have to pack up the van and move my family. See y'all later. Support Romney's child allowance proposal; it's pretty swell.

(Oh sorry, one last aside: including TANF and Head of Household repeal reduces the income boost received by people at low income levels especially, and repealing SALT raises taxes at the highest income levels; this doesn't change any of my key arguments)

So, I'm realizing I made a mistake in this thread. I miscalculated the non-refundable portions of the CTC for people with >1 kid. So actually I've OVERESTIMATED how generous the current system is for people with >1 kid, especially for working-class people.

That also means my IMTR estimate for working class people is wrong. It's not as negative as I suggested, but it remains negative over a longer income range for people with more kids.

Correcting for TANF is a bit trickier. States have different rules for TANF and some states basically give no direct support at all.

As a substitute, I use CPS ASEC-reported cash welfare receipt by income, marital status, and child number.

As a substitute, I use CPS ASEC-reported cash welfare receipt by income, marital status, and child number.

Here's what net benefits to Romney's plan look like once we account for self-reported receipt of cash welfare (i.e. mostly TANF). I'm assuming this number falls to zero; in reality some state programs would persist.

Everything is still positive.

Everything is still positive.

Now look. I'm probably messing something up somewhere. I may have an error somewhere. Indeed, I'm sure I am. There will in reality be differences in claimancy rates and filing rates, etc

That all the lines are positive is a bit surprising since it's a deficit neutral plan and most of the payfors are included here.

But while the overall positivity of each line is probably overstated, the relative trends are not, and there *is* a net transfer to poor, working class, and middle class parents by using SALT as a payfor.

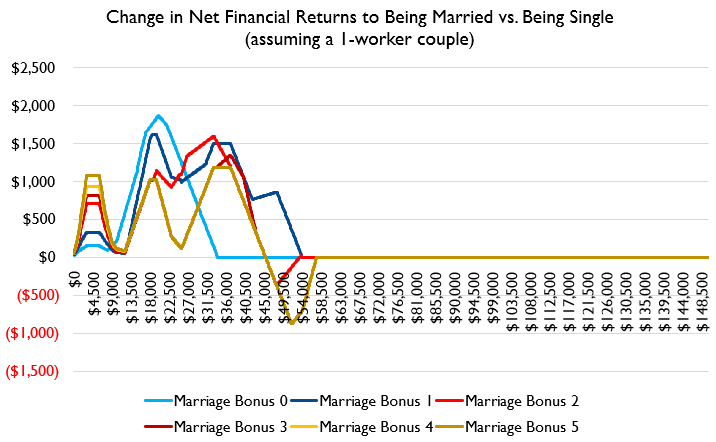

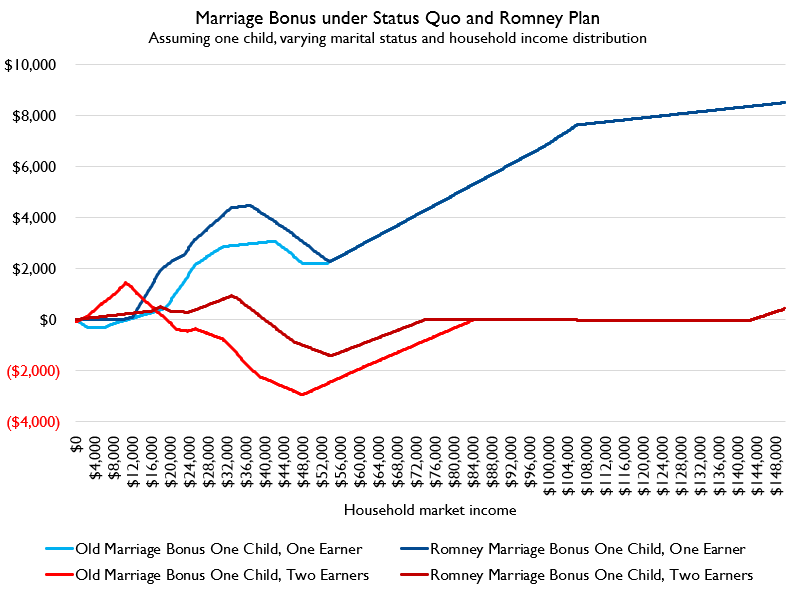

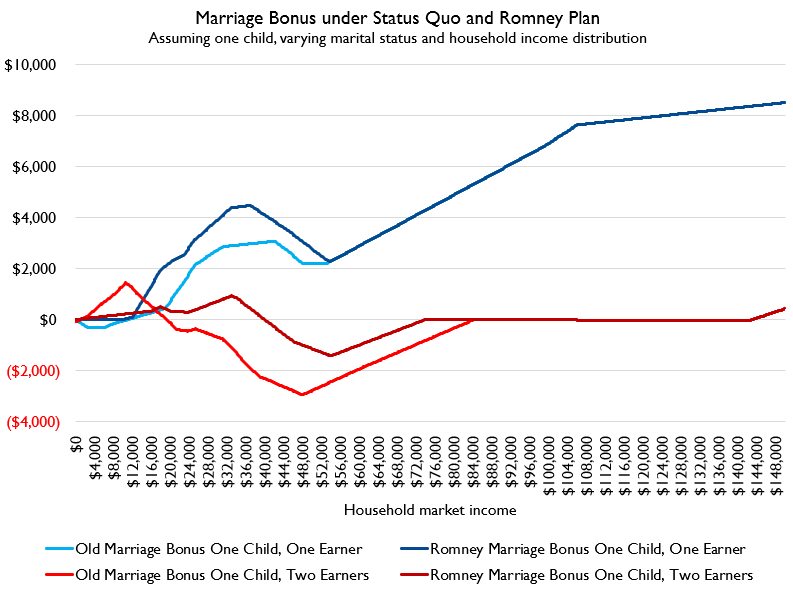

Just how much does the Romney plan alter the financial returns to being married?

Here's how much. This is "change in post-program income for married people from status quo to Romney plan, minus same change for single people, by child parity."

Here's how much. This is "change in post-program income for married people from status quo to Romney plan, minus same change for single people, by child parity."

Marriage penalties are complicated things.

If we imagine a couple debating marriage, whether they get a penalty or a bonus from married filing status depends on a lot of stuff.

If we imagine a couple debating marriage, whether they get a penalty or a bonus from married filing status depends on a lot of stuff.

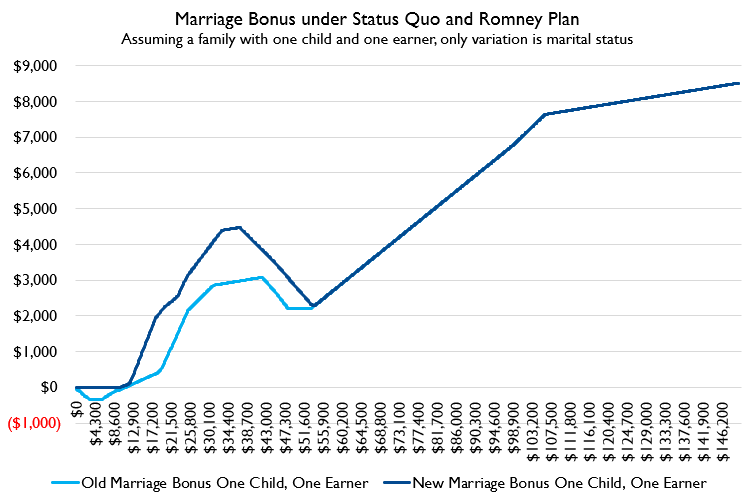

So if we assume that this couple has ONE earner and ONE child, here's how marital status influences net income in the current tax code vs. Romney's proposals.

Both the current code and Romney's code subsidize marriage *for most single earners*.

Both the current code and Romney's code subsidize marriage *for most single earners*.

If I added in Medicaid, Section 8, SNAP, this changes, so don't take this to mean the welfare state has a net pro-marriage bias. But just these few provisions on net do.

IF YOU ARE A ONE-EARNER HOUSEHOLD.

IF YOU ARE A ONE-EARNER HOUSEHOLD.

And even then, at very low incomes, the tax code discourages marriage even among those groups.

Romney's plan eliminates all marriage PENALTIES for breadwinners, and boosts the bonuses for working-class folks.

Romney's plan eliminates all marriage PENALTIES for breadwinners, and boosts the bonuses for working-class folks.

But what about TWO INCOME families?

This gets complicated. I'm going to assume they have *evenly divided* incomes here, so a 50/50 split.

This gets complicated. I'm going to assume they have *evenly divided* incomes here, so a 50/50 split.

Here's what that looks like.

As you can see, the CURRENT tax code is.... weird. People under $10k in income have a marriage INCENTIVE (to get bigger tax liability to claim more CTC). But it quickly turns to a BIG disincentive.

As you can see, the CURRENT tax code is.... weird. People under $10k in income have a marriage INCENTIVE (to get bigger tax liability to claim more CTC). But it quickly turns to a BIG disincentive.

That marriage incentive below $10k is.... irrelevant. There are soooooo many other marriage penalties for those people related to Medicaid, housing, SNAP, disability, and a million other benefits I don't think that marriage bonus would exist on a more complete analysis.

But that huge marriage penalty as household income rises is no joke!

If you're a breadwinner household, the government subsidizes you.

If you're a two-earner working class household, the government punishes you.

If you're a breadwinner household, the government subsidizes you.

If you're a two-earner working class household, the government punishes you.

The Romney plan does not iron out 100% of the complexities and problems. But it does DRAMATICALLY reduce them, and helps put two-earner households on more equal footing with one-earner households.

This two-earner household gets a net marriage bonus up through like $40,000 in joint earnings, their marriage penalty is relatively modest as income rises over that, and then it's neutral at higher incomes.

The result of Romney's plan is not some some huge Mormon Social Engineering Scheme to get everybody hitched.

The result is that the current benefits high-income breadwinners receive are extended to working-class, while two-earner families get fairer treatment.

The result is that the current benefits high-income breadwinners receive are extended to working-class, while two-earner families get fairer treatment.

Now, let's flip the coin here:

Marriage penalties penalize *two worker households for getting married*.

But they also penalize *lower-income spouses from working*.

Marriage penalties penalize *two worker households for getting married*.

But they also penalize *lower-income spouses from working*.

This is a widely known and documented economic trend and one salient enough empirical papers regularly DO find effects. Marginal tax rate structures which create marriage penalties do IN FACT reduce work participation of lower-wage-earning spouses.

To a non-trivial extent, reducing the marriage penalty for this people might actually *increase* labor force participation, even as income effects of reduced need among low-income women would *reduce* labor force participation.

In the long run idk which effect predominates, and my view is that "not having a wage because you're taking care of 3 kids" is.... totally fine for society and something worth supporting.

Okay. I really have to take a break from this because I have some death data to update now.

the car is packed, the baby is sleeping, the death spreadsheets are updated, and so it's back to WHY THE CHILD ALLOWANCE IS A GOOD THING: The All-Day Tweet-o-Rama.

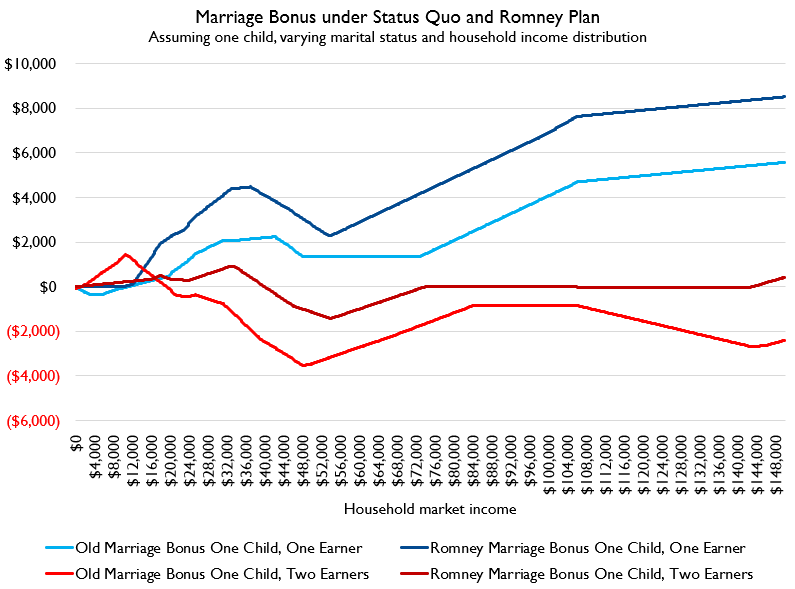

Several people have replied to me saying, "But Lyman, singles with a child would not file as singles, but as heads of household, which is a more advantageous status. Does that impact your calculations?"

Well it's a pain to account for that but let's give it a shot.

Well it's a pain to account for that but let's give it a shot.

To do this, we have to account for not just changes in CTC/EITC, but also that head of household filers are kicked off the filing status to single.

So here's how it looks.

Romney's plan actually does leave middle- and upper-income head of household filers with 1 kid noticeably worse off. Losses for 1-2 kid HoH filers at working-class incomes are small but I suppose not nothing.

Romney's plan actually does leave middle- and upper-income head of household filers with 1 kid noticeably worse off. Losses for 1-2 kid HoH filers at working-class incomes are small but I suppose not nothing.

But it's important to note that adjusting for HoH filing status does NOT cause the huge benefits at the bottom end to vanish.

And here's marriage penalties for one-earner and two-earner couples, accounting for the fact that one member of the couple is HoH and one is single.

Romney plan makes the treatment of two-earner couples fairer.

Romney plan makes the treatment of two-earner couples fairer.

Okay, now I want to address another issue.

I cut my analysis off at 5 kids. I do that 1) because that's where the Romney plan caps but also 2) because 99% of US households with children have 5 or fewer children.

I cut my analysis off at 5 kids. I do that 1) because that's where the Romney plan caps but also 2) because 99% of US households with children have 5 or fewer children.

But I want to note here that about 1% of families with children DO have 6 or more kids at home at once.

For these couples, Romney's plan *does* create a marriage penalty. They'd get more money being separate.

For these couples, Romney's plan *does* create a marriage penalty. They'd get more money being separate.

However, again, we're talking about literally 1% of households with kids, which means like half that of total households. This is not a huge problem. And households with 7 or fewer kids come out ahead from Romney's plan even with the cap.

Finally, I want to wade into the debate about behavioral effects with @swinshi and others.

First off, my view is that while I do strenuously disagree with Scott, he's been extremely unfairly maligned for advancing a view that is not wicked or bad or something.

First off, my view is that while I do strenuously disagree with Scott, he's been extremely unfairly maligned for advancing a view that is not wicked or bad or something.

The view @swinshi is expressing as I understand it is basically that "income effects" are very important: some >0% of the population disprefers working enough that they will live on transfer income alone even if it's low. As transfer income grows, that % rises.

I have called this view "perverse," referring to "perverse incentives" and "perverse outcomes," in that while I understand @swinshi 's desire to think about behavioral effects, I think the way he does it has perverse outcomes. That's not a moral judgment.

So what's the deal?

Is @swinshi right that income effects are a big deal?

The academic literature on this is somewhat divided. My view of it is that income effects probably do matter; that basically @swinshi is *right* that the direction of LFP for e.g. single moms is ambiguous

Is @swinshi right that income effects are a big deal?

The academic literature on this is somewhat divided. My view of it is that income effects probably do matter; that basically @swinshi is *right* that the direction of LFP for e.g. single moms is ambiguous

And indeed, that our bias should probably be that the combination of higher IMTRs for these single parents alongside the income effects of transfers point to a very likely disemployment effect.

*But only among single parents*.

*But only among single parents*.

Among childless folks, the Romney plan may actually *increase* work incentives.

But more broadly, I am simply less optimistic about the putatively salutary effects of low-wage work on economic mobility than @swinshi is.

But more broadly, I am simply less optimistic about the putatively salutary effects of low-wage work on economic mobility than @swinshi is.

There are a few ways that low-wage work might help people re: long-term poverty and mobility. Three of the most salient in the literature are:

1) more income

2) role model effects of employment on kids

3) development of economically productive habits or attitudes

1) more income

2) role model effects of employment on kids

3) development of economically productive habits or attitudes

1) is a moot question because we can supplement income with transfers. I don't think @swinshi denies this.

2) is interesting. the empirical literature on role model effects is mixed. Some studies and contexts find big effects, some no effect. I think a small effect is plausible.

2) is interesting. the empirical literature on role model effects is mixed. Some studies and contexts find big effects, some no effect. I think a small effect is plausible.

3) is something I think conservatives think is super important.... but God kind of disagrees in the Bible, "rain falls on the just and the unjust alike," something about camels and needles, or Proverbs 23:5 is a favorite of mine

But more important than God to you heathens on this hellsite is that common sense and empirical research disagree. Low-income work is not lower-effort than high-income, and high-income people are not in fact less slothful or wasteful than the poor.

It would be awesome if getting a low-wage job actually provided workers with significant opportunities to cultivate attitudes, values, or skills which would lead to significant upward mobility.

But there's not a lot of evidence for that.

But there's not a lot of evidence for that.

Low-wage work is great for getting somebody from 75% of poverty to 150% but a person who's never been above 150% FPL by age 35 is extreeeeeemly unlikely to climb to like 250% or 300% by 45 or 50.

Ask ANY employer who employs lots of "marginal" minimum wage workers, i.e. people who are at the edge of work being worth it in terms of benefits, and they'll tell you the same story: employees drift in and out, and nobody expects upward mobility.

The key thing to grasp here is that *reservation wages* are a heckuva drug. And the key factor setting reservation wages for parents isn't just benefits, it's the availability and cost of childcare.

But my actual point here is that the "benefits" of the work that someone JUST on the edge of being incented into work are.... small. They're largely jobs everybody knows will be automated away within a few years anyways.

Meanwhile, "role model" effects cut both ways. The literature is pretty clear that while welfare reform boosted maternal labor force participation, it *worsened* a lot of child outcomes, especially for boys.

It turns out, the work that parents do at home is not zero-marginal-product! A lot of people who are barely-worth-hiring in market jobs are in fact extremely productive as parents, and having that parental attention is beneficial for kids.

(Here somebody is gonna chime in about "genetic confounds" but I'll note that virtually all studies with genetic controls are exclusively among middle- and high-income families; nobody thinks leaving your 3 year old unattended for 6 hours is good for child development)

That's why FUNDAMENTALLY I think the question at hand is:

Is parenting worthy work which society desires to support?

Do we think that it is important to take measures to ensure that the next generation 1) is born at all and 2) receives significant parental input?

Is parenting worthy work which society desires to support?

Do we think that it is important to take measures to ensure that the next generation 1) is born at all and 2) receives significant parental input?

I know a lot of people are sharing this thread as, "wow, for a conservative, Lyman is okay," so let me absolutely wreck your image of me by reframing the question for my conservative compatriots:

Do you want your church to die or not?

Do you want your church to die or not?

Speaking to my fellow dyed-in-the-wool ideological social conservatives, you have a choice: adopt pronatal policies which remove destructive obstacles to family and childbearing as this plan does, or watch the continuing collapse of the cultural norms you cherish.

I agree with my fellow conservatives who talk about things like "the dignity of work" and who worry about "cultures of dependency"

but y'all

*parenting is work*

*"dependency" on daycare is the same problem*

but y'all

*parenting is work*

*"dependency" on daycare is the same problem*

"The government will double your minimum wages for episodic and unreliable work so that your dependency can be outsourced to a daycare provider" is not going to somehow create a nation of can-do self-starting Horatio Algers.

So that's why, while I do not think that @swinshi 's view is bad, I do think it is 1) incorrectly weighting the benefits of the work in question and 2) not a view conservatives concerned about the decline of the family and social capital should really have any interest in at all.

Now because I know at this point some conservative readers are gonna be like, "LYMAN'S CLEARLY A COMMUNIST LYING ABOUT HIS POLITICS" I must provide at least one example of a big spending program I oppose, so, here you go. Don't subsidize daycare: https://ifstudies.org/blog/why-a-child-allowance-is-preferable-to-subsidized-child-care

Read on Twitter

Read on Twitter