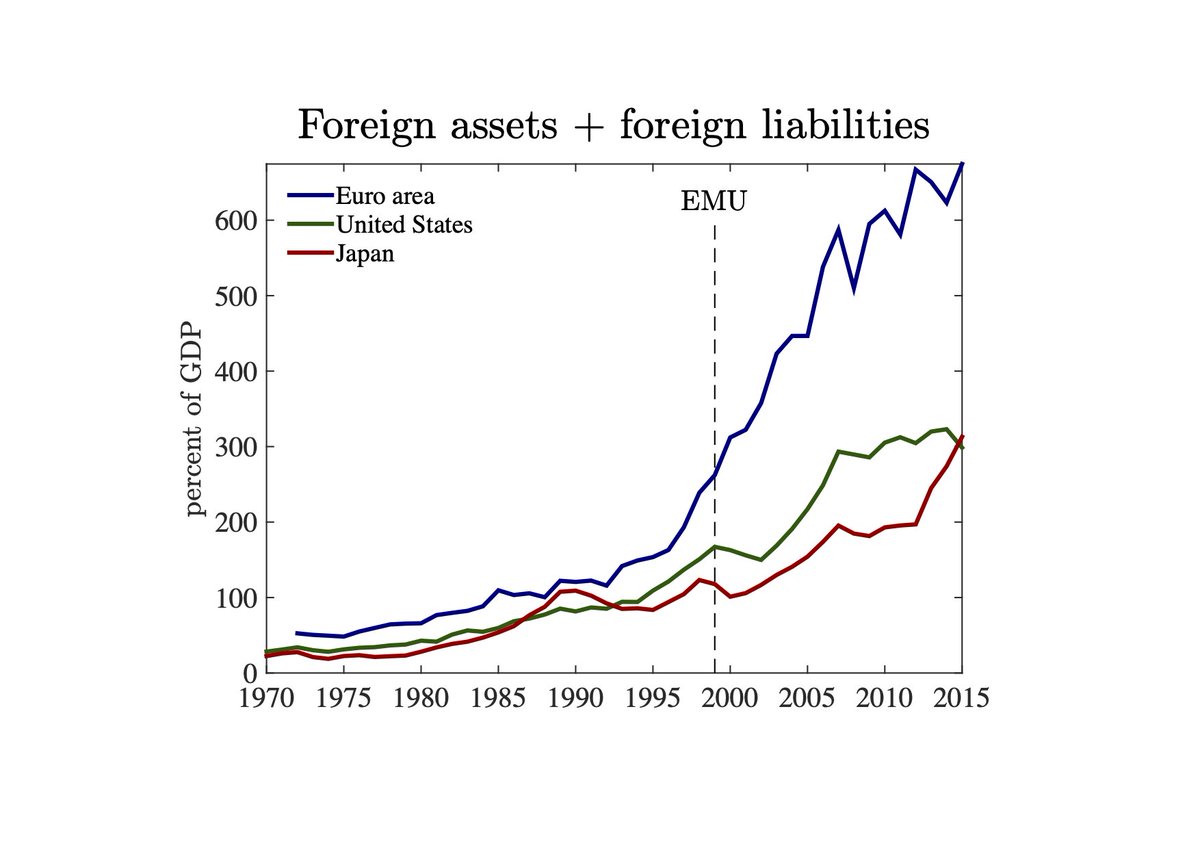

A thread on the euro and on its impact on welfare. Perhaps the most visible consequence of the euro has been a huge increase in capital mobility and financial integration among member countries ( https://www.aeaweb.org/articles?id=10.1257/jep.20.4.47, https://www.ceps.eu/ceps-publications/one-market-one-money-mistaken-argument-post-factum/).

The idea, which goes back at least to Keynes, is that national governments can expropriate foreign creditors by devaluing the exchange rate . Forming a currency union eliminates this possibility, leading to higher capital mobility ( https://crei.cat/wp-content/uploads/2020/07/MUFI.pdf).

In fact, following the introduction of the euro, countries such as Spain or Italy suddenly became able to borrow more and more cheaply from foreign investors. But they also became more exposed to capital flights toward core countries in response to adverse shocks.

What’s the net impact on welfare? I think it depends on the policy framework. The potential benefit is that higher financial integration might lead to more efficient allocation of capital and better risk sharing ( https://ies.princeton.edu/pdf/E98.pdf ). But there are several potential costs.

First, large capital inflows might be directed toward socially inefficient investments and cause slowdowns in productivity growth ( @GitaGopinath @skalemliozcan https://academic.oup.com/qje/article-abstract/132/4/1915/3871448?redirectedFrom=fulltext, @R2Rsquared https://www.nber.org/papers/w19288 , https://www.crei.cat/wp-content/uploads/2020/02/GFRC.pdf).

Cheap capital inflows might also fuel credit booms, leading to financial crises and deep recessions ( @profsufi @AtifRMian @EmilVerner @KMuellerEcon https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2971086, https://static1.squarespace.com/static/58f6b1c3e6f2e1a8b58d5fb5/t/5fe0d906ca013d032d5ca5ff/1608571152600/Muller+Verner+2020.pdf).

Second, high capital mobility means that adverse shocks might be compounded by capital flights. This makes it hard for national governments to run countercyclical fiscal policy ( https://www.ineteconomics.org/uploads/papers/koo-richard-berlin-paper.pdf). Moreover, if capital mobility is sufficiently high, capital flights might be

purely driven by pessimistic animal spirits ( https://crei.cat/wp-content/uploads/2020/07/MUFI.pdf, @pdegrauwe https://voxeu.org/article/design-failures-eurozone). So, IMO, to benefit from the increase in financial integration caused by the introduction euro we need policies that prevent these risks from materializing.

What are these policies? Though question, but here are some suggestions from the literature mentioned above. At the national level, policy interventions might be needed to ensure that capital inflows do not hurt productivity growth (subsidies to innovation?) or end up causing

financial crises and deep recessions (macroprudential policies?). Second, at the union level, countercyclical fiscal transfers might be needed to tame the impact of countercyclical capital flights on the economy ( @IvanWerning https://www.aeaweb.org/articles?id=10.1257/aer.20130817).

A system of countercyclical fiscal transfers, coupled with the union’s central bank acting as lender of last resort, might also be useful to prevent episodes of capital flights driven by pessimistic animal spirits.

This thread was sparked by an interesting discussion between @arpitrage and @FrancoisGourio https://twitter.com/arpitrage/status/1357526721407438850?s=20. Also, for those interested in the euro area, here is an excellent paper by @MarkusEconomist and @R2Rsquared https://personal.lse.ac.uk/reisr/papers/99-crashcourse.pdf.

Read on Twitter

Read on Twitter