Do you want to invest in real estate but cannot afford the downpayment?

Here is how you can become a real estate investor with only $100 per month

/THREAD/

Here is how you can become a real estate investor with only $100 per month

/THREAD/

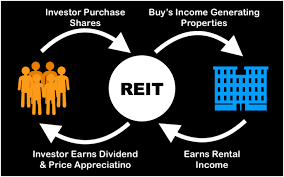

1/ REITs, or real estate investment trusts, are companies that own or finance income-producing real estate across a range of property sectors.

These real estate companies have to meet a number of requirements to qualify as REITs.

These real estate companies have to meet a number of requirements to qualify as REITs.

2/ Most REITs trade on major stock exchanges, and they offer a number of benefits to investors.

REITs provide all investors the chance to own valuable real estate, and the opportunity to receive dividend-based income.

REITs provide all investors the chance to own valuable real estate, and the opportunity to receive dividend-based income.

3/ REITs allow anyone to invest in portfolios of real estate assets the same way they invest in other industries through:

1. The purchase of an individual company stock

2. A mutual fund

3. An exchange-traded fund (ETF)

1. The purchase of an individual company stock

2. A mutual fund

3. An exchange-traded fund (ETF)

4/ The stockholders of a REIT earn a share of the income produced through real estate investment.

And this without actually having to go out and buy, manage or finance any property.

And this without actually having to go out and buy, manage or finance any property.

5/ To qualify as a REIT a company must:

1. Invest > 75% of its total assets in real estate

2. Derive > 75% of its gross income from real estate assets

3. Pay > 90% of its taxable income to the shareholders via dividends

1. Invest > 75% of its total assets in real estate

2. Derive > 75% of its gross income from real estate assets

3. Pay > 90% of its taxable income to the shareholders via dividends

6/ 4. Be an entity that is taxable as a corporation

5. Be managed by a board of directors or trustees

6. Have > 100 shareholders

7. Have < 50% of its shares held by five or fewer individuals

5. Be managed by a board of directors or trustees

6. Have > 100 shareholders

7. Have < 50% of its shares held by five or fewer individuals

7/ There are different types of REITs

1. Equity REITs: They own or operate income-producing real estate

2. mREITs (or mortgage REITs): They earn income from financing for income-producing real estate by purchasing or originating mortgages and mortgage-backed securities

1. Equity REITs: They own or operate income-producing real estate

2. mREITs (or mortgage REITs): They earn income from financing for income-producing real estate by purchasing or originating mortgages and mortgage-backed securities

8/ 3. Public Non-listed REITs: They are registered with the SEC but do not trade on any national stock exchanges

4. Private REITs: They are exempt from SEC registration and their shares do not trade on national stock exchanges.

4. Private REITs: They are exempt from SEC registration and their shares do not trade on national stock exchanges.

9/ REITs invest in a wide range of real estate property types

Offices

Apartment buildings

Warehouses

Retail centers

Medical facilities

Data centers

Cell towers

Infrastructure

Hotels

Offices

Apartment buildings

Warehouses

Retail centers

Medical facilities

Data centers

Cell towers

Infrastructure

Hotels

10/ Most REITs focus on a particular property type, but some hold multiple types of properties in their portfolios.

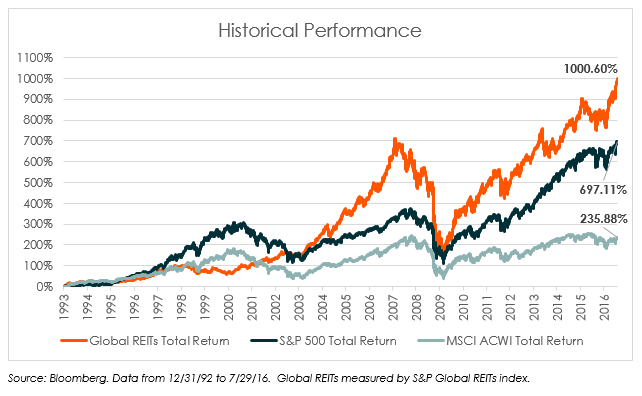

REITs historically have delivered competitive returns, based on high, steady dividend income and long-term capital appreciation.

REITs historically have delivered competitive returns, based on high, steady dividend income and long-term capital appreciation.

11/ Their comparatively low correlation with other assets also makes them an excellent choice to diversify your portfolio.

If you are a beginner investor willing to invest in real estate, REITs are the best and most affordable choice for you.

/END/

If you are a beginner investor willing to invest in real estate, REITs are the best and most affordable choice for you.

/END/

If you liked this thread click below and retweet the first tweet, and follow to stay updated https://twitter.com/itsKostasOnFIRE/status/1357614089049104384?s=20

For more educational threads on financial independence and investing for beginners see below for a collection of threads

https://twitter.com/itsKostasOnFIRE/status/1345790210441928708?s=20

https://twitter.com/itsKostasOnFIRE/status/1345790210441928708?s=20

https://twitter.com/itsKostasOnFIRE/status/1345790210441928708?s=20

https://twitter.com/itsKostasOnFIRE/status/1345790210441928708?s=20

Read on Twitter

Read on Twitter