1/23

Further to my notes on the #BMN Q4 production update webinar, here's some quotes/thoughts on the energy storage side of the business.

"We are obviously involved with Invinity, where we've got a right of first refusal of vanadium to their systems" https://twitter.com/BigBiteNow/status/1357369984826097665?s=20

Further to my notes on the #BMN Q4 production update webinar, here's some quotes/thoughts on the energy storage side of the business.

"We are obviously involved with Invinity, where we've got a right of first refusal of vanadium to their systems" https://twitter.com/BigBiteNow/status/1357369984826097665?s=20

2/

"we are 'quite' pleased in terms of the pipeline there we see developing."

"we have a similar arrangement with Enerox. As they secure more projects, we would anticipate that we will be supplying into those projects as well."

"we are 'quite' pleased in terms of the pipeline there we see developing."

"we have a similar arrangement with Enerox. As they secure more projects, we would anticipate that we will be supplying into those projects as well."

2/

"You don't get to see much from Enerox only because it is private but in time you will get to hear more around their project pipeline."

This hones in on that first refusal supply them, that I talked about in my previous sets of posts. https://twitter.com/BigBiteNow/status/1354826968697548802?s=20

"You don't get to see much from Enerox only because it is private but in time you will get to hear more around their project pipeline."

This hones in on that first refusal supply them, that I talked about in my previous sets of posts. https://twitter.com/BigBiteNow/status/1354826968697548802?s=20

3/

"Suffice to say we are very encouraged by what we see and anticipate that this year, you will start to see some meaningful volumes of our sales, being in the electrolyte category."

This is what its all about. Proving to the market that this concept of a vanadium miner,

"Suffice to say we are very encouraged by what we see and anticipate that this year, you will start to see some meaningful volumes of our sales, being in the electrolyte category."

This is what its all about. Proving to the market that this concept of a vanadium miner,

4/

supplying into a non-cyclical and expanding eneryg storage market, truly has legs and longevity.

Two significant vanadium rental projects. Pivot Power at Oxford and the mini grid at Vametco.

Now a really important bit.

The mini grid rental is designed to...

supplying into a non-cyclical and expanding eneryg storage market, truly has legs and longevity.

Two significant vanadium rental projects. Pivot Power at Oxford and the mini grid at Vametco.

Now a really important bit.

The mini grid rental is designed to...

5/

"prove the business case for leasing the electrolyte and it gives us the platform for the 3rd stage of our roll out strategy, which is establishing a fund platform, which will involve and attract financial investors into a platform that is essentially acquiring vanadium..."

"prove the business case for leasing the electrolyte and it gives us the platform for the 3rd stage of our roll out strategy, which is establishing a fund platform, which will involve and attract financial investors into a platform that is essentially acquiring vanadium..."

5/

and leasing it into VRFBs."

"We will be providing more information on the developments in this respect in due course but it is work that is progressing well."

Because BMN like to pack their updates so tightly with information, the strategy can sometimes become...

and leasing it into VRFBs."

"We will be providing more information on the developments in this respect in due course but it is work that is progressing well."

Because BMN like to pack their updates so tightly with information, the strategy can sometimes become...

6/

lost in translation but that doesn't mean its not a very sound and exciting one.

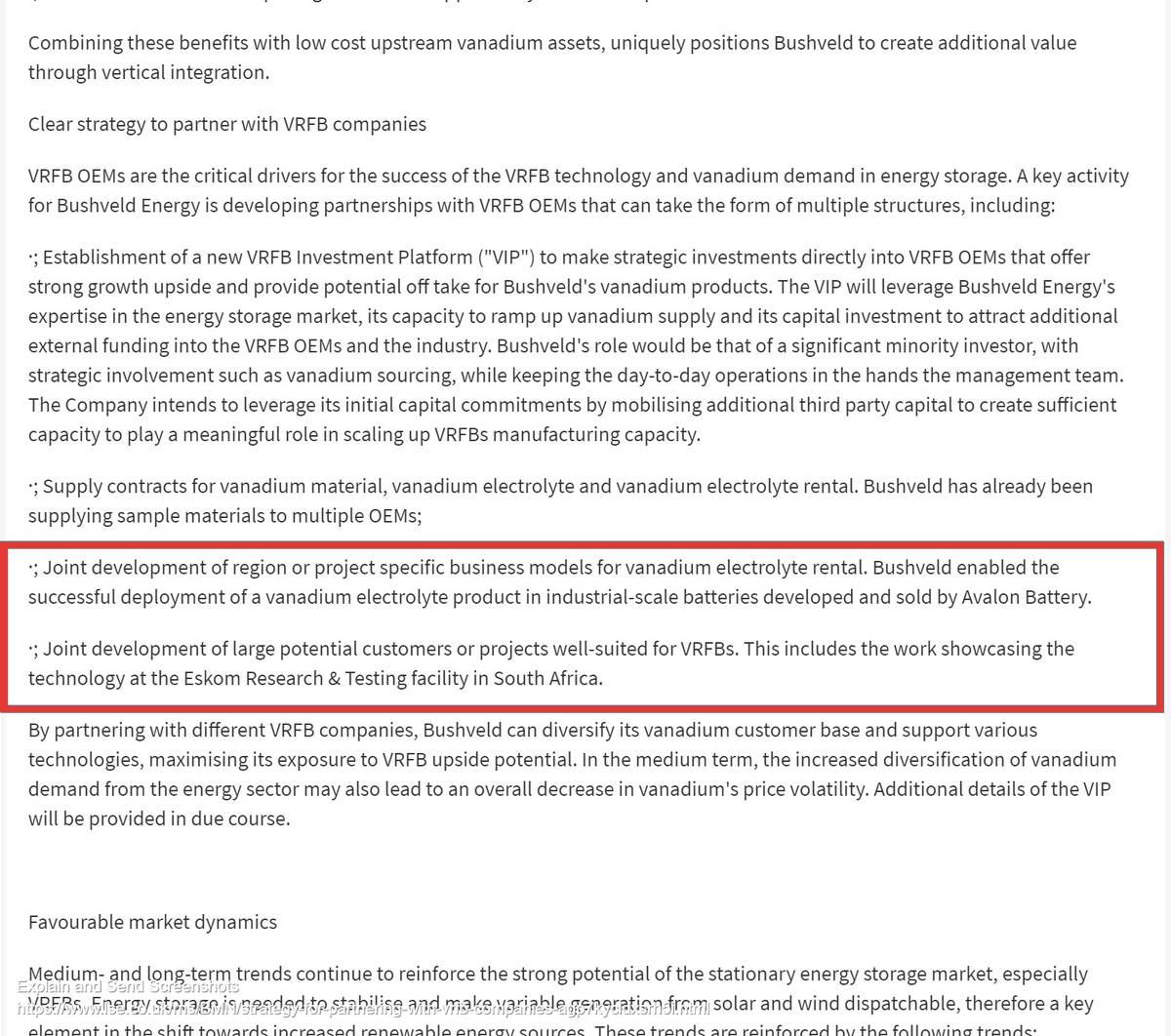

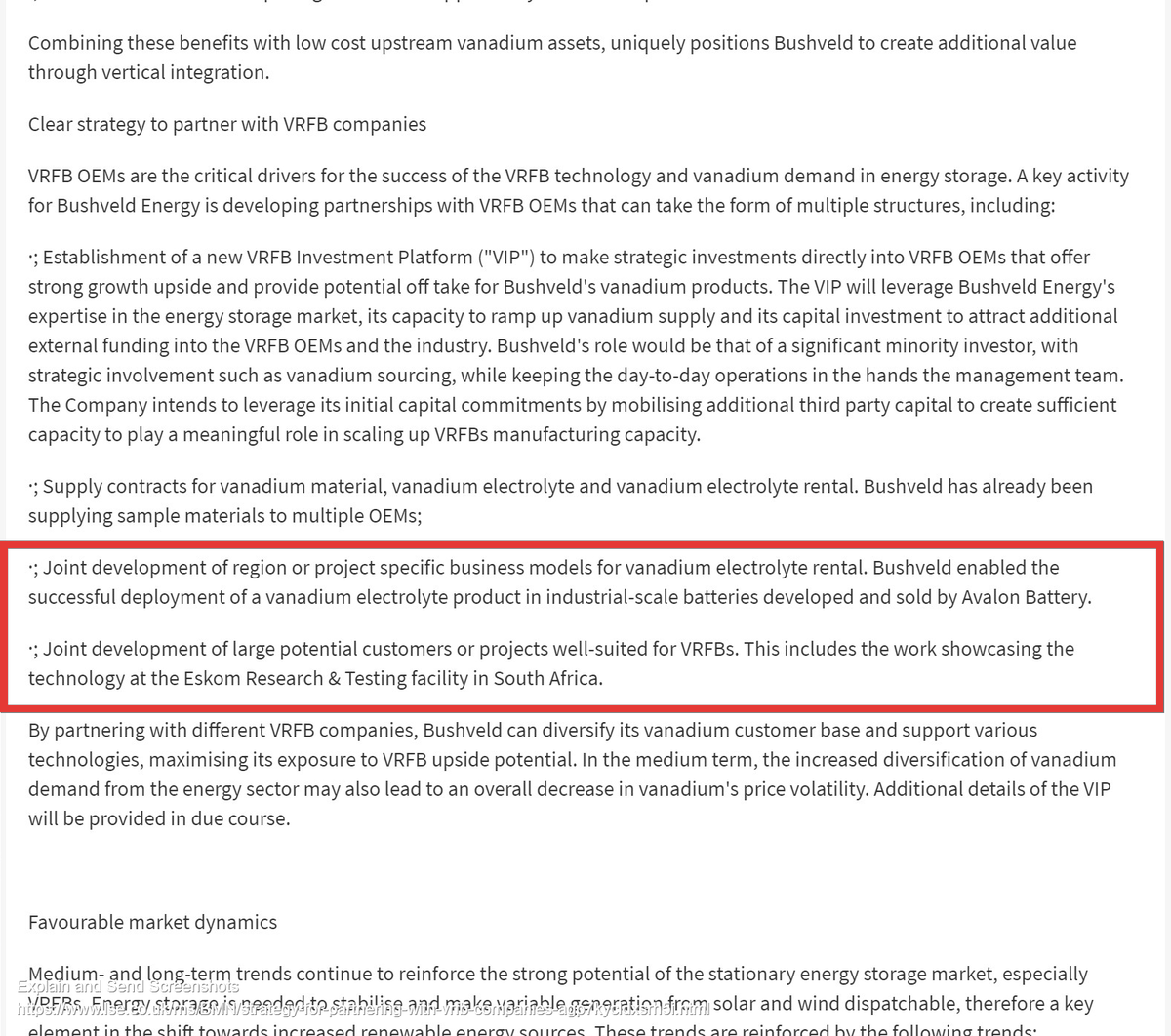

Here's an extract from their 1st November "trategy for partnering with VRFB companies" RNS. I have highlighted 2 important sections.

lost in translation but that doesn't mean its not a very sound and exciting one.

Here's an extract from their 1st November "trategy for partnering with VRFB companies" RNS. I have highlighted 2 important sections.

7/

Firstly item 3 (3rd)

"Joint development of region or project specific business models for vanadium electrolyte rental."

What the above insight into this "3rd stage of our roll out" demonstrates, is a clear strategy to not only demonstrate a working industrial/mining...

Firstly item 3 (3rd)

"Joint development of region or project specific business models for vanadium electrolyte rental."

What the above insight into this "3rd stage of our roll out" demonstrates, is a clear strategy to not only demonstrate a working industrial/mining...

8/

example in South Africa but to establish a regional business model, with funders on board to help further customers follow the same path.

For local businesses that have struggled with rising costs of power, such a highly attractive option, which removes a significant...

example in South Africa but to establish a regional business model, with funders on board to help further customers follow the same path.

For local businesses that have struggled with rising costs of power, such a highly attractive option, which removes a significant...

9/

portion of the upfront cost, must surely be of great interest.

As a person who has studied nearly every word that Mr Mojapelos has spoken these last 6 years or so, I can say with confidence that "will involve and attract financial investors," means its much further along...

portion of the upfront cost, must surely be of great interest.

As a person who has studied nearly every word that Mr Mojapelos has spoken these last 6 years or so, I can say with confidence that "will involve and attract financial investors," means its much further along...

10/

than investors could ever hope to appreciate.

What makes all of this all the more intriguing, is that it is Enerox that is supplying the battery into that mini grid.

So if the mini grid is successful and the business model successfully demonstrated, which is as much of...

than investors could ever hope to appreciate.

What makes all of this all the more intriguing, is that it is Enerox that is supplying the battery into that mini grid.

So if the mini grid is successful and the business model successfully demonstrated, which is as much of...

11/

a given as an investor could wish for, then it looks very much like a localised fund is coming, that will drive further business (initially) in South Africa, which inevitably will go a long way towards delivering localised VRFB assembly and manufacture....

a given as an investor could wish for, then it looks very much like a localised fund is coming, that will drive further business (initially) in South Africa, which inevitably will go a long way towards delivering localised VRFB assembly and manufacture....

12/

and that's just one avenue of opportunity.

If the strategy truly is running in order and that was the 3rd stage, then the 4th stage is coming up next...

A reminder.

and that's just one avenue of opportunity.

If the strategy truly is running in order and that was the 3rd stage, then the 4th stage is coming up next...

A reminder.

13/

"Joint development of large potential customers or projects well-suited for VRFBs."

"This includes the work showcasing the technology at the Eskom Research & Testing facility in South Africa."

You tease you.

All of these 'stages' fall under the umbrella ;

"Joint development of large potential customers or projects well-suited for VRFBs."

"This includes the work showcasing the technology at the Eskom Research & Testing facility in South Africa."

You tease you.

All of these 'stages' fall under the umbrella ;

14/

"Clear strategy to partner with VRFB companies."

So the BMN energy storage story isn't simply about Invinity and Enerox, although they alone have the ability to keep Bushveld Vanadium very busy in the coming years.

BMN's partner on their demonstration battery at Eskom,

"Clear strategy to partner with VRFB companies."

So the BMN energy storage story isn't simply about Invinity and Enerox, although they alone have the ability to keep Bushveld Vanadium very busy in the coming years.

BMN's partner on their demonstration battery at Eskom,

15/

is Rongke Power, who recently took part in the Vanitec Energy Storage Committee webinar, which is chaired by Mikhail Nikomarov.

Back to that 2019 VRFB strategy and stage 2.

BMN was supplying samples of their electrolyte capabilities as early as Nov 2019.

is Rongke Power, who recently took part in the Vanitec Energy Storage Committee webinar, which is chaired by Mikhail Nikomarov.

Back to that 2019 VRFB strategy and stage 2.

BMN was supplying samples of their electrolyte capabilities as early as Nov 2019.

16/

There can be no doubt that BMN and a suitable partner (my view Rongke Power), are making every attempt to secure contracts in the pending 2,000MW risk mitigation tender, the 200MW Eskom BESS tender and indeed the IRP.

The opportunities are just too big and too local,

There can be no doubt that BMN and a suitable partner (my view Rongke Power), are making every attempt to secure contracts in the pending 2,000MW risk mitigation tender, the 200MW Eskom BESS tender and indeed the IRP.

The opportunities are just too big and too local,

17/

for BMN and their strategy/partners, to simply let slip them by.

Having followed this story for so long and (in the case of the Eskom BESS) having watched how BMN themselves, have created this very opportunity, through their work with the IDC,

for BMN and their strategy/partners, to simply let slip them by.

Having followed this story for so long and (in the case of the Eskom BESS) having watched how BMN themselves, have created this very opportunity, through their work with the IDC,

18/

I just cannot see how they are not pushing very hard to win a good chunk of that work.

The only negative I saw on this front, centred around the requirements on the Eskom BESS tender, for participants to have ;

I just cannot see how they are not pushing very hard to win a good chunk of that work.

The only negative I saw on this front, centred around the requirements on the Eskom BESS tender, for participants to have ;

19/

"BESS plant of culmulative capacity of not less than 60MW and each contract of not less than 20MW, substantially completed in the last 7 years."

Having reviewed the Rongke Power project slide from the 8th Energy Storage meeting (see here),

http://vanitec.org/vanadium/ESC-Meetings

"BESS plant of culmulative capacity of not less than 60MW and each contract of not less than 20MW, substantially completed in the last 7 years."

Having reviewed the Rongke Power project slide from the 8th Energy Storage meeting (see here),

http://vanitec.org/vanadium/ESC-Meetings

20/

i saw that they have a culmulative c. 66MW of installations over c. min. 10 years and 2 projects of +20MW, carried out in 2016 and 2019.

Add to this the commissioning of phase 1 100MW battery at Dalian + their 300MW production facility and for me, they at the very least,

i saw that they have a culmulative c. 66MW of installations over c. min. 10 years and 2 projects of +20MW, carried out in 2016 and 2019.

Add to this the commissioning of phase 1 100MW battery at Dalian + their 300MW production facility and for me, they at the very least,

21/

meet the very stringent criteria set down by Eskoms technical team.

We may all have missed someone out there but I would go as far as to say that they are the only VRFB OEM, that can meet this criteria.

meet the very stringent criteria set down by Eskoms technical team.

We may all have missed someone out there but I would go as far as to say that they are the only VRFB OEM, that can meet this criteria.

22/

Conclusions.

1. There's clearly a lot to come on the energy storage front from BMN in 2021.

2. There is clearly a strategy to focus in on South African market with mini grids and vanadium rental and Vametco helps act as a trigger for it.

3. Joint development of large...

Conclusions.

1. There's clearly a lot to come on the energy storage front from BMN in 2021.

2. There is clearly a strategy to focus in on South African market with mini grids and vanadium rental and Vametco helps act as a trigger for it.

3. Joint development of large...

23/

potential customers and projects is a strategy and S.A. has many opportunities coming to a head over the coming weeks.

4. As i highlighted yesterday, BMN simply has to act now to expand its capacity and ensure its reliability because these opportunities are fast approaching.

potential customers and projects is a strategy and S.A. has many opportunities coming to a head over the coming weeks.

4. As i highlighted yesterday, BMN simply has to act now to expand its capacity and ensure its reliability because these opportunities are fast approaching.

24-30

There's more.

Whilst #BMN may want to "under promise and over deliver,"

there's simply no getting away from the fact, that the energy storage opportunity, demands a concerted effort to expand production substantially.

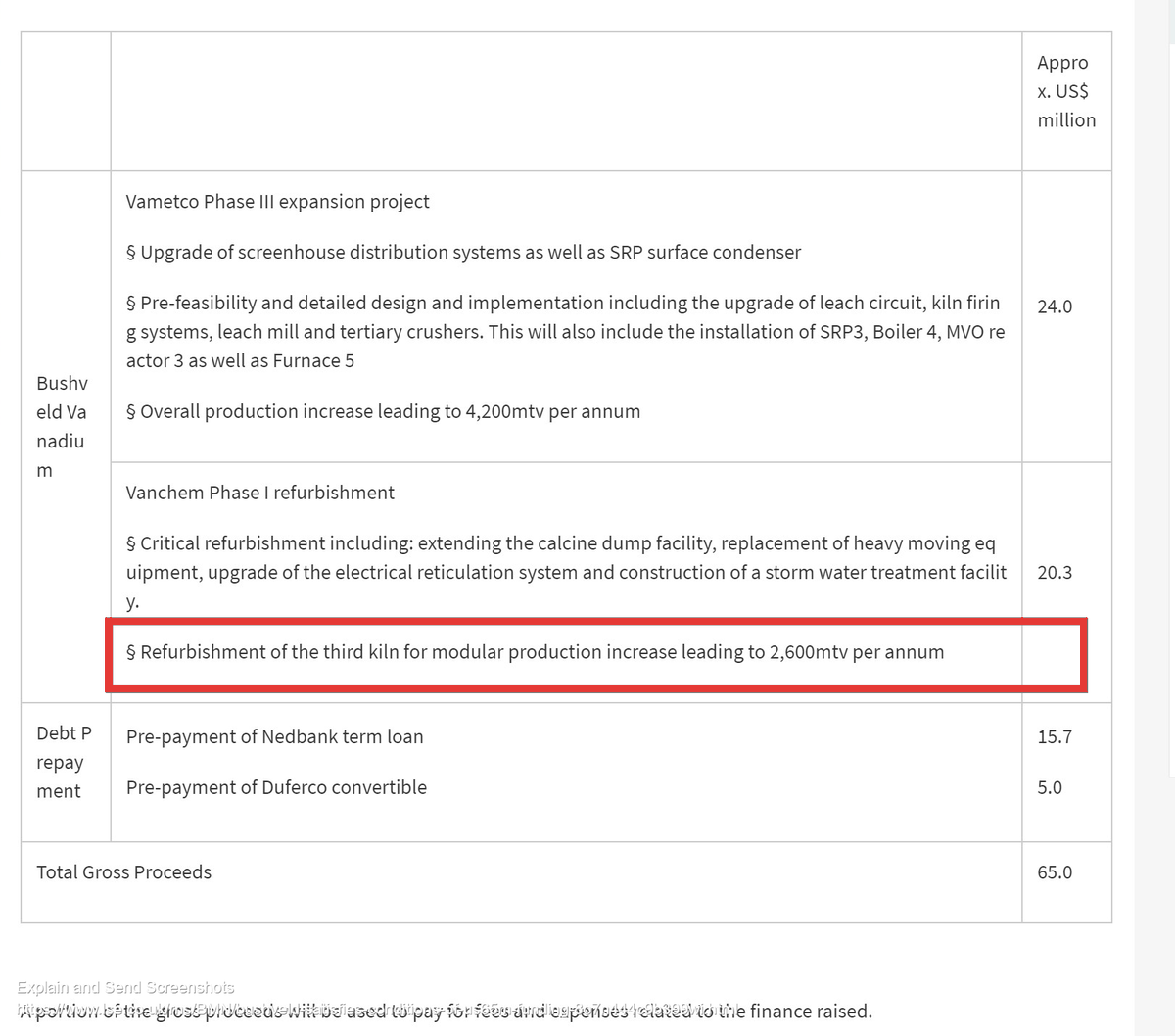

Clearly BMN see that too because Vanchem kiln 3...

There's more.

Whilst #BMN may want to "under promise and over deliver,"

there's simply no getting away from the fact, that the energy storage opportunity, demands a concerted effort to expand production substantially.

Clearly BMN see that too because Vanchem kiln 3...

25/

refurbishment started as early as December 2020.

That phase 1 refurbishment adds a 1,500 mtV to an already 1,100 mtV production rate.

From what Mr Mojapelo stated in the webinar, Vametco has every chance of adding more in 2021, with reliability and consistent production...

refurbishment started as early as December 2020.

That phase 1 refurbishment adds a 1,500 mtV to an already 1,100 mtV production rate.

From what Mr Mojapelo stated in the webinar, Vametco has every chance of adding more in 2021, with reliability and consistent production...

26/

also a key policy, to ensure that these new and expanding energy storage demands, can be met with confidence.

Its highly likely that the market needs to have this opportunity thrust into its face to truly see it.

Anyone who takes the time to research BMN properly,

also a key policy, to ensure that these new and expanding energy storage demands, can be met with confidence.

Its highly likely that the market needs to have this opportunity thrust into its face to truly see it.

Anyone who takes the time to research BMN properly,

27/

gets into the history, the relationships, the strategy, the market...

will surely see just how real this all is.

A moment is coming when the market finally starts to appreciate the enormity of what BMN is achieving.

gets into the history, the relationships, the strategy, the market...

will surely see just how real this all is.

A moment is coming when the market finally starts to appreciate the enormity of what BMN is achieving.

28/

Carving out a position in a multi billion dollar energy storage market, with or without wider market acceptance of the technology.

Single handily enabling what were failing VRFB companies, but with great technology, the ability to now only re-enter the market but...

Carving out a position in a multi billion dollar energy storage market, with or without wider market acceptance of the technology.

Single handily enabling what were failing VRFB companies, but with great technology, the ability to now only re-enter the market but...

29/

start to compete with lithium-ion and access further capital, by de-risking these enterprises sufficiently enough, to make them worth the investment.

Its the same strategy that delivered Vametco and Vanchem to the business in the first place.

These strategic moves are...

start to compete with lithium-ion and access further capital, by de-risking these enterprises sufficiently enough, to make them worth the investment.

Its the same strategy that delivered Vametco and Vanchem to the business in the first place.

These strategic moves are...

30/

continuing because a leopard doesn't change its spots.

BMN management has form and when they set a strategy in play, its usually backed by considerably more progress, than the market is ever being told.

A reality which I expect to prove itself again and again, in 2021.

continuing because a leopard doesn't change its spots.

BMN management has form and when they set a strategy in play, its usually backed by considerably more progress, than the market is ever being told.

A reality which I expect to prove itself again and again, in 2021.

31/

@BushveldMin_Ltd

Given you started refurbishing kiln 3 at Vanchem back in Dec 2020, why don't you share such wonderful progress with the market at the time?

The same goes for what said Kiln refurb will do to total production. Stated in Dec RNS but many may not have seen it.

@BushveldMin_Ltd

Given you started refurbishing kiln 3 at Vanchem back in Dec 2020, why don't you share such wonderful progress with the market at the time?

The same goes for what said Kiln refurb will do to total production. Stated in Dec RNS but many may not have seen it.

Read on Twitter

Read on Twitter