1/n Some Friday thoughts on #Bitcoin  - which were piqued by the excellent @ARKInvest Big Ideas 2021 report, which you can (and should) read here https://research.ark-invest.com/hubfs/1_Download_Files_ARK-Invest/White_Papers/ARK–Invest_BigIdeas_2021.pdf?hsCtaTracking=4e1a031b-7ed7-4fb2-929c-072267eda5fc%7Cee55057a-bc7b-441e-8b96-452ec1efe34c Before I start

- which were piqued by the excellent @ARKInvest Big Ideas 2021 report, which you can (and should) read here https://research.ark-invest.com/hubfs/1_Download_Files_ARK-Invest/White_Papers/ARK–Invest_BigIdeas_2021.pdf?hsCtaTracking=4e1a031b-7ed7-4fb2-929c-072267eda5fc%7Cee55057a-bc7b-441e-8b96-452ec1efe34c Before I start

1. I own #BTC

2. I wish I owned more #BTC

3. I am not a bear

4. I'm biased

OK - so here we go

- which were piqued by the excellent @ARKInvest Big Ideas 2021 report, which you can (and should) read here https://research.ark-invest.com/hubfs/1_Download_Files_ARK-Invest/White_Papers/ARK–Invest_BigIdeas_2021.pdf?hsCtaTracking=4e1a031b-7ed7-4fb2-929c-072267eda5fc%7Cee55057a-bc7b-441e-8b96-452ec1efe34c Before I start

- which were piqued by the excellent @ARKInvest Big Ideas 2021 report, which you can (and should) read here https://research.ark-invest.com/hubfs/1_Download_Files_ARK-Invest/White_Papers/ARK–Invest_BigIdeas_2021.pdf?hsCtaTracking=4e1a031b-7ed7-4fb2-929c-072267eda5fc%7Cee55057a-bc7b-441e-8b96-452ec1efe34c Before I start 1. I own #BTC

2. I wish I owned more #BTC

3. I am not a bear

4. I'm biased

OK - so here we go

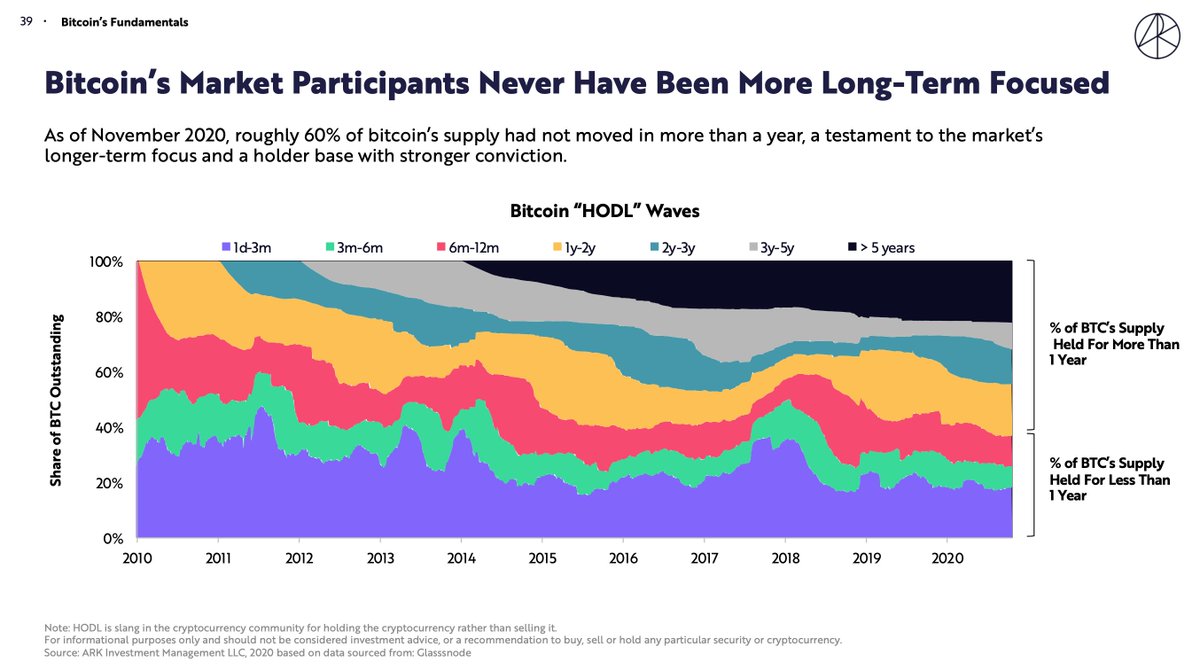

2/n See this chart - and headline "Market participants never more long-term focused" - that may be true, the alternative argument is that 12 years into #bitcoins, never has there been less interest in using it as form of payment. It's all (or mostly) asset price speculation.

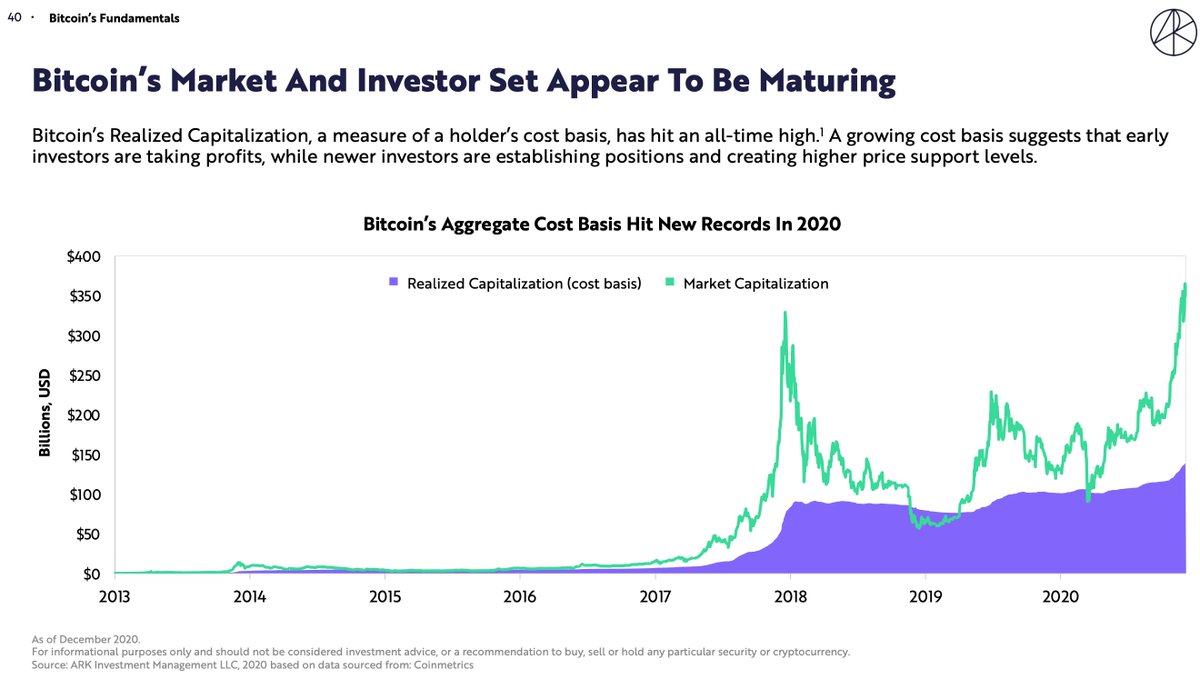

3/n Chart says holder cost basis have hit all-time high, which they claim suggests early investors are taking profits (I agree) and new investors are "creating higher price support levels" - alternative headline - "Bagholders have bought into a bubble at/near top". Time will tell

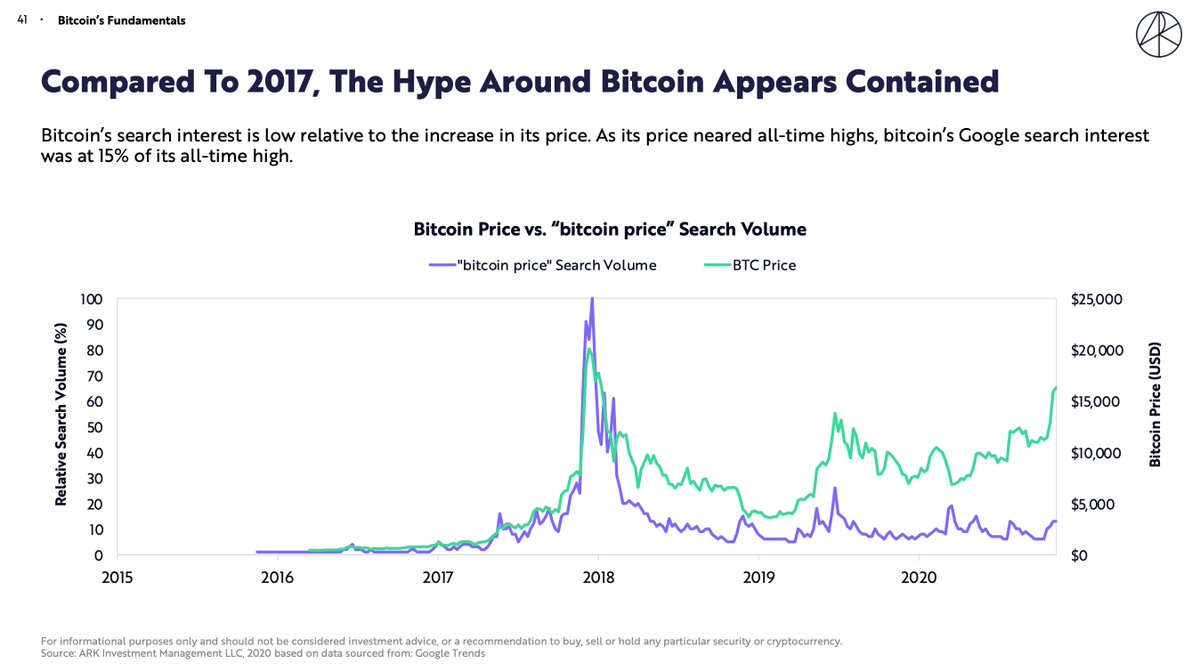

4/n Chart suggest hype isn't as big this time based on Google. Maybe - but those who Googled in 2017 don';t need to do it again. Also - check out second chart (not from @ark) on weekly crypto subreddit subscribers. Seems plenty bubbly from that perspective. Also worth noting

that, according to @findercomau info - 5 million Aussies have an interest in crypto, 13% trade #Bitcoin  whilst local exchange @coinspotau has 1 million users https://coinspot.zendesk.com/hc/en-us/articles/360003040716-CoinSpot-Hits-1-Million-Users-2-BTC-Giveaway- (h/t @josephskewes for the link)

whilst local exchange @coinspotau has 1 million users https://coinspot.zendesk.com/hc/en-us/articles/360003040716-CoinSpot-Hits-1-Million-Users-2-BTC-Giveaway- (h/t @josephskewes for the link)

whilst local exchange @coinspotau has 1 million users https://coinspot.zendesk.com/hc/en-us/articles/360003040716-CoinSpot-Hits-1-Million-Users-2-BTC-Giveaway- (h/t @josephskewes for the link)

whilst local exchange @coinspotau has 1 million users https://coinspot.zendesk.com/hc/en-us/articles/360003040716-CoinSpot-Hits-1-Million-Users-2-BTC-Giveaway- (h/t @josephskewes for the link)

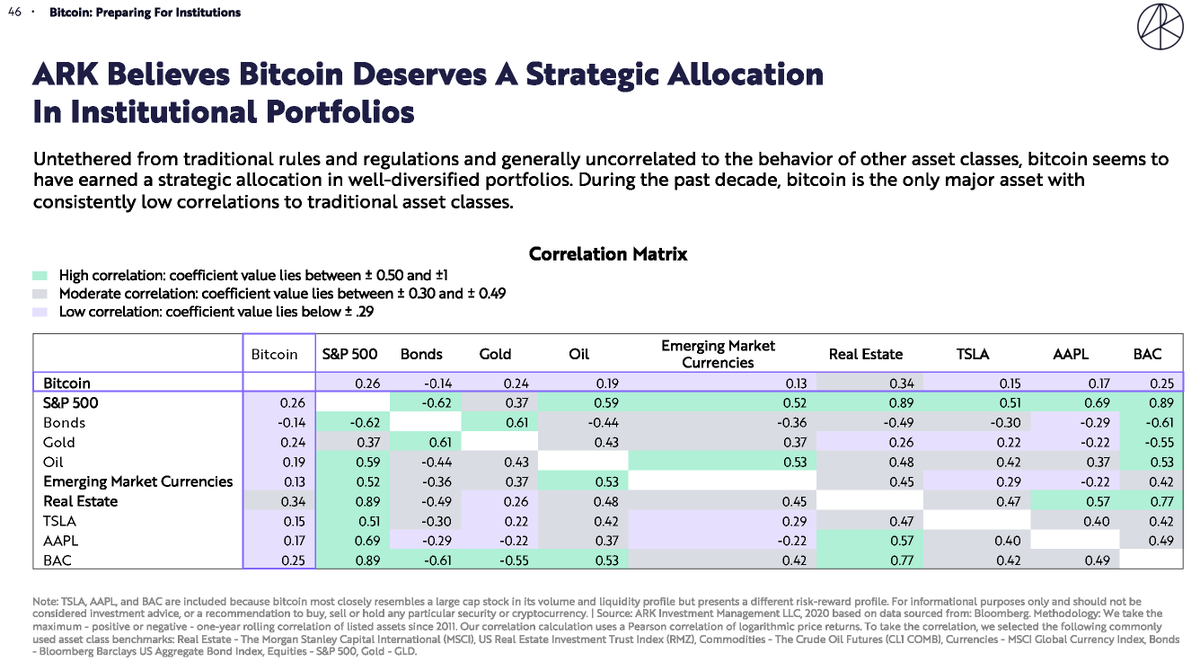

Now onto #BTC  role in a portfolio and @ARKInvest say it deserves one as its uncorrelated - see below table, which appears based on data from 2011. All well and good - no arguments (so far) but then consider

role in a portfolio and @ARKInvest say it deserves one as its uncorrelated - see below table, which appears based on data from 2011. All well and good - no arguments (so far) but then consider

role in a portfolio and @ARKInvest say it deserves one as its uncorrelated - see below table, which appears based on data from 2011. All well and good - no arguments (so far) but then consider

role in a portfolio and @ARKInvest say it deserves one as its uncorrelated - see below table, which appears based on data from 2011. All well and good - no arguments (so far) but then consider

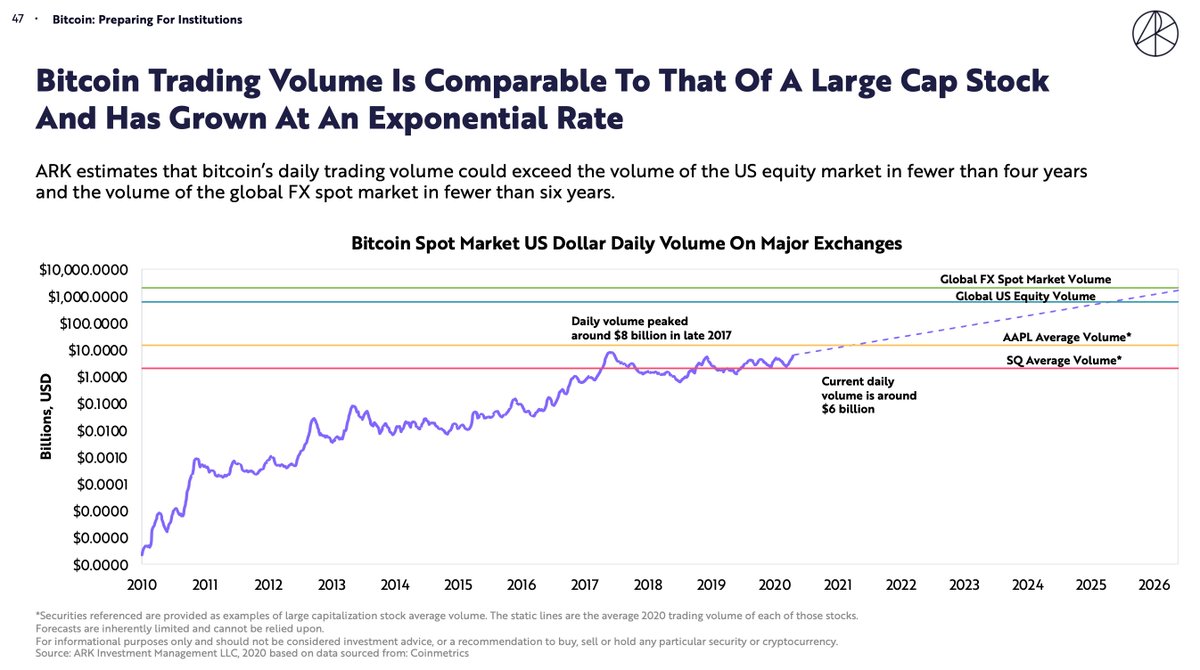

this chart - which shows volume of #BTC  traded over time - doesn't look like it hit $1bn in daily turnover until 2016/2017 (happy to be corrected), and market cap was tiny. Ergo - all of the correlation data prior to that is probably meaningless for insto investors

traded over time - doesn't look like it hit $1bn in daily turnover until 2016/2017 (happy to be corrected), and market cap was tiny. Ergo - all of the correlation data prior to that is probably meaningless for insto investors

traded over time - doesn't look like it hit $1bn in daily turnover until 2016/2017 (happy to be corrected), and market cap was tiny. Ergo - all of the correlation data prior to that is probably meaningless for insto investors

traded over time - doesn't look like it hit $1bn in daily turnover until 2016/2017 (happy to be corrected), and market cap was tiny. Ergo - all of the correlation data prior to that is probably meaningless for insto investors

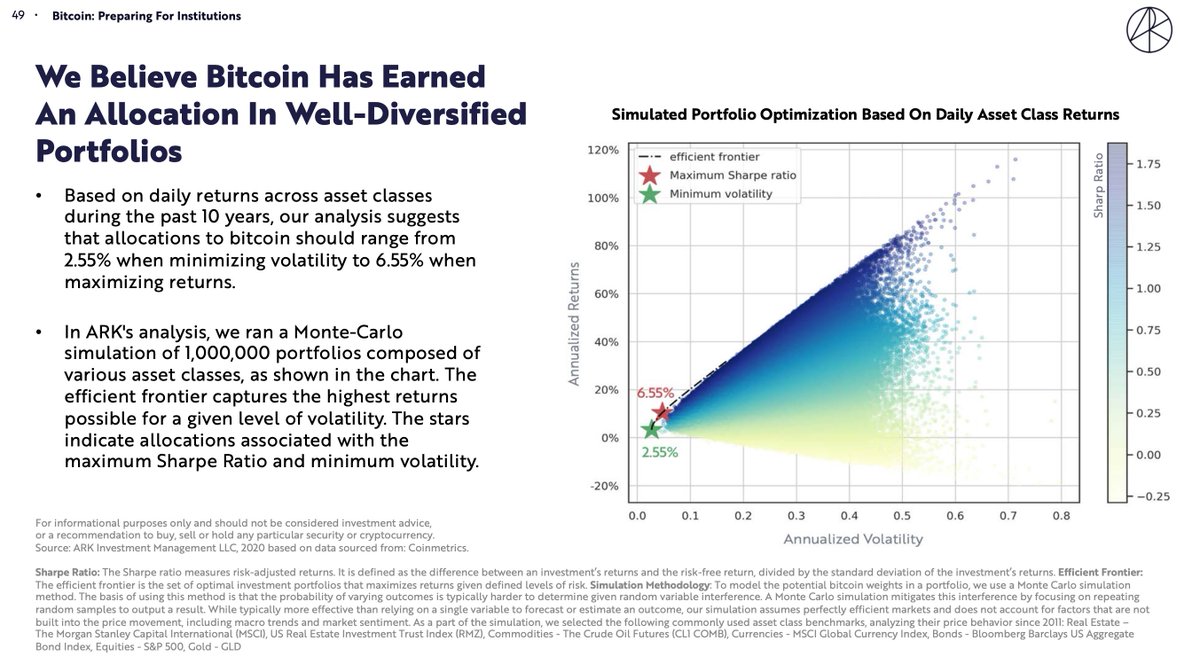

Not because anything wrong with #BTC  but it was a Mickey Mouse market up until then (some argue it still is). It would be like using #GME data to make the same point. Ergo for this chart which argues for a 2.55% to 6.55% allocation - based on simulations that used similar data.

but it was a Mickey Mouse market up until then (some argue it still is). It would be like using #GME data to make the same point. Ergo for this chart which argues for a 2.55% to 6.55% allocation - based on simulations that used similar data.

but it was a Mickey Mouse market up until then (some argue it still is). It would be like using #GME data to make the same point. Ergo for this chart which argues for a 2.55% to 6.55% allocation - based on simulations that used similar data.

but it was a Mickey Mouse market up until then (some argue it still is). It would be like using #GME data to make the same point. Ergo for this chart which argues for a 2.55% to 6.55% allocation - based on simulations that used similar data.

Final comment - this should not be interpreted as being anti #Bitcoin  because I'm not. Thus endeth the unsolicited spreading of FUD.

because I'm not. Thus endeth the unsolicited spreading of FUD.

because I'm not. Thus endeth the unsolicited spreading of FUD.

because I'm not. Thus endeth the unsolicited spreading of FUD.

Ping @josephskewes @michaelbatnick @bronsuchecki @AlexSaundersAU @profplum99 @RaoulGMI @ttmygh @RonStoeferle @bronsuchecki @JohnFeeney10 @Scutty @Colgo @SantiagoAuFund

@threadreaderapp unroll

Read on Twitter

Read on Twitter