Taeko Yamazaki is the Director of the Yamatane Museum of Art, which has a major collection of works in the nihonga genre. She came to mind when GameStop started dominating the headlines.

The art museum was founded by her grandfather, Taneji Yamazaki. The name Yamatane (山種) combines the first and third characters of his name, 山崎種二. Yamazaki made his fortune from commodity and stock markets.

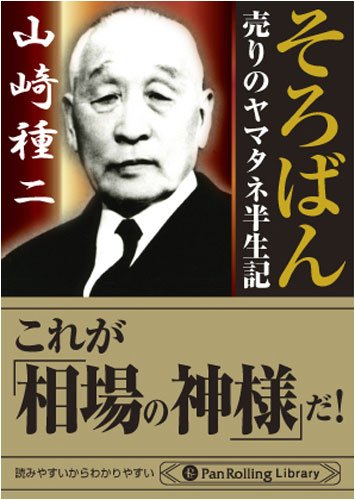

This is Yamazaki's autobiography, "Soroban" (The Abacus). The cover burb calls him "god of the markets" and 売りのヤマタネ. Yamazaki was famous for short-selling, the strategy at the heart of the GameStop saga.

With GameStop, short-selling hedge funds were demonized for trying to destroy a business. Yamazaki started in the rice markets, where short-selling was viewed differently. Yamazaki sold short when he though someone was hoading rice to articially drive up the price.

One famous coup came against Sadashichi Ishii, who was known as the Shogun of Yokobori, after the huge mansion he built there from profits he made in the timber and copper markets.

With expectations of a bad harvest, Ishii started cornering the market in rice, driving the price up 60%. Yamazaki started selling, and succeeded in driving the price down. Ishii sustained such heavy losses, and owed so much money, he became known as the 借金王 (Debt King).

While low rice prices might be good for consumers. they could be disastrous for farmers, so anyone thought to be manipulating the market could become a target for abuse, or political action. Yamazaki decided he might be better off playing the stock market instead.

The Great Crash of 1929 made stocks unpopular but Yamazaki was early to ride the market gains which started after the Mukden Incident in 1931, and the new economic policies which followed. By 1935, he though the market looked toppy and had become a seller.

However, the market kept rising into 1936, and Yamazaki was on the brink. He decided to cut his losses. In those days, you couldn't make telephone calls at will, you had to book a slot. On the 25th February, he arranged to call his Niigata brokers the next morning.

Today, the 26th February, 1936 is known as the 二・二六事件, an attempted coup d'état by young Imperial Army officers, which saw the assasination of several leading politicians.

The coup took place in the early morning, so Yamazaki knew all about it. He also had a call booked to trade on the Niigata Exchange, which opened earlier than the Tokyo Stock Exchange. In Niigata, they hadn't yet heard about the coup attempt.

Yamazaki took full advantage. Instead of buying back, he sold more. Tokyo Stock Exchange trading had been suspended but Niigata didn't hear about it until Yamazaki's orders had already been processed.

The coup was finally put down but the stock market did not re-open until nearly two weeks later in March, when there was an avalanche of selling. Yamazaki covered his shorts at a huge profit, and was also able to build new long positions, taking advantage of distressed sellers.

Yamazaki did not always come out on the winning side when shorting. One well-known defeat was in 1950, in a battle over stock in Asahi Glass (known today as AGC).

In 1950, the contractionary policies of Joseph Dodge were in effect. Ther were slim-pickings for speculators, as GHQ had effectively banned margin trading. There were some exceptions, however.

This was also the time the zaibatsu were being broken up. During the war, Asahi Glass had merged with Mitsubishi Chemical but GHQ ordered it be spun off again, and listed independently on the Tokyo Stock Exchange. Newly listed shares were not subject to margin trading limits.

Fair value for Asahi Glass shares was estimated to be 250 yen but it ran up to 420 on heavy buying by Yamaichi Securities, which was the largest broker at the time. Yamazaki led a group of sellers, and the stock fell to 350 yen, in volatile trading.

Yamaichi boss Hajime Okami (大神一 ) went to the floor of the exchange to rally his side. He could also count on the support of Wasaburo Sato, a colourful speculator nicknamed買いのブーチャン (Bu-chan the Bull) because of his penchant for buying big.

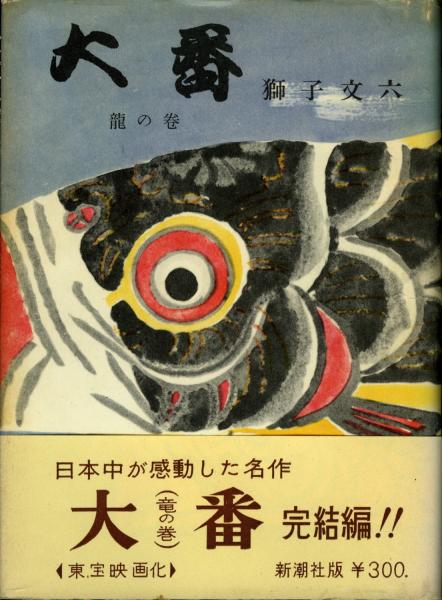

Bu-chan was the model for the Gyu-chan character in Bunroku Shishi's novel "Oban". It was made into a film, and then a TV series, where rags-to-riches speculator Gyu-chan was played by Tora-san actor Kiyoshi Atsumi.

With a known buyer and known seller against each other, the 12th April 1950 was the big market showdown. The price of Asahi Glass shares skyrocketed from 350 yen to 451 yen.

The next day, the exchange limited margin trading, which affected the ability of sellers to continue shorting. The stock barrelled on to 531 yen. At that level, everyone who had sold short was out of pocket.

The market was so chaotic, the exchange suspended trading in Asahi Glass. The Finance Ministry and GHQ had to decide a price, so transactions could clear. They picked 514 yen. While this was lower than short sellers feared, it still spelled bankruptcy for some firms.

Yamazaki, and his Yamatane Securities brokerage, lived to fight another day but it counted as a significant defeat. It later transpired that his opponents may have been playing with a stacked deck.

Account here says Yamaichi was actually buying a stake for Asahi Glass, who needed to offer it in exchange for licensing rights. There was a genuine buyer, not just speculative boosterism behind the stock price rise. http://jcoffee.g2s.biz/retsuden4.html#asahigarasu3

Read on Twitter

Read on Twitter