My investing style explained.

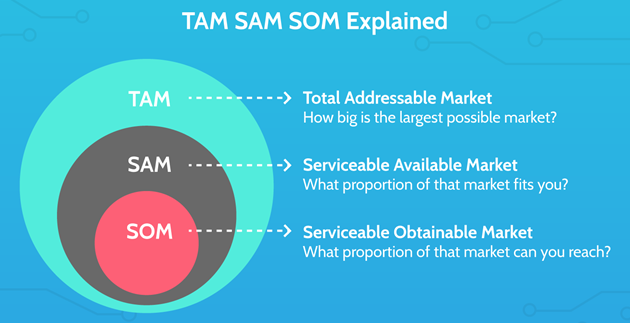

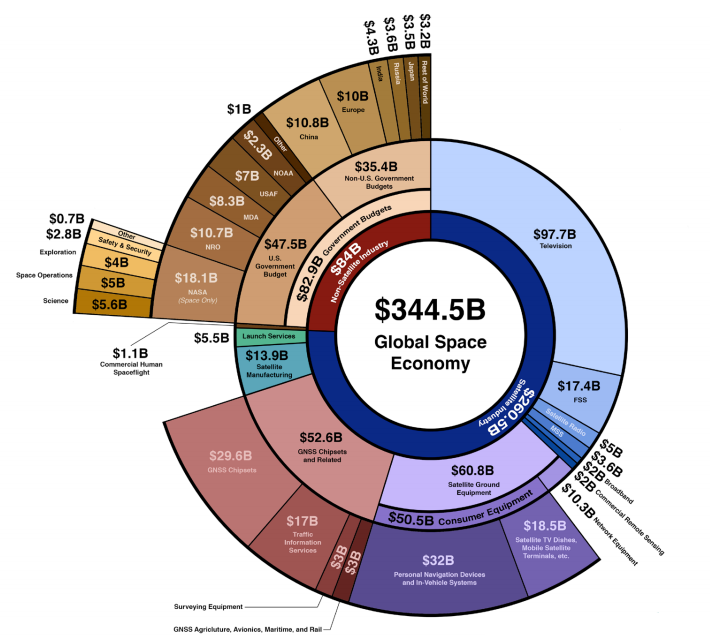

1. I focus first on markets - I like large TAM & SAM, obvious market structures and composite market dynamics.

If the market does not suit my criteria even if the stock is awesome I won't invest. E.g. $CERT - the market is too small for me.

1. I focus first on markets - I like large TAM & SAM, obvious market structures and composite market dynamics.

If the market does not suit my criteria even if the stock is awesome I won't invest. E.g. $CERT - the market is too small for me.

2. Market size: Markets matter to me more than anything else.

Good market, good team - OMG

Good market, bad team - ok outcome

Bad market, good team - bad outcome

Bad market, bad team - why bother?

Good market, good team - OMG

Good market, bad team - ok outcome

Bad market, good team - bad outcome

Bad market, bad team - why bother?

3. Which is why you will see in all my DD - I focus on Market size, dynamics and composition.

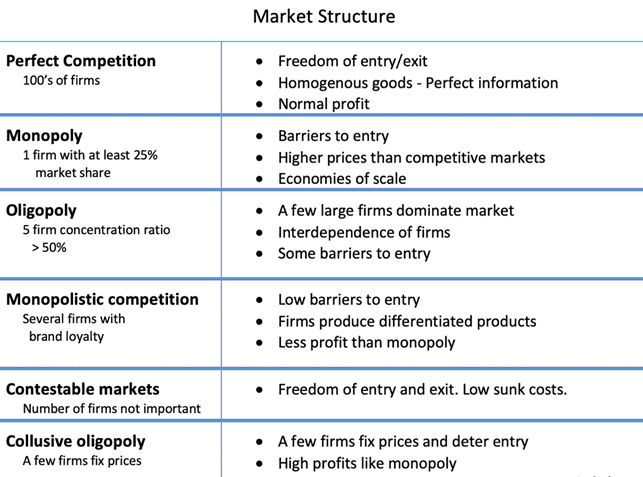

I try to understand what structure is possible - "Is it winner take all"? Or "Winner take most"? or "Rising tide lifts all boats"?

I try to understand what structure is possible - "Is it winner take all"? Or "Winner take most"? or "Rising tide lifts all boats"?

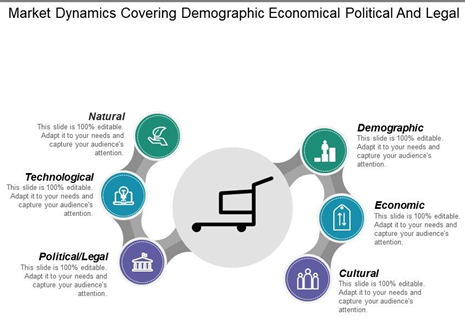

Then I try to understand the shifts happening in the market. E.g. The move from ICE (Internal Combustion Engine) to EV - what happens to the incumbents? Who benefits? Who will thrive? Who might become the next Sears or J C Penny?

I focus on tech, so I know some of the segments

I focus on tech, so I know some of the segments

Markets are not static, so I try to learn from some of the experts. Calls to friends, insiders who are in the space helps. If the market has some underlying shifts that I can uncover it helps me a lot to put my thesis together.

Notice I still have not talked about the stock yet.

Notice I still have not talked about the stock yet.

Bottom line: My DD begins with market size, potential, structure and dynamics. Depending on that I form a thesis:

e.g. #1

"In the EV charging market there will be many players and the market will grow so all players will experience growth"

e.g. #1

"In the EV charging market there will be many players and the market will grow so all players will experience growth"

Thesis e.g. #2:

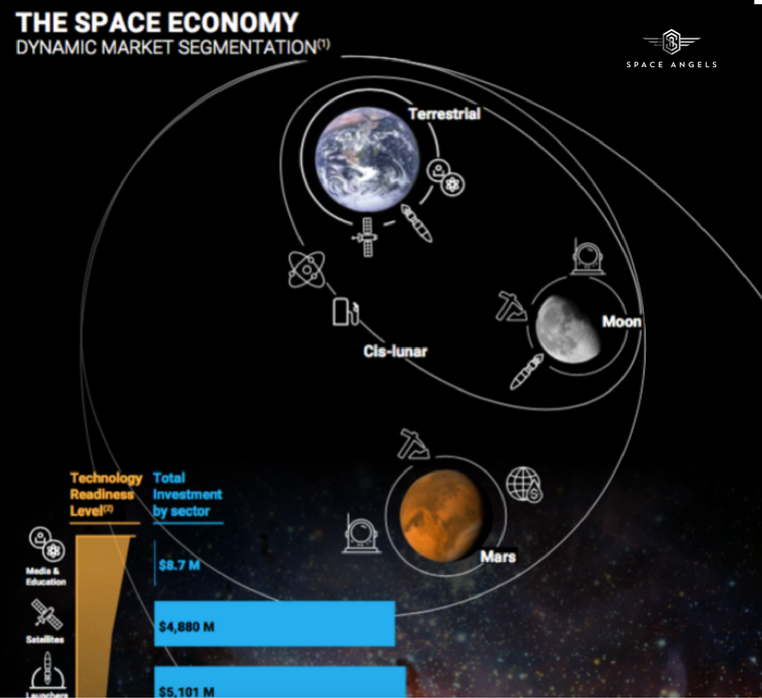

The "Space is the next frontier" market will have few players - since the investment required is high". So I have to pick one or two winners by time.

The "Space is the next frontier" market will have few players - since the investment required is high". So I have to pick one or two winners by time.

After the thesis, I try to segment the market. That is important so you can find the value chain. Where is there opportunity for most profit. Up closer to the consumer? Or lower in picks and shovels plays?

E.g. EV segments

1. EV consumer vehicles

2. Charging

3. Batteries

4. Infrastructure

5. Commercial vehicles

1. EV consumer vehicles

2. Charging

3. Batteries

4. Infrastructure

5. Commercial vehicles

E.g. 2 Space Segments

1. Space Tourism

2. Rare earths mining

3. Satellites, communication and imagery

4. Space Energy

5. Infrastructure

1. Space Tourism

2. Rare earths mining

3. Satellites, communication and imagery

4. Space Energy

5. Infrastructure

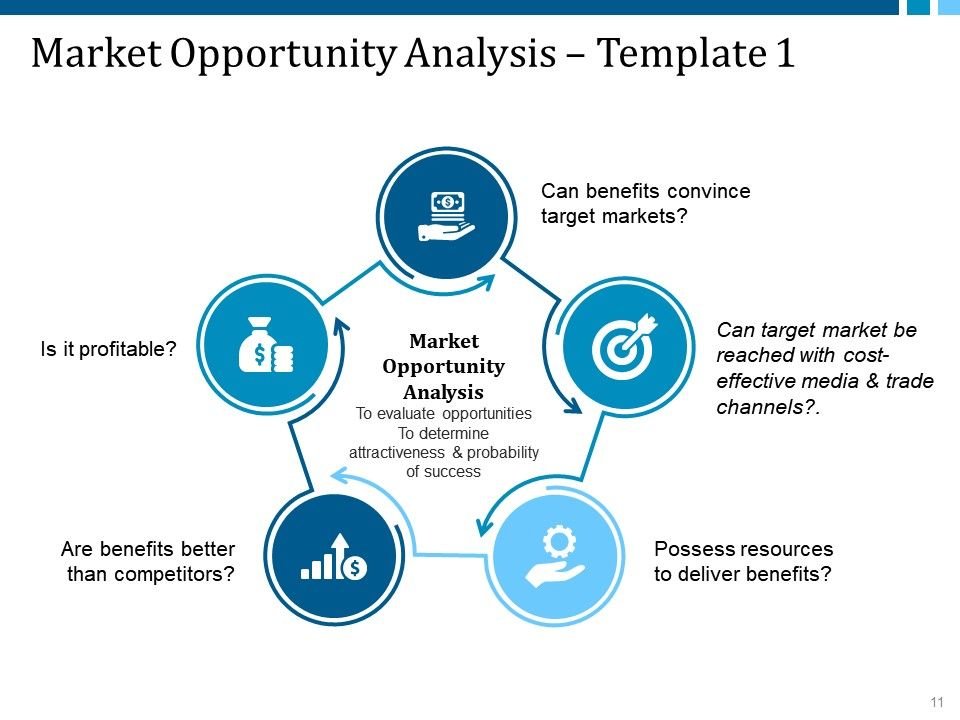

Given the segments, I start to form my hypothesis and see where could changer occur.

I want to answer 3 questions:

1. What makes one vs another a winner?

2. Why now - what is the catalyst?

3. What is the 1-3 key things needed for success?

I want to answer 3 questions:

1. What makes one vs another a winner?

2. Why now - what is the catalyst?

3. What is the 1-3 key things needed for success?

The market assessment is very critical for me to even begin thinking about likely "plays" or "winners". After that I scan the segment for potential companies.

Some others call this thematic investing. I have not invented this. Cathie Wood for e.g. gives "ARK Big ideas"

Some others call this thematic investing. I have not invented this. Cathie Wood for e.g. gives "ARK Big ideas"

In my next thread I will go into my next step - teams. After that comes companies and products.

To summarize my style:

I look at markets first and spend a lot of time on them because I believe markets trump all else.

More than a stock, more than a team, markets matter to me.

To summarize my style:

I look at markets first and spend a lot of time on them because I believe markets trump all else.

More than a stock, more than a team, markets matter to me.

None of what I have stated so far is unique or new probably. You could say I "learned" from many masters and ex colleagues in the VC industry and other experts.

This is just my approach. I use a checklist to track this for markets I care about most.

This is just my approach. I use a checklist to track this for markets I care about most.

Read on Twitter

Read on Twitter