$ENGMF - Grew 400%+ in 2020, 120% in 2021. Trading at 5x NTM rev

eSports/gaming is getting BIG and doing so very quickly. $ENGMF is a content platform centered around the gaming universe.

Thread here..

(not inv. Advice)

eSports/gaming is getting BIG and doing so very quickly. $ENGMF is a content platform centered around the gaming universe.

Thread here..

(not inv. Advice)

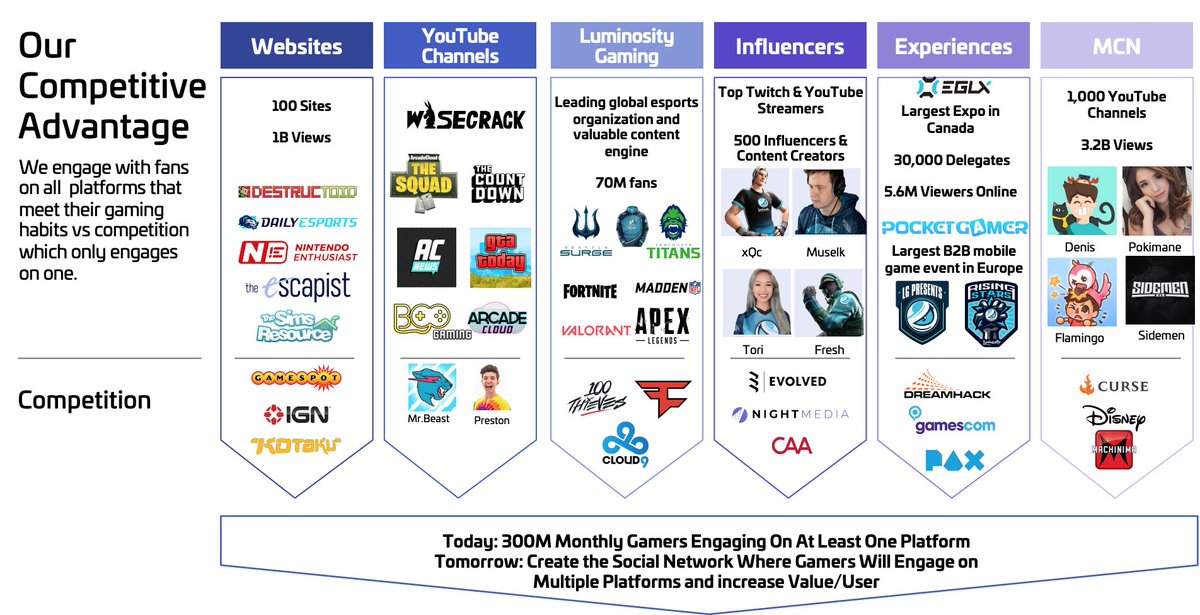

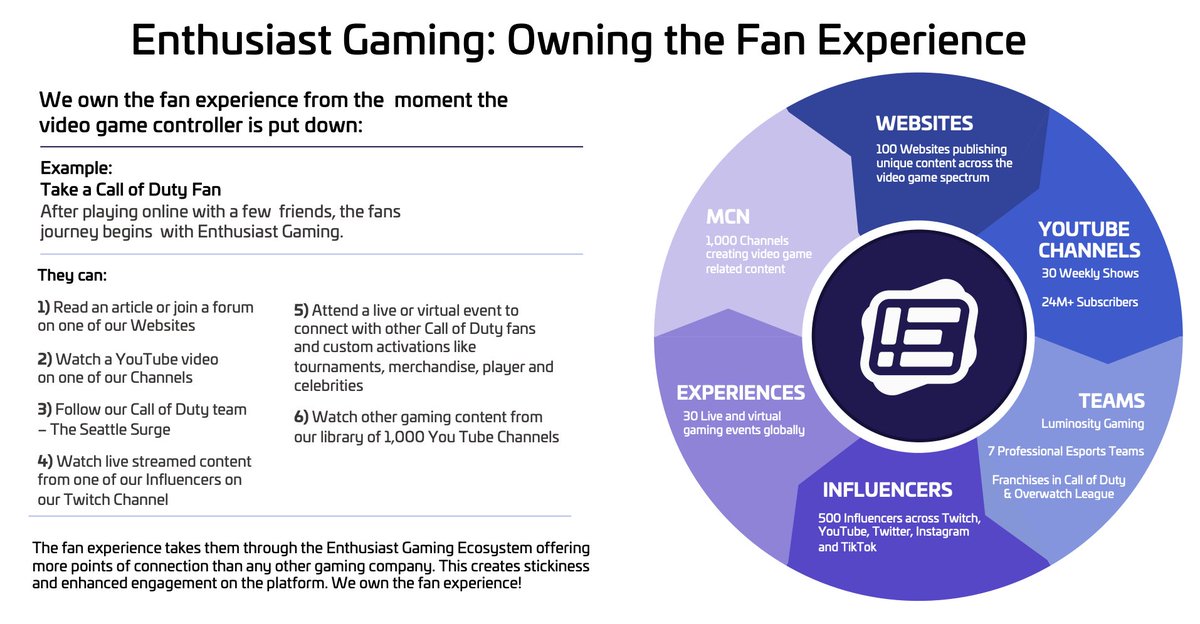

$ENGMF (fka. Enthusiast Gaming), is building the largest eSports platform via media, events, and their own eSports team. They are building a strong platform in the eSports space to compete with the point solutions offered by competitors

Media: the Company owns over 100 gaming centric websites and also has 1,000+ gaming centric YouTube channels. Combined, the platform reaches over 300 million visitors monthly and generates over 4.2 billion page views per month.

Media (2): The company has built a talent mgmt platform to work with c. 1,000 creators / influencers reaching over 500 million subscribers on Twitch and YouTube.

Media (3): The Company's gaming content division includes 2 of the top 20 gaming entertainment video brands with BCC Gaming & Arcade Cloud, reaching 50+ million unique viewers a month across 9 YouTube pages, 8 Snapchat shows and related Facebook, Instagram and TikTok accounts

Events: owns and operates Canada’s largest gaming expo, EGLX, and the largest mobile gaming event in Europe, Pocket Gamer Connects.

Imo, this is just another element that aids in creating a horizontally integrated eSports platform.

Imo, this is just another element that aids in creating a horizontally integrated eSports platform.

eSports: the Company acquired Luminosity Gaming in 2019, a leading global esports organization consists of 8 pro esports teams including the #1 ranked Overwatch team and over 50 gaming influencers with a total audience of 60 million followers. //

The company is creating lots of traffic to their media outlets. The beauty is that they have done so by spending $0 (ZERO!) on SEO and CAC. Even without spending a dime, 20% of the US population and 43% of males 18-34 visit one EG site per month.

How do they make money?

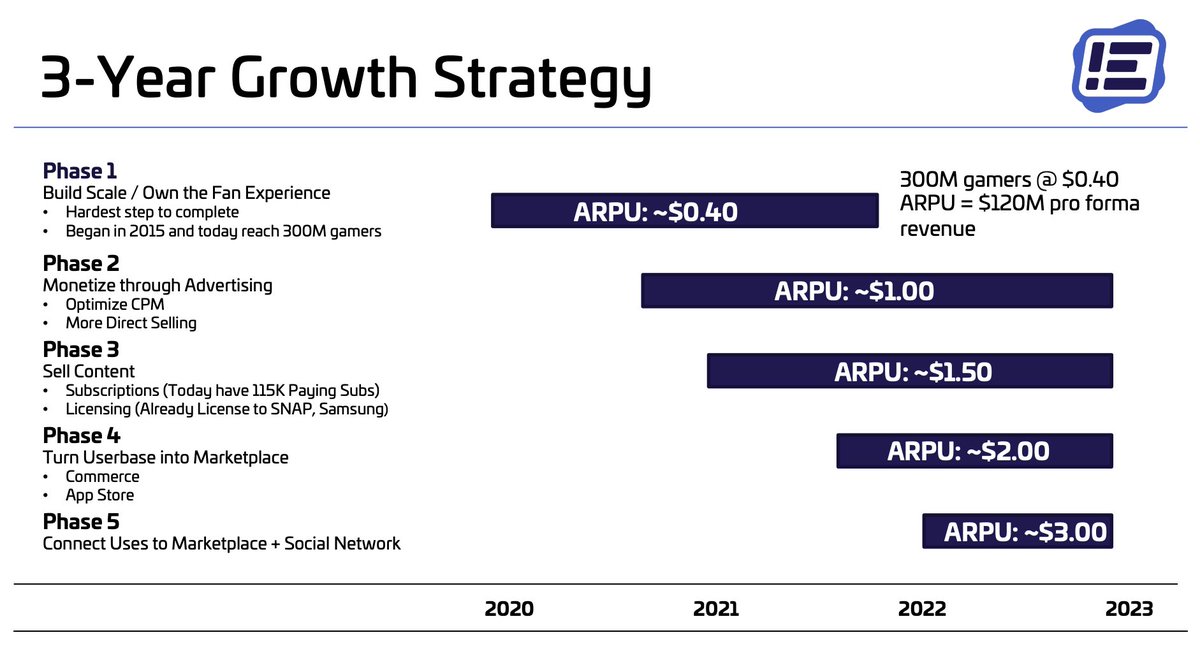

+115k users pay for premium content.

+Content distribution deals with $SNAP, $FB, Tik Tok, and Samsung

+Advertising revenue through their unique content platform

+115k users pay for premium content.

+Content distribution deals with $SNAP, $FB, Tik Tok, and Samsung

+Advertising revenue through their unique content platform

More on advertising rev: The company has built a strong niche for itself in the mind of brands. Some blue chip customers include Nintendo, Gillette, Playstation, Amazon, and Pizza Hut among others. They have been able to do this because…

They do not sell the data they aggregate. Instead, they created a walled garden (a la $FB, $GOOG, $AMZN) and are building a robust advertising platform. As traditional TV falls by the wayside, it is more likely that advertisers transition some spend to eSports

Thankfully, they are in the early stages here. ARPU sits at c. $0.40 currently but mgmt is targeting $3.00 by 2023 (7.5x change). Now think about the potential growth in MAUs… explosive growth is a real possibility.

Unfortunately the co does not break out revenue by line item so we do not know exactly how much rev comes from each segment.

Financials:

Revenue was just under 9m in 2019, projected 53m for 2020, and 117m in 2021. It is also projected that the company will be EBITDA positive by EoY 2021. Gross margins are unimpressive now at c. 30% but should expand significantly with increased operating leverage.

Revenue was just under 9m in 2019, projected 53m for 2020, and 117m in 2021. It is also projected that the company will be EBITDA positive by EoY 2021. Gross margins are unimpressive now at c. 30% but should expand significantly with increased operating leverage.

I dare you to find another player in this space, growing as quickly, with as much chance for outsized success with such a pedestrian valuation. $SKLZ trades at 64x, $DKNG 53x, $GNOG 12x, $SLGG 28x, $GAN 24x (all as of Wed. close)

Given how well positioned the company is in a growing industry, I struggle to come up with a scenario where they do not grow tremendously. The eSports mkt is projected to grow at 25% p.a. through 2027.

Gaming will continue to benefit from more ubiquitous internet access, democratization of smartphones, decreased latency, higher quality games, and the vast improvement of AR / VR applications.

What are the potential catalysts?

+ NASDAQ up-listing, they are currently traded OTC and via TSX

+ entering the sports betting mkt (likely via partnership)

+ plans to launch social media ntwk

+ rumors of content licensing w/ $FUBO, $ROKU

+ earnings coming 2/16 (per bloomberg)

+ NASDAQ up-listing, they are currently traded OTC and via TSX

+ entering the sports betting mkt (likely via partnership)

+ plans to launch social media ntwk

+ rumors of content licensing w/ $FUBO, $ROKU

+ earnings coming 2/16 (per bloomberg)

Like any investment, there are risks here. This is a small company with tremendous upside in the near and long-term given their strong user base and continuing monetization. There is obviously more to this company than these few tweets. Please do your own DD.

Read on Twitter

Read on Twitter