It was only a year ago when @AaveAave launched

Now they're the #14 most valuable crypto asset

They also have a $5B+ balance sheet

And approaching $1B in debt outstanding

That's some insane growth

So let's check in on their road to billions https://newsletter.banklesshq.com/p/aave-road-to-billions

https://newsletter.banklesshq.com/p/aave-road-to-billions

Now they're the #14 most valuable crypto asset

They also have a $5B+ balance sheet

And approaching $1B in debt outstanding

That's some insane growth

So let's check in on their road to billions

https://newsletter.banklesshq.com/p/aave-road-to-billions

https://newsletter.banklesshq.com/p/aave-road-to-billions

First up: Establish a clear path to value accrual

The Aavenomics upgrade pivoted the token from a simple burn model to a staking model

$AAVE became the collateral of last resort if Aave ever incurs a deficit

Just stake AAVE and earn rewards in return for your service

The Aavenomics upgrade pivoted the token from a simple burn model to a staking model

$AAVE became the collateral of last resort if Aave ever incurs a deficit

Just stake AAVE and earn rewards in return for your service

With the token dialed in, all that's left are fundamentals

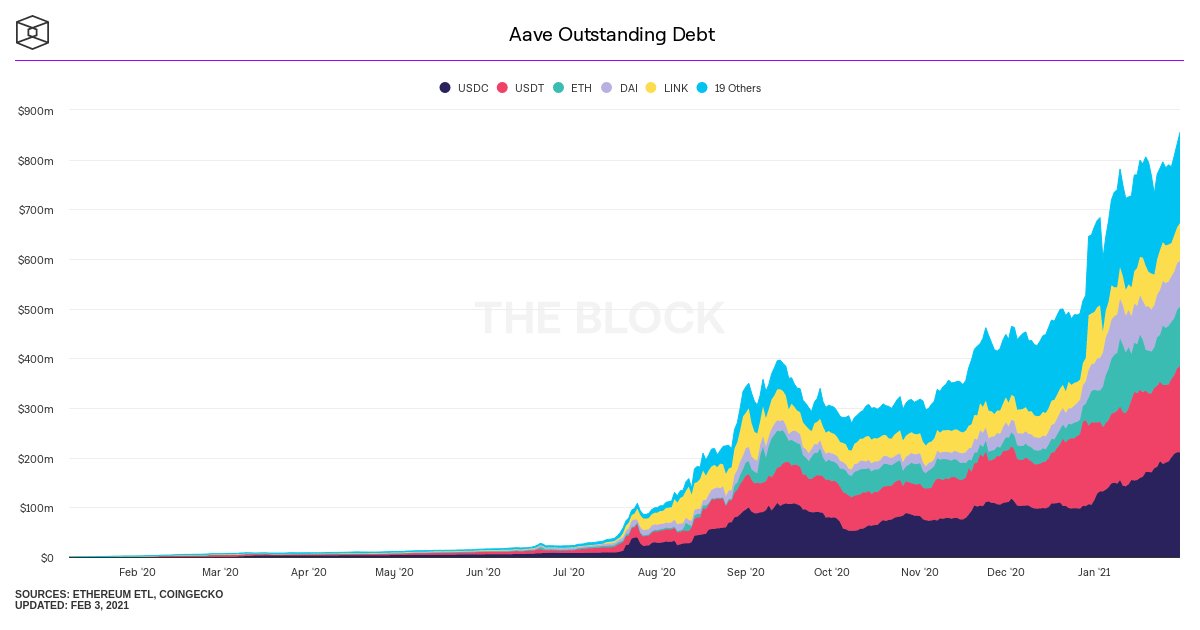

Outstanding debt has risen to over $800M - a key stat for interest rate protocols. Why?

Higher the demand to borrow -> better rates for suppliers -> greater incentive to provide liquidity

Yup...feedback loop engaged

Outstanding debt has risen to over $800M - a key stat for interest rate protocols. Why?

Higher the demand to borrow -> better rates for suppliers -> greater incentive to provide liquidity

Yup...feedback loop engaged

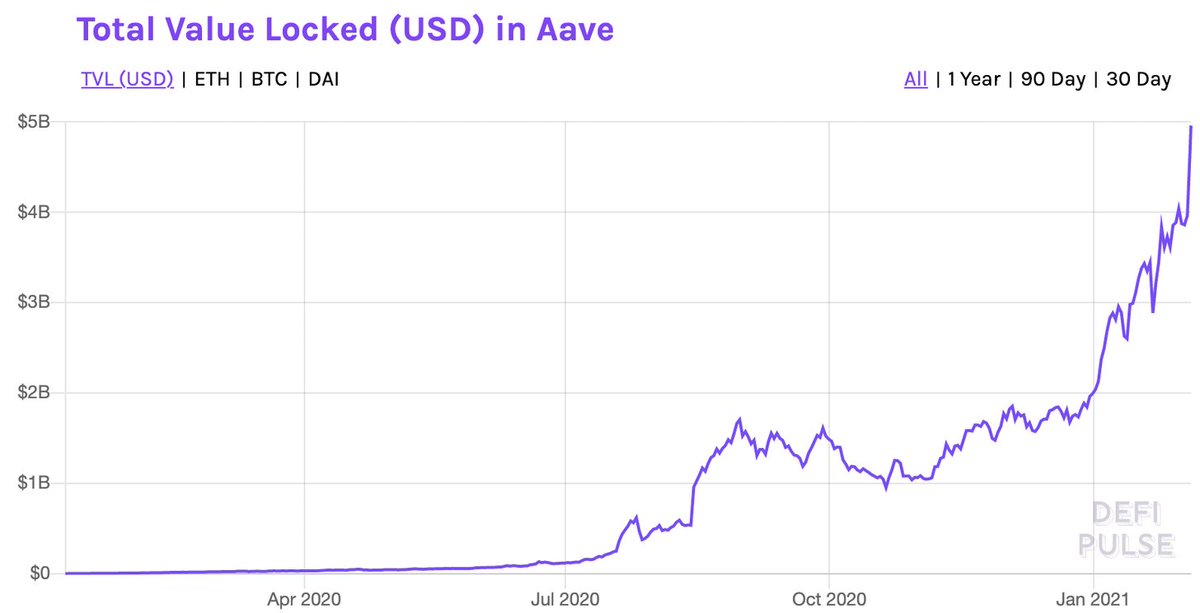

Aave's balance sheet (i.e. TVL) has gone completely vertical too

A year ago $8.7M

Today it touched $5B

That's a 57,371% growth in a year for those keeping track at home

And all of this is organic. No yield farming incentives needed

Insane

A year ago $8.7M

Today it touched $5B

That's a 57,371% growth in a year for those keeping track at home

And all of this is organic. No yield farming incentives needed

Insane

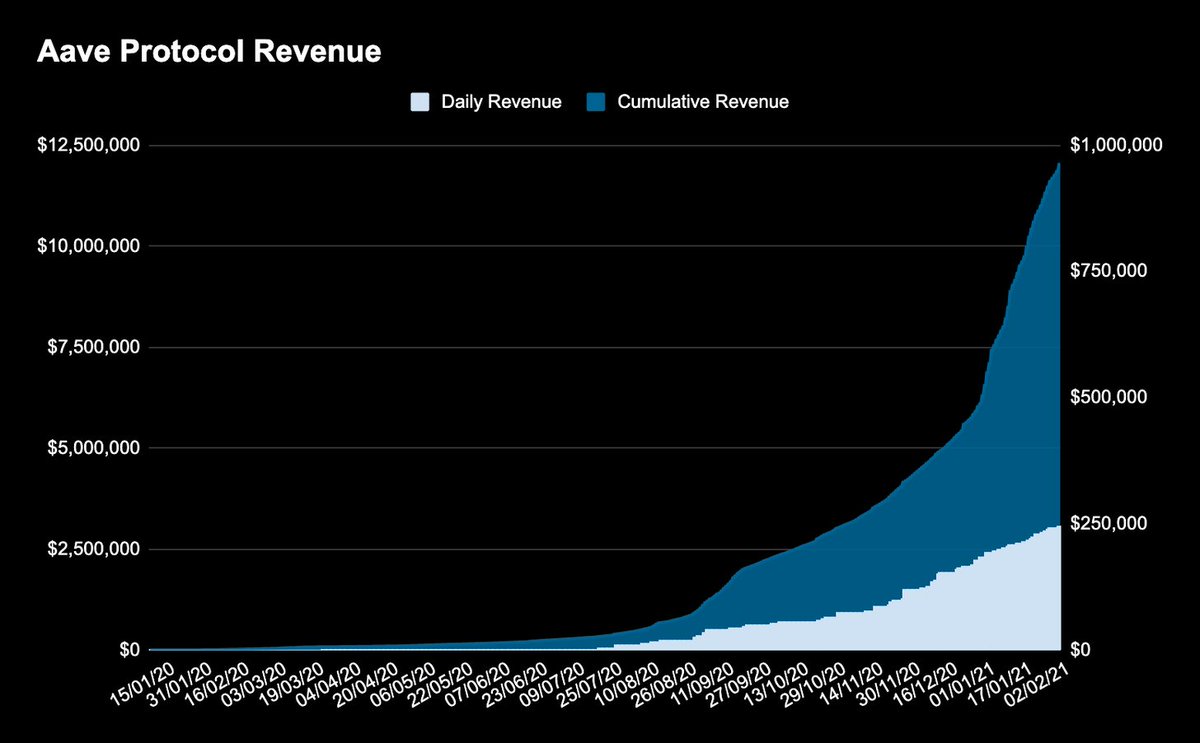

Revenue for V1 also saw a notable rise

Remember, revenue for interest rate protocols = the amount of interest generated per day to suppliers

Good thing V1 is still pumping out $250K per day

Wonder what V2 will do once it's in full gear...

Remember, revenue for interest rate protocols = the amount of interest generated per day to suppliers

Good thing V1 is still pumping out $250K per day

Wonder what V2 will do once it's in full gear...

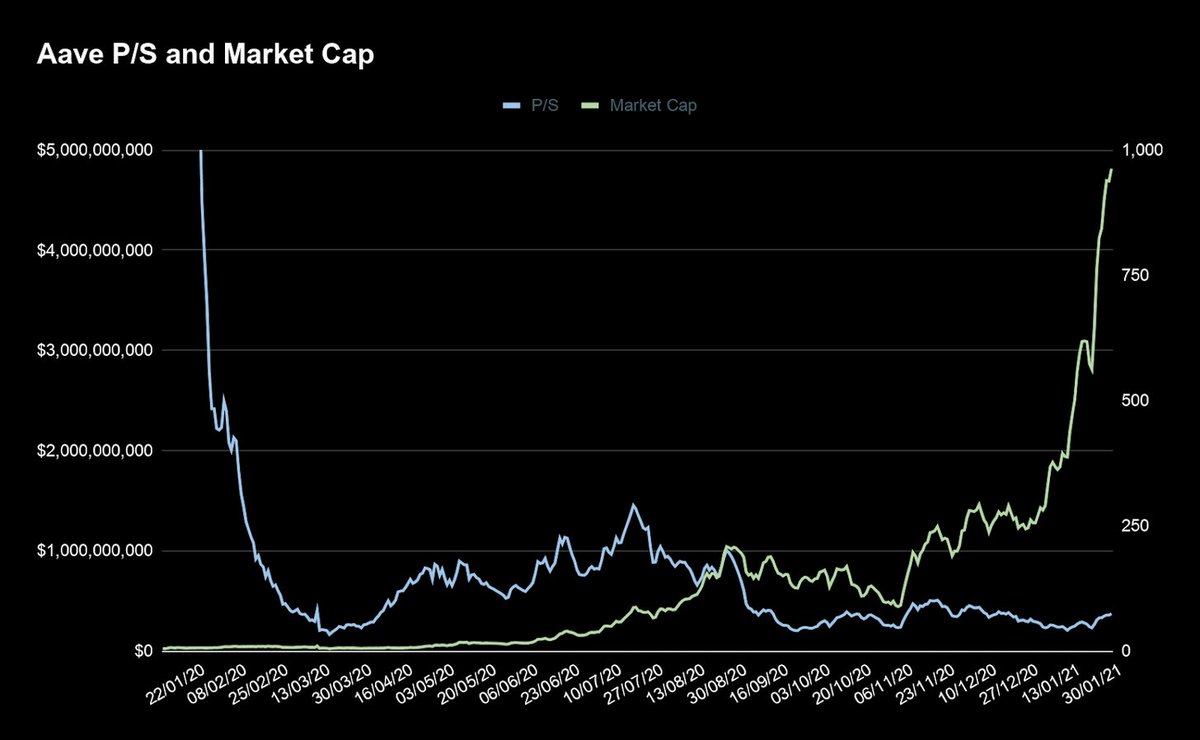

Next: P/S Ratio

With a P/S of 54, that means the market is willing to pay $54 for every $1 in interest generated today

When Aave first reached $1B mcap, it was ~155

Meaning under this measurement, you're actually getting a better deal on $AAVE today than ever before

With a P/S of 54, that means the market is willing to pay $54 for every $1 in interest generated today

When Aave first reached $1B mcap, it was ~155

Meaning under this measurement, you're actually getting a better deal on $AAVE today than ever before

Aave has also become one of the fastest horses in #DeFi

The tally since Q4?

$AAVE: +581%

$ETH: +380%

$DPI: +294%

If you're holding AAVE, you're doing better than most of the market

Good for you

The tally since Q4?

$AAVE: +581%

$ETH: +380%

$DPI: +294%

If you're holding AAVE, you're doing better than most of the market

Good for you

So what's next?

Here's what you should keep an eye out for:

- Potential for liquidity mining incentives

- Credit Delegation with V2

- Bitwise 10 listing

- Grayscale filing for an AAVE trust

All of these could be catalysts for new growth

Here's what you should keep an eye out for:

- Potential for liquidity mining incentives

- Credit Delegation with V2

- Bitwise 10 listing

- Grayscale filing for an AAVE trust

All of these could be catalysts for new growth

There's no shortage of ways to cut it: Aave is crushing it

They've not only survived a brutal bear market following their ICO, but pivoted into massive success

The sky's the limit now

Read more on @AaveAave's road to bilions on @BanklessHQ https://newsletter.banklesshq.com/p/aave-road-to-billions

https://newsletter.banklesshq.com/p/aave-road-to-billions

They've not only survived a brutal bear market following their ICO, but pivoted into massive success

The sky's the limit now

Read more on @AaveAave's road to bilions on @BanklessHQ

https://newsletter.banklesshq.com/p/aave-road-to-billions

https://newsletter.banklesshq.com/p/aave-road-to-billions

Read on Twitter

Read on Twitter