Time for a SPAC ATTACK, and I do mean "attack."

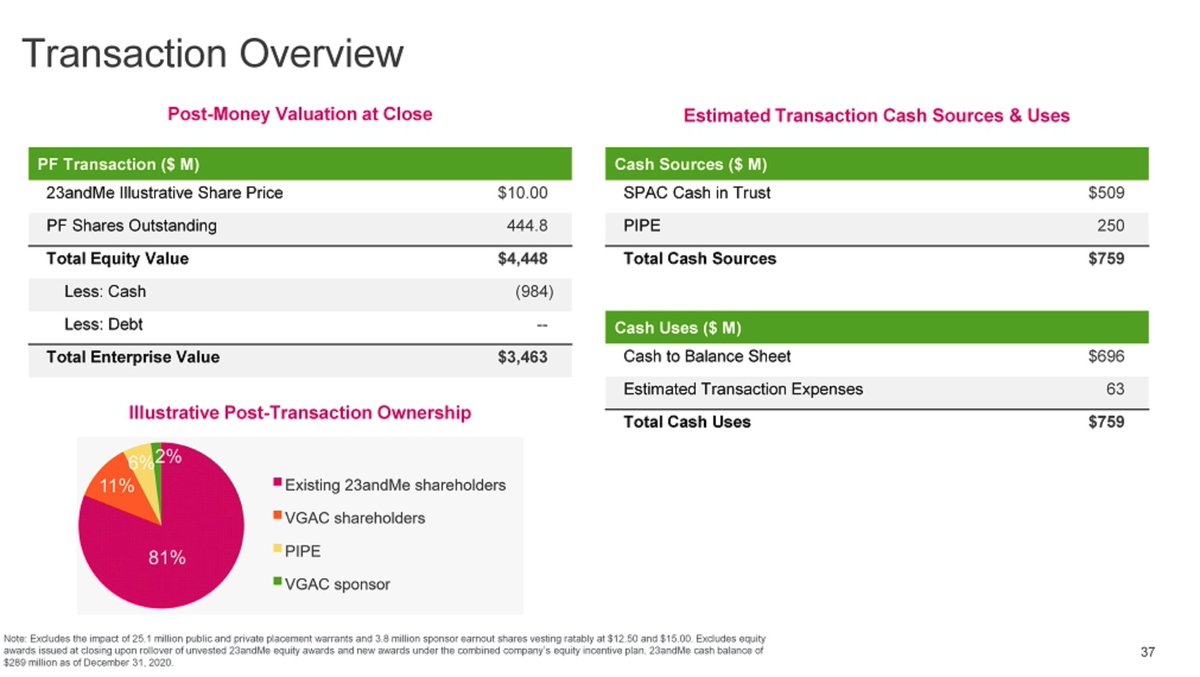

Let's walk through $VGAC, Virgin Galactic Acquisition Corp, which is going to put $759M ($509 & 250 PIPE) into perenially profitless, nobody-wants-to-acquire-so-lets-SPAC-it-to-the-hacks, 23andMe $ME

FOUNDED 2006: 15 yrs old!

Let's walk through $VGAC, Virgin Galactic Acquisition Corp, which is going to put $759M ($509 & 250 PIPE) into perenially profitless, nobody-wants-to-acquire-so-lets-SPAC-it-to-the-hacks, 23andMe $ME

FOUNDED 2006: 15 yrs old!

Before FinTwit's expert SPACalysts explain to me how I don't understand the future/data: GSK, Genentech, & Google are investors, & zero are buying it ($3.5B is a rounding error for pharma buys) or putting in more money. Sequoia is an investor; it can IPO (almost) anything.

What a strong leadoff. This is true for $RICK. Also for $DASH. It's even true for $MO.

Next: Every healthcare pitch deck, ever.

Next: Every healthcare pitch deck, ever.

Ask media execs about YouTube $GOOG.

Ask anyone about $AMZN.

Ask hotels about $ABNB.

Ask airline execs about Virgin.

Ask doctors about 23andMe.

Ask anyone about $AMZN.

Ask hotels about $ABNB.

Ask airline execs about Virgin.

Ask doctors about 23andMe.

None of these folks re-upping into this giant opportunity.

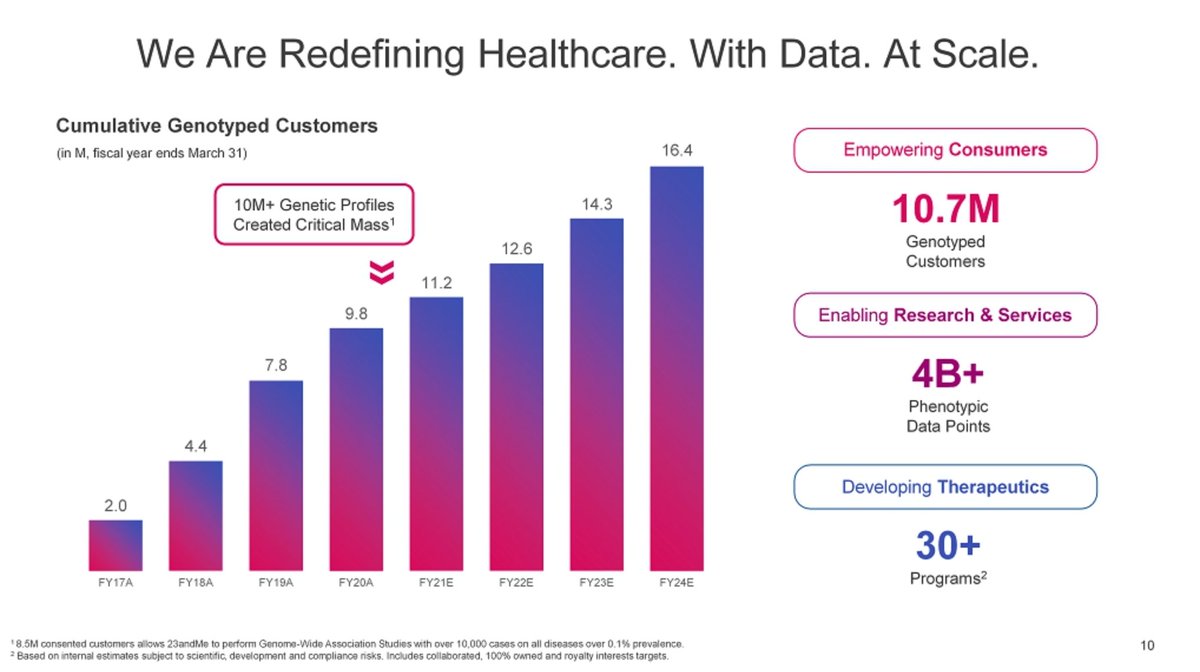

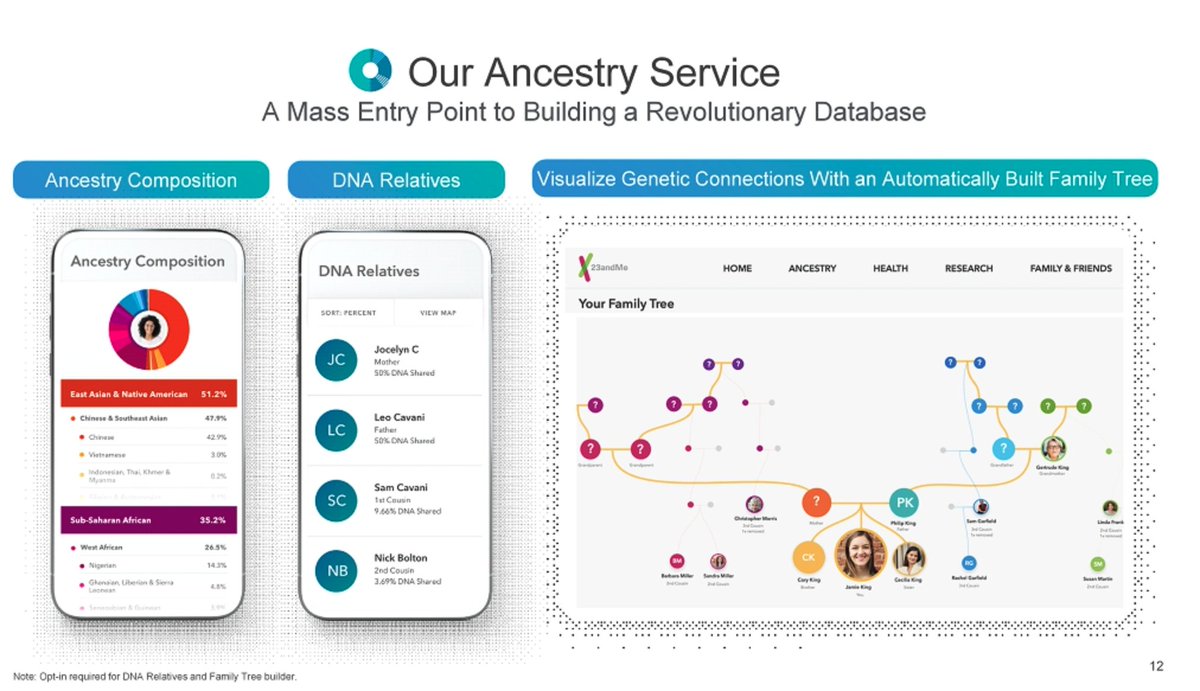

99.5% alike, but wow, look: $ME JUST happened to hit 10M+ critical mass!

WAIT THE FOOTNOTE SAYS ONLY 8.5M CUSTOMERS CONSENTED.

SO IT DIDN'T ACHIEVE CRITICAL MASS ("CREATED.")

that seems fraudy

99.5% alike, but wow, look: $ME JUST happened to hit 10M+ critical mass!

WAIT THE FOOTNOTE SAYS ONLY 8.5M CUSTOMERS CONSENTED.

SO IT DIDN'T ACHIEVE CRITICAL MASS ("CREATED.")

that seems fraudy

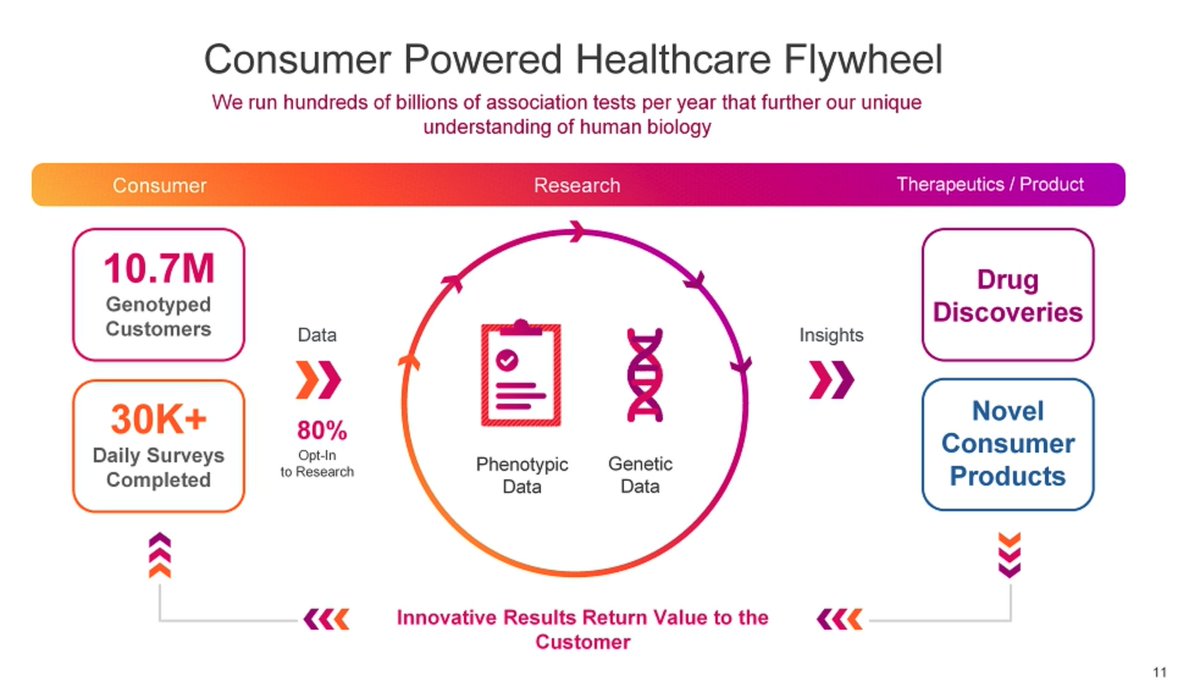

"Flywheel," of course. 15 years in let's see how that flywheel is humming.

Well, "Ancestry" is a money-maker for PE & http://Ancestry.com , so I'm excited to see how this is coming together!

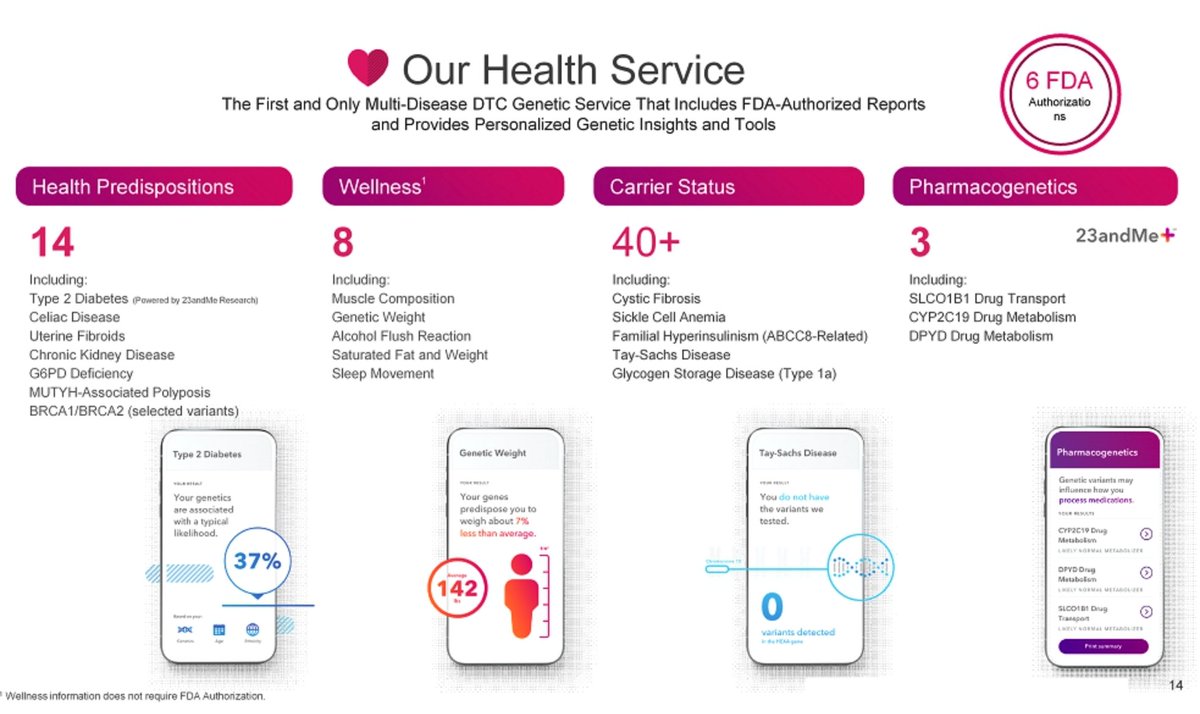

Health service! That's huge.

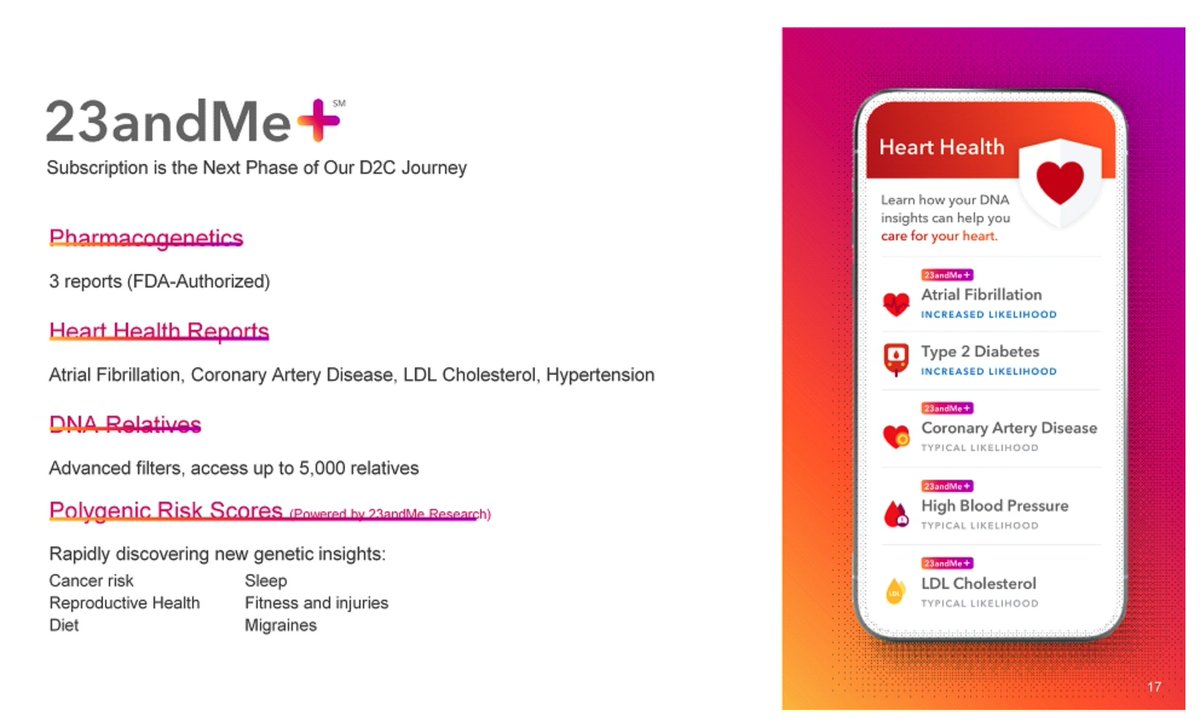

Subscription! Why bad underlining?

Well, "Ancestry" is a money-maker for PE & http://Ancestry.com , so I'm excited to see how this is coming together!

Health service! That's huge.

Subscription! Why bad underlining?

BEZOS CHART CRIME: No scale.

Line is cumulative and total is 75k, so drawn to scale the gold columns would look be approximately the size of the "l" in "Jul" in the chart.

Soft launched Oct20? When was the real launch? You're saving that for your public shareholders aren't you?

Line is cumulative and total is 75k, so drawn to scale the gold columns would look be approximately the size of the "l" in "Jul" in the chart.

Soft launched Oct20? When was the real launch? You're saving that for your public shareholders aren't you?

Above, I also wonder why there's a white rectangle. Was it covering something that @SEC_Enforcement didn't like?

Google has an "Other Bets" about life extension. Why doesn't it want to own this company?

Google has an "Other Bets" about life extension. Why doesn't it want to own this company?

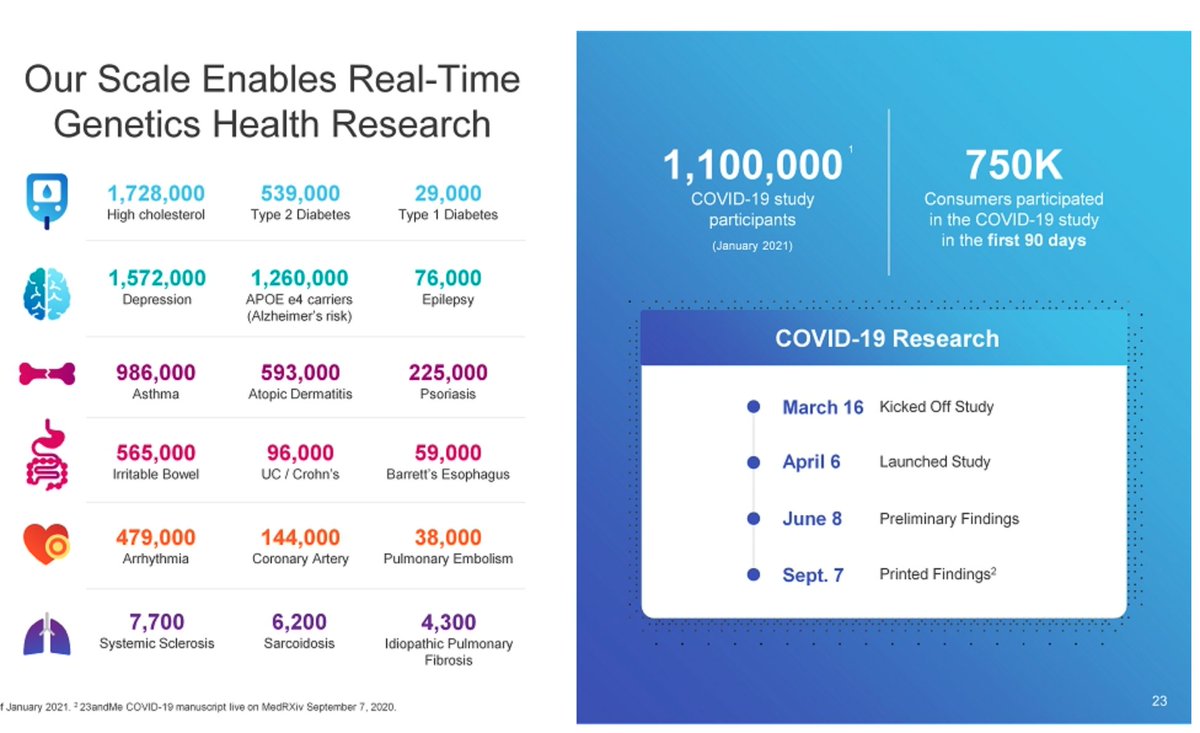

Love this.

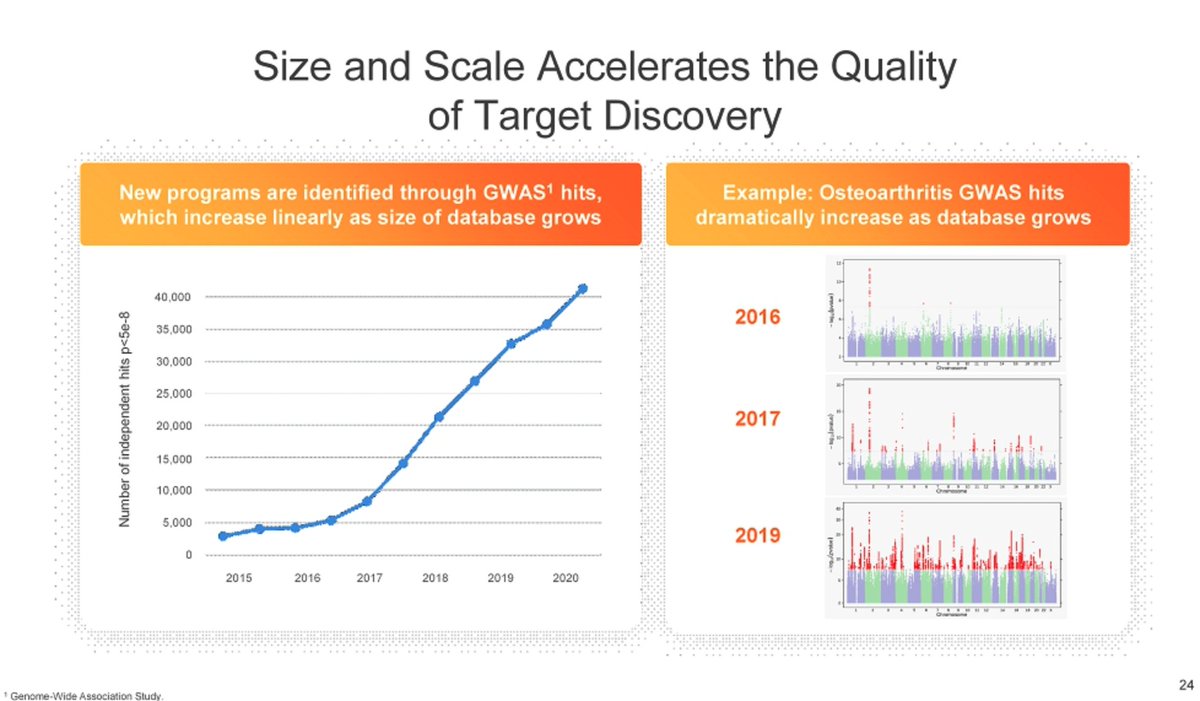

Linear growth leads to "dramatic increases."

"We barely had customers before to find stuff. Now we have enough customers to find stuff."

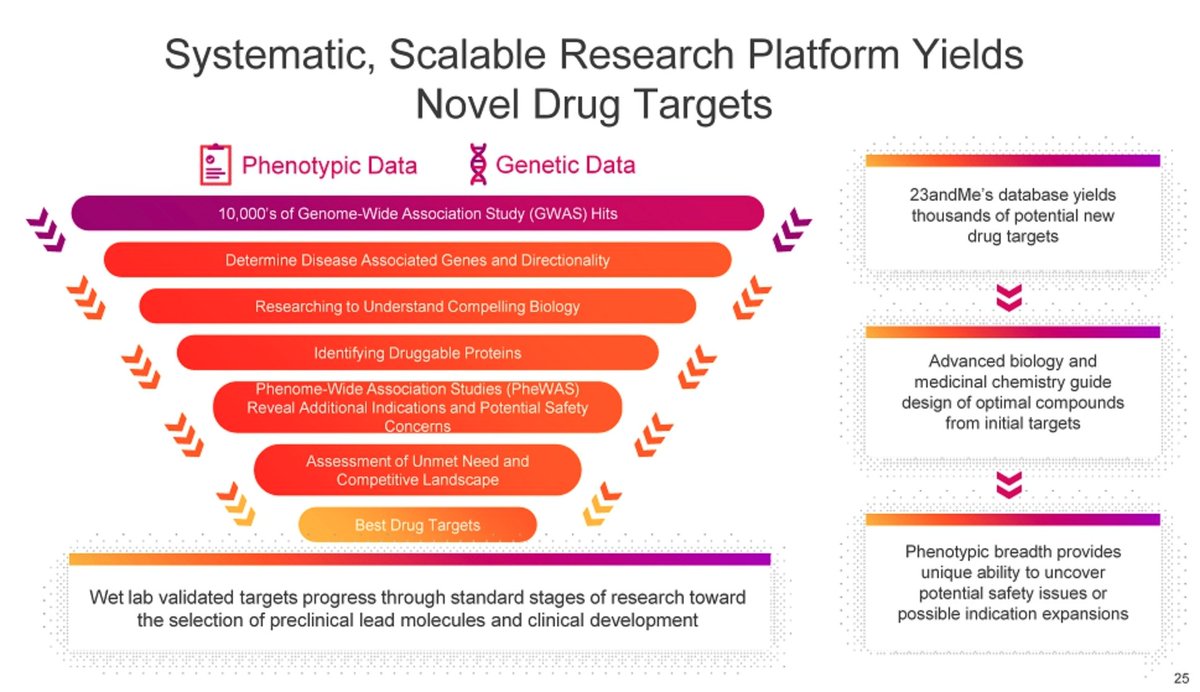

Novel drug targets are worth mega-billions, why doesn't GSK want to own this? Why is a Record Label, Not-Spaceman leading this?

Linear growth leads to "dramatic increases."

"We barely had customers before to find stuff. Now we have enough customers to find stuff."

Novel drug targets are worth mega-billions, why doesn't GSK want to own this? Why is a Record Label, Not-Spaceman leading this?

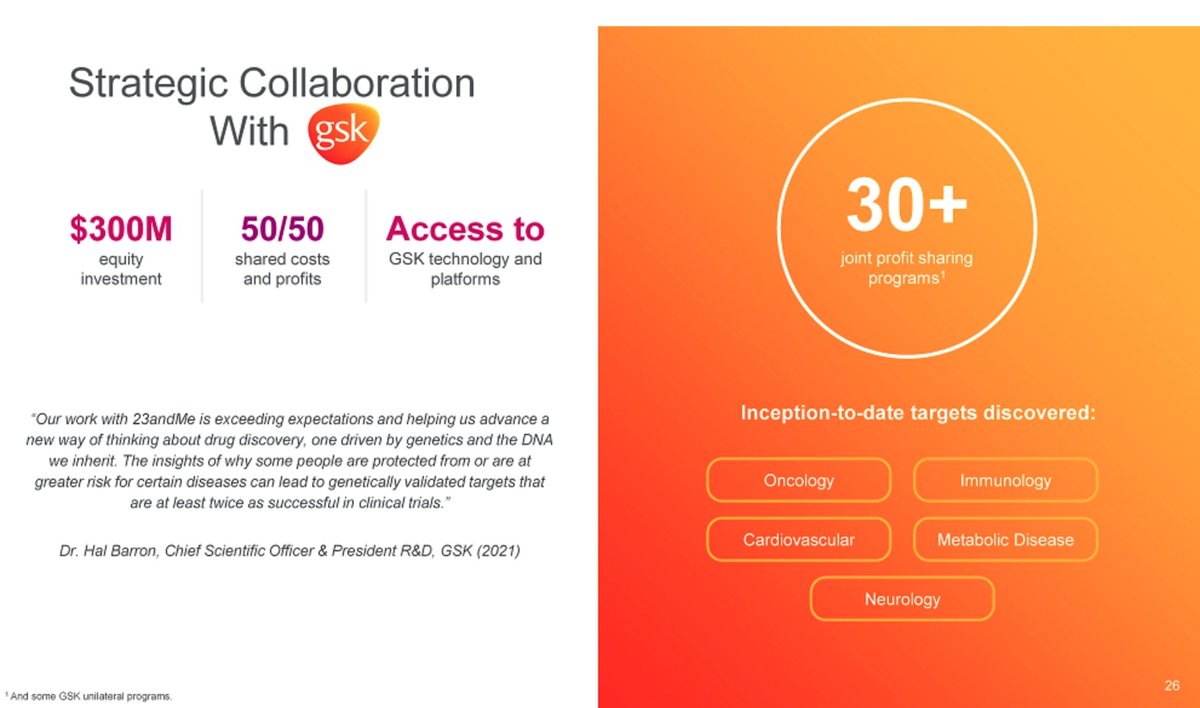

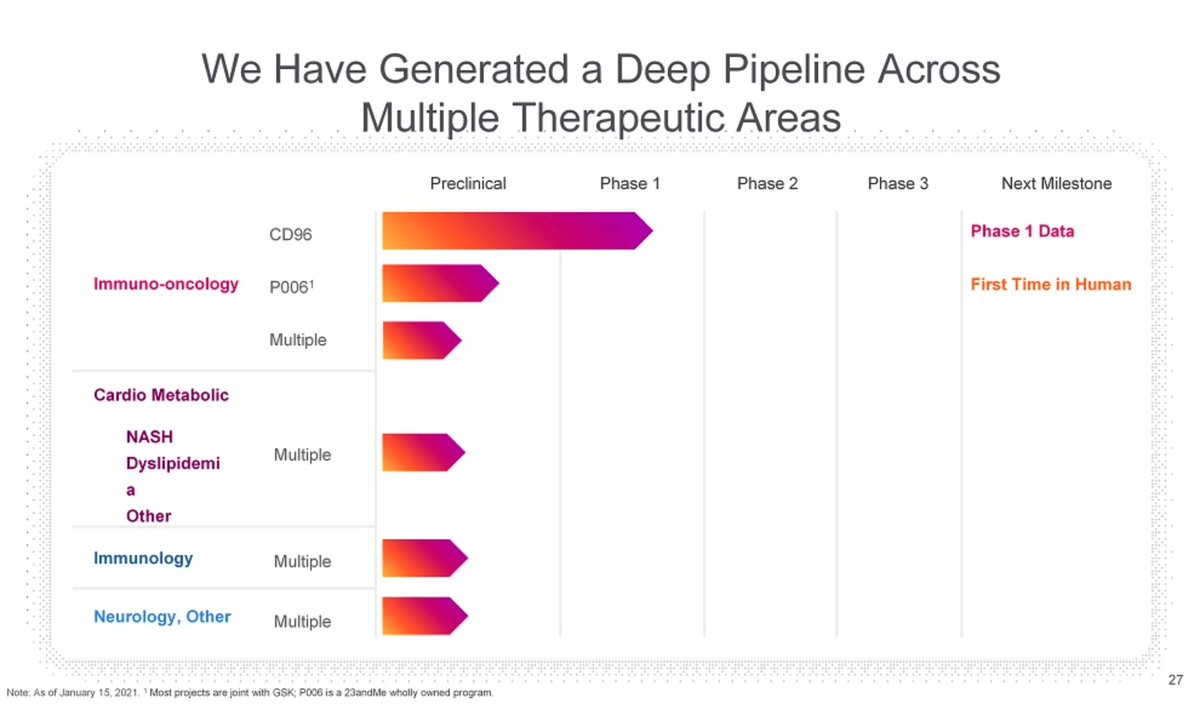

$GSK invested in.... 2018. This must have turbocharged $ME over the last 3 years.

This pipeline - with ANY promise - is worth billions to pharma RIGHT NOW.

If so rapid, why not get more private funding and IPO next year? Why SPAC?

This pipeline - with ANY promise - is worth billions to pharma RIGHT NOW.

If so rapid, why not get more private funding and IPO next year? Why SPAC?

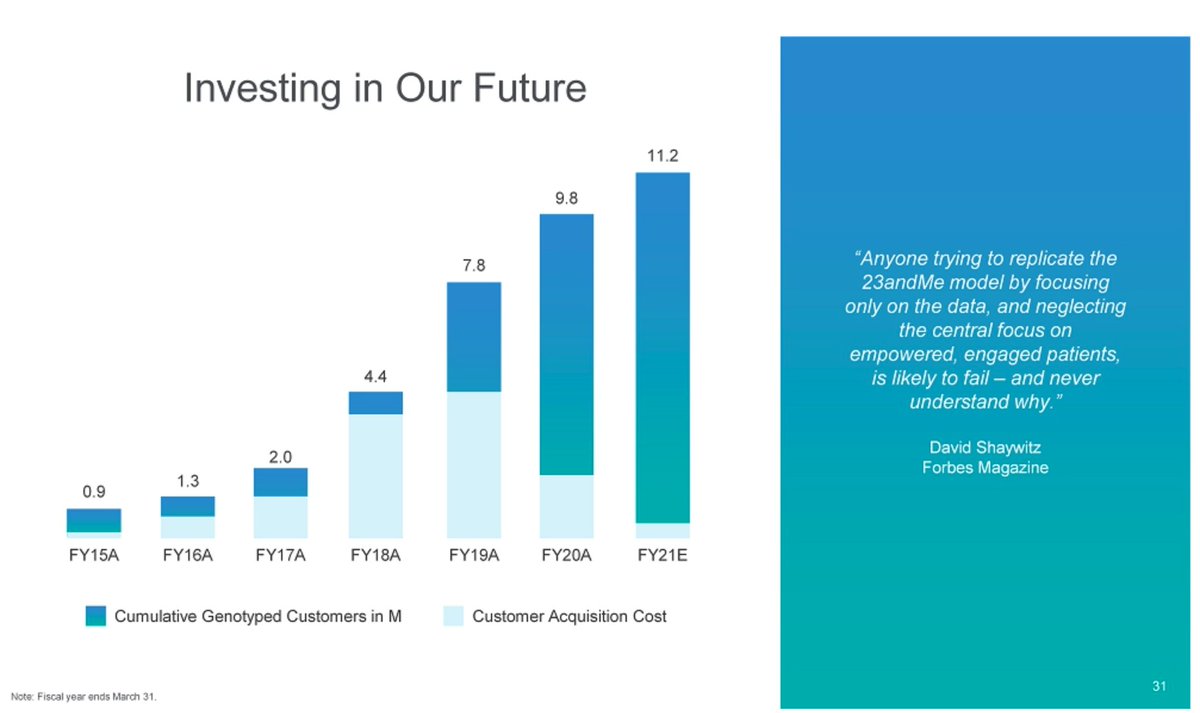

LOVE THIS:

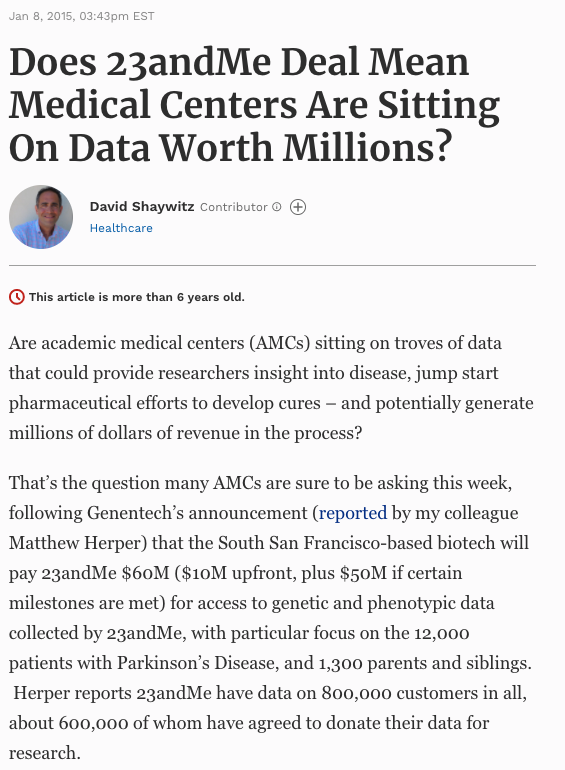

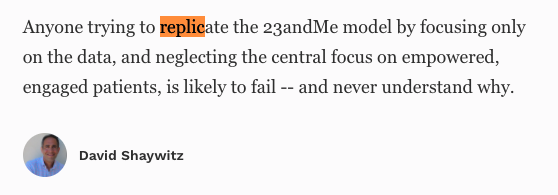

That David Shaywitz quote - he's a contributor, not Forbes writer. Not sure it was ever in the magazine (Forbes let's almost anyone post to the website).

It's 6 yrs old. SPACing in 2021 & needing to use a 6 yr old quote...that isn't even that good.

That David Shaywitz quote - he's a contributor, not Forbes writer. Not sure it was ever in the magazine (Forbes let's almost anyone post to the website).

It's 6 yrs old. SPACing in 2021 & needing to use a 6 yr old quote...that isn't even that good.

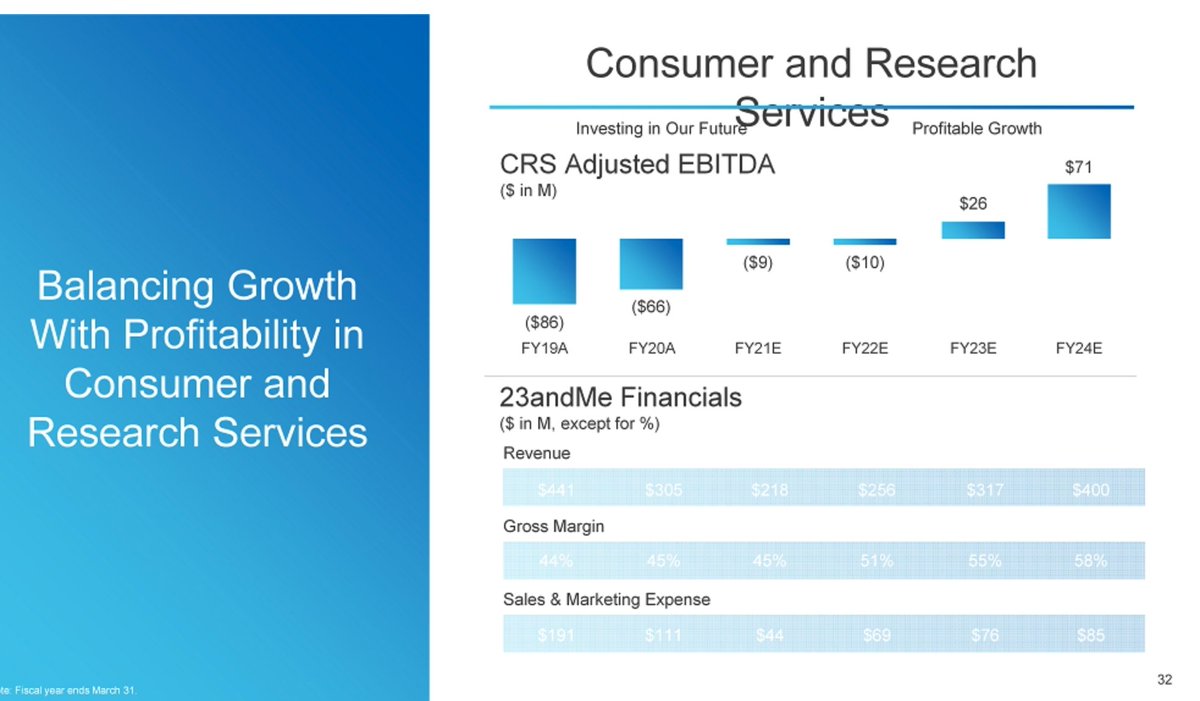

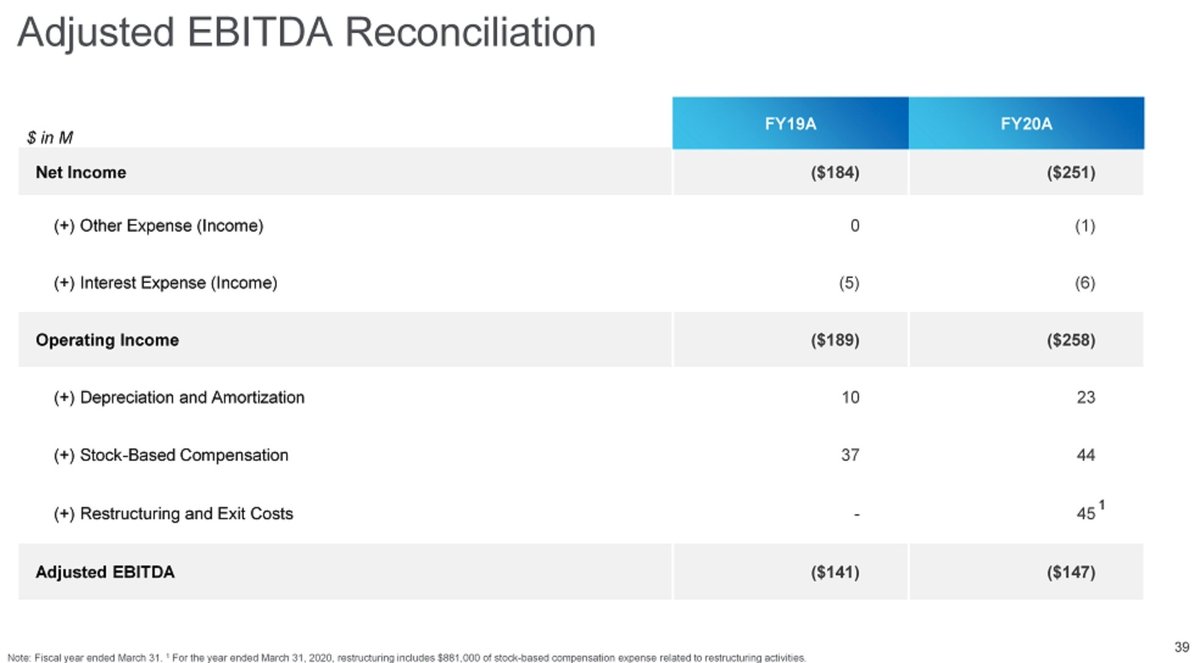

Surely they'll hit these negative Adjusted EBITDA numbers this yr.

Hard to make out ( ), but Rev fell fr $441M to $305M in 2020 & '21 FORECAST is for $218 21, $256M 22.

), but Rev fell fr $441M to $305M in 2020 & '21 FORECAST is for $218 21, $256M 22.

THEY ARE SPAC'ING W REV DOWN 50% OVER 2 YRS, 33% 1 YEAR

S&M exp to plummet while topline grows. Sure.

Hard to make out (

), but Rev fell fr $441M to $305M in 2020 & '21 FORECAST is for $218 21, $256M 22.

), but Rev fell fr $441M to $305M in 2020 & '21 FORECAST is for $218 21, $256M 22.THEY ARE SPAC'ING W REV DOWN 50% OVER 2 YRS, 33% 1 YEAR

S&M exp to plummet while topline grows. Sure.

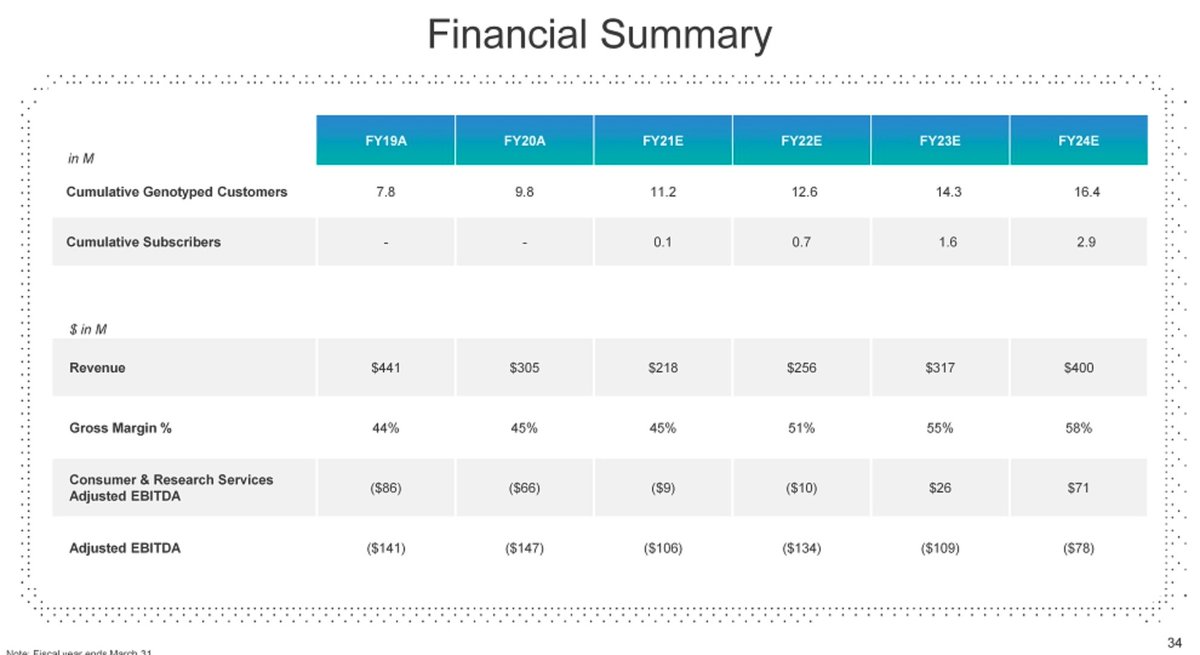

Come 2024 this will be an 18 year old company that isn't Adjusted EBITDA profitable. It's not even forecasted.

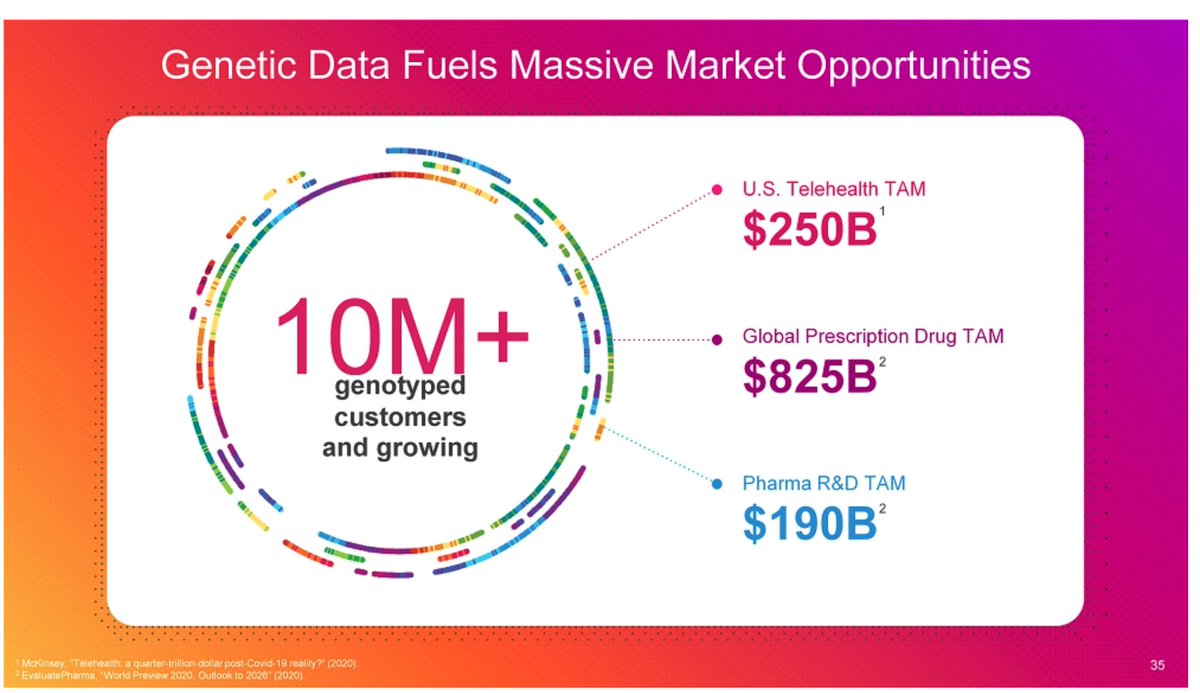

These TAMs are damning - '24 Rev forecast of $400M... in a market this big? Even if its forecast it's product doesn't apparently resonate with anything but a niche.

These TAMs are damning - '24 Rev forecast of $400M... in a market this big? Even if its forecast it's product doesn't apparently resonate with anything but a niche.

$3.5B Pre-Money. This isn't worth $0 pre-money if you had to put $759M into it.

"Growth Initiatives"?! See prior tweet there is literally no growth. '24E Rev is smaller than '19!

The forecast is -$427 Adj EBITDA, so if cash burn is higher the SPAC investment will be gone quickly

"Growth Initiatives"?! See prior tweet there is literally no growth. '24E Rev is smaller than '19!

The forecast is -$427 Adj EBITDA, so if cash burn is higher the SPAC investment will be gone quickly

This indicates it has $208M cash right now vs -$100M AdjEBITDA 2021.

This is existing investors marking an "up" round w the public holding the bag, then existing getting liquidity to sneak out the back door.

Plus Net Income was $100M lower in 2020. $45M in restructuring costs.

This is existing investors marking an "up" round w the public holding the bag, then existing getting liquidity to sneak out the back door.

Plus Net Income was $100M lower in 2020. $45M in restructuring costs.

CEO Anne Wojcicki laid off 100 ppl last year amid demand for the kits tapering off. Getting your genome sequenced is the ultimate once-and-done product. Early adopters ran out.

$786M VC raised to date.

Sure the stock could go up.

No position. https://www.cnbc.com/2020/01/23/23andme-lays-off-100-people-ceo-anne-wojcicki-explains-why.html

$786M VC raised to date.

Sure the stock could go up.

No position. https://www.cnbc.com/2020/01/23/23andme-lays-off-100-people-ceo-anne-wojcicki-explains-why.html

Oh, and this is its VC partner.

All silicon valley pumpy roads of zombie shitcos that sell the future lead to $TSLAQ.

Jam tomorrow, jam yesterday, but never ever jam today.

-The White Queen, Through the Looking Glass.

All silicon valley pumpy roads of zombie shitcos that sell the future lead to $TSLAQ.

Jam tomorrow, jam yesterday, but never ever jam today.

-The White Queen, Through the Looking Glass.

Read on Twitter

Read on Twitter