Zoom announced it reached 1m Phone seats a few weeks ago, which seems to have gone under the radar. But what does 1m Phone seats actually mean?

Here's why I think this press release is important and why the $ZM CFO says Phone will 'absolutely be a key growth driver' in 2021:

Here's why I think this press release is important and why the $ZM CFO says Phone will 'absolutely be a key growth driver' in 2021:

Zoom Phone is a cloud calling solution aimed at businesses migrating to the cloud, and is integral to Zoom's unified communications offering. First rolled out in early 2019, it is Zoom's fastest growing product /1

https://zoom.us/docs/doc/Zoom%20Phone%20Product%20Overview.pdf

https://zoom.us/docs/doc/Zoom%20Phone%20Product%20Overview.pdf

The UCaaS market is estimated up to $46bn today and to triple to $140bn by 2025, at a CAGR of 25%. Zoom will report ~$2.6bn total revenue this year /2 https://www.nextiva.com/blog/ucaas-market.html

In March-August 2020 Zoom expanded Phone from 18 to 43 countries, but international still only represents 13% of Phone revenue

For comparison, international makes up 31% of $ZM total revenue, growing +629% YoY. $ZM sees international rising to 50% of total revenue in future/3

For comparison, international makes up 31% of $ZM total revenue, growing +629% YoY. $ZM sees international rising to 50% of total revenue in future/3

While 'video' decelerates from its pandemic peak growth-rate, Phone accelerates (at pace). In mid-October Zoom reported 500k+ Phone seats TTM, in mid-Jan, 1 million seats

~DOUBLING sequentially, in Q4 Zoom has sold as many Phone seats as in the previous 12 months combined /4

~DOUBLING sequentially, in Q4 Zoom has sold as many Phone seats as in the previous 12 months combined /4

With:

~$ 24bn Phone TAM (Zoomtopia)

International expansion

~ 0.5m customers >10 employees = pipeline

Pent up demand for when offices reopen

Zoom has reached an inflection point in its Phone growth and is hiring rapidly to continue the momentum /5 https://twitter.com/AznWeng/status/1349011412606189573

~$ 24bn Phone TAM (Zoomtopia)

International expansion

~ 0.5m customers >10 employees = pipeline

Pent up demand for when offices reopen

Zoom has reached an inflection point in its Phone growth and is hiring rapidly to continue the momentum /5 https://twitter.com/AznWeng/status/1349011412606189573

Using the ~500k Phone seats sold in Q4 as a benchmark, Zoom might add 500k seats per Q in 2021 (at a minimum - ie no further acceleration) - ending the year at 3 million Phone seats (+200% YoY)

Continuing its acceleration, 4 or 5 million Phone seats is possible (+3/400% YoY) /6

Continuing its acceleration, 4 or 5 million Phone seats is possible (+3/400% YoY) /6

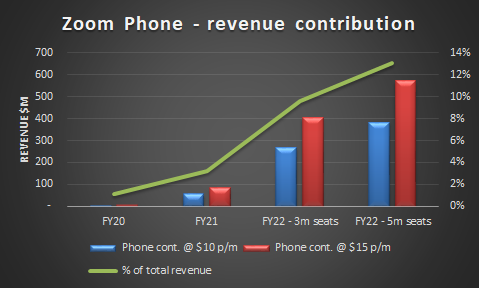

So what does this all mean in terms of revenue contribution?

Zoom Phone pricing for the standalone option ranges from $10/15/20 p/m per user to $30 for the unified option /7 https://zoom.us/pricing/zoom-phone

Zoom Phone pricing for the standalone option ranges from $10/15/20 p/m per user to $30 for the unified option /7 https://zoom.us/pricing/zoom-phone

22% of Phone customers are new to Zoom, contributing up to $30 p/m for the unified option vs $10-15 p/m incremental revenue for existing customers (eg. on top of Meetings)

Watch out for this % mix in Q4

For simplicity, let's just look at $10-15 p/m revenue contribution: /8

Watch out for this % mix in Q4

For simplicity, let's just look at $10-15 p/m revenue contribution: /8

At $10-15 p/m per Phone seat and 3m seats by EOY Phone would contribute:

~$270-405m in 2021 or +10-15% growth

~An exit rate (Q4 annualised) of $360-540m

At 5m seats, it would contribute $385-575m ($600-900m Q4 annualised), driving +15-22% YoY growth on total revenue /9

~$270-405m in 2021 or +10-15% growth

~An exit rate (Q4 annualised) of $360-540m

At 5m seats, it would contribute $385-575m ($600-900m Q4 annualised), driving +15-22% YoY growth on total revenue /9

Taking a mid-range, Zoom Phone could contribute $420m or +16% to total revenue growth in 2021 while growing +300% YoY, making a base of up to 13% of total revenue

~2 years after releasing the product, Phone would contribute more revenue in 2021 than Zoom did in FY19 in TOTAL /10

~2 years after releasing the product, Phone would contribute more revenue in 2021 than Zoom did in FY19 in TOTAL /10

Was Zoom in the right place at the right time? Sure. But it has proven it can execute at velocity, scale rapidly and has demonstrated product-market fit

Can it do it again with Phone? It seems like it is already is.

/11

Can it do it again with Phone? It seems like it is already is.

/11

With consensus estimates for Zoom's growth of 35% I view 2021 (FY22) growth:

Q4: ~$850m

FY21: $2.6bn

Baseline: $3.4bn +30% ($850mx4)

Phone: $0.4bn 15%+

Monetisation: $0.75bn 30%+ (historic DBNER +130%)

New biz: ?

Churn: ? $(0.4)bn (13)%

Rebased FY22: $4.2bn (~60%+ YoY)/12

Q4: ~$850m

FY21: $2.6bn

Baseline: $3.4bn +30% ($850mx4)

Phone: $0.4bn 15%+

Monetisation: $0.75bn 30%+ (historic DBNER +130%)

New biz: ?

Churn: ? $(0.4)bn (13)%

Rebased FY22: $4.2bn (~60%+ YoY)/12

In this scenario $Zm would go from ~350% growth in FY21 to 60%+ YoY vs 35% consensus

For more idea of the other drivers: https://twitter.com/TommyT017/status/1344456659876380673

I emailed @zoom_us investor relations this morning trying to get some clarity over my assumptions used on Zoom Phone /13

For more idea of the other drivers: https://twitter.com/TommyT017/status/1344456659876380673

I emailed @zoom_us investor relations this morning trying to get some clarity over my assumptions used on Zoom Phone /13

Zoom report on March 1st, my birthday & the first day of spring. I'm hoping for a nice present in form of a revenue beat (inc. a small Phone bump), more Phone guidance & positive insight into FY22 /14

Read on Twitter

Read on Twitter