1/ One of the most competitive spaces in payments and e-commerce is the checkout page. Many different companies want you to pay with their button not only for the economic benefit but also for the data. Card networks ultimately want you to use a card. https://fintechacrossthepond.substack.com/p/checkoutbattle

2/ With e-commerce spend growing at 6x the 2019 growth rate and digital marketplaces like Amazon, eBay, Flipkart and Shopify taking an increasing slice of the pie (~60%), all attention is on the checkout page.

3/ By looking at the physical commerce space we may get an insight into how the battle for the checkout plays out.

Will merchants be able to drive hard bargains and monetise checkout page real estate through digital slotting fees?

Will merchants be able to drive hard bargains and monetise checkout page real estate through digital slotting fees?

4/ Merchants jobs to be done include increasing average order value (AOV), reducing cart abandonment, increasing authorisation rates, reducing fraud and gathering customer data.

Payment gateway's are a key partner @stripe @Checkout

Payment gateway's are a key partner @stripe @Checkout

5/ Customers are looking to be able to pay with their preferred method in an easy and frictionless experience and for the safe and secure storage of their payment information.

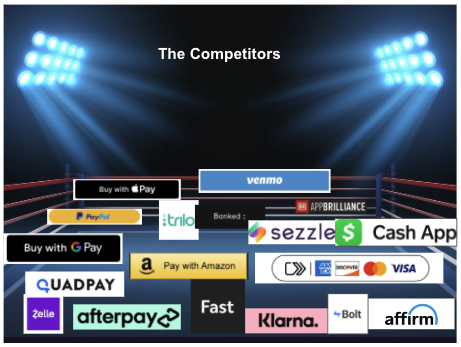

The stage is set, lets meet the challengers

The stage is set, lets meet the challengers

6/ Challenger 1: Status Quo

Not the english rock band but basically doing nothing. Customers manually input card info or remember their log in info. The average 23 fields of data to complete make this a bad UX. Yet only 1/3 of e-comm ex Amazon was done via checkout buttons.

Not the english rock band but basically doing nothing. Customers manually input card info or remember their log in info. The average 23 fields of data to complete make this a bad UX. Yet only 1/3 of e-comm ex Amazon was done via checkout buttons.

7/ Challenger 2: Card networks

Unexpected co-operation between @Visa @Mastercard @Discover @AmericanExpress with the click to pay button highlights how competitive it is. Will networks incentivise merchants to use click to pay with discounts, slotting fees or liability shifts?

Unexpected co-operation between @Visa @Mastercard @Discover @AmericanExpress with the click to pay button highlights how competitive it is. Will networks incentivise merchants to use click to pay with discounts, slotting fees or liability shifts?

8/ Challenger 3: Digital wallets

All the usual suspects here @GooglePay @Apple @PayPal @amazonpay trying to hoover up data for their businesses. Apple and Google have a distribution advantage through mobile/browsers but PayPal's button has 25x advantage over next closest wallet

All the usual suspects here @GooglePay @Apple @PayPal @amazonpay trying to hoover up data for their businesses. Apple and Google have a distribution advantage through mobile/browsers but PayPal's button has 25x advantage over next closest wallet

9/

it will be interesting how @Venmo @CashApp and @Zelle can be positioned here.

a @Zelle button could be a way for banks to get a foothold into e-commerce.

it will be interesting how @Venmo @CashApp and @Zelle can be positioned here.

a @Zelle button could be a way for banks to get a foothold into e-commerce.

10/ Challenger 4: BNPL

These companies promise huge AOV increases for merchants to justify their large costs and provide tangible benefit to customers, delaying payments even further, for free.

Traditional incumbents @PayPal @Visa & Amex are coming for the Pay in 4 space though

These companies promise huge AOV increases for merchants to justify their large costs and provide tangible benefit to customers, delaying payments even further, for free.

Traditional incumbents @PayPal @Visa & Amex are coming for the Pay in 4 space though

11/ Challenger 5: Universal Checkout solutions

@fast and @bolt are the biggest players in this space. @fast is taking a more B2C approach and is backed by @stripe.

@bolt is targeting more independent retailers.

Both need more than a frictionless UX to compete.

@fast and @bolt are the biggest players in this space. @fast is taking a more B2C approach and is backed by @stripe.

@bolt is targeting more independent retailers.

Both need more than a frictionless UX to compete.

12/ Challenger 6: Account to account payments

Reducing interchange is the main sell for companies in this space @JoinTrilo @wearebanked & App Brilliance. But consumers need an incentive to sign up and @JoinTrilo has "boost"

@Zelle could be a sleep giant here with bank support

Reducing interchange is the main sell for companies in this space @JoinTrilo @wearebanked & App Brilliance. But consumers need an incentive to sign up and @JoinTrilo has "boost"

@Zelle could be a sleep giant here with bank support

13/. Find out how this may all play out in the future

Special thanks to everyone who read my early drafts @MAustin4249 @mengxilu @jomojoemoe @SugamSarin @dbkahn @NikMilanovic @franciscojarceo !

#fintech #payments #checkout https://fintechacrossthepond.substack.com/p/checkoutbattle

Special thanks to everyone who read my early drafts @MAustin4249 @mengxilu @jomojoemoe @SugamSarin @dbkahn @NikMilanovic @franciscojarceo !

#fintech #payments #checkout https://fintechacrossthepond.substack.com/p/checkoutbattle

Read on Twitter

Read on Twitter