Today I want to share with you my overall financial goal and the thought process behind this financial goal. This is the bare minimum for me.

[A thread]

[A thread]

I think everyone can agree that they've all fantasized about being a part of the top 1%. I plan on making it a reality for myself (in South Africa  )

)

)

)

According to this article, I don't make the cut.

https://businesstech.co.za/news/wealth/372138/how-much-money-you-need-to-earn-to-be-in-the-top-1-in-south-africa/amp/

https://businesstech.co.za/news/wealth/372138/how-much-money-you-need-to-earn-to-be-in-the-top-1-in-south-africa/amp/

However, it would be naive to compare a 25 year old who has just started their career to a 50 year old who has had twice the lifetime to accumulate their wealth. Is there a solution to this?

Turns out there is.

Turns out there is.

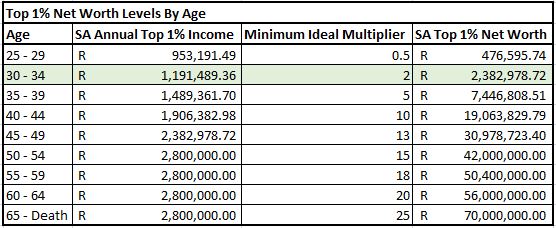

Basically, this table highlights the top 1% income by age group and the top 1% networth; thereafter, gives a multiplier of the income to networth.

Assuming that the R2.8Mil mentioned from the article quoted in this thread applies to the 50+ age group; the picture is pleasing.

Assuming that the R2.8Mil mentioned from the article quoted in this thread applies to the 50+ age group; the picture is pleasing.

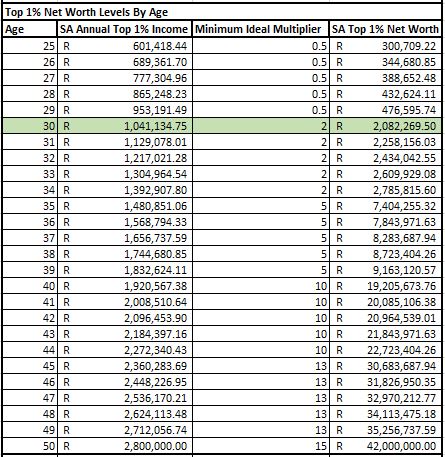

But I need to know what my target is on an annual basis from my current age. By how much should my annual income and networth increase by? Here's the picture:

I'm 29 and far beyond par. Now that I'm entering a new 5-year cycle this year; I have big moves to make in order to finish the cycle on par. As you can see, my targets are quite steep.

What are your lifetime financial goals and the thought process behind them?

What are your lifetime financial goals and the thought process behind them?

Disclaimer: this thread was compiled under the influence of Ramaphosa's actions. If you can improve on the maths then by all means, help me improve my goals.

Read on Twitter

Read on Twitter