BREAKING: Landmark @UniofOxford research has found 218,000 Britons spend more than £1,800-a-month on gambling.

BREAKING: Landmark @UniofOxford research has found 218,000 Britons spend more than £1,800-a-month on gambling.Huge project analysed spending of 6.5m Lloyds Bank customers, making it largest study of its kind ever conducted.

Incredibly important work with lots of findings

The study, released today at 4pm, analysed anonymised transactions for all spending - food, housing, travel, everything - and found:

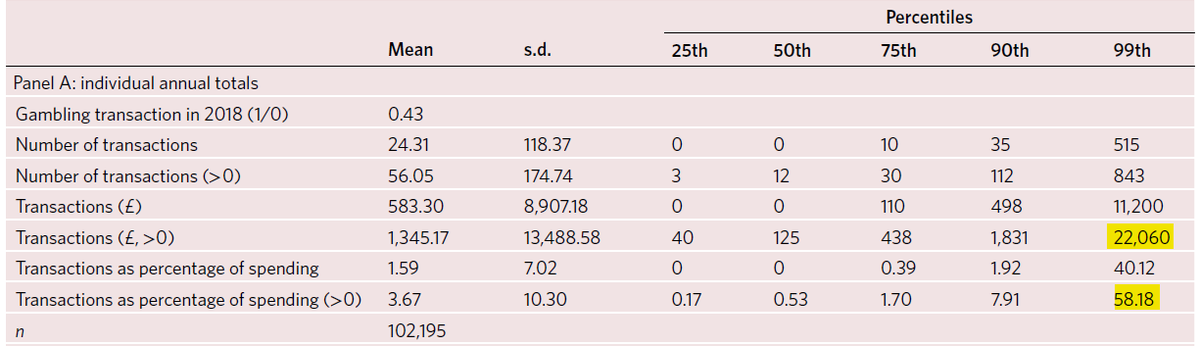

In 2018, the top 1% of gamblers spent *at least* £22,060 in 2018.

In 2018, the top 1% of gamblers spent *at least* £22,060 in 2018.

Or, 218,000 people spent more than £1,838 per month.

Or, 218,000 people spent more than £1,838 per month.

In 2018, the top 1% of gamblers spent *at least* £22,060 in 2018.

In 2018, the top 1% of gamblers spent *at least* £22,060 in 2018. Or, 218,000 people spent more than £1,838 per month.

Or, 218,000 people spent more than £1,838 per month.

The next group is the next 9% of spenders - they spent between £1,831 and £22,060 in 2018

The next group is the next 9% of spenders - they spent between £1,831 and £22,060 in 2018 Or, c. 1.9m people spent between £153 and £1,838 per month. A lot of people and a lot of money.

Or, c. 1.9m people spent between £153 and £1,838 per month. A lot of people and a lot of money.

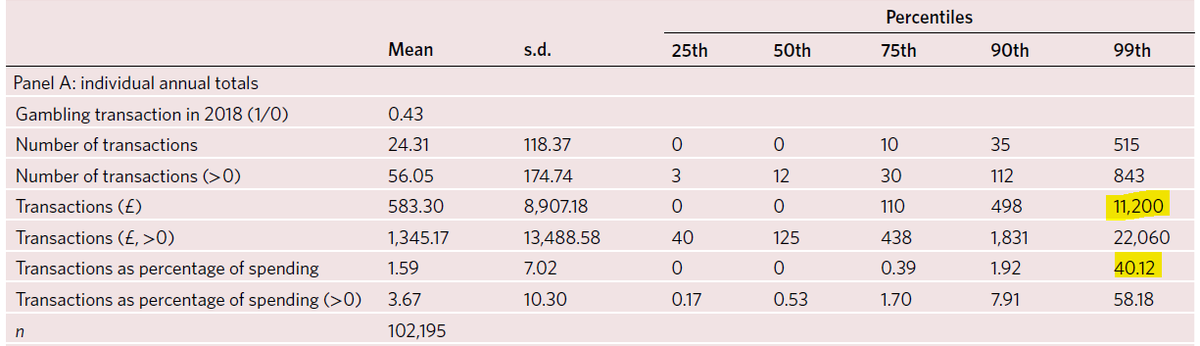

There are also 508,000 people who spent more than £11,200, or £933 per month (the highest 1% of the UK adult population by gambling spend).

There are also 508,000 people who spent more than £11,200, or £933 per month (the highest 1% of the UK adult population by gambling spend). This is equivalent to at least 40.8% of their overall spending.

This is equivalent to at least 40.8% of their overall spending.

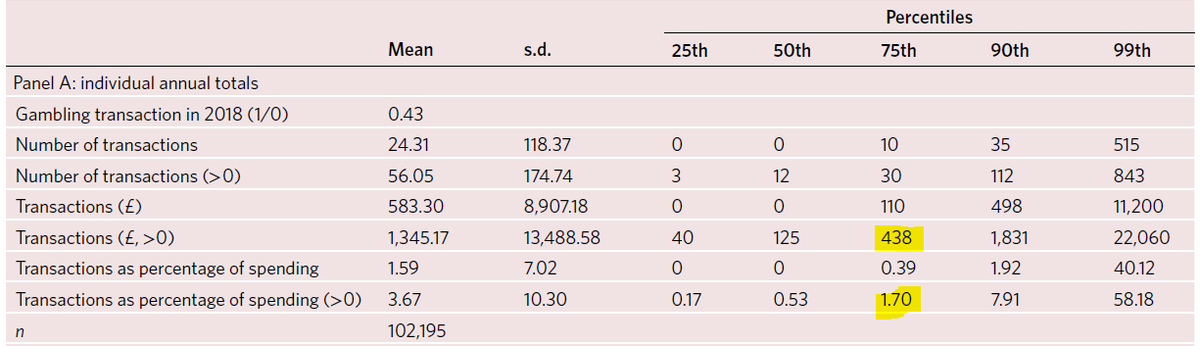

At the other end you’ve got lots of people devoting a low % of their overall spend to gambling.

At the other end you’ve got lots of people devoting a low % of their overall spend to gambling. The 75% lowest gamblers, around 15.2m people, spend less than £438 per year, or £10.40 per month.

The 75% lowest gamblers, around 15.2m people, spend less than £438 per year, or £10.40 per month. Clearly this group would likely be below any affordability ‘soft cap’.

Clearly this group would likely be below any affordability ‘soft cap’.

In fact, my reading of the data is that even at the lowest £100 level, less than one in seven gamblers would face a check.

At £450, you’re into the single-digits per cent of gamblers being affected (somewhere between 5-9% of gamblers).

At £450, you’re into the single-digits per cent of gamblers being affected (somewhere between 5-9% of gamblers).

Perhaps most importantly the Oxford-led team analysed the relationship between:

Perhaps most importantly the Oxford-led team analysed the relationship between:a) Various harms - including financial distress, mortality, social inclusion and financial inclusion, and

b) The proportion of spend players devoted to gambling.

There’s a lot here so strap in!

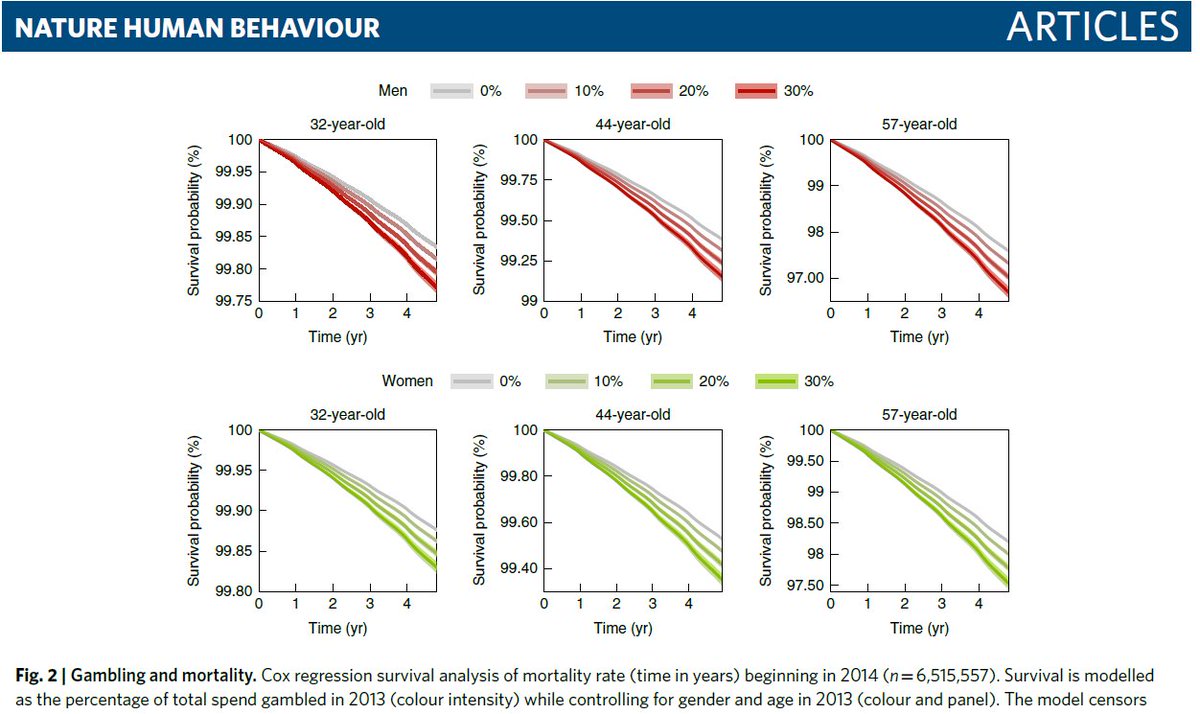

The headlines on harms - *Mortality*

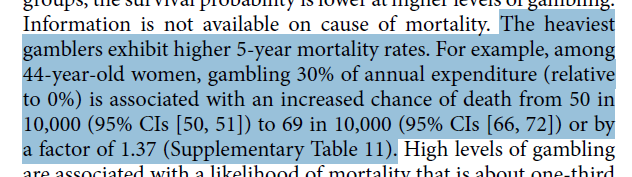

A person gambling 30% of their overall spend was a third (37%) more likely to die within five years, than a non-gambler.

A person gambling 30% of their overall spend was a third (37%) more likely to die within five years, than a non-gambler.

Even someone devoting just a tenth of their spending to gambling was 12 per cent more likely to die.

Even someone devoting just a tenth of their spending to gambling was 12 per cent more likely to die.

A person gambling 30% of their overall spend was a third (37%) more likely to die within five years, than a non-gambler.

A person gambling 30% of their overall spend was a third (37%) more likely to die within five years, than a non-gambler. Even someone devoting just a tenth of their spending to gambling was 12 per cent more likely to die.

Even someone devoting just a tenth of their spending to gambling was 12 per cent more likely to die.

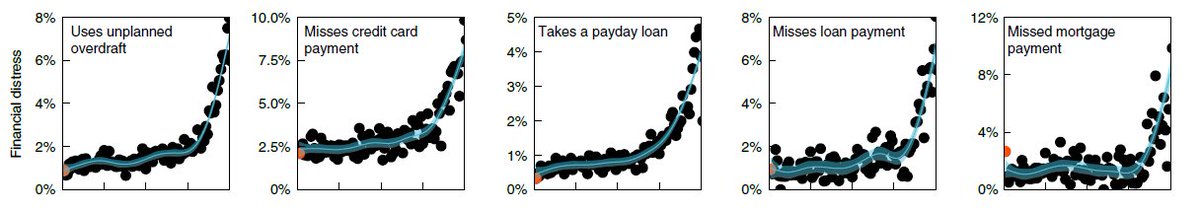

*Financial Distress*

A person devoting 10 per cent of their spending to gambling was:

51.5% more likely to use a payday loan,

51.5% more likely to use a payday loan,

97.5% more likely to miss a mortgage payment,

97.5% more likely to miss a mortgage payment,

36.5% more likely to miss a credit card payment,

36.5% more likely to miss a credit card payment,

... than a non-gambler.

A person devoting 10 per cent of their spending to gambling was:

51.5% more likely to use a payday loan,

51.5% more likely to use a payday loan, 97.5% more likely to miss a mortgage payment,

97.5% more likely to miss a mortgage payment, 36.5% more likely to miss a credit card payment,

36.5% more likely to miss a credit card payment,... than a non-gambler.

Higher levels of gambling were associated with paying less into a mortgage

Higher levels of gambling were associated with paying less into a mortgage ... but higher credit card use and debt collection.

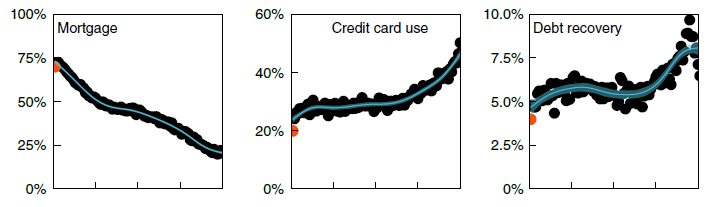

*Financial inclusion and planning*

Higher gambling, as a proportion of total spend, was associated with paying less out for insurances (such as life insurance)

Higher gambling, as a proportion of total spend, was associated with paying less out for insurances (such as life insurance)

... And less into savings, ISAs and pensions.

Higher gambling, as a proportion of total spend, was associated with paying less out for insurances (such as life insurance)

Higher gambling, as a proportion of total spend, was associated with paying less out for insurances (such as life insurance)... And less into savings, ISAs and pensions.

*Lifestyle*

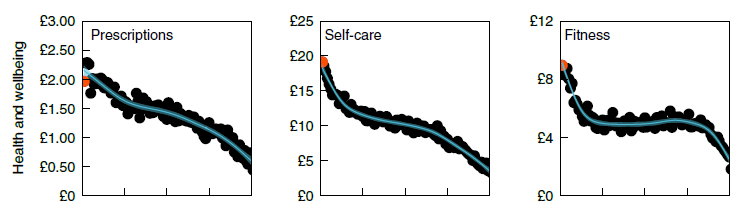

Interestingly the researchers were even able to show that as people gambled more they looked after themselves less well.

Interestingly the researchers were even able to show that as people gambled more they looked after themselves less well.

They spent less on prescriptions, self-care and fitness (e.g. gym subscriptions).

They spent less on prescriptions, self-care and fitness (e.g. gym subscriptions).

Interestingly the researchers were even able to show that as people gambled more they looked after themselves less well.

Interestingly the researchers were even able to show that as people gambled more they looked after themselves less well. They spent less on prescriptions, self-care and fitness (e.g. gym subscriptions).

They spent less on prescriptions, self-care and fitness (e.g. gym subscriptions).

*Socialising and self-improvement*

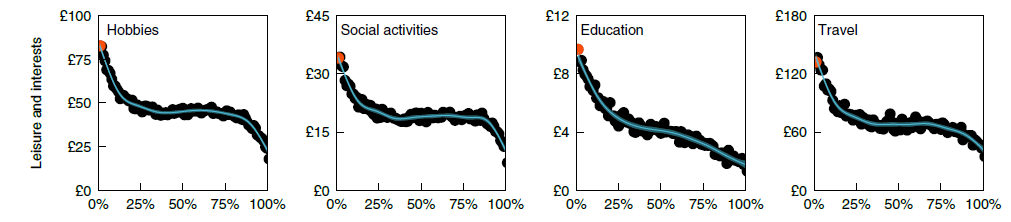

They also spent less on hobbies, doing stuff with friends, learning new things and travelling.

They also spent less on hobbies, doing stuff with friends, learning new things and travelling.

Look how these ones accelerate down at low levels of gambling, and then again at the highest level.

They also spent less on hobbies, doing stuff with friends, learning new things and travelling.

They also spent less on hobbies, doing stuff with friends, learning new things and travelling.Look how these ones accelerate down at low levels of gambling, and then again at the highest level.

Back to the really worrisome ones…

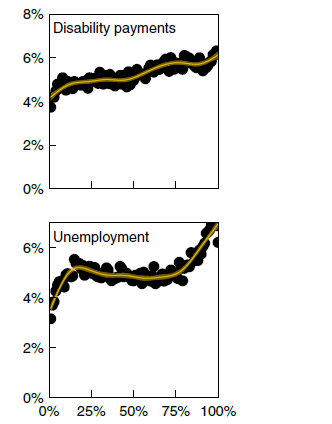

:: Those who devoted more spend to gambling in 2013 were more likely to end up unemployed in later years.

:: They were also more slightly more likely to claim disabled benefits down the line.

:: Those who devoted more spend to gambling in 2013 were more likely to end up unemployed in later years.

:: They were also more slightly more likely to claim disabled benefits down the line.

So what do we take away.

So what do we take away.1) Higher levels of gambling spend, as a proportion of everything you spend, are *associated with* loads of negative outcomes.

It’s likely to be a mixture of causality and co-morbidity - as we know it’s a complex area.

2) Many of the harms start accelerating when a gambler devotes more than 4% of total spend to gambling - that’s just £80 for someone who spends £2,000 a month.

So low levels of spend are also harmful - see @ByRobDavies piece https://www.theguardian.com/society/2021/feb/04/even-low-levels-of-gambling-linked-to-financial-hardship-study-finds

https://www.theguardian.com/society/2021/feb/04/even-low-levels-of-gambling-linked-to-financial-hardship-study-finds

So low levels of spend are also harmful - see @ByRobDavies piece

https://www.theguardian.com/society/2021/feb/04/even-low-levels-of-gambling-linked-to-financial-hardship-study-finds

https://www.theguardian.com/society/2021/feb/04/even-low-levels-of-gambling-linked-to-financial-hardship-study-finds

3) The enormous sums spent on gambling by the heaviest 1% and 10% of gamblers tells us a huge amount of gambling company profits come from this group.

The House of Lords estimated 60% of profits came from 5% of customers. This data would appear to back up that up.

The House of Lords estimated 60% of profits came from 5% of customers. This data would appear to back up that up.

You have to think. Can people who are spending 58% of their total spending on gambling really afford their losses?

That means they are spending £3 in every £5 on gambling.

And £2 in every £5 on housing, food, bills, transport, sofas, presents for their kids, EVERYTHING ELSE.

That means they are spending £3 in every £5 on gambling.

And £2 in every £5 on housing, food, bills, transport, sofas, presents for their kids, EVERYTHING ELSE.

4) Gamblers’ spend is spikey!

Report looks at spending in just one month - and finds the highest spending 218,000 gamblers lost more than £2,723 in that month.

Report looks at spending in just one month - and finds the highest spending 218,000 gamblers lost more than £2,723 in that month.

It’s higher than £1,838 cos gamblers will binge one month and bet less the next (and averages out over a year).

It’s higher than £1,838 cos gamblers will binge one month and bet less the next (and averages out over a year).

Report looks at spending in just one month - and finds the highest spending 218,000 gamblers lost more than £2,723 in that month.

Report looks at spending in just one month - and finds the highest spending 218,000 gamblers lost more than £2,723 in that month. It’s higher than £1,838 cos gamblers will binge one month and bet less the next (and averages out over a year).

It’s higher than £1,838 cos gamblers will binge one month and bet less the next (and averages out over a year).

5) An affordability limit set at £100 per month won’t affect seven in eight gamblers.

A limit at £450 will hardly affect anyone - only those people who, we know from other parts of the report, are suffering the most harm (see all those graphs).

A limit at £450 will hardly affect anyone - only those people who, we know from other parts of the report, are suffering the most harm (see all those graphs).

A limit at £450 will hardly affect anyone - only those people who, we know from other parts of the report, are suffering the most harm (see all those graphs).

A limit at £450 will hardly affect anyone - only those people who, we know from other parts of the report, are suffering the most harm (see all those graphs).

6) People who gamble more are dying younger.

Really shocking to see this laid out so starkly. It could be down to poverty, housing quality, access to healthcare, or all those negative lifestyle traits gamblers have (see graphs). One imagines that suicides are also contributing.

Really shocking to see this laid out so starkly. It could be down to poverty, housing quality, access to healthcare, or all those negative lifestyle traits gamblers have (see graphs). One imagines that suicides are also contributing.

Author Naomi Muggleton said: ‘Fact there is a relationship between gambling and mortality, especially at higher levels, is shocking. It suggests there is a need for public health interventions.’

Report has ‘significant implications for policy-makers and public health experts’.

Report has ‘significant implications for policy-makers and public health experts’.

Snap reaction;

Snap reaction;@MPIainDS: ‘This is a devastating indictment of gambling companies’ behaviour.’

@CarolynHarris24: ‘Affordability checks and stake limits are urgently needed.’

@Gamblewithlives: ‘This confirms gambling does kill. How many more deaths before action is taken?’

Full story in tomorrow's paper!

Until then, enormous kudos to the researchers and @LloydsBank - it's a vital bit of work that will be crucial in informing the current gambling review, particularly around affordability. [ENDS]

Until then, enormous kudos to the researchers and @LloydsBank - it's a vital bit of work that will be crucial in informing the current gambling review, particularly around affordability. [ENDS]

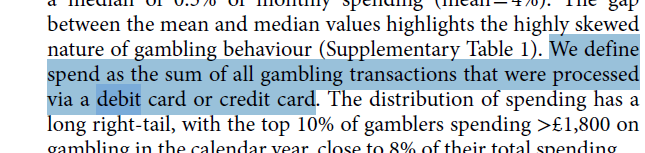

To clarify under main thread, report’s definition of spend is bets/deposits paid for with a debit/credit card.

Clearly this doesn't detract from the key point of the report - measuring harm against the amount players choose to devote to gambling.

Clearly this doesn't detract from the key point of the report - measuring harm against the amount players choose to devote to gambling.

It is the relationship between play (deposits/spend) and harm. Net loss will be lower than deposits - but clearly depositing 58% of income will be a concern to policymakers. (Ladbrokes boss: ‘99% of gamblers lose’, right).

In fact the report’s use of deposits, without withdrawals, makes the harm even starker.

The increase in harm - inc people *dying younger* - is occurring at lower amounts lost in cash terms. And if you can't see that from my thread, I suggest you go and read the report yourself!

The increase in harm - inc people *dying younger* - is occurring at lower amounts lost in cash terms. And if you can't see that from my thread, I suggest you go and read the report yourself!

Read on Twitter

Read on Twitter