$PENN Q4 -- results

- Revs down 23% YOY to $1.03B -- misses by 4%

-- "trended ahead of forecast pre pandemic-related closures"

- 35.5% EBITDA margin -- +570 bps YOY

- $13M in net income vs. -$93M YOY

- 11.6% op margin +1060 bps YOY

- $577M in net debt vs. $1.9B YOY

- Revs down 23% YOY to $1.03B -- misses by 4%

-- "trended ahead of forecast pre pandemic-related closures"

- 35.5% EBITDA margin -- +570 bps YOY

- $13M in net income vs. -$93M YOY

- 11.6% op margin +1060 bps YOY

- $577M in net debt vs. $1.9B YOY

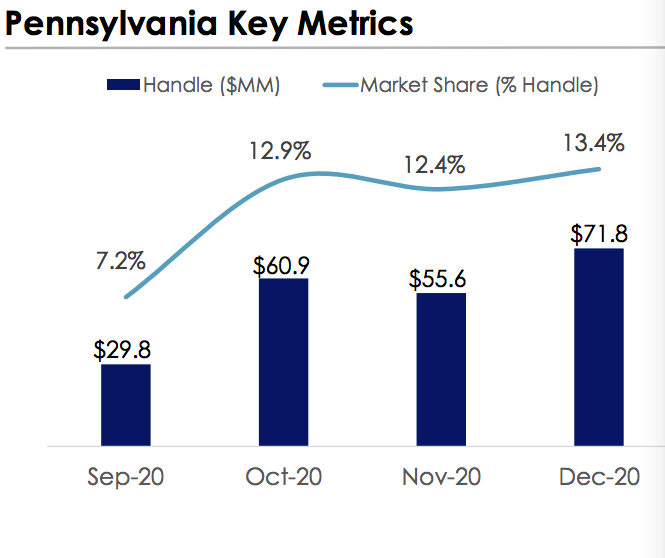

$PENN Q4 -- @BSSportsbook

- Growing Pennsylvania share (see image)

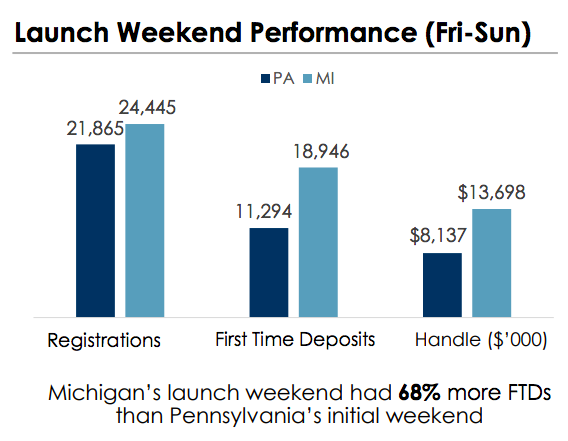

- Excelling in Michigan -- 48K users in 10 days (see other image)

- Will be live in 10+ states in 2021

- 15% of Mich users convert to $PENN loyalty program already

& again.. 0 external marketing spend.

- Growing Pennsylvania share (see image)

- Excelling in Michigan -- 48K users in 10 days (see other image)

- Will be live in 10+ states in 2021

- 15% of Mich users convert to $PENN loyalty program already

& again.. 0 external marketing spend.

$PENN Q4 -- Barstool omni-channel impact

In the week following Barstool re-brand at its East Chicago Property:

- +35% betting handle

- +27% table volume

- +26% slots volume

In the week following Barstool re-brand at its East Chicago Property:

- +35% betting handle

- +27% table volume

- +26% slots volume

$PENN Q4 -- Barstool

"Barstool continues to grow profitably through ads, licensing & merch sales. We view Barstool as a fantastic channel to promote our offerings & also an undervalued media asset."

Barstool posts record revs & EBITDA in 2020 despite sports halted.

I am long!

"Barstool continues to grow profitably through ads, licensing & merch sales. We view Barstool as a fantastic channel to promote our offerings & also an undervalued media asset."

Barstool posts record revs & EBITDA in 2020 despite sports halted.

I am long!

Not all that surprising but:

Snowden confirms $PENN will exercise its option to raise Barstool equity stake to 50% in 2 years.

Snowden confirms $PENN will exercise its option to raise Barstool equity stake to 50% in 2 years.

Read on Twitter

Read on Twitter