Emotions play an important role in investing. Every investor is aware of it but is still subject to many emotional biases.

Lets take a look at some of these biases:

Overconfidence

Overconfidence

Loss aversion

Loss aversion

Portfolio construction and diversification

Portfolio construction and diversification

Misuse of information

Misuse of information

Lets take a look at some of these biases:

Overconfidence

Overconfidence Loss aversion

Loss aversion Portfolio construction and diversification

Portfolio construction and diversification Misuse of information

Misuse of information

1/ Overconfident investors are flooding the markets in 2020/21. Many amateur investors have never suffered a bear market.

Overconfidence bias: investors think they have more control over their investments than they really do.

Overconfidence bias: investors think they have more control over their investments than they really do.

Overconfidence bias: investors think they have more control over their investments than they really do.

Overconfidence bias: investors think they have more control over their investments than they really do.

2/ Overconfidence (cont.)

Self-attribution bias: investors tend to...

Self-attribution bias: investors tend to...

Attribute success to skill

Attribute success to skill

Attribute failure to external factors

Attribute failure to external factors

You should also analyse the reasons why an investment has gone up! Maybe it went up for reasons you did not take into account!

Self-attribution bias: investors tend to...

Self-attribution bias: investors tend to... Attribute success to skill

Attribute success to skill Attribute failure to external factors

Attribute failure to external factorsYou should also analyse the reasons why an investment has gone up! Maybe it went up for reasons you did not take into account!

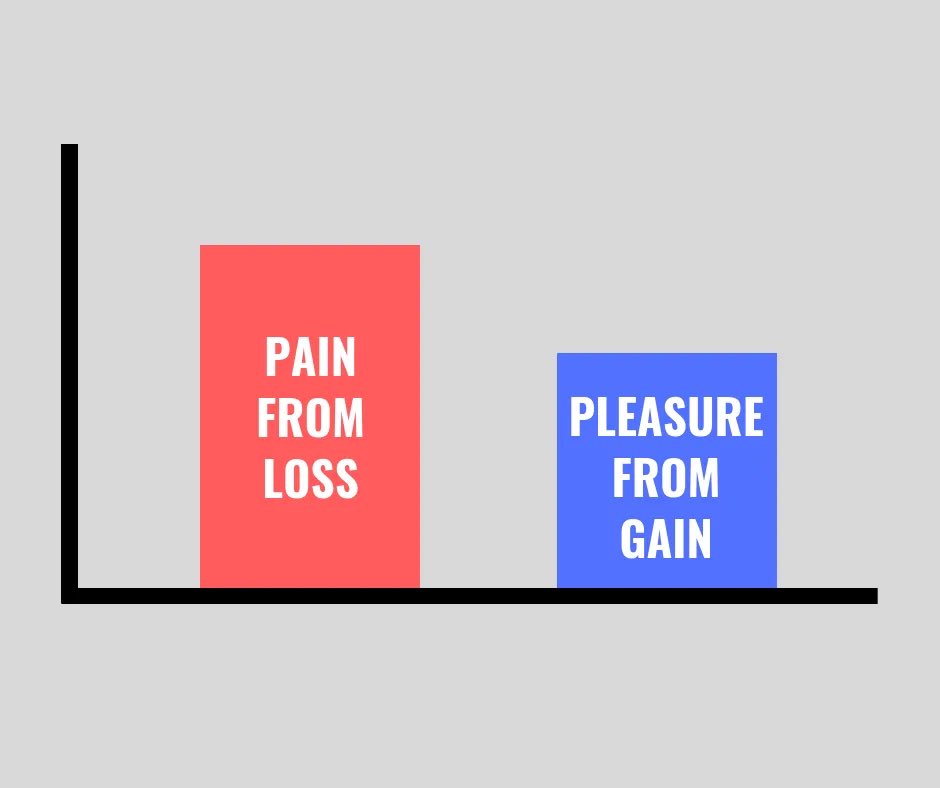

3/ Loss aversion is one of the most well known biases and it is one of the most difficult to mitigate. Losses will hurt even if you try to think rationally.

Fear of loss: losses hurt more than the joy you get from equal gains.

Fear of loss: losses hurt more than the joy you get from equal gains.

This may lead investors to risk aversion.

Fear of loss: losses hurt more than the joy you get from equal gains.

Fear of loss: losses hurt more than the joy you get from equal gains.This may lead investors to risk aversion.

4/ Loss aversion (cont.)

Disposition effect: investors tend to delay realizing losses and on the flipside they tend to sell winners too soon.

Disposition effect: investors tend to delay realizing losses and on the flipside they tend to sell winners too soon.

The negative effects this has on returns is quite evident. Take a look at when you should sell a long term investment https://twitter.com/invesquotes/status/1355846982724677633

https://twitter.com/invesquotes/status/1355846982724677633

Disposition effect: investors tend to delay realizing losses and on the flipside they tend to sell winners too soon.

Disposition effect: investors tend to delay realizing losses and on the flipside they tend to sell winners too soon.The negative effects this has on returns is quite evident. Take a look at when you should sell a long term investment

https://twitter.com/invesquotes/status/1355846982724677633

https://twitter.com/invesquotes/status/1355846982724677633

5/ Portfolio construction and diversification is somewhat personal for every investor but you should be open-minded

Narrow framing: investors tend to become hyperfocused on specific investments, failing to study other investments that may be good sources of wealth

Narrow framing: investors tend to become hyperfocused on specific investments, failing to study other investments that may be good sources of wealth

Narrow framing: investors tend to become hyperfocused on specific investments, failing to study other investments that may be good sources of wealth

Narrow framing: investors tend to become hyperfocused on specific investments, failing to study other investments that may be good sources of wealth

6/ Portfolio construction and diversification (cont.)

Familiarity bias: investors prefer familiar investments (from their own company, state or region). This bias is becoming less and less important as globalization gains strength.

Familiarity bias: investors prefer familiar investments (from their own company, state or region). This bias is becoming less and less important as globalization gains strength.

Familiarity bias: investors prefer familiar investments (from their own company, state or region). This bias is becoming less and less important as globalization gains strength.

Familiarity bias: investors prefer familiar investments (from their own company, state or region). This bias is becoming less and less important as globalization gains strength.

7/ Portfolio construction and diversification (cont.)

Having said this always remember that there is no correct or incorrect number of stocks to hold, this decision is personal.

Take a look at how many stocks top-tier investors hold. Quite different right? https://twitter.com/invesquotes/status/1348774329337737217

Having said this always remember that there is no correct or incorrect number of stocks to hold, this decision is personal.

Take a look at how many stocks top-tier investors hold. Quite different right? https://twitter.com/invesquotes/status/1348774329337737217

8/ Misuse of information is another key aspect of investor underperformance and it really is very common.

Anchoring: when investors receive information about any investment they tend to use this as reference for future judgement.

Anchoring: when investors receive information about any investment they tend to use this as reference for future judgement.

You should be open minded to receive new info

Anchoring: when investors receive information about any investment they tend to use this as reference for future judgement.

Anchoring: when investors receive information about any investment they tend to use this as reference for future judgement.You should be open minded to receive new info

9/ Misuse of information (cont.)

Representative bias: occurs when investors label an investment as good or bad based on recent performance.

Representative bias: occurs when investors label an investment as good or bad based on recent performance.

Classic comment from a friend: “Have you seen how this stock increased last year? It’s a good investment”

Representative bias: occurs when investors label an investment as good or bad based on recent performance.

Representative bias: occurs when investors label an investment as good or bad based on recent performance.Classic comment from a friend: “Have you seen how this stock increased last year? It’s a good investment”

10/ Misuse of information (cont.)

Gambler’s fallacy: don’t try to look for patterns where they don’t exist. Uncertainty will be always present in investment.

Gambler’s fallacy: don’t try to look for patterns where they don’t exist. Uncertainty will be always present in investment.

It’s impossible to predict random outcomes.

Gambler’s fallacy: don’t try to look for patterns where they don’t exist. Uncertainty will be always present in investment.

Gambler’s fallacy: don’t try to look for patterns where they don’t exist. Uncertainty will be always present in investment.It’s impossible to predict random outcomes.

11/ Misuse of information (cont.)

Remember two things:

• Financial markets are flooded with info, stick to what is important.

• Past returns do not guarantee future returns

Remember two things:

• Financial markets are flooded with info, stick to what is important.

• Past returns do not guarantee future returns

12/ Hope you liked the thread and hope it helps you be aware of these biases to increase your future returns.

For more threads go take a look at the following thread of threads

/END/ https://twitter.com/invesquotes/status/1356274376342204417

For more threads go take a look at the following thread of threads

/END/ https://twitter.com/invesquotes/status/1356274376342204417

Read on Twitter

Read on Twitter