Carbon pricing is supposed to incentivize change we know must happen, not punish households and companies through the inaction of governments. The time for democratic debate on policies that can avoid undesirable social and economic impacts from carbon pricing is above all before https://twitter.com/andreasgraf/status/1357081930408333317

Under an emissions trading system or anticipated carbon price, the time for action by governments more than ever is now because that shadow carbon price is not an irrelevant detail in an impact assessment, but a very real risk analysis tool.

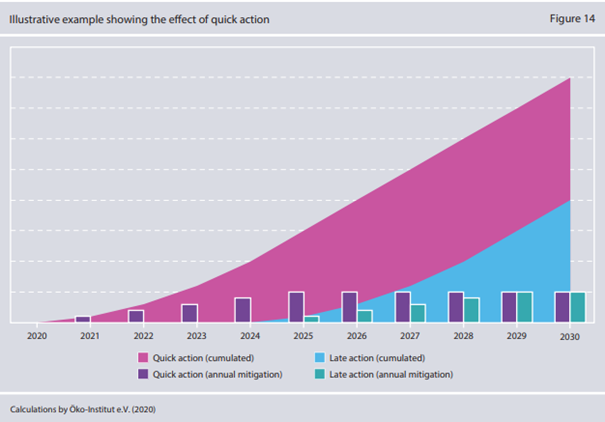

Under such a system, early and decisive action pays dividends. Just like a household or investor can see a looming cost imposition on the horizon and seek to contain that risk, so especially can governments.

In fact, in many cases governments are the only actor that can contain such 'risk', especially where infrastructure, tax and regulatory decisions are concerned. In climate policy the buck never truly stops with the individual, but always with the collective and its government.

The good news is with the EU Recovery Fund we have more money ostensibly earmarked to climate than governments know what to do with and the European Commission looking over their shoulder for the first time in a robust way. Shadow carbon pricing can help produce wiser decisions.

So let's get a good look into our collective balance sheet. We know we are not on track. Let's start discussing more conretely what this could mean for individual segments of society and legislate accordingly. And the consequence of inaction should be real, not hypothetical.

Read on Twitter

Read on Twitter