"COVID-19 and its economic consequences for the Euro Area" - That is the title of a paper that Michael Paetz and I wrote and that was published last month. Let me guide you through the arguments... [Thread] https://link.springer.com/article/10.1007/s40822-020-00159-w

We note that "governments and central banks all over the world have reacted swiftly. Without these interventions, the world economy would probably have collapsed. Nevertheless, the short-run negative economic impact of the pandemic is already bigger than that of 2008/09."

"It should be clear that a quick return to pre-COVID-19 policies in the €A would have devastating consequences for economic and political reasons. If governments would try to consolidate their budgets [..] a long-lasting depression is the most likely outcome."

"Yet, Southern European countries have already been in a bad economic shape before COVID-19. The unemployment rates in 2019 for Spain (14.1%), Italy (10.0%) and Greece (17.3%) were in the double digits, with a recession in Germany looming at the end of the year."

"Austerity policy cannot be successful within the next few years for the same reason it has not been successful in the past decade: It exacerbates the economic downturn and the substantial fall in income increases both public deficits and debt-to-GDP ratios."

"The pandemic causes painful real costs, in terms of losses in production and employment. However, the financial costs of the pandemic—losses in revenues of households, firms and the public sector—can be neutralized by increases in government spending."

"Instead of aiming at low public debt ratios, governments should therefore spend whatever it takes to keep demand at a level that is consistent with full employment. As long as the ECB cooperates with national governments, higher public deficits will not have any negative impact"

"The central bank is always able to make payments on behalf of the government. It is not a technical issue."

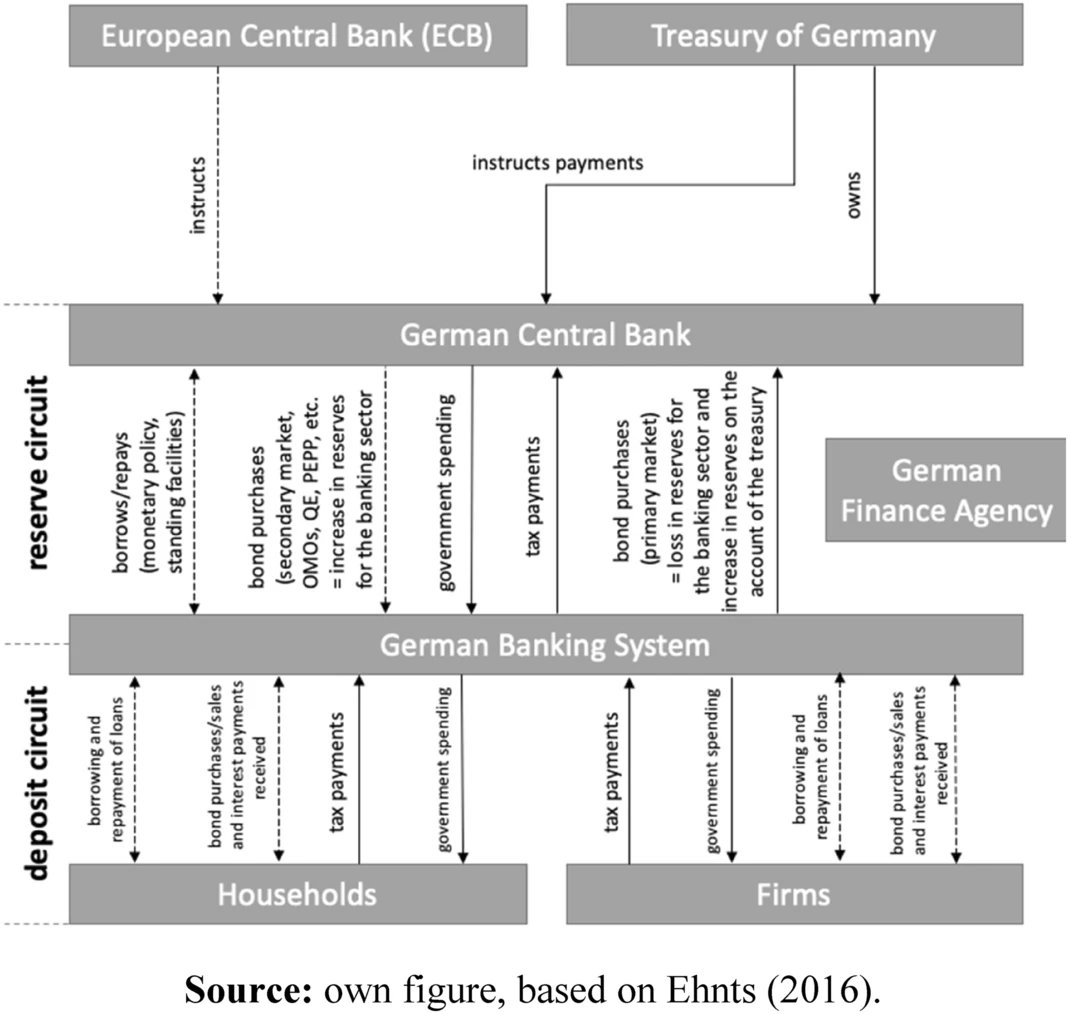

The fiscal-monetary nexus for Germany: https://link.springer.com/article/10.1007/s40822-020-00159-w/figures/5

"Under this cooperative institutional arrangement, the state is the creator of currency and simply cannot run out of money. Its central bank is a fiscal agent of the government and manages the payment system of private banks, the federal government and other state agencies."

"All spending by the federal government creates new currency and new money (reserves and deposits). The currency flows back to the government when taxes are paid, while the deposits are deleted. The state merely promises to accept its own currency for tax payments in the future."

"Tying the Euro Treasury to the JG only would solve this problem. The only expenditures that the Euro Treasury would be allowed to execute would be those connected to the JG."

"A Job Guarantee could be an appropriate supplement to public investment programs if a political consensus for higher national government spending cannot be reached."

European policy makers should use the next years to bring forward the following reform proposals:

European policy makers should use the next years to bring forward the following reform proposals:

1. Most importantly, government bonds need to be generally risk-free in the EA. The PEPP should be made permanent and the ECB should get a mandate to equalize interest rates on government bonds across EA member states and guarantee solvency of member state governments.

2. National governments should further increase their investments in the ecological reconstruction of its industrial base in the form of a GND ... using the EIB to channel money towards national governments, which would have the advantage that current fiscal rules are not broken.

3. SGP and Maastricht Treaty need to be reformed. Increasing debt-to-GDP ratios are no problem, if the ECB secures the solvency of the EA member states... Deficits are not controlled by national governments and the existing rules bear the risk of a pro-cyclical fiscal policy.

Instead, the size of national deficits should be replaced by measures of economic activity, for example, unemployment rates. As long as unemployment is high, national government expenditures should not be restricted.

It is time to gear the political system to our real problems instead of arbitrary figures like the government deficit or debt divided by the gross domestic product.

The end.

Ehnts, D., Paetz, M. COVID-19 and its economic consequences for the Euro Area. Eurasian Econ Rev (2021). https://doi.org/10.1007/s40822-020-00159-w

Ehnts, D., Paetz, M. COVID-19 and its economic consequences for the Euro Area. Eurasian Econ Rev (2021). https://doi.org/10.1007/s40822-020-00159-w

Read on Twitter

Read on Twitter