Silver Thursday and the Hunt brothers

How they went from the richest men on earth to bankruptcy trying to corner the silver market

/THREAD/

How they went from the richest men on earth to bankruptcy trying to corner the silver market

/THREAD/

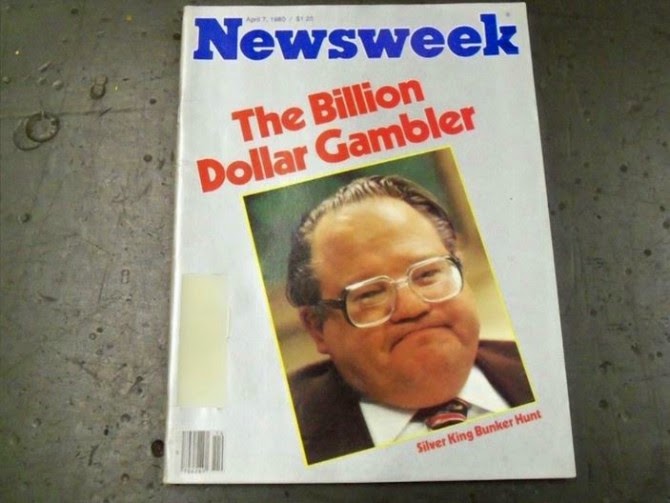

1/ Nelson Bunker Hunt and William Herbert Hunt were two of the wealthiest persons in the world in the late 1970s.

They were sons of Texas oil billionaire Haroldson Lafayette Hunt, Jr.

They were sons of Texas oil billionaire Haroldson Lafayette Hunt, Jr.

2/ Prevented by Franklin Roosevelt’s 1933 prohibition on U.S. citizens owning gold, they chose silver, with its price at $1.50 per ounce, as their speculative hedge.

Fearing paper money would soon be worthless, they bought futures contracts on 55 million ounces of silver.

Fearing paper money would soon be worthless, they bought futures contracts on 55 million ounces of silver.

3/ A huge chunk of their purchases was completed using margin, i.e. using credit provided by their brokers.

They eventually accumulated an estimated 100 million ounces of the precious metal.

They eventually accumulated an estimated 100 million ounces of the precious metal.

4/ They didn't sell the contracts like most commodity traders would do.

Instead, they took delivery of the bullion and transferred all of it to Switzerland using three Boeing 707s.

At some point, they controlled approximately 2/3 of the silver market.

Instead, they took delivery of the bullion and transferred all of it to Switzerland using three Boeing 707s.

At some point, they controlled approximately 2/3 of the silver market.

5/ What they unintentionally (or intentionally) did was create a short squeeze on silver.

Due to the lack of supply and short-sellers trying to close their positions, the price skyrocketed.

For more on short squeezes see this thread below https://twitter.com/itsKostasOnFIRE/status/1354400942871994369?s=20

Due to the lack of supply and short-sellers trying to close their positions, the price skyrocketed.

For more on short squeezes see this thread below https://twitter.com/itsKostasOnFIRE/status/1354400942871994369?s=20

6/ In 1979, the price of silver would rise from around $6.00 per troy ounce to nearly $50.00, and the Hunt brothers had amassed an estimated 200 million ounces of silver.

The Hunts owned $4.5 billion worth of silver, safely stored in Swiss vaults.

The Hunts owned $4.5 billion worth of silver, safely stored in Swiss vaults.

7/ The more than 700% increase in the silver price in such a short period caught the attention of Uncle Sam.

Such rampant speculation and profits triggered new government oversight, prompting the Federal Reserve to suspend trading in silver.

Such rampant speculation and profits triggered new government oversight, prompting the Federal Reserve to suspend trading in silver.

8/ The situation for other prospective purchasers of silver was so dire that on March 26, 1980, the jeweler Tiffany's & Co. took out an ad in The New York Times, condemning the Hunt Brothers and stating

9/ "Unconscionable

We think it is unconscionable for anyone to hoard several billion, yes billion, dollars worth of silver and thus drive the price up so high that others must pay artificially high prices for articles made of silver,....

We think it is unconscionable for anyone to hoard several billion, yes billion, dollars worth of silver and thus drive the price up so high that others must pay artificially high prices for articles made of silver,....

10/ from baby spoons to tea sets, as well as photographic film and other products."

In early 1980, the COMEX (the primary market for commodities trading) adopted Silver Rule 7, which placed several additional restrictions on the purchase of commodities on margin.

In early 1980, the COMEX (the primary market for commodities trading) adopted Silver Rule 7, which placed several additional restrictions on the purchase of commodities on margin.

11/ The boom was suddenly over, but the Hunts still had to honor contracts to buy at prices over $50.

On March 27th, 1980, the Hunt brothers finally missed a margin call of $100 million to the Bache brokerage firm, and the market plunged, with silver leading the way.

On March 27th, 1980, the Hunt brothers finally missed a margin call of $100 million to the Bache brokerage firm, and the market plunged, with silver leading the way.

12/ That day became known as "Silver Thursday".

The impact of Silver Thursday was felt across all markets globally.

Gold saw significant rises and falls in March 1980, and the threat of the Hunt brother’s losing a potential $1.7 billion caused panic in the stock markets.

The impact of Silver Thursday was felt across all markets globally.

Gold saw significant rises and falls in March 1980, and the threat of the Hunt brother’s losing a potential $1.7 billion caused panic in the stock markets.

13/ This triggered a sharp selloff as well as a steep decline in the price of silver.

By April 1st, the price of silver had dropped from $21.25 to $10.80, wiping off half of its value in a few days.

By April 1st, the price of silver had dropped from $21.25 to $10.80, wiping off half of its value in a few days.

14/ Their losses were approximately $1.7 billion.

This prompted Bunker Hunt to famously state“A billion dollars isn’t what it used to be”.

This prompted Bunker Hunt to famously state“A billion dollars isn’t what it used to be”.

15/ Unable to meet their financial obligations, several banks provided a $1.1 billion line of credit to the Hunt brothers to restore stability to the commodity and futures markets.

Their main intention was to stabilize an already struggling American economy.

Their main intention was to stabilize an already struggling American economy.

16/ The market was stabilized, but for the Hunts, it meant complete failure

They went eventually bankrupt, after being convicted of trying to illegally corner the silver market.

They went eventually bankrupt, after being convicted of trying to illegally corner the silver market.

17/ Failing to disclose their financial stake in Bache also added insider trading to their list of felonies.

They were fined $10 million each, on top of owing millions in taxes to the IRS, and were also banned from any future trading on the commodities market.

They were fined $10 million each, on top of owing millions in taxes to the IRS, and were also banned from any future trading on the commodities market.

18/ In 1988, the brothers were found responsible for civil charges of conspiracy to corner the market in silver.

They were ordered to pay $134 million in compensation to a Peruvian mineral company that had lost money as a result of their actions.

They were ordered to pay $134 million in compensation to a Peruvian mineral company that had lost money as a result of their actions.

19/ This forced the brothers to declare bankruptcy, in one of the biggest such filings in Texas history.

In the end, greed (or fear?) was their ultimate nemesis taking them from the wealthiest in the world to bankrupt and disgraced.

In the end, greed (or fear?) was their ultimate nemesis taking them from the wealthiest in the world to bankrupt and disgraced.

20/ So next time you try to game the system for quick profits, remember that the rules can always change.

And they probably won't be in your favor.

/END/

And they probably won't be in your favor.

/END/

If you liked this thread click below and retweet the first tweet, and follow to stay updated https://twitter.com/itsKostasOnFIRE/status/1357247909436289024?s=20

For more educational threads on financial independence and investing for beginners see below for a collection of threads

https://twitter.com/itsKostasOnFIRE/status/1345790210441928708?s=20

https://twitter.com/itsKostasOnFIRE/status/1345790210441928708?s=20

https://twitter.com/itsKostasOnFIRE/status/1345790210441928708?s=20

https://twitter.com/itsKostasOnFIRE/status/1345790210441928708?s=20

Read on Twitter

Read on Twitter