Did some cyberhornet sleuthing.

Some interesting corporate attendees at the Microstrategy conference. Now, keep in mind that MSTR does offer intelligence products that are used by CFO's and Treasury teams, so not all of these are necessarily #Bitcoin related

related

You be the judge:

Some interesting corporate attendees at the Microstrategy conference. Now, keep in mind that MSTR does offer intelligence products that are used by CFO's and Treasury teams, so not all of these are necessarily #Bitcoin

related

related You be the judge:

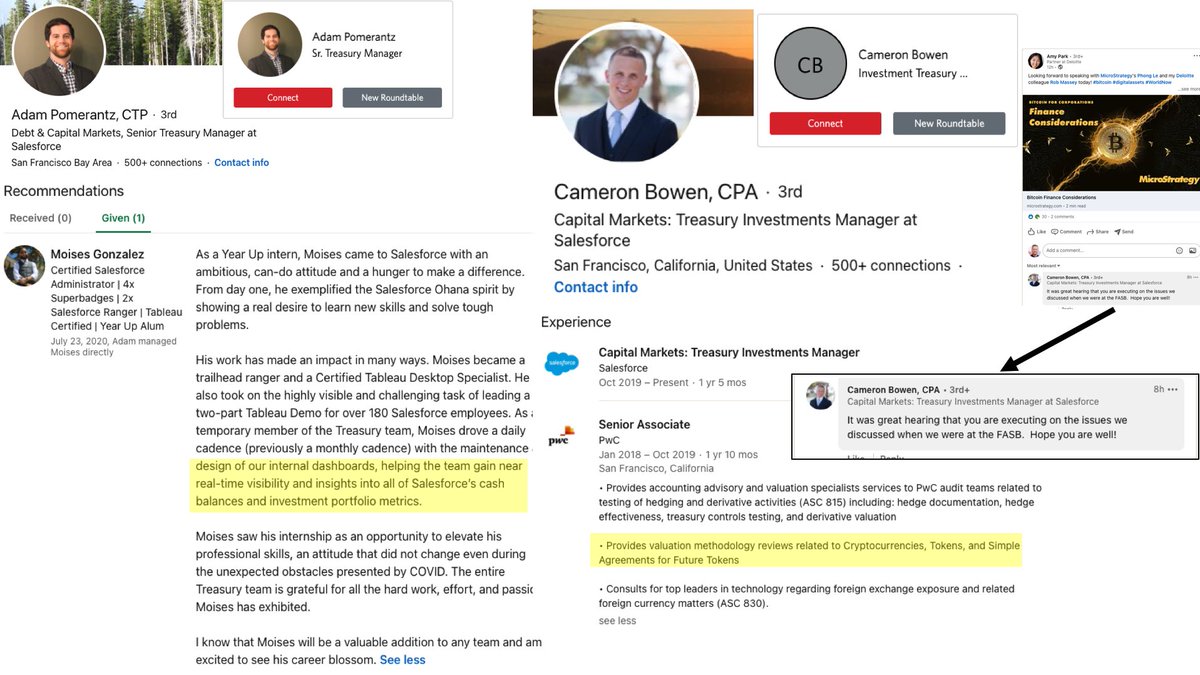

Salesforce.

Definitely seems like something is happening in terms of investing into Cryptocurrencies.

Might be related to the 'Blockchain' solutions they've been working on. (We know how that worked out for IBM)

https://www.salesforce.com/blog/what-is-blockchain-technology/

Definitely seems like something is happening in terms of investing into Cryptocurrencies.

Might be related to the 'Blockchain' solutions they've been working on. (We know how that worked out for IBM)

https://www.salesforce.com/blog/what-is-blockchain-technology/

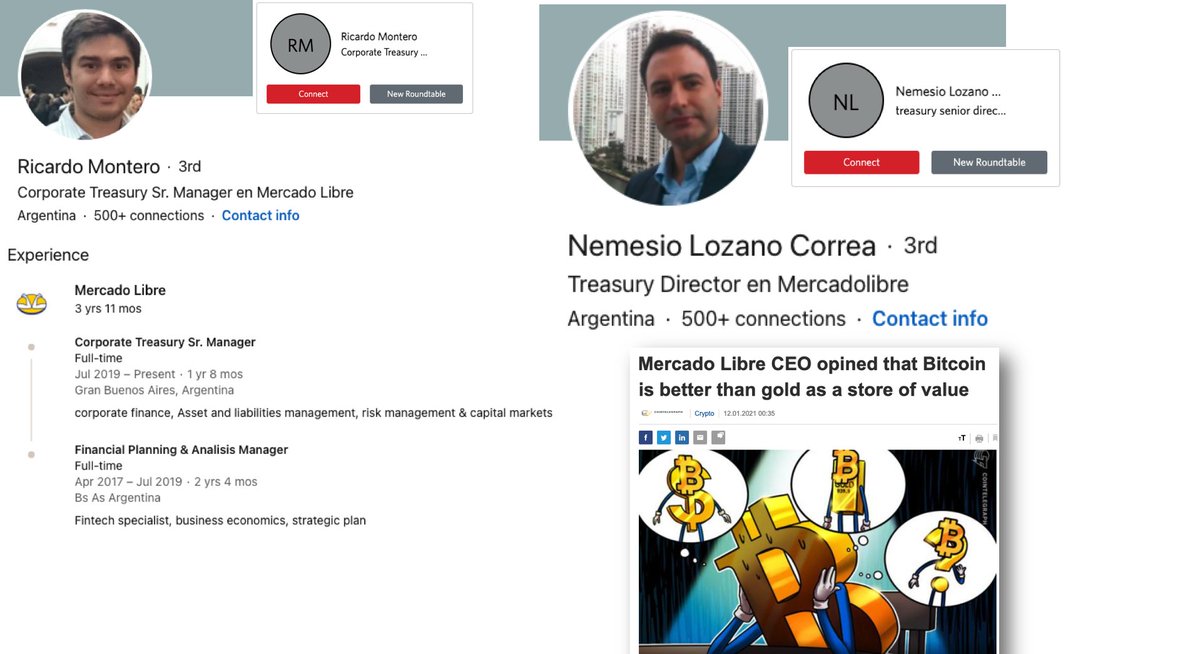

Mercado Libre.

They are like the Amazon of South America. Their CEO has apparently Tweeted about Bitcoin recently. Several folks from their Treasury in attendance at the conference.

https://es.cointelegraph.com/news/mercado-libres-ceo-believes-that-bitcoin-is-better-than-gold-as-a-store-of-value

They are like the Amazon of South America. Their CEO has apparently Tweeted about Bitcoin recently. Several folks from their Treasury in attendance at the conference.

https://es.cointelegraph.com/news/mercado-libres-ceo-believes-that-bitcoin-is-better-than-gold-as-a-store-of-value

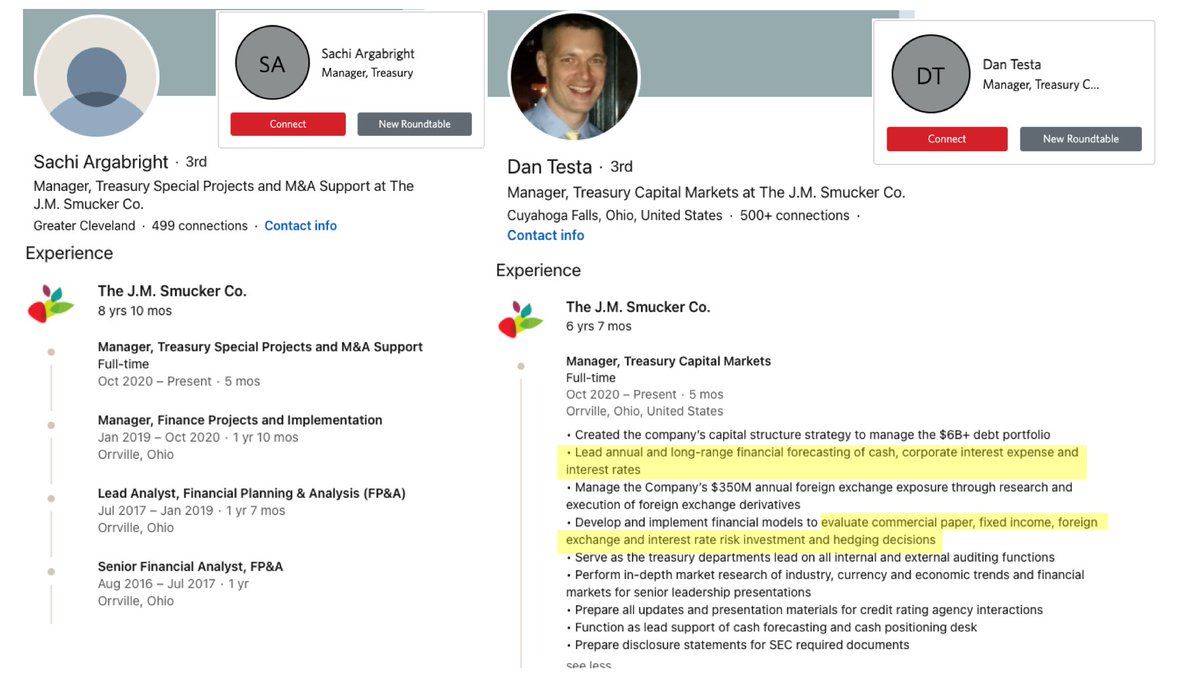

J.M. Smucker Co.

A little harder to tell here. The treasury employees could be trying to learn about Bitcoin, or they might just be trying to learn about Microstrategy intelligence solutions for data analytics.

A little harder to tell here. The treasury employees could be trying to learn about Bitcoin, or they might just be trying to learn about Microstrategy intelligence solutions for data analytics.

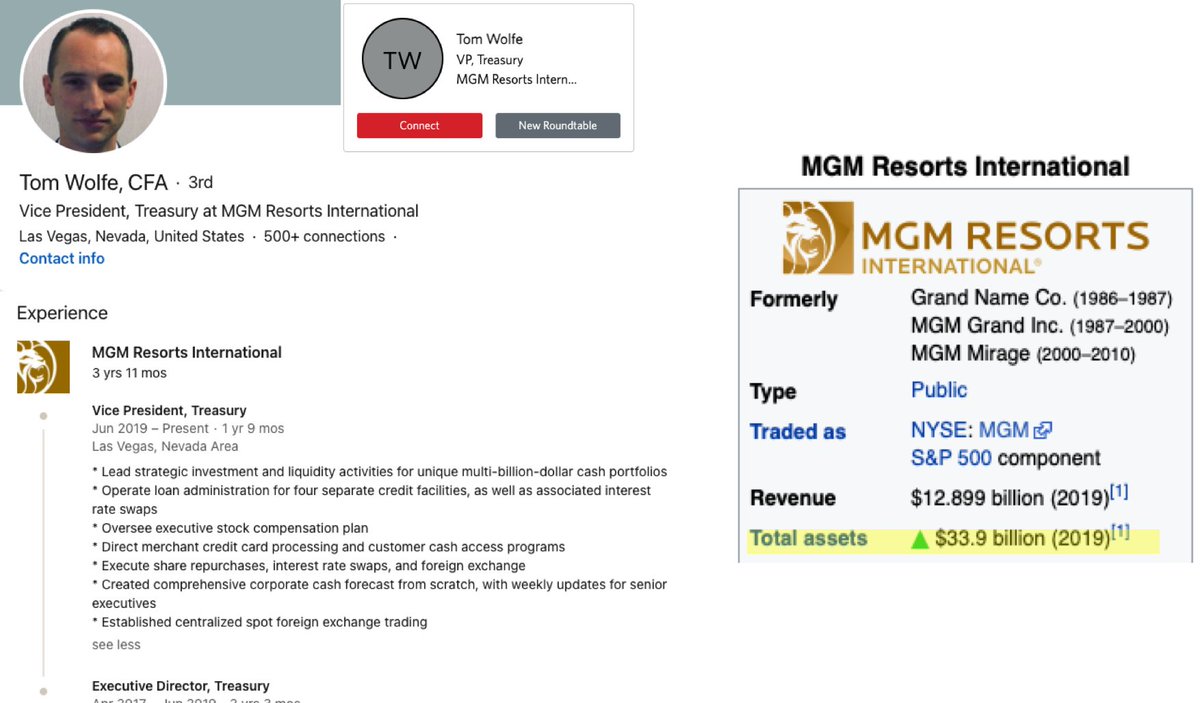

MGM Grand.

Not sure this is Bitcoin related. They do a lot of analytics and fraud detection, and may be using MSTR intelligence to parse through that data.

But, $33.9 billion in assets! Just 1% in #Bitcoin would be a good start.

would be a good start.

Not sure this is Bitcoin related. They do a lot of analytics and fraud detection, and may be using MSTR intelligence to parse through that data.

But, $33.9 billion in assets! Just 1% in #Bitcoin

would be a good start.

would be a good start.

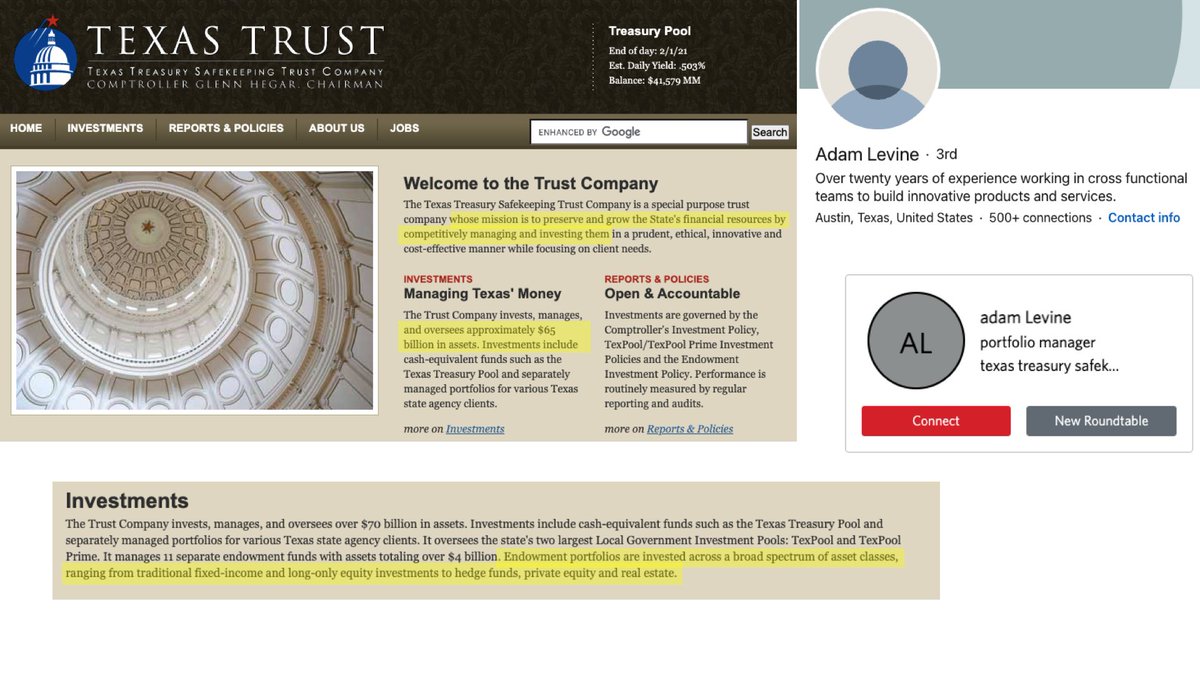

Texas Trust.

This one was most interesting to me. $65-70B in assets, and they invest in a broad spectrum of asset classes.

Texas buying Bitcoin?

This one was most interesting to me. $65-70B in assets, and they invest in a broad spectrum of asset classes.

Texas buying Bitcoin?

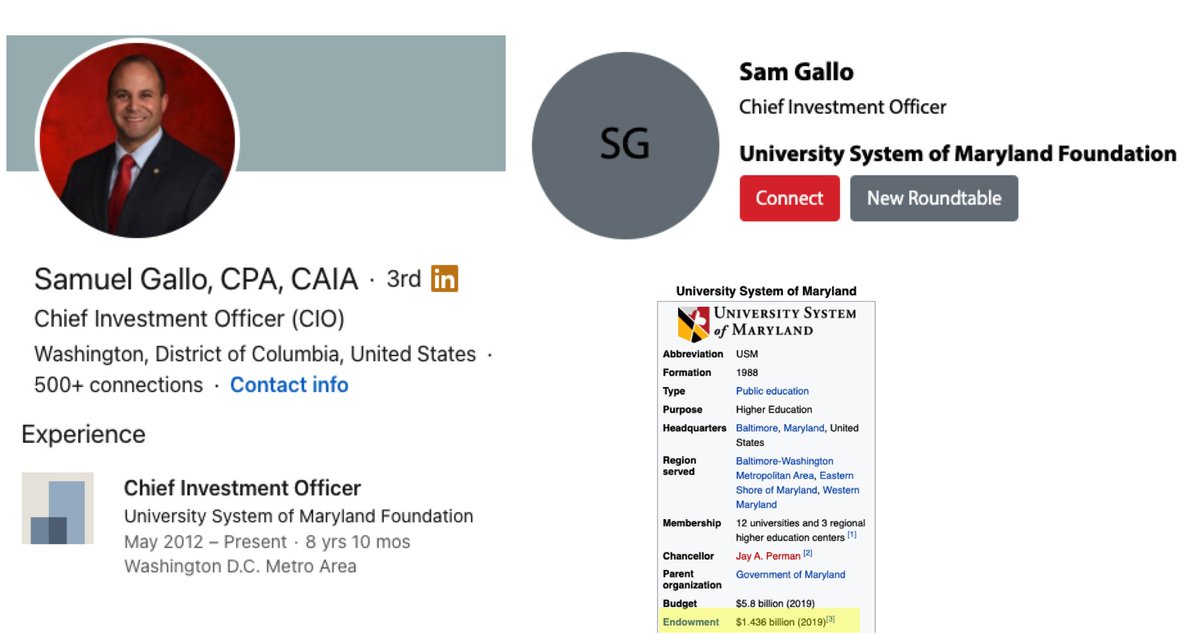

University of Maryland Foundation.

Seems they have a nice tidy $1B endowment. Maybe throw a bit into #Bitcoin ?

?

Seems they have a nice tidy $1B endowment. Maybe throw a bit into #Bitcoin

?

?

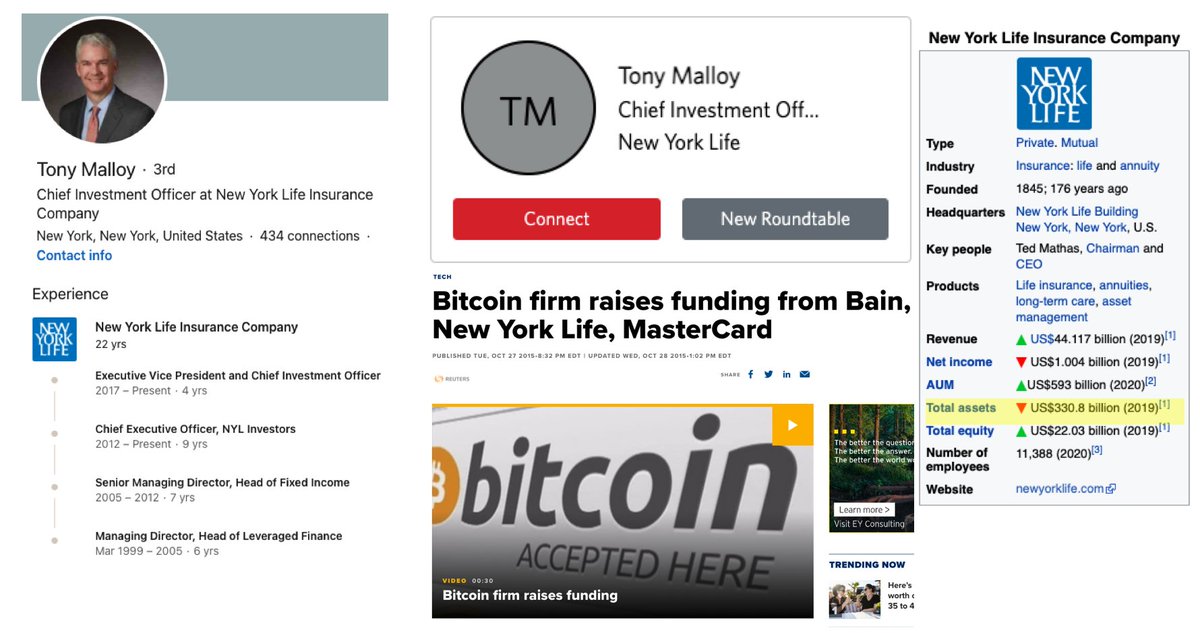

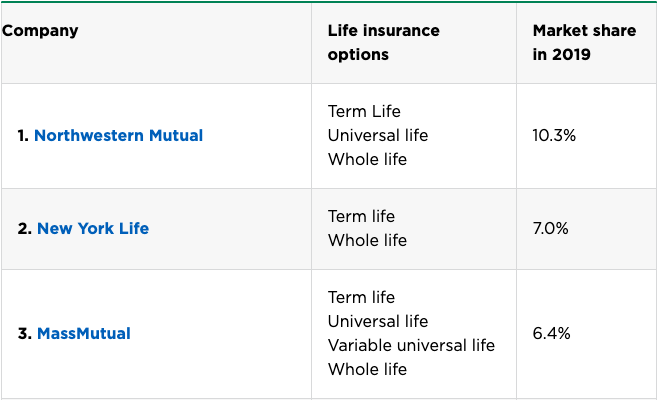

New York Life.

$330B+ in total assets! We know about Mass Mutual recently buying Bitcoin. Could New York Life be getting FOMO and wanting to jump in next? They have dabbled in Bitcoin venture investments...

$330B+ in total assets! We know about Mass Mutual recently buying Bitcoin. Could New York Life be getting FOMO and wanting to jump in next? They have dabbled in Bitcoin venture investments...

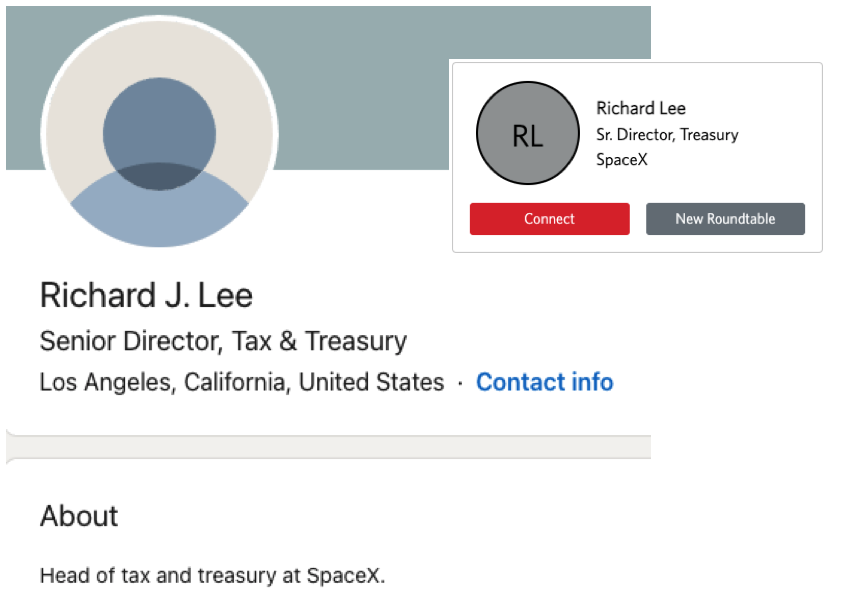

Space X.

We know Elon is a fan of #Bitcoin . But, will he maybe go with SpaceX balance sheet first instead of Tesla? It's still private, so probably less of a reporting hassle to deal with.

. But, will he maybe go with SpaceX balance sheet first instead of Tesla? It's still private, so probably less of a reporting hassle to deal with.

We know Elon is a fan of #Bitcoin

. But, will he maybe go with SpaceX balance sheet first instead of Tesla? It's still private, so probably less of a reporting hassle to deal with.

. But, will he maybe go with SpaceX balance sheet first instead of Tesla? It's still private, so probably less of a reporting hassle to deal with.

I saw all sorts of treasury employees from small/medium businesses, family offices, wealth management firms.

I am no finance or treasury expert, so anyone who has a background in FX hedging, treasury operations, and processes probably would have a lot to add

Fun to speculate!

I am no finance or treasury expert, so anyone who has a background in FX hedging, treasury operations, and processes probably would have a lot to add

Fun to speculate!

Read on Twitter

Read on Twitter