Unveiling ACoconut, the chassis behind #acBTC, #BTC

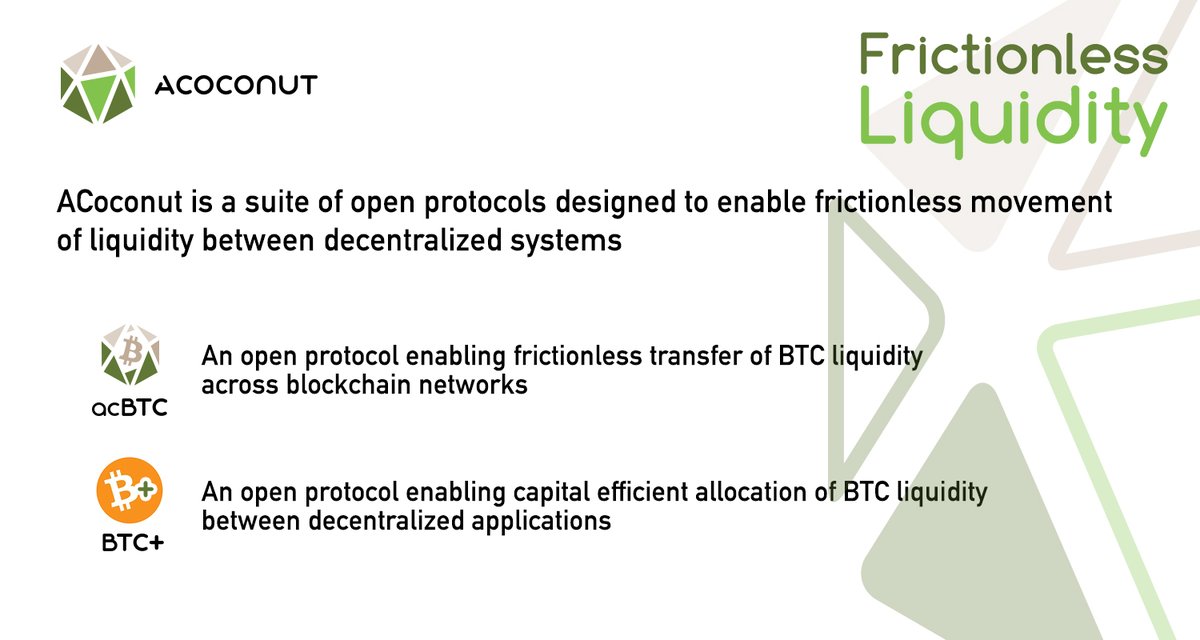

Unveiling ACoconut, the chassis behind #acBTC, #BTC  +, $AC and a vision to realize frictionless liquidity in a decentralized economy!

+, $AC and a vision to realize frictionless liquidity in a decentralized economy! With the redefined vision, we are extremely thrilled to introduce BTC+ to the ACoconut protocol suite.

With the redefined vision, we are extremely thrilled to introduce BTC+ to the ACoconut protocol suite. A thread

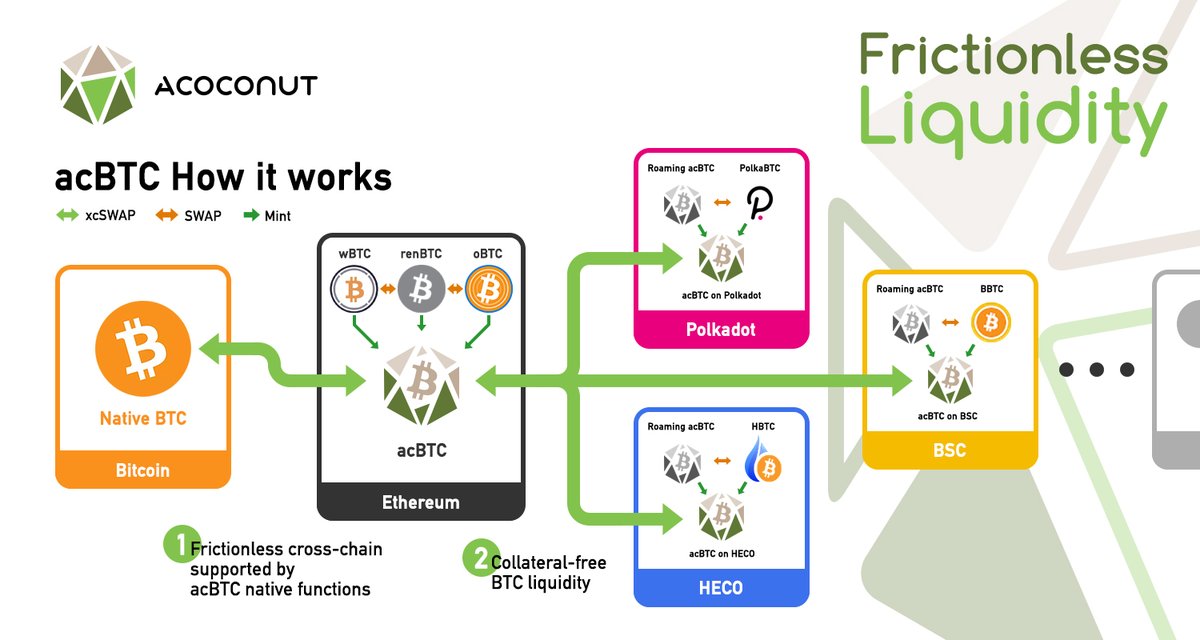

1/ The movement of liquidity between decentralized systems is currently entrenched with user frictions, largely impacting capital efficiency and usability.

2/ BTC-pegged tokens aim to maintain a stable peg against native BTC, token holders must seek for yields across various applications while bearing exorbitant transaction fees associated with allocation adjustments.

3/ BTC LP tokens, which includes vault share tokens from yEarn/Pickle/Harvest, generate profits and socialize costs for their holders.

However, these BTC LP tokens lose their peg against BTC and thus limits their usage in certain applications such as staking.

However, these BTC LP tokens lose their peg against BTC and thus limits their usage in certain applications such as staking.

4/ That's why we designed BTC+: With recurring positive rebase based on accrued interest, BTC+ can achieve the best of both worlds.

It's the first ERC20 BTC that can both maintain peg to native BTC and generate yield automatically for their holders.

It's the first ERC20 BTC that can both maintain peg to native BTC and generate yield automatically for their holders.

5/ BTC+ can be minted with both BTC-pegged tokens and BTC LP tokens. Addition and removal of supported tokens will be driven and decided by the ACoconut community.

6/ The following tokens are supported in the launch of BTC+:

BTC-pegged tokens: #WBTC, #renBTC, #tBTC, #oBTC

BTC LP tokens: #renCrv, #hbtcCrv, #obtcCrv

@WrappedBTC @renprotocol @HBTC_Official @BoringDAO_Defi @keep_project @CurveFinance

BTC-pegged tokens: #WBTC, #renBTC, #tBTC, #oBTC

BTC LP tokens: #renCrv, #hbtcCrv, #obtcCrv

@WrappedBTC @renprotocol @HBTC_Official @BoringDAO_Defi @keep_project @CurveFinance

7/ BTC+ Pool accepts deposits of ERC20-related tokens, generates yield with the deposits and mints BTC+ based on the total number of BTC-pegged token available in the pool

All BTC-pegged tokens are converted into BTC LP tokens, and BTC+ is minted

All BTC-pegged tokens are converted into BTC LP tokens, and BTC+ is minted

8/ This means 1 BTC+ can always redeem to a combination of multiple BTC-pegged tokens whose total amount is 1. Therefore, BTC+ maintains its peg to native BTC price.

9/ BTC+ Pool rely on another ACoconut product, #acSavings, to generate yield for its underlying assets. acSavings is a suite of vaults that helps BTC+, along with other acSavings users, to seek yield based on opportunities on the market.

10/ The returns from acSavings are used to mint additional BTC+ which are distributed to all token holders as interest. The interest collection process can be triggered automatically when BTC+ is minted or redeemed, or manually by any user of the protocol.

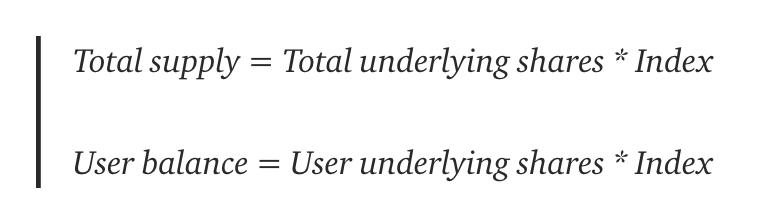

11/ BTC+ distributes interest using rebase mechanism. It manages a variable named index which represents the ratio between the underlying shares and the actual balance amount.

12/ The index is ever-increasing and increases each time interest is collected. Therefore, holders of #BTC  + can see their balance increased over time while the price of #BTC

+ can see their balance increased over time while the price of #BTC  + remains peg. This is a fundamental difference between #BTC

+ remains peg. This is a fundamental difference between #BTC  + and BTC LP tokens.

+ and BTC LP tokens.

+ can see their balance increased over time while the price of #BTC

+ can see their balance increased over time while the price of #BTC  + remains peg. This is a fundamental difference between #BTC

+ remains peg. This is a fundamental difference between #BTC  + and BTC LP tokens.

+ and BTC LP tokens.

13/ Since users’ balance of #BTC  + keeps increasing over time, DeFi developers should handle the balance properly when integrate their protocol with BTC+. Fortunately, this is not a problem for most existing DeFi protocols.

+ keeps increasing over time, DeFi developers should handle the balance properly when integrate their protocol with BTC+. Fortunately, this is not a problem for most existing DeFi protocols.

+ keeps increasing over time, DeFi developers should handle the balance properly when integrate their protocol with BTC+. Fortunately, this is not a problem for most existing DeFi protocols.

+ keeps increasing over time, DeFi developers should handle the balance properly when integrate their protocol with BTC+. Fortunately, this is not a problem for most existing DeFi protocols.

14/ DEX Protocols

Liquidity provider can earn both transaction fees from DEX and interest from #BTC + by supplying #BTC

+ by supplying #BTC  + liquidity.

+ liquidity.

@Uniswap @BreederDodo @SushiSwap

Liquidity provider can earn both transaction fees from DEX and interest from #BTC

+ by supplying #BTC

+ by supplying #BTC  + liquidity.

+ liquidity.@Uniswap @BreederDodo @SushiSwap

15/ Lending Protocols

BTC+ can server as collateral in lending protocols. Users can continue to earn BTC+ interest while using it as collateral.

@compoundfinance @AaveAave @CreamdotFinance

BTC+ can server as collateral in lending protocols. Users can continue to earn BTC+ interest while using it as collateral.

@compoundfinance @AaveAave @CreamdotFinance

16/ Options Protocols

BTC+ is also a good choice for options since it’s pegged to BTC, and options users won’t lose their BTC+ interest even in the options market.

@HegicOptions @fin_nexus @opyn_

BTC+ is also a good choice for options since it’s pegged to BTC, and options users won’t lose their BTC+ interest even in the options market.

@HegicOptions @fin_nexus @opyn_

17/ Currently, the ACoconut protocol suite have two ERC20 BTC protocols: #acBTC and #BTC  +

+

While acBTC focuses on reliability and usability, BTC+ focuses on capital efficiency and protocol compatibility.

+

+While acBTC focuses on reliability and usability, BTC+ focuses on capital efficiency and protocol compatibility.

18/ Together, #acBTC and #BTC  + are complementary decentralized solutions, designed to provide BTC DeFi users the ultimate frictionless experience.

+ are complementary decentralized solutions, designed to provide BTC DeFi users the ultimate frictionless experience.

Full read: https://medium.com/nuts-foundation/introducing-btc-a-positively-rebasing-erc20-btc-9e3b3833daf4

+ are complementary decentralized solutions, designed to provide BTC DeFi users the ultimate frictionless experience.

+ are complementary decentralized solutions, designed to provide BTC DeFi users the ultimate frictionless experience.Full read: https://medium.com/nuts-foundation/introducing-btc-a-positively-rebasing-erc20-btc-9e3b3833daf4

Read on Twitter

Read on Twitter