A primer on 'Investing in Debt Mutual Funds' for retail investors

Do hit the re-tweet and help us educate more investors

Have also started a telegram channel to discuss investments; you can join using this link – https://t.me/kirtanshahcfp (1/n)

Do hit the re-tweet and help us educate more investors

Have also started a telegram channel to discuss investments; you can join using this link – https://t.me/kirtanshahcfp (1/n)

(Q1) What r the challenges of investing in deposits (Banks/Corporates)?

a. Concentration & Default Risk – Most investors invest their entire corpus in 2-3 deposits. If either of the deposits default, a large chunk of the corpus is lost (2/n)

a. Concentration & Default Risk – Most investors invest their entire corpus in 2-3 deposits. If either of the deposits default, a large chunk of the corpus is lost (2/n)

b. Tax inefficiency – Taxed at ur slab rates. If a deposit pays 6% right now, post tax is 6% - 30% = 4.2%. This does not beat inflation

c. Illiquidity Risk – If u invest in a deposits for 3 years, to exit before that, you will be charged a penalty of 1% interest (3/n)

c. Illiquidity Risk – If u invest in a deposits for 3 years, to exit before that, you will be charged a penalty of 1% interest (3/n)

d. Interest Rate Risk – Specially in the current market situation where the rates r at the bottom & expected to move up, investing in deposits for 3 or 5 years tenure means locking urself at lower rates when the rates can increase in the future (4/n)

(Q2) Why invest in Debt MFs over deposits?

a. Each debt scheme of MF would invest in around 100 bonds/deposits. This reduces the concentration risk & the impact of any default risk

b. Tax – Investment in Debt MF for above 3 years, would get indexation advantage (5/n)

a. Each debt scheme of MF would invest in around 100 bonds/deposits. This reduces the concentration risk & the impact of any default risk

b. Tax – Investment in Debt MF for above 3 years, would get indexation advantage (5/n)

Tax advantage explained,

For Ex,

Fund return – 6%

Inflation in the same period – 4%

Tax to be paid only on 2% (returns – inflation)

Even if you are in the 30% tax bracket, tax to be paid is 20%

So 2% * 20% = 0.4% tax

Net return = 6% - 0.4% = 5.6% vs 4.2% in deposits (6/n)

For Ex,

Fund return – 6%

Inflation in the same period – 4%

Tax to be paid only on 2% (returns – inflation)

Even if you are in the 30% tax bracket, tax to be paid is 20%

So 2% * 20% = 0.4% tax

Net return = 6% - 0.4% = 5.6% vs 4.2% in deposits (6/n)

c. Investment can be withdrawn in 1 day without any penalty

d. As these investments are managed by professionals, they can do a much better job in reducing risk & increasing returns (ofcourse there can be exceptions) (7/n)

d. As these investments are managed by professionals, they can do a much better job in reducing risk & increasing returns (ofcourse there can be exceptions) (7/n)

(Q3) R there guarantees in investing in Debt Mutual Funds?

No, there are no guarantees like deposits. These investments are market linked.

(Q4) So you are saying debt mutual fund investing is risky like stock markets?

Not really. Lets try and understand how Debt MF’s work (8/n)

No, there are no guarantees like deposits. These investments are market linked.

(Q4) So you are saying debt mutual fund investing is risky like stock markets?

Not really. Lets try and understand how Debt MF’s work (8/n)

(Q5) How do Debt MFs generate returns?

When you invest in a Debt MF scheme, the scheme further invests in multiple bonds/deposits. The scheme generates return in 2 ways, coupon & capital gains. (9/n)

When you invest in a Debt MF scheme, the scheme further invests in multiple bonds/deposits. The scheme generates return in 2 ways, coupon & capital gains. (9/n)

Coupon – Its same as the interest paid out by the deposits. We call it coupon in the debt market. The coupon is higher for riskier bonds & lower for less risky bonds, same as deposits (10/n)

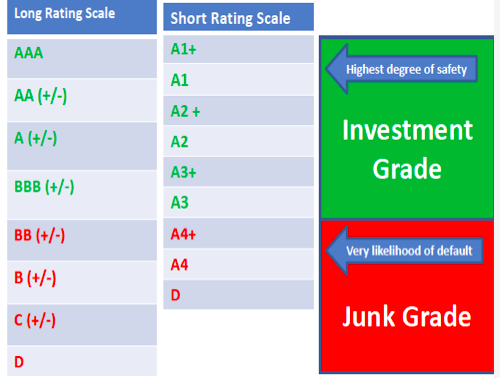

How do I understand the credit risk in the bonds?

Look at the credit rating. SOV means government, AAA & A1+ are considered to be the best ratings in corporate bonds & the lower you go on the rating, the risk increases. AA+ & A1 has higher risk than AAA & A1+ and so on (11/n)

Look at the credit rating. SOV means government, AAA & A1+ are considered to be the best ratings in corporate bonds & the lower you go on the rating, the risk increases. AA+ & A1 has higher risk than AAA & A1+ and so on (11/n)

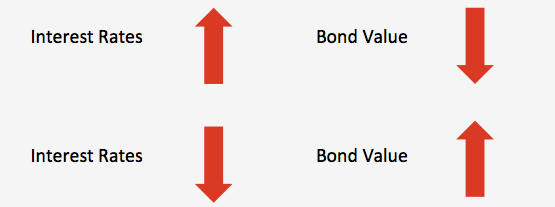

Capital Gains – Interest rates or yields like they are called & bonds value are inversely proportional. So when interest rates (yields) go up, the existing bonds fall in value & when interest rates (yields) go down, existing bonds increase in value. (12/n)

Consider a bond 2b exactly same as FD with the only difference being that bond trades in the market & v can buy/sell it like we do with equities

Imagine a bond v have invested in at 6% for 5 years & after our investment, the interest rates in the market or

or  , (13/n)

, (13/n)

Imagine a bond v have invested in at 6% for 5 years & after our investment, the interest rates in the market

or

or  , (13/n)

, (13/n)

Case 1–yields decrease to 5%

If any1 now wants 2 buy a new bond, will get it @ 5% yield bt our old bond is paying 6% yield & hence the demand 4 our bonds will go & the price will

& the price will  . So when market yields

. So when market yields  , price of the existing bonds

, price of the existing bonds  , leading 2 gains in the scheme(14/n)

, leading 2 gains in the scheme(14/n)

If any1 now wants 2 buy a new bond, will get it @ 5% yield bt our old bond is paying 6% yield & hence the demand 4 our bonds will go

& the price will

& the price will  . So when market yields

. So when market yields  , price of the existing bonds

, price of the existing bonds  , leading 2 gains in the scheme(14/n)

, leading 2 gains in the scheme(14/n)

Read on Twitter

Read on Twitter