$SKLZ was flying today. Easy DD

@gavutaclan @GetBenchmarkCo @ParrotStock @JonahLupton @DaddySpac @MartinDayTrader @NickGreenCC @ThomasVidaI @Jimmyjude13 @SteveHanley19 @balwx @MichaelRippe @THExander03

@gavutaclan @GetBenchmarkCo @ParrotStock @JonahLupton @DaddySpac @MartinDayTrader @NickGreenCC @ThomasVidaI @Jimmyjude13 @SteveHanley19 @balwx @MichaelRippe @THExander03

Business Model

Unique mobile gaming platform, creating a win-win proposition for both gamers and developers. It has a high potential to generate a strong flywheel effect once it kicks off. Unlike other developers/platform, they don’t monetize via ads and in-game purchases

Unique mobile gaming platform, creating a win-win proposition for both gamers and developers. It has a high potential to generate a strong flywheel effect once it kicks off. Unlike other developers/platform, they don’t monetize via ads and in-game purchases

Unique mobile gaming platform, creating a win-win proposition for both gamers and developers. It has a high potential to generate a strong flywheel effect once it kicks off. Unlike other developers/platform, they don’t monetize via ads and in-game purchases

Unique mobile gaming platform, creating a win-win proposition for both gamers and developers. It has a high potential to generate a strong flywheel effect once it kicks off. Unlike other developers/platform, they don’t monetize via ads and in-game purchases

Continued/

They make money by taking a cut from the competitive game played between players. Have a 95% gross margin, and developers get a 25-30% cut of the GMV. They are making the casual games feel competitive and http://skill-based.In turn, it makes the platform sticky

They make money by taking a cut from the competitive game played between players. Have a 95% gross margin, and developers get a 25-30% cut of the GMV. They are making the casual games feel competitive and http://skill-based.In turn, it makes the platform sticky

They make money by taking a cut from the competitive game played between players. Have a 95% gross margin, and developers get a 25-30% cut of the GMV. They are making the casual games feel competitive and http://skill-based.In turn, it makes the platform sticky

They make money by taking a cut from the competitive game played between players. Have a 95% gross margin, and developers get a 25-30% cut of the GMV. They are making the casual games feel competitive and http://skill-based.In turn, it makes the platform sticky

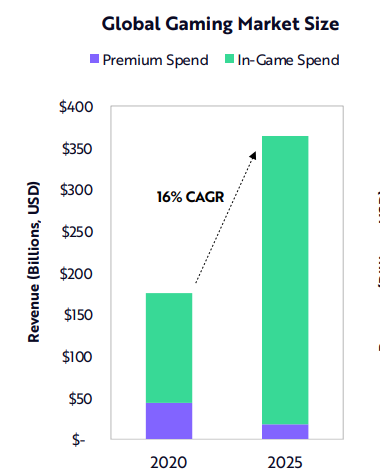

Industry/

Mobile gaming is forecasted to grow at 20% (faster than gaming).

Mobile gaming is forecasted to grow at 20% (faster than gaming).

The average time spent playing a video game is set to increase 1.1 hours per person to 1.5 hours in 2025.

The gaming industry is very fragmented, and $SKLZ can take advantage of this

Mobile gaming is forecasted to grow at 20% (faster than gaming).

Mobile gaming is forecasted to grow at 20% (faster than gaming). The average time spent playing a video game is set to increase 1.1 hours per person to 1.5 hours in 2025.

The gaming industry is very fragmented, and $SKLZ can take advantage of this

Compelling Economics

4.7x LTV CAC

4.7x LTV CAC

Low churn Rate

Low churn Rate

95% Gross Profit

95% Gross Profit

Large TAM (E-sports)

Large TAM (E-sports)

88% sales growth

88% sales growth

4.7x LTV CAC

4.7x LTV CAC Low churn Rate

Low churn Rate 95% Gross Profit

95% Gross Profit Large TAM (E-sports)

Large TAM (E-sports) 88% sales growth

88% sales growth

Strong future Optionality

Brand Sponsored Tournaments

Their app gets incorporated into Google Play

International expansion

New game genres (recently announced 3rd person)

Monetize non-paying customer maybe via Ad’s

Brand Sponsored Tournaments

Their app gets incorporated into Google Play

International expansion

New game genres (recently announced 3rd person)

Monetize non-paying customer maybe via Ad’s

Have economic MOAT

Network effect – fragmented market and first mover in e-sports

Network effect – fragmented market and first mover in e-sports

58 patents and billions of data points to catch cheat and frauds. Also, detect if games are skills-based or not.

58 patents and billions of data points to catch cheat and frauds. Also, detect if games are skills-based or not.

Network effect – fragmented market and first mover in e-sports

Network effect – fragmented market and first mover in e-sports 58 patents and billions of data points to catch cheat and frauds. Also, detect if games are skills-based or not.

58 patents and billions of data points to catch cheat and frauds. Also, detect if games are skills-based or not.

Apart from Fed we also have company-specific risk here

Revenue Concentration Risk – 88% coming from Two developers

Revenue Concentration Risk – 88% coming from Two developers

“For the 9 months ended September 2020 Tether and Big Run accounted for 63% and 25%, of their revenue”

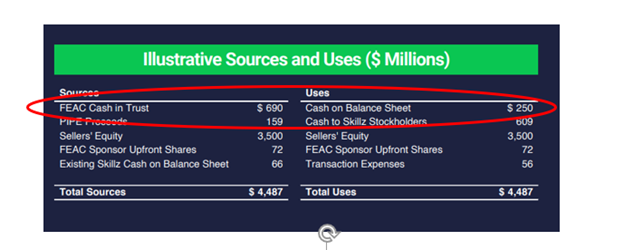

Two pictures below in their presentation is just BS

Revenue Concentration Risk – 88% coming from Two developers

Revenue Concentration Risk – 88% coming from Two developers“For the 9 months ended September 2020 Tether and Big Run accounted for 63% and 25%, of their revenue”

Two pictures below in their presentation is just BS

Game quality and diversity is a bit sad

Game quality and diversity is a bit sad  Marketing is focused on user acquisition and not developer’s – No flywheel impact!

Marketing is focused on user acquisition and not developer’s – No flywheel impact! Can large Game Developers will build something similar?

Can large Game Developers will build something similar? Apple’s policy to let cash gaming apps be exempt from the take rate – May impose fees!

Apple’s policy to let cash gaming apps be exempt from the take rate – May impose fees!

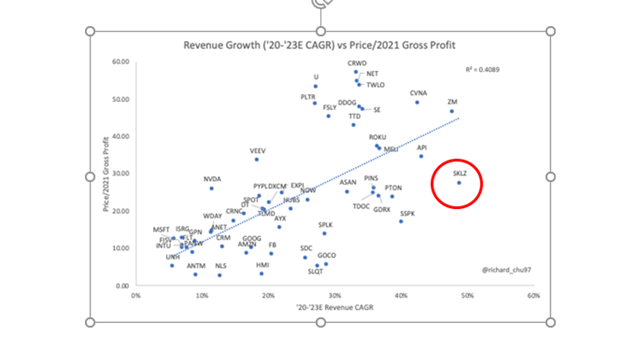

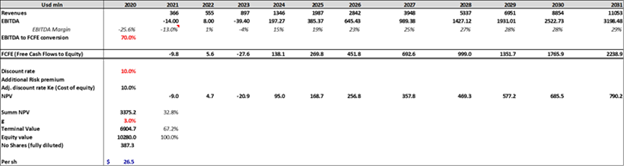

Intrinsic value ( at current prices expensive)

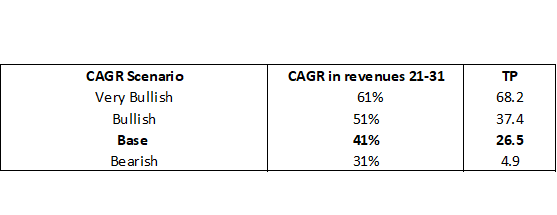

According to our CAGR sensitivity analysis, if the growth rate increases from 41% to 61%, stock can more than 2X. So not all is lost - it depends if the company executes

According to our CAGR sensitivity analysis, if the growth rate increases from 41% to 61%, stock can more than 2X. So not all is lost - it depends if the company executes

If you like this tweet you are going to love our video

Also, join our telegram chat for trade/investment ideas https://t.me/joinchat/J90VAhuJOZsEBhmxJ_26hw

I am also trying to impress my line manager so please RT as well thanks.

Also, join our telegram chat for trade/investment ideas https://t.me/joinchat/J90VAhuJOZsEBhmxJ_26hw

I am also trying to impress my line manager so please RT as well thanks.

Read on Twitter

Read on Twitter