$ALUS THREAD:

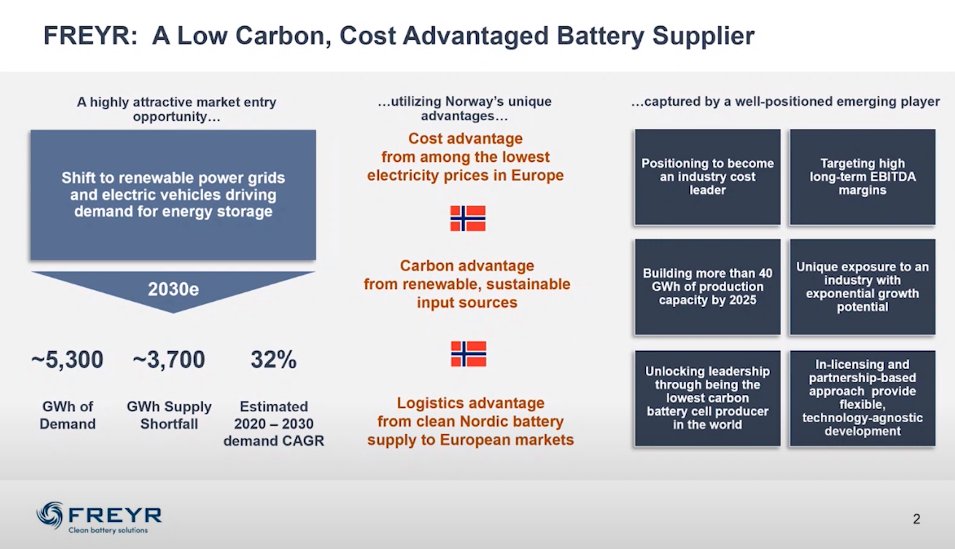

Tom Jensen, Freyr CEO: "We believe in a highly attractive market opportunity, and we represent one of very few opportunites to get exposed to this industry for investors. We believe the shift to renewable powergrids and electric vehicles is driving demand...

Tom Jensen, Freyr CEO: "We believe in a highly attractive market opportunity, and we represent one of very few opportunites to get exposed to this industry for investors. We believe the shift to renewable powergrids and electric vehicles is driving demand...

...for energy storage and lithium ion battery solutions much faster than most people think".

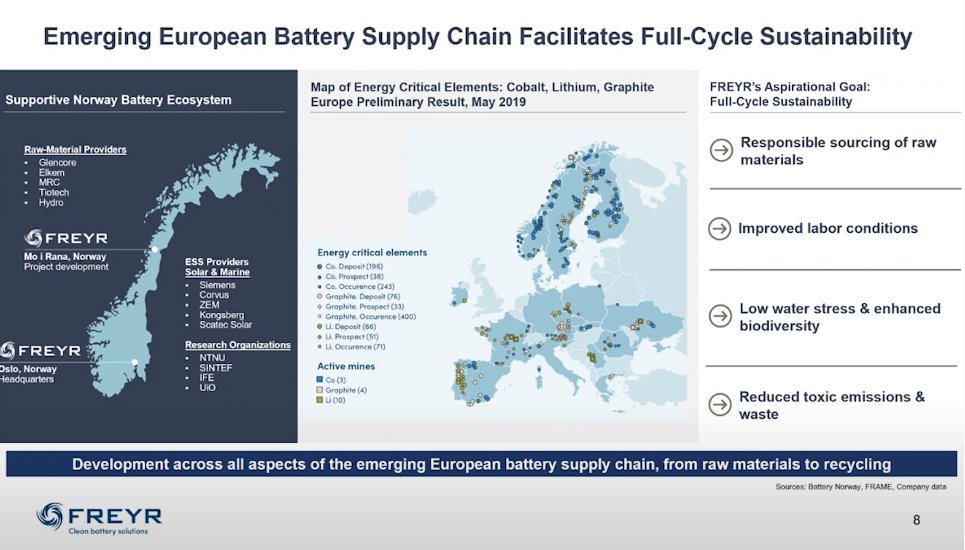

"...we believe Norway has critically important advantages to offer in this regard. While battery is a raw material business and a material conversion business. Norway's starting point..

"...we believe Norway has critically important advantages to offer in this regard. While battery is a raw material business and a material conversion business. Norway's starting point..

...with ultra-low cost electricity prices relative to all other locations in Europe where battery-cell production is planned, combined with the zero carbon nature of that energy, provides a starting point which is fundementally very positive."

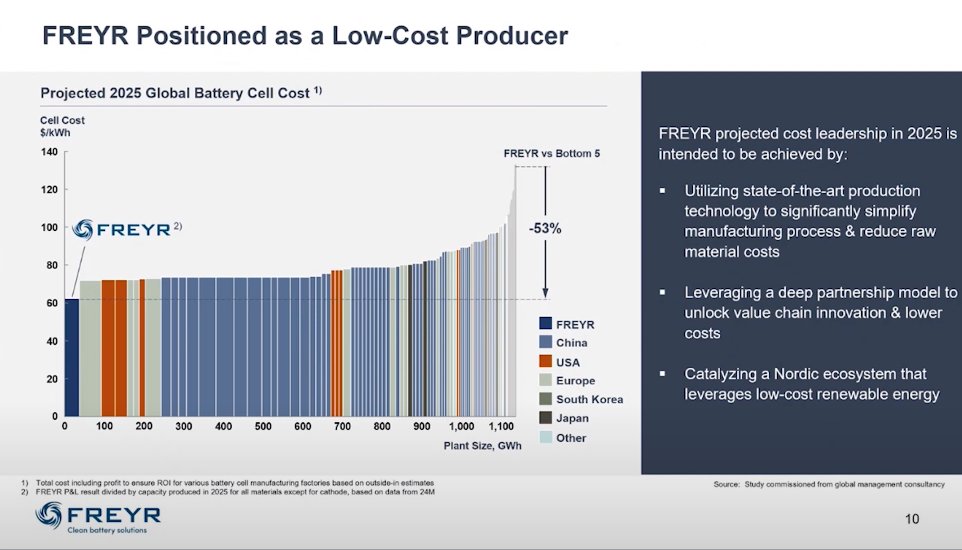

"We are going to be THE most well positioned player in this industry. That is our ambition. We want to become an industry cost leader. We want to deliver high EBITDA margins. We're going to start that journey by building more than 40 GWh of production capacity already by 2025"

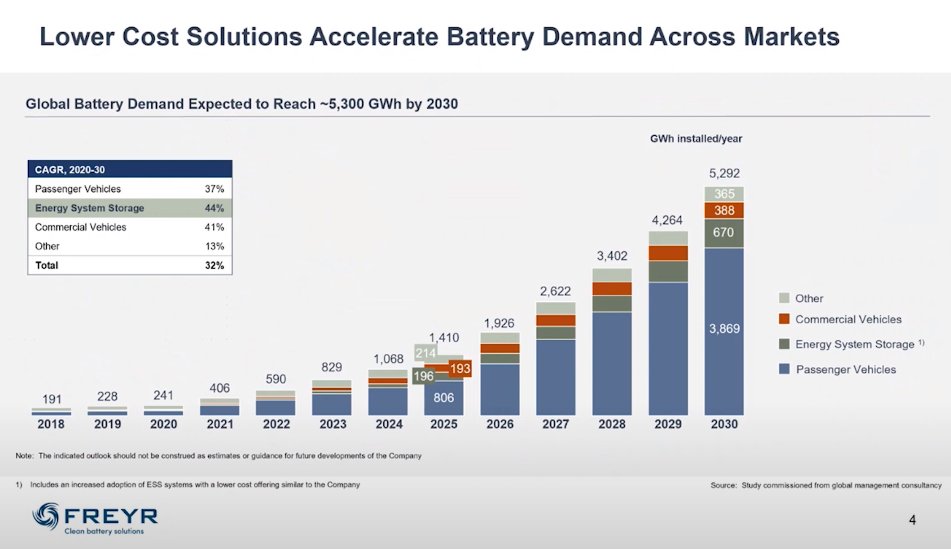

$ALUS "We have done analysis together with McKinsey & Co on the perspective of the battery market. We have sort of asked the question: what will happen if technology development continues, and what will happen if that development is coupled with increased regulatory pressure...

...from governments around the world?"

Currently a lot of the worlds battery supply derives from China. As China aims to meet ambition of getting in front of renewable energy sources, he expects much of this supply to stay in China...

Currently a lot of the worlds battery supply derives from China. As China aims to meet ambition of getting in front of renewable energy sources, he expects much of this supply to stay in China...

...This will ultimately make for a huge increase in battery demand both in Europe and the US.

"Our main point is that these markets driven by technology development and driven by regulatory pressure, will grow a lot faster than most analysts predict"

"Our main point is that these markets driven by technology development and driven by regulatory pressure, will grow a lot faster than most analysts predict"

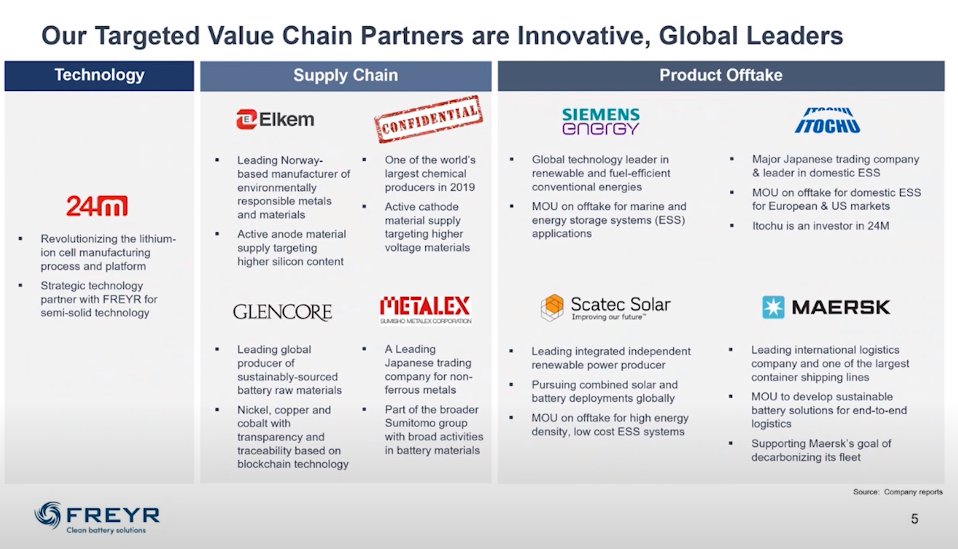

$ALUS "We have, since our inception, entered into agreements with more than 30 different companies along the value-chain, and we are right now in more than 40 different customer discussions"

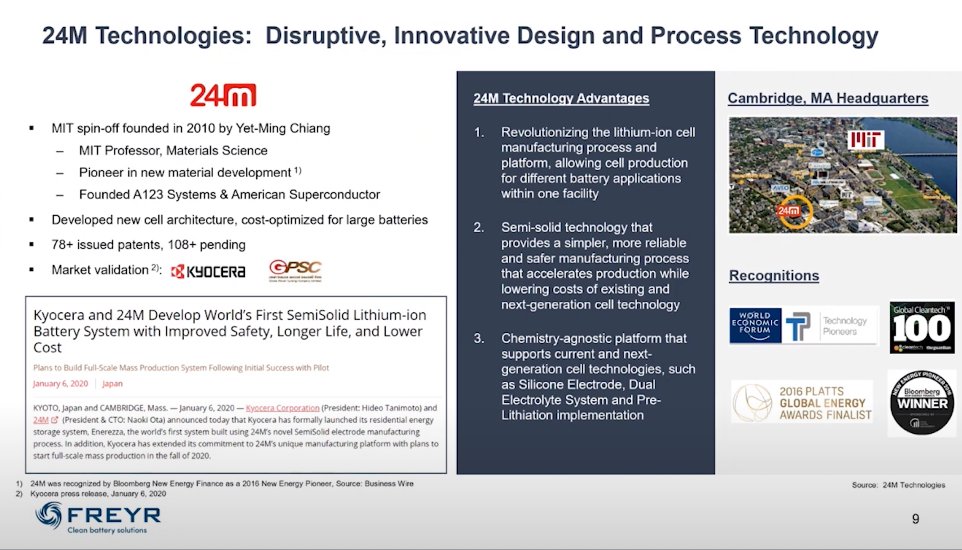

"We also selected our first disruptive technology. Commerically introduced best available technology in our opinion, which really offers a step change in cost and performance on battery cell production"

"We have entered into agreements with leading global players and supplychain that can provide "top noch" materials into this business which is a raw material and material based business, and having the best possible suppliers trough long term agreements and partnerships...

...are going to be fundementally important"

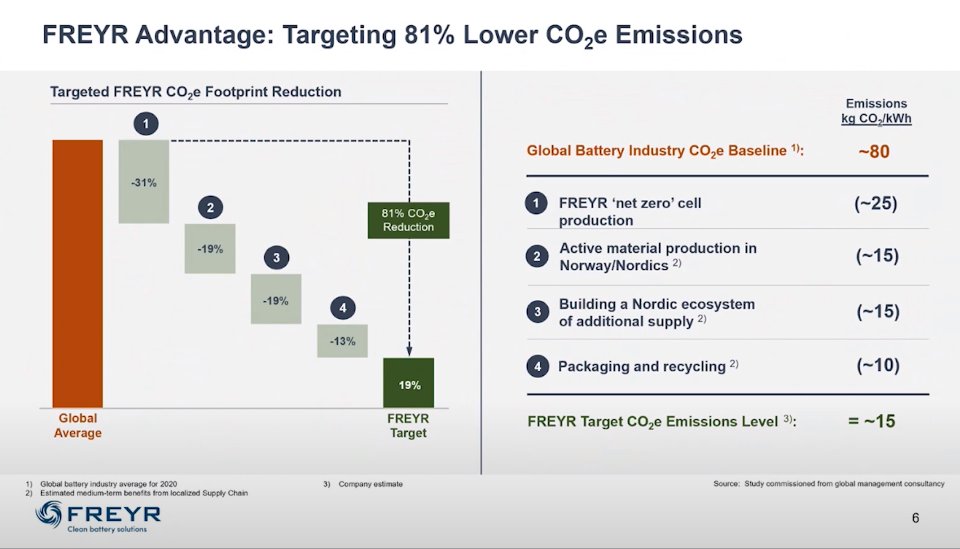

"Our starting point is to decarbonize the battery value-chain, and we're going to do that through 4 distinctive steps. 1: We're going to place battery cell production in Norway at scale with the right technology...

"Our starting point is to decarbonize the battery value-chain, and we're going to do that through 4 distinctive steps. 1: We're going to place battery cell production in Norway at scale with the right technology...

...2: We're going to source our active materials from Norwegian and/or nordic providers, OR providers which have low carbon footprints in the production of those critical elements for battery-cell production...

...3: We will enter into partnerships and long-term agreements with additional stakeholders to source other elements of battery production into the cell-production itself...

4: not quoted, but generally they aim to significantly increase efficiency in production and recycling, to be as eco-friendly as possible

"...that will place us on the absolute left-hand side of the so called "carbon curve". This is again a bottom-up analysis done by all battery producers in 2025, if we are able to realize our plans. And there is no reason we shouldn't be able to do so, demand is strong...

...partners are lining up, customers are lining up, and the opportunity to build this in Norway is very strong across a broad variety of locations, so we're really comfortable that we can offer this fundamentally strategic advantage."

"Important to note is that Norway IS leading the charge, pun intended, in terms of electrification. We started the roll-out of electric vehicles more than 10 years ago, as most in this room whould recognize, and that has triggered a lot of development in Norwegian battery scene"

"24M is a technology that we have licensed in, we announced it last year. This is a revolutionary new way of producing lithium-ion battery cells, both in terms of how the cells themselves are designed, and not least how they are produced"

"We are, in addition to selecting next generation technology such as 24M, also targeting joint-venture partnerships tier 1 battery cell producers in Asia. Most of the Asian providers want to establish a presence in the European region, and we are in detailed discussions with...

...one very large Asian battery-cell producer who wants to come to Norway to set up large battery-cell production facilities and down-stream activites and up-stream acivities"

"We're now getting ready to order equipment for Norway's first large scale lithium-ion battery production facility. Then we will in a modular way roll out capacity, and scale out capacity relative to demand, and demand is picking up very nicely, so inside Mo Industrial Park...

...with the benefits of 20 frames technology, we will actually build more than 30 GWh capacity in the short term, and then we will add to that to bring us above 40 GWh by 2025"

"This ambition of ours can amount to revenue of 25B NOK yearly, with a gross cash-flow of over 6B NOK. The plan is for $ALUS investors to be left with 30% ownership post-merger."

"We expect to be generating revenue from 2022 when production facilites move into production. As we scale towards full production, revenue will increase to several billion (NOK) in 2023, and upwards of 25B in 2025" $ALUS

"We're expecting further revenue growth past 2025, around 20% YOY growth till 2028. We're expecting to break even sometime in 2023." $ALUS

Read on Twitter

Read on Twitter