When assessing multifamily apartments across Ontario I find secondary markets more compelling on a risk/return basis relative to primary markets.

I believe in the short to medium term there is a clear asymmetric payoff for value add properties in these markets

I believe in the short to medium term there is a clear asymmetric payoff for value add properties in these markets

1) Economies of scale are much more achievable when purchasing units at 30-50% of the cost of primary markets

2) Fragmentation and ability to operate better with "professional" less competition (specifically in sub 80ish unit buildings) https://twitter.com/Liam_Dougherty/status/1350856008365727745?s=20

2) Fragmentation and ability to operate better with "professional" less competition (specifically in sub 80ish unit buildings) https://twitter.com/Liam_Dougherty/status/1350856008365727745?s=20

3) Operating Margins are lower which allows for a greater increase in NOI growth for each dollar of rent increased or expenses decreased.. All else equal a 20% increase in rents in lower margin business causes a LARGER growth in NOI relative in primary market

4) Borrowing power - this is specific to Ontario multifamily and CMHC insured loans. As interest rates are the same for all markets and debt service requirements hinder low cap rate markets borrowing ability..

5) "But maximum borrowing is bad"

Well not all borrowing is created equal.. Canadian lenders in the Multifam space are notoriously conservative, if you qualify for more $ at 1.5-2% to me that's a positive not a negative as you lower your overall cost of capital

Well not all borrowing is created equal.. Canadian lenders in the Multifam space are notoriously conservative, if you qualify for more $ at 1.5-2% to me that's a positive not a negative as you lower your overall cost of capital

6) To me with prudent leverage LTV is much less important than DSCR when factoring in you are acquiring a potentially mismanaged assets that has rents below todays market (not assuming the overall market will increase) https://twitter.com/Liam_Dougherty/status/1356961001837625347?s=20

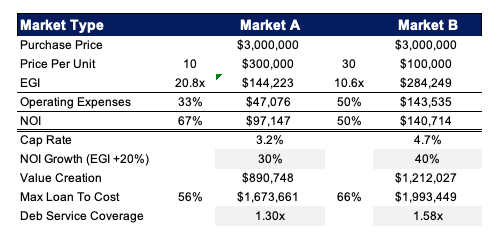

7) Heres a little chart that I simplified where I did an analysis on two different assets I was sent by brokers.

If you're interested in what assumptions went in happy to share a simple spreadsheet that details what goes into these numbers.

If you're interested in what assumptions went in happy to share a simple spreadsheet that details what goes into these numbers.

Summary - two identical assets in a 1st vs 2nd market w/ rents =ly below mkt.

I am going to the secondary market;

1) more upside if you execute

2) lower equity requirement

3) better debt service if things go wrong

4) less sensitivity to int rates rising

5) less pro competition

I am going to the secondary market;

1) more upside if you execute

2) lower equity requirement

3) better debt service if things go wrong

4) less sensitivity to int rates rising

5) less pro competition

Read on Twitter

Read on Twitter