I'll summarize what I learned about Clearpoint Neuro ($CLPT), how I got the idea, and why I have strong conviction on the future of this company.

Disclaimer: This is not investment advice. https://twitter.com/fahdananta/status/1357034781167521794

Disclaimer: This is not investment advice. https://twitter.com/fahdananta/status/1357034781167521794

I have no real background in finance, I'm a computer scientist.

When I first started actively investing, I met with all the finance folks I knew. Asked questions, spent hours reading, Googling, and tracking ideas.

Then I discovered fintwit...

When I first started actively investing, I met with all the finance folks I knew. Asked questions, spent hours reading, Googling, and tracking ideas.

Then I discovered fintwit...

This became a great way to meet other investors, see how they think, and learn new ideas to research myself.

About 8 weeks ago, I saw this tweet: https://twitter.com/maxwellhouse99/status/1332058118533115906

About 8 weeks ago, I saw this tweet: https://twitter.com/maxwellhouse99/status/1332058118533115906

I love the idea of concentrated positions. I only hold 6-8 positions at any given time myself.

This was the first time I heard about CLPT and first time I saw someone holding a 37% position in a small cap (180M cap at the time).

This was the first time I heard about CLPT and first time I saw someone holding a 37% position in a small cap (180M cap at the time).

Over the next few weeks, I started a tracking position and kept trying to find information.

I liked the company but didn't know enough to have conviction yet.

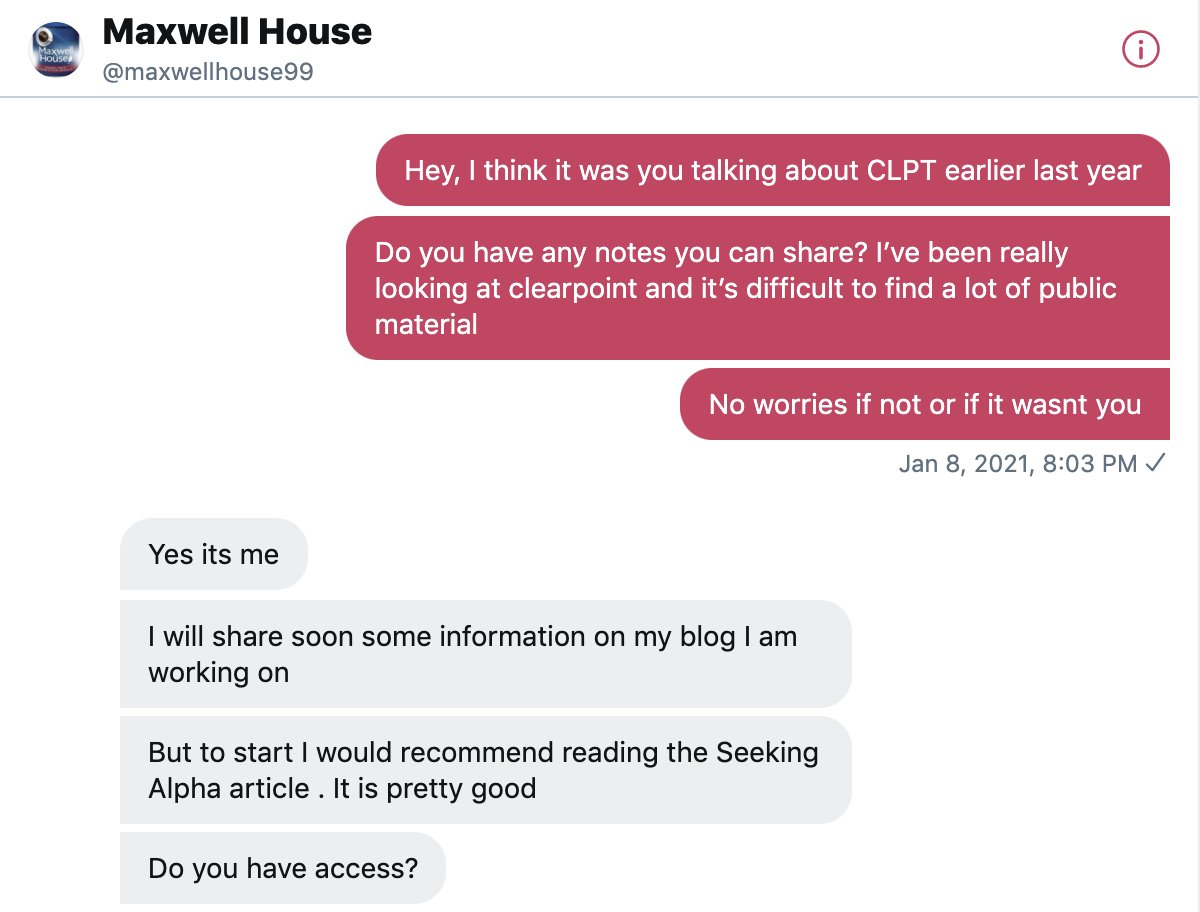

Finally, I just asked where I can find more about the company. This was our exchange

I liked the company but didn't know enough to have conviction yet.

Finally, I just asked where I can find more about the company. This was our exchange

We set up time to chat and @maxwellhouse99 walked me through the entire business. Thank you once again for this  .

.

Here's my short memo on what I've learned about CLPT since

.

.Here's my short memo on what I've learned about CLPT since

ClearPoint is a medical device company for precise surgical procedures.

Traditional method uses still MRI images then estimates target location

ClearPoint uses real-time imaging to determine exact target site and optimal trajectory for penetration

Traditional method uses still MRI images then estimates target location

ClearPoint uses real-time imaging to determine exact target site and optimal trajectory for penetration

They've also built a flexible system that can be adapted for other use-cases unlike their closest competitors.

Their building blocks

- Hardware: Head fixation frame

- Disposables: SmartGrid patch applied to head, SmartFrame for alignment

- Software: ClearPoint Workstation

Their building blocks

- Hardware: Head fixation frame

- Disposables: SmartGrid patch applied to head, SmartFrame for alignment

- Software: ClearPoint Workstation

In my view, this makes ClearPoint a true platform company.

They've realized this too. Joe Burnett, the CEO, has said "We have evolved to become two companies in one"

They've realized this too. Joe Burnett, the CEO, has said "We have evolved to become two companies in one"

The “first company” is their surgical system. It’s used for a range of procedures including deep-brain stimulation (ex. Parkinson's)

Already installed at 60 leading hospitals in the US and expanding to EU

Already installed at 60 leading hospitals in the US and expanding to EU

"Second company” is their drug delivery product. With the flexibility of their system, ClearPoint can be used effectively for drug delivery and gene therapy.

20+ partnerships already in late stage trials, ~$2B+ in annual revenue opportunity

20+ partnerships already in late stage trials, ~$2B+ in annual revenue opportunity

Huge upside if drug delivery can scale, downside protected by 30%+ CAGR surgery biz.

There's a lot more detail that I didn't cover here. I tend to think like an angel investor even in public markets.

To me this is an opportunity with asymmetric risk and the pillars make sense.

There's a lot more detail that I didn't cover here. I tend to think like an angel investor even in public markets.

To me this is an opportunity with asymmetric risk and the pillars make sense.

Read on Twitter

Read on Twitter