Wall Street vs The Internet.

Is the $GME over or is this a billion dollar shift in power?

Time for a thread

Is the $GME over or is this a billion dollar shift in power?

Time for a thread

1/ RETAIL RENAISSANCE

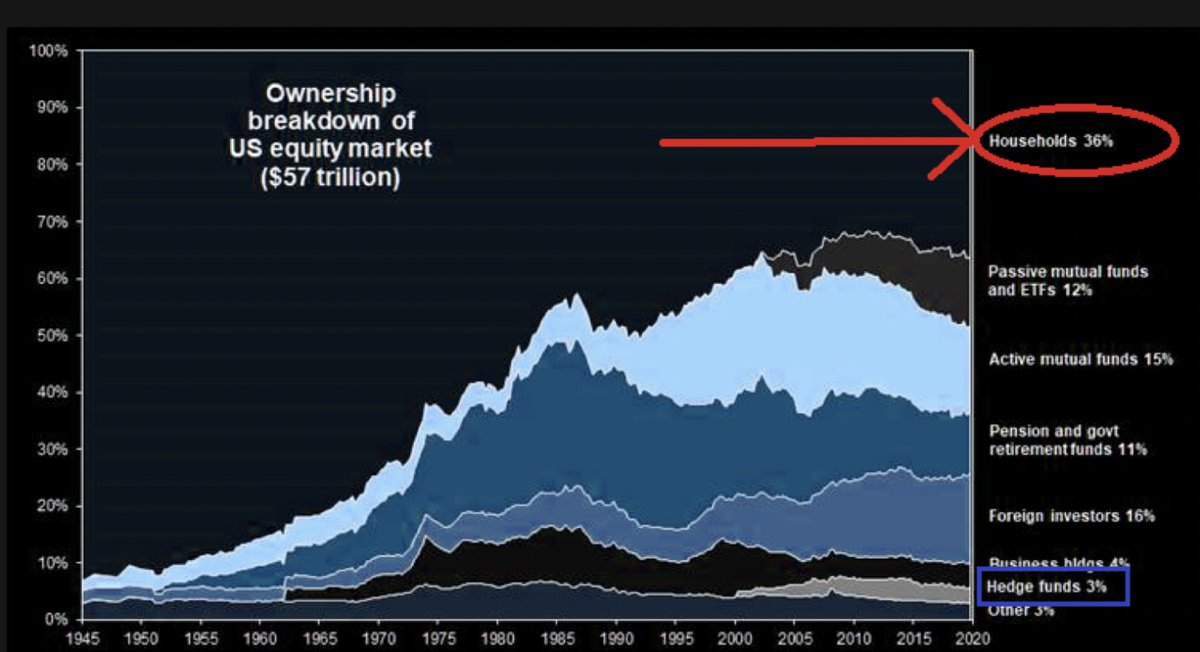

“Prior to 2020, retail activity stayed flat for 20 yrs. Now households, active/passive mutual funds & ETFs represent 63% of the market ($36 Trillion). Hedge Funds own 3% of the $57T US equity market - so "Retail" is 12x more important than hedge funds.”

“Prior to 2020, retail activity stayed flat for 20 yrs. Now households, active/passive mutual funds & ETFs represent 63% of the market ($36 Trillion). Hedge Funds own 3% of the $57T US equity market - so "Retail" is 12x more important than hedge funds.”

2/ RETAIL RENAISSANCE

There’s a new important investor at the table and Wall Street will have to adjust.

*Now 8.4MM followers under management

There’s a new important investor at the table and Wall Street will have to adjust.

*Now 8.4MM followers under management

3/ RETAIL RENAISSANCE

Let’s dive into ‘The Rise of the Retail Investor’ in <2 mins:

- DEFINING MOMENT

- COMMUNITIES

- PLATFORMS

- LEADERS

Let’s dive into ‘The Rise of the Retail Investor’ in <2 mins:

- DEFINING MOMENT

- COMMUNITIES

- PLATFORMS

- LEADERS

4/ DEFINING MOMENT  Crowd-Sourced Squeeze

Crowd-Sourced Squeeze

This story is easily told through:

- A Dog

- Two Wolves

- Pack of Lions

Crowd-Sourced Squeeze

Crowd-Sourced SqueezeThis story is easily told through:

- A Dog

- Two Wolves

- Pack of Lions

5/ DEFINING MOMENT

Dog: Video $GME retailer with an underwhelming track record.

Two Wolves: Hedge fund Melvin Capital & short-seller Citron Research. Believed $GME “brick & mortar” stores were a liability in an increasingly digital world & they could profit by SHORTING

Dog: Video $GME retailer with an underwhelming track record.

Two Wolves: Hedge fund Melvin Capital & short-seller Citron Research. Believed $GME “brick & mortar” stores were a liability in an increasingly digital world & they could profit by SHORTING

6/ DEFINING MOMENT

Pack of Lions: +8 Million retail investors on Reddit group r/Wallstreetbets. Plus influencers like @elonmusk , @chamath, @tyler and even politicians like @AOC — who ‘piled-on’ the trade and/or Tweeted about it.

Pack of Lions: +8 Million retail investors on Reddit group r/Wallstreetbets. Plus influencers like @elonmusk , @chamath, @tyler and even politicians like @AOC — who ‘piled-on’ the trade and/or Tweeted about it.

8/ DEFINING MOMENT

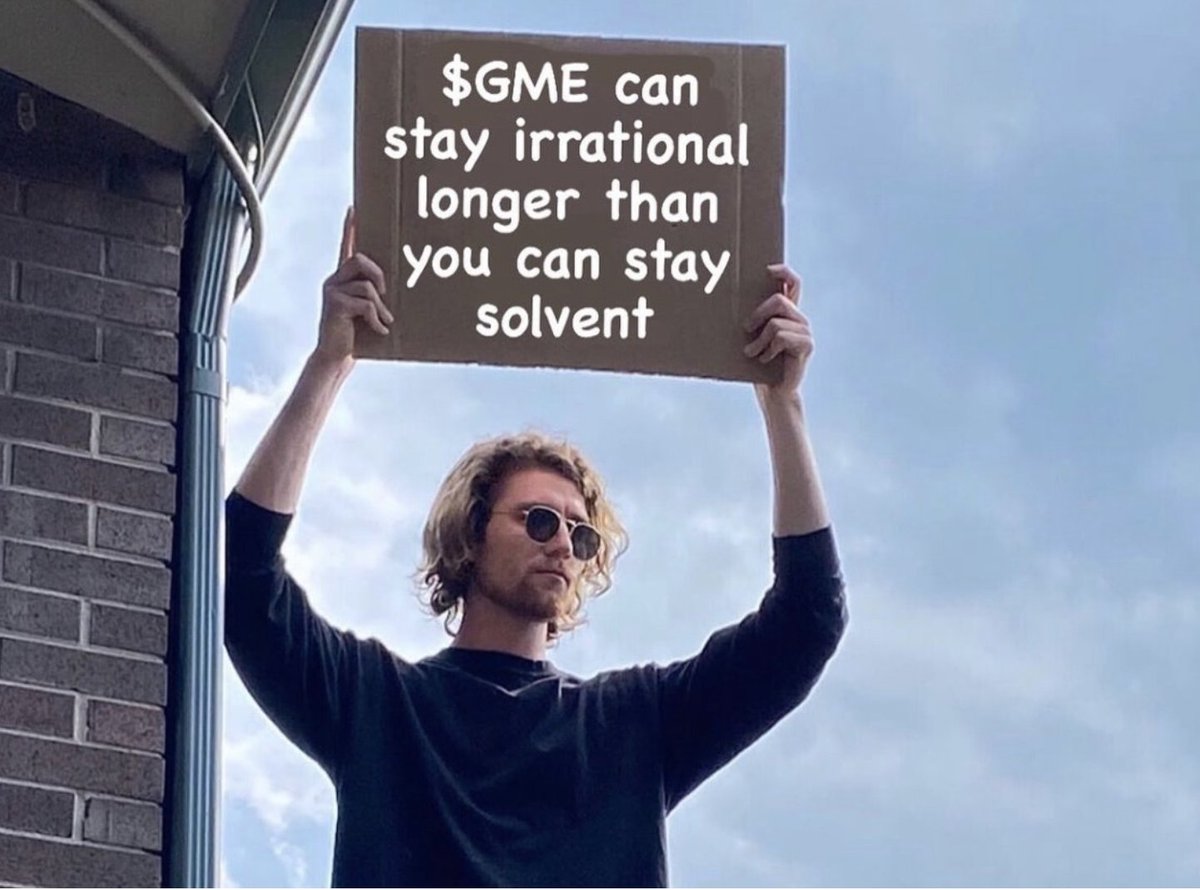

“All the math you need in the stock market you get in the fourth grade.” — Peter Lynch

$GME had a HUGE short interest of 140%. Retail investors saw this and believed they could make a profit by taking the other side of the bet.

“All the math you need in the stock market you get in the fourth grade.” — Peter Lynch

$GME had a HUGE short interest of 140%. Retail investors saw this and believed they could make a profit by taking the other side of the bet.

9/ DEFINING MOMENT

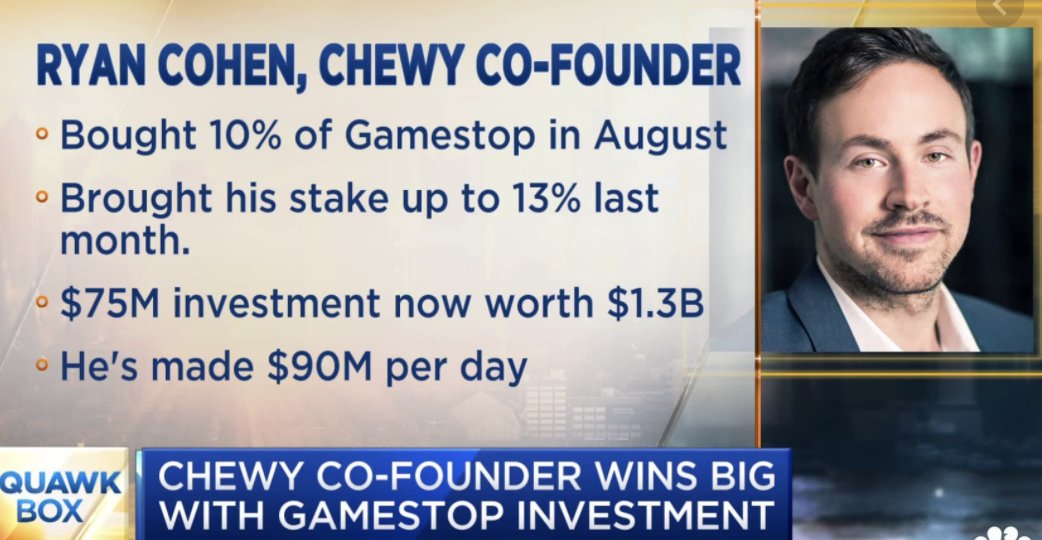

Further encouraged by activist investor Ryan Cohen buying +$76MM of stock looking to turn the company around like he did with http://Chewy.com sold to PetSmart for $3.5B.

Further encouraged by activist investor Ryan Cohen buying +$76MM of stock looking to turn the company around like he did with http://Chewy.com sold to PetSmart for $3.5B.

10/ DEFINING MOMENT

Retail started buying stock & tons of “out-of-the-money” call options, driving the stock price way up!

They also ordered dozens of pizzas to some of the short sellers’ homes, LMFAO!

Retail started buying stock & tons of “out-of-the-money” call options, driving the stock price way up!

They also ordered dozens of pizzas to some of the short sellers’ homes, LMFAO!

11/ DEFINING MOMENT

Next, a Black Swan event happened, not accounted in anyone’s ‘risk models.’

TWO simultaneous SQUEEZES:

1) Short Squeeze: related to offside short positions

2) Gamma Squeeze: related to offside option positions

Next, a Black Swan event happened, not accounted in anyone’s ‘risk models.’

TWO simultaneous SQUEEZES:

1) Short Squeeze: related to offside short positions

2) Gamma Squeeze: related to offside option positions

12/ DEFINING MOMENT

Without going into CFA mode, trust me this led to a perfect parabolic ‘buying storm’ sending the stock from $40 to +$480 last week. Closing at $325 on Friday.

Now, back down below $100

Without going into CFA mode, trust me this led to a perfect parabolic ‘buying storm’ sending the stock from $40 to +$480 last week. Closing at $325 on Friday.

Now, back down below $100

13/ DEFINING MOMENT

Next:

- Hedge Fund Gets $2.7B Bailout

- Reddit Group Gets Mysteriously Taking Offline (now back online)

- Trading on $GME & other stocks & options halted (for retail only)

Only 2 platforms (I can confirm) didn’t halt trading are @Fidelity & @Wealthsimple

Next:

- Hedge Fund Gets $2.7B Bailout

- Reddit Group Gets Mysteriously Taking Offline (now back online)

- Trading on $GME & other stocks & options halted (for retail only)

Only 2 platforms (I can confirm) didn’t halt trading are @Fidelity & @Wealthsimple

14/ DEFINING MOMENT

- Hedge Funds Announce Covering Their Shorts

- Robinhood Raises Billions & Gets Sued By Its Own Customer, delays IPO

And this...

- Hedge Funds Announce Covering Their Shorts

- Robinhood Raises Billions & Gets Sued By Its Own Customer, delays IPO

And this...

15/ DEFINING MOMENT

“It was a smart trade. Retail saw it and Wall Street missed it.” @chamath

The reason “retail saw it” is because they are incredibly powerful in numbers, tools & community. They are now armed with much of the same information as professional investors.

“It was a smart trade. Retail saw it and Wall Street missed it.” @chamath

The reason “retail saw it” is because they are incredibly powerful in numbers, tools & community. They are now armed with much of the same information as professional investors.

16/ COMMUNITIES

“Hedge fund ‘Idea Dinner’ with +8 million guests”

For decades, Wall Street has been hosting fancy ‘ideas dinners’ behind closed doors where they discuss investment strategies.

Retail investors created their own version: Reddit, Discord, Twitter & TikTok

“Hedge fund ‘Idea Dinner’ with +8 million guests”

For decades, Wall Street has been hosting fancy ‘ideas dinners’ behind closed doors where they discuss investment strategies.

Retail investors created their own version: Reddit, Discord, Twitter & TikTok

17/ COMMUNITIES

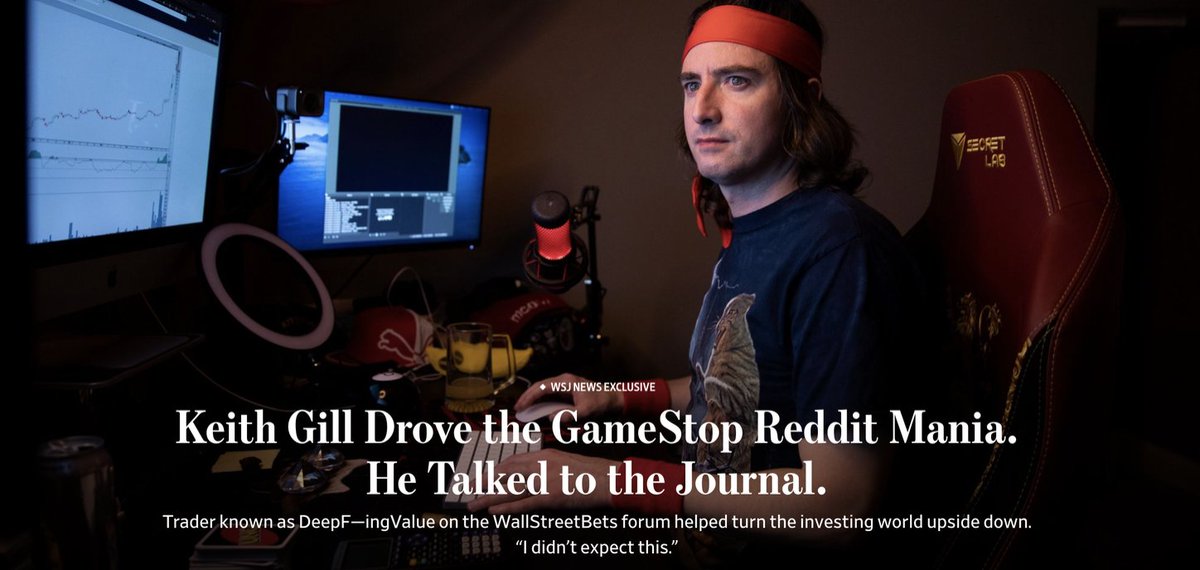

It would be easy to dismiss them as unsophisticated.

But it’s simply NOT true.

For example, one of the influencers from r/WallStreeBets “DeepF—ingValue” has CFA and was a financial advisor.

It would be easy to dismiss them as unsophisticated.

But it’s simply NOT true.

For example, one of the influencers from r/WallStreeBets “DeepF—ingValue” has CFA and was a financial advisor.

18/ COMMUNITIES

My fund manager friends tell me their firms ‘scrape the group for trading ideas.’

I have also personally seen investment banks email research from WallStreetBets Reddit group to get their own institutional clients to trade the ideas.

My fund manager friends tell me their firms ‘scrape the group for trading ideas.’

I have also personally seen investment banks email research from WallStreetBets Reddit group to get their own institutional clients to trade the ideas.

19/ COMMUNITIES

Also, I am seeing lots of finance groups proliferating on the wildly NEW popular audio-only app @joinClubhouse.

Launched during the pandemic, it now boast +2MM users and a $1B valuation.

Also, I am seeing lots of finance groups proliferating on the wildly NEW popular audio-only app @joinClubhouse.

Launched during the pandemic, it now boast +2MM users and a $1B valuation.

20/ PLATFORMS

'Do-It-Yourself' (DIY) investor is on the rise.

Retail, high networth, corporate executives, small business owners and even ex-Wall Street bankers have billions in DIY accounts.

'Do-It-Yourself' (DIY) investor is on the rise.

Retail, high networth, corporate executives, small business owners and even ex-Wall Street bankers have billions in DIY accounts.

21 / PLATFORMS

"Robinhood and the other zero commission brokers that everyone used didn't have enough capital to fund the fight" @mcuban

Some have capital and some have confetti.

Now, we need trading platforms that have both ; )

"Robinhood and the other zero commission brokers that everyone used didn't have enough capital to fund the fight" @mcuban

Some have capital and some have confetti.

Now, we need trading platforms that have both ; )

22/ LEADERS

There are BIG influencers who move markets with Tweets:

@APOMPLIANO BITCOIN

BITCOIN

@CHAMATH SPACS

SPACS

@RAYDALIO CASH IS TRASH

CASH IS TRASH

@STOOLPRESIDENTE STONKS

STONKS

@ELONMUSK ANYTHING #Signal, $Etsy, $DOGE. This week he even changed his bio to #Bitcoin

ANYTHING #Signal, $Etsy, $DOGE. This week he even changed his bio to #Bitcoin  , sending it +15%

, sending it +15%

There are BIG influencers who move markets with Tweets:

@APOMPLIANO

BITCOIN

BITCOIN@CHAMATH

SPACS

SPACS@RAYDALIO

CASH IS TRASH

CASH IS TRASH@STOOLPRESIDENTE

STONKS

STONKS@ELONMUSK

ANYTHING #Signal, $Etsy, $DOGE. This week he even changed his bio to #Bitcoin

ANYTHING #Signal, $Etsy, $DOGE. This week he even changed his bio to #Bitcoin  , sending it +15%

, sending it +15%

23/ LEADERS

Also, there are thousands if not MILLIONS of small micro influencers with engaged communities like Sara Well, a nurse by day who talks stocks by night in her discord group with dozens of investors.

Also, there are thousands if not MILLIONS of small micro influencers with engaged communities like Sara Well, a nurse by day who talks stocks by night in her discord group with dozens of investors.

24/LEADERS

BUT the community FAVOURITES are the “MEME-AS-A-SERVICE” army:

@wallstmemes

@parikpatelcfa

@Litquidity

@leveredlloyd

@trustfundterry

and many more!

BUT the community FAVOURITES are the “MEME-AS-A-SERVICE” army:

@wallstmemes

@parikpatelcfa

@Litquidity

@leveredlloyd

@trustfundterry

and many more!

Read on Twitter

Read on Twitter