The GME insanity has made me reconsider my view on big tech monopolies and fix common issues in traditional discounted cash flow models

1 -Capital structure and cost of capital

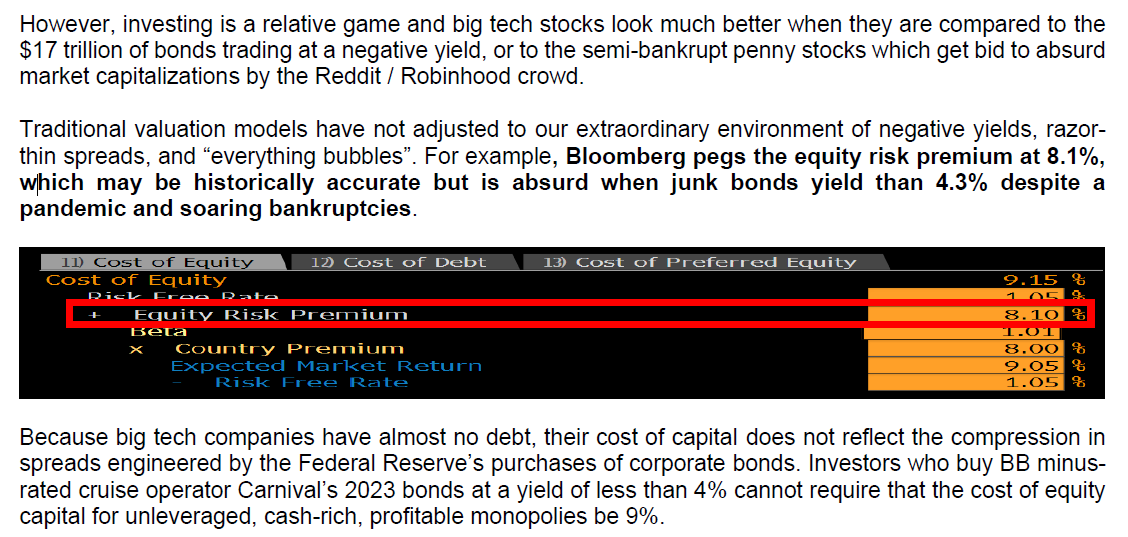

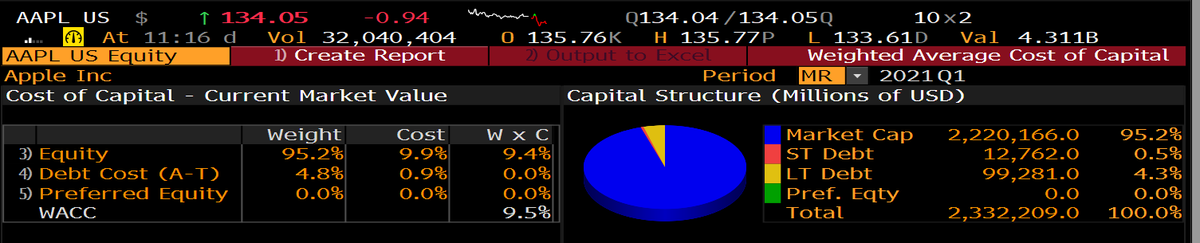

Because big tech is debt-free, the cost of capital is derived from CAPM - Apple's is at 9.5%

1/6

1 -Capital structure and cost of capital

Because big tech is debt-free, the cost of capital is derived from CAPM - Apple's is at 9.5%

1/6

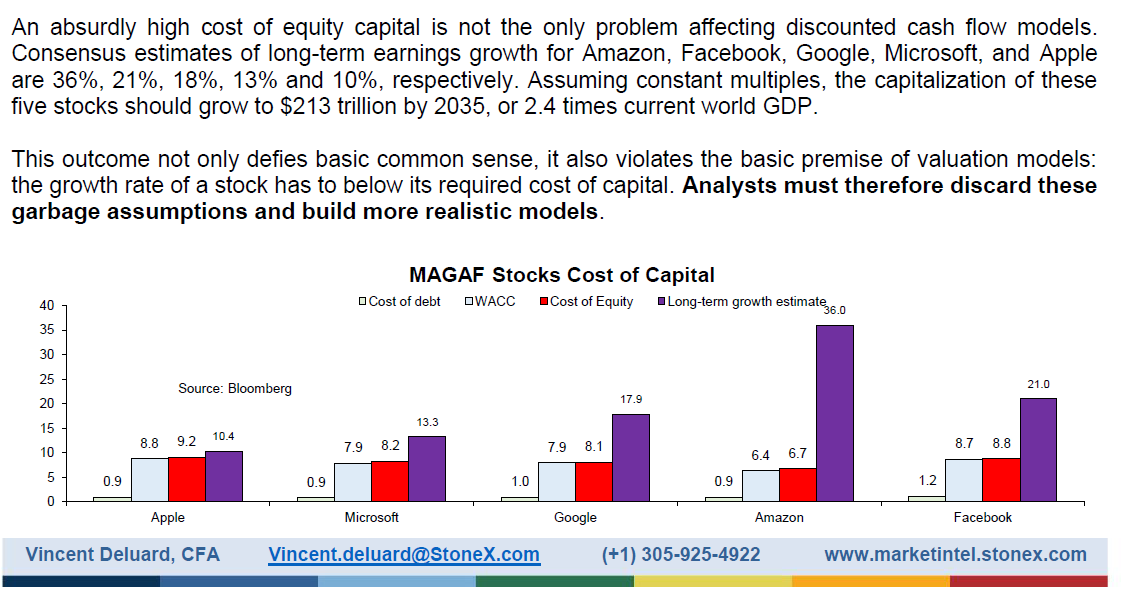

Absurdly high WACC are offset by even crazier consensus LT growth estimates which lead to the nonsensical result that 'g' > 'r'

--> analysts should adjust the two numbers

2/6

--> analysts should adjust the two numbers

2/6

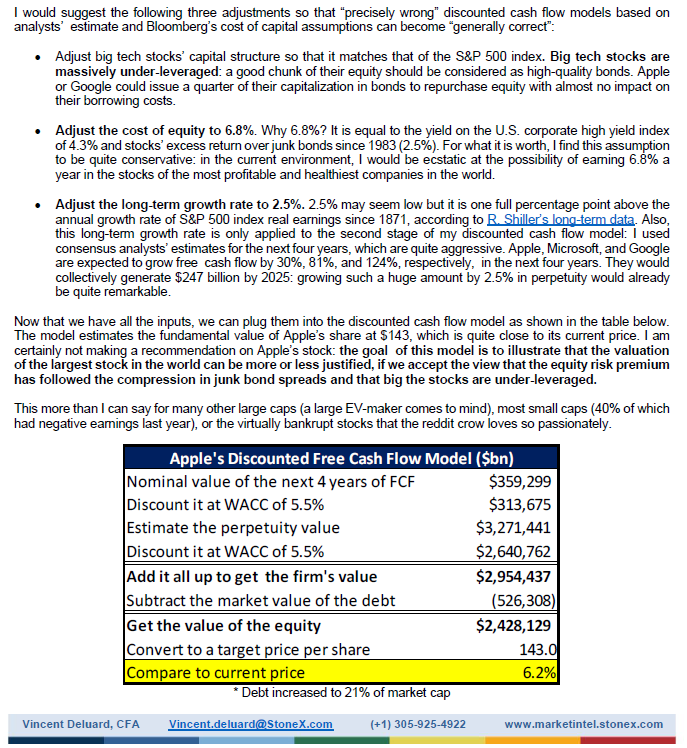

I took 3 steps

- "re-lever" the balance sheet to normal levels

- Adjust the cost of equity to HY bonds' yields + 2.5%

- Adjust long-term growth to 2.5%

With this Apple's current valuation looks justifiable

3/6

- "re-lever" the balance sheet to normal levels

- Adjust the cost of equity to HY bonds' yields + 2.5%

- Adjust long-term growth to 2.5%

With this Apple's current valuation looks justifiable

3/6

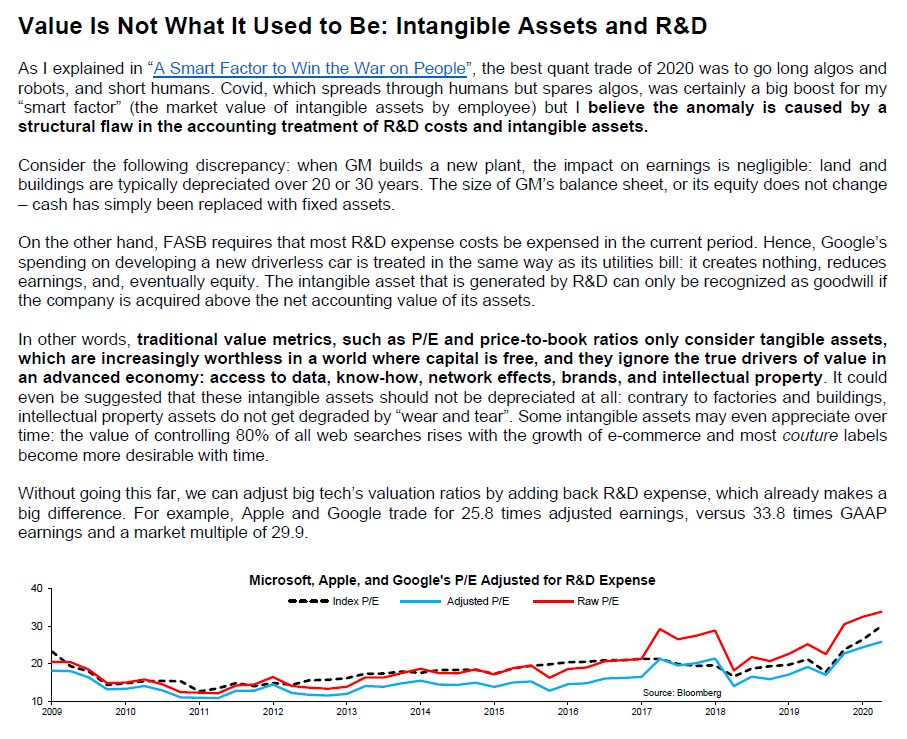

Then there is the question on intangible assets (rarely recognized under GAAP) and R&D costs (usually expensed, rather than capitalized)

Treat R&D as a capital expense with infinite depreciation and big tech stocks trade at about 26X EPS, not far form the market

4/6

Treat R&D as a capital expense with infinite depreciation and big tech stocks trade at about 26X EPS, not far form the market

4/6

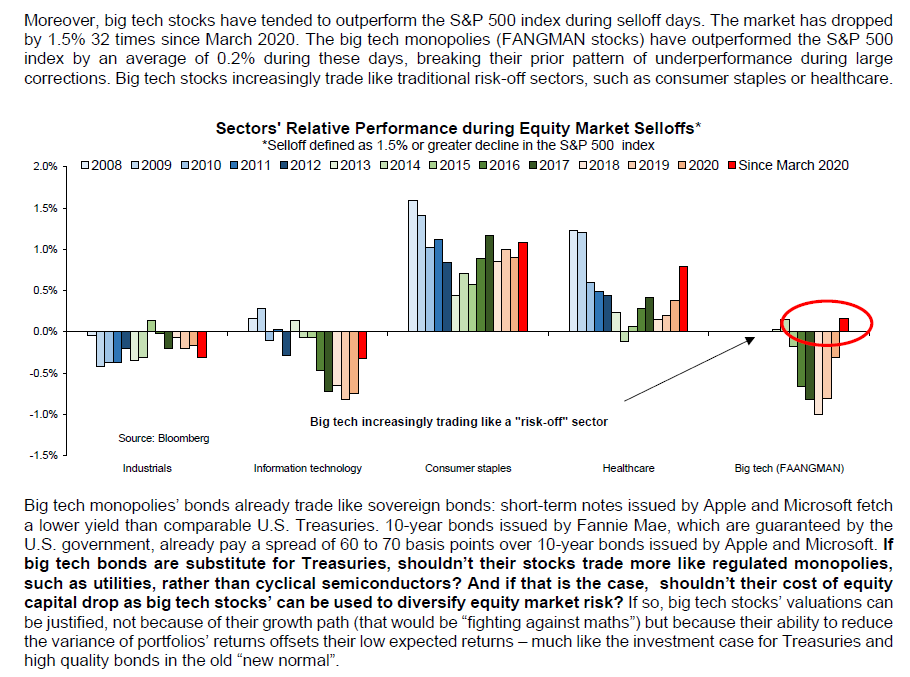

5/6 finally, big tech is increasingly trading like risk-off sectors, outperforming on down days. That diversification potential justifies higher multiples, especially in a world of financial repression

Read on Twitter

Read on Twitter