1/14

With ETH breaking above $1,500, lets do a chart thread!

TLDR: Several of the metrics we monitor on a monthly basis recorded record numbers in January. For many, January alone accounted for about 50% of total 2020 volume.

With ETH breaking above $1,500, lets do a chart thread!

TLDR: Several of the metrics we monitor on a monthly basis recorded record numbers in January. For many, January alone accounted for about 50% of total 2020 volume.

2/14

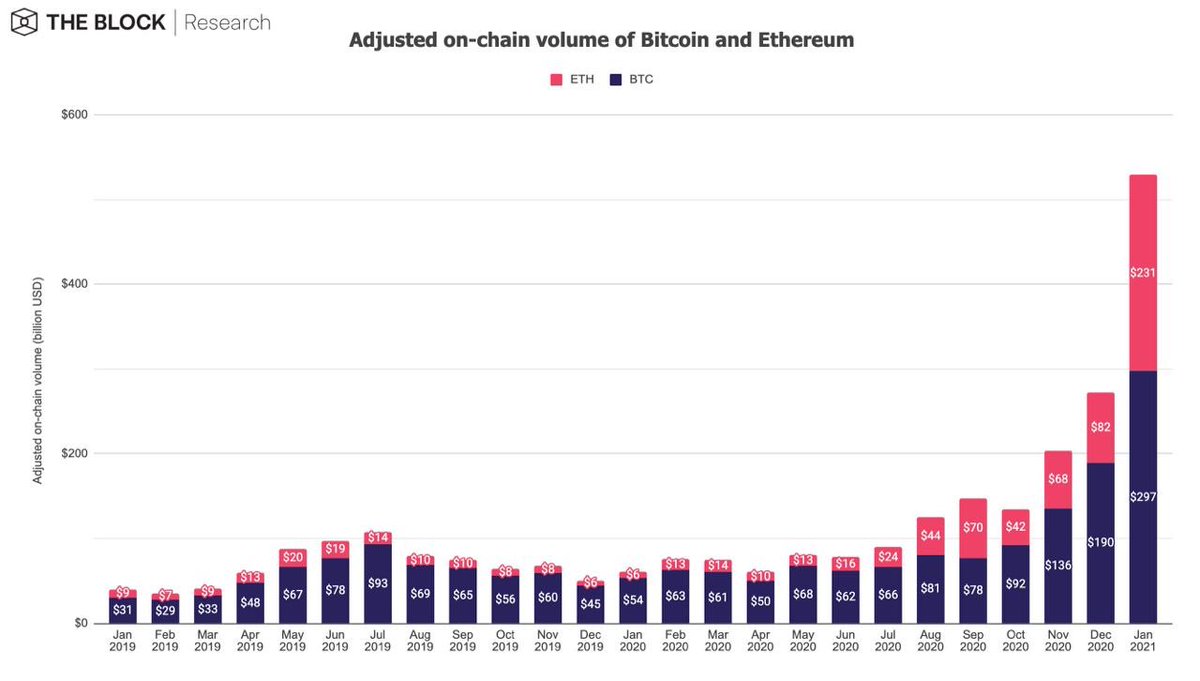

Total adjusted on-chain volume, a proxy for economic throughput, saw an increase of 94.4% to a new all-time high of $528.8 bn in January — 71.5% above the previous all-time high of $308.3 bn in January 2018; and already almost a third of total 2020 in-chain volume!

Total adjusted on-chain volume, a proxy for economic throughput, saw an increase of 94.4% to a new all-time high of $528.8 bn in January — 71.5% above the previous all-time high of $308.3 bn in January 2018; and already almost a third of total 2020 in-chain volume!

3/14

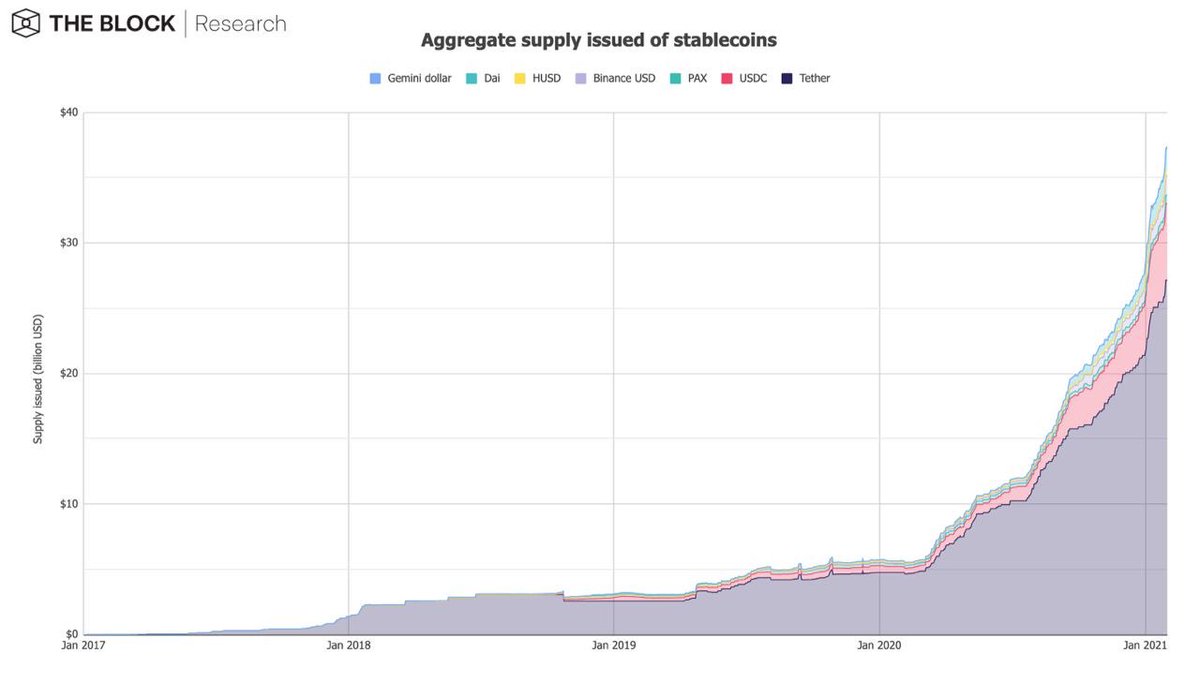

Aggregate stablecoin supply grew from $27.9 bn to $37.4 bn in January, representing a growth rate of 34%. Tether continues to lead, with a market share of 72.7%.

Aggregate stablecoin supply grew from $27.9 bn to $37.4 bn in January, representing a growth rate of 34%. Tether continues to lead, with a market share of 72.7%.

4/14

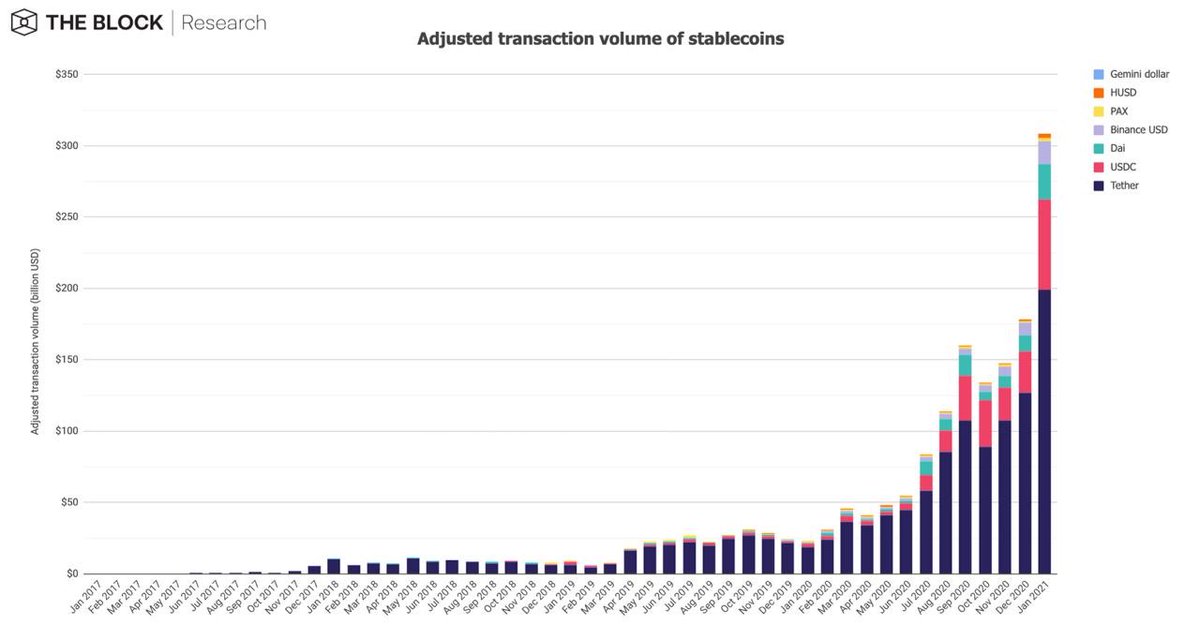

The adjusted on-chain volume of stablecoins also set a new record all-time high. It increased by 73.1% MoM, from $178.3 to $308.7 bn.

The adjusted on-chain volume of stablecoins also set a new record all-time high. It increased by 73.1% MoM, from $178.3 to $308.7 bn.

5/14

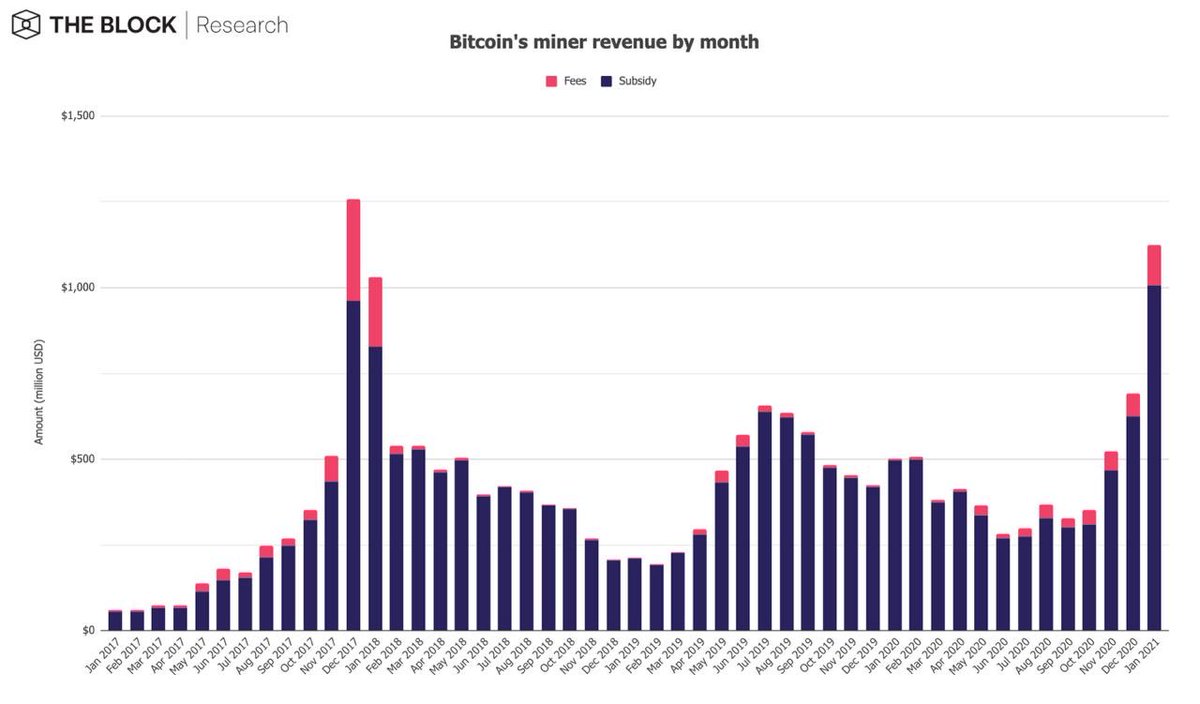

As for miners, Bitcoin miners generated $1.12 bn in revenue in January (10.4% were fees), representing a MoM increase of 62.3% — and only short of their all-time high revenue in December 2017.

As for miners, Bitcoin miners generated $1.12 bn in revenue in January (10.4% were fees), representing a MoM increase of 62.3% — and only short of their all-time high revenue in December 2017.

6/14

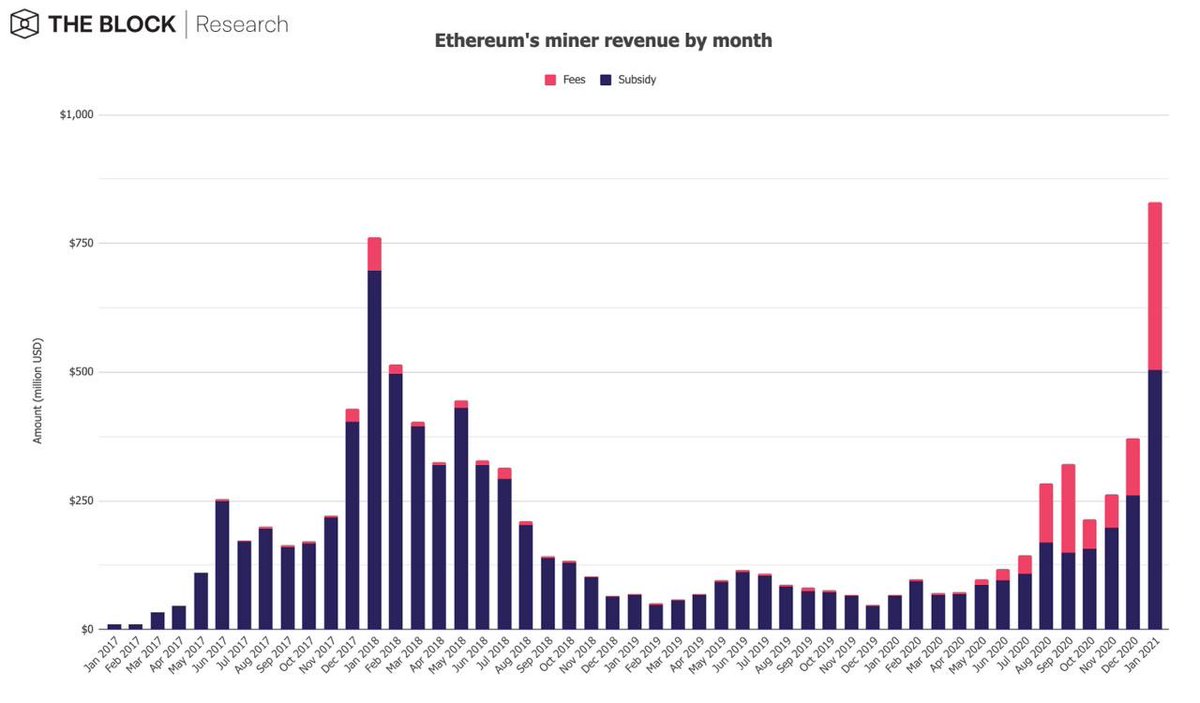

As tweeted Monday, Ethereum miners generated $829.6 mn in revenue in January, representing a MoM increase of 123.3% — and a new all-time high (39.2% were fees).

As pointed out by many replies on Monday, fees need to be fixed ASAP.

As tweeted Monday, Ethereum miners generated $829.6 mn in revenue in January, representing a MoM increase of 123.3% — and a new all-time high (39.2% were fees).

As pointed out by many replies on Monday, fees need to be fixed ASAP.

7/14

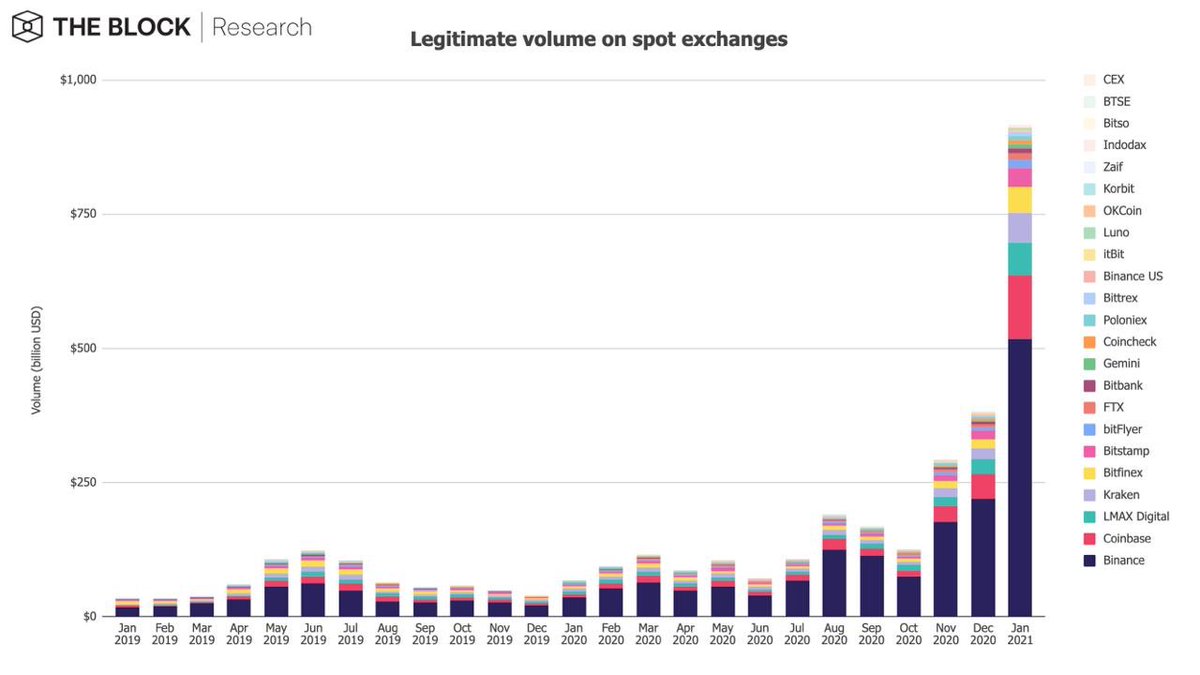

Legitimate spot volumes saw an increase of 138.7% to $916.6 bn in January — a new all-time high.

For 2020, total CEX volume was about $1.82 trillion. January alone accounts for 50.4% of total 2020 CEX volume.

Binance continues to lead with a market share of 56.5%.

Legitimate spot volumes saw an increase of 138.7% to $916.6 bn in January — a new all-time high.

For 2020, total CEX volume was about $1.82 trillion. January alone accounts for 50.4% of total 2020 CEX volume.

Binance continues to lead with a market share of 56.5%.

8/14

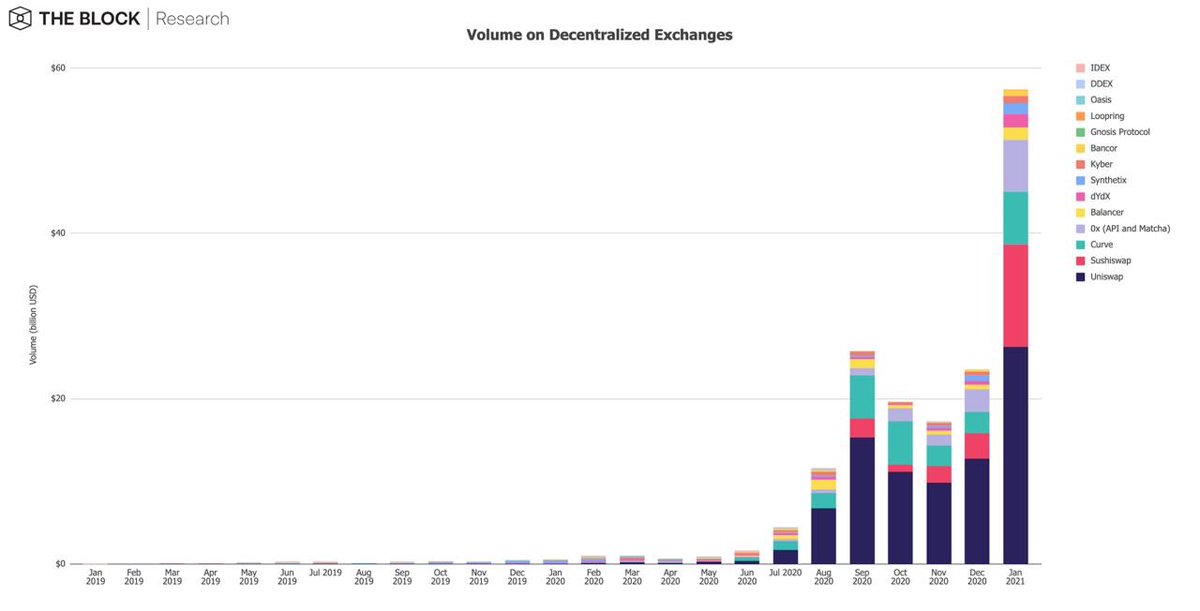

DEX volumes increased by 143.6% MoM and set a new all-time high with $57.4 bn.

Notably, Sushiswap increased its market share from 13.2% in December to 21.6% in January.

In 2020, DEX's traded about $106.7 bn in volume. January alone accounts for 53.8% of 2020 DEX volumes.

DEX volumes increased by 143.6% MoM and set a new all-time high with $57.4 bn.

Notably, Sushiswap increased its market share from 13.2% in December to 21.6% in January.

In 2020, DEX's traded about $106.7 bn in volume. January alone accounts for 53.8% of 2020 DEX volumes.

9/14

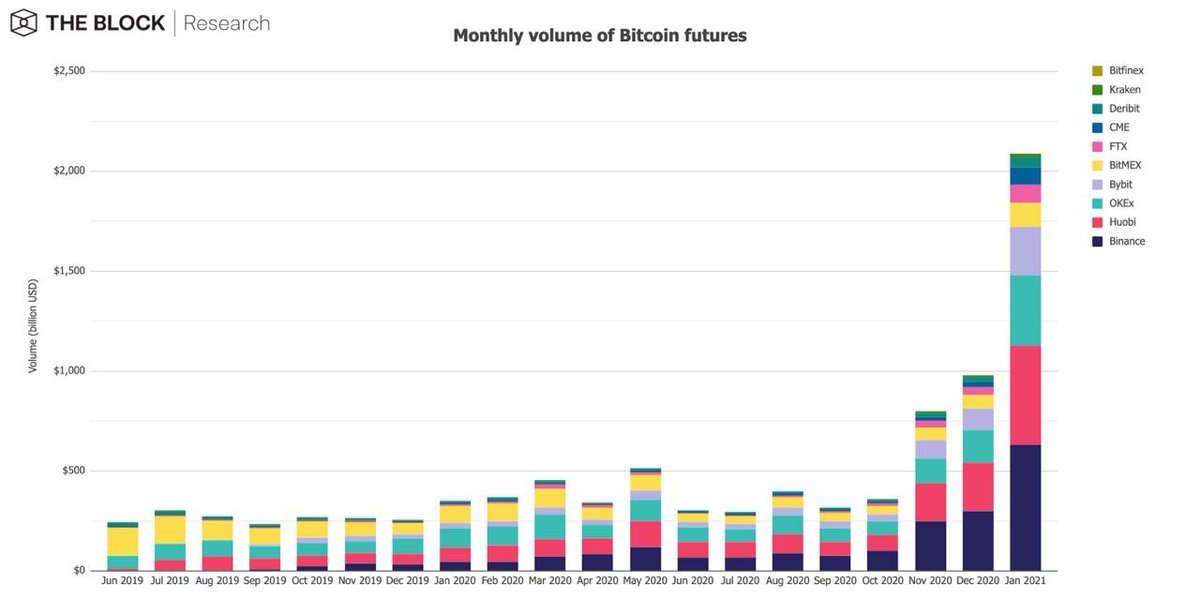

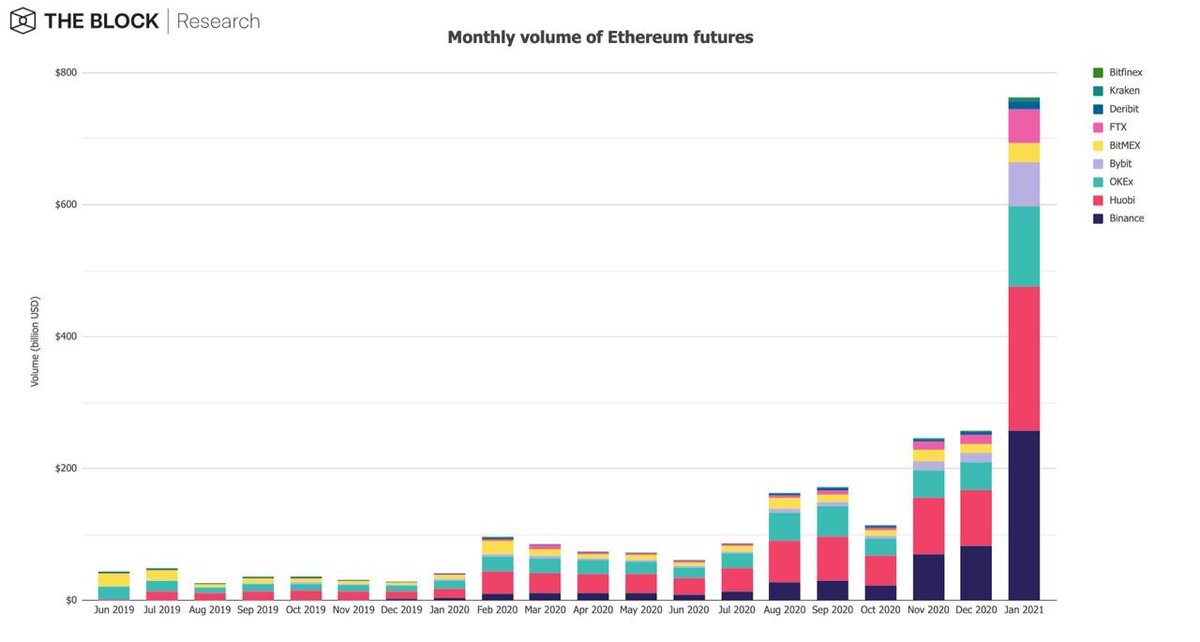

On the derivatives side, volumes for both BTC and ETH futures and options set new volume records.

The monthly volume of Bitcoin futures saw an increase of 97.4% in January and hit a new all-time high of $2.09 trillion.

On the derivatives side, volumes for both BTC and ETH futures and options set new volume records.

The monthly volume of Bitcoin futures saw an increase of 97.4% in January and hit a new all-time high of $2.09 trillion.

10/14

The monthly volume of Ethereum futures grew by 196.8%, from $257 bn in December to a new all-time high of $763 bn in January.

The monthly volume of Ethereum futures grew by 196.8%, from $257 bn in December to a new all-time high of $763 bn in January.

11/14

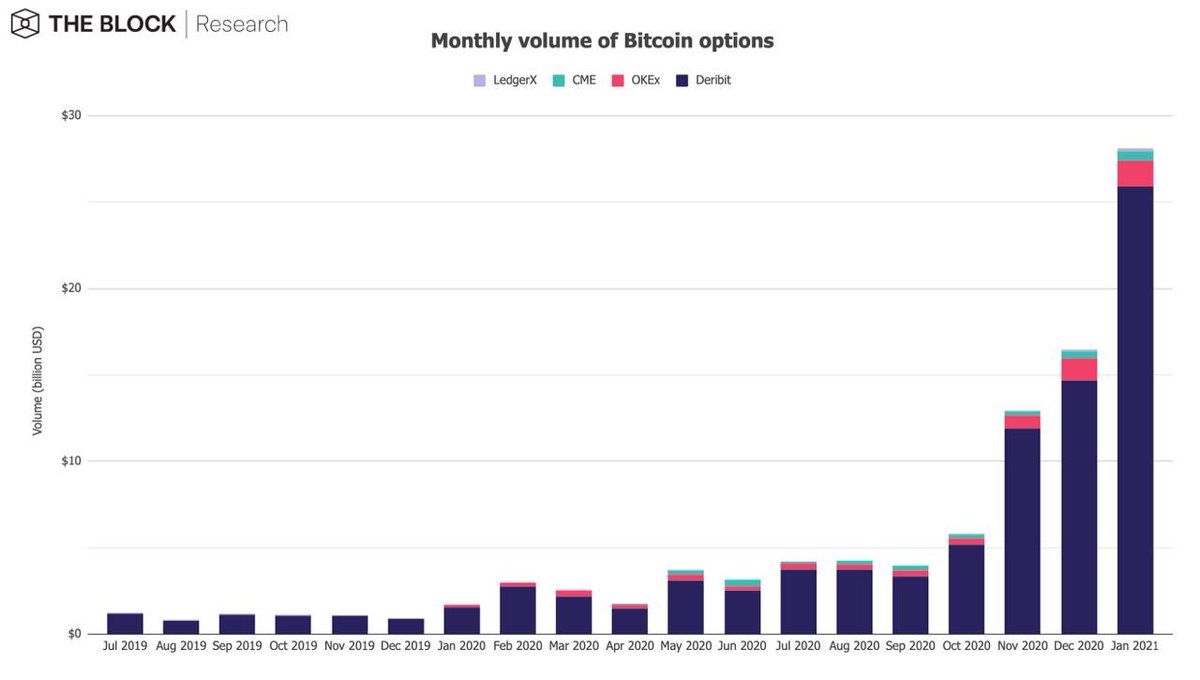

On the options side, the monthly volume of Bitcoin options increased by 71.3% MoM, from $16.4 bn to a new all-time high of $28.1 bn.

On aggregate in 2020, Bitcoin options traded a total volume of $66.9 bn. January alone accounts for 42% of total 2020 volume.

On the options side, the monthly volume of Bitcoin options increased by 71.3% MoM, from $16.4 bn to a new all-time high of $28.1 bn.

On aggregate in 2020, Bitcoin options traded a total volume of $66.9 bn. January alone accounts for 42% of total 2020 volume.

12/14

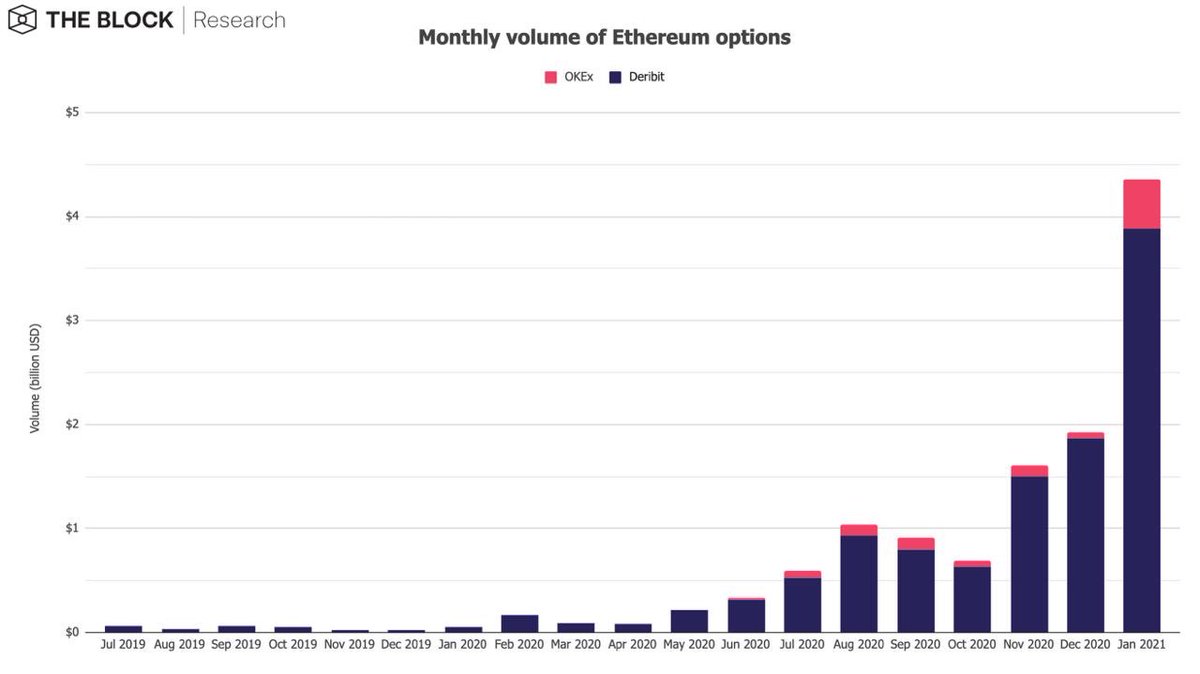

As tweeted yesterday, the monthly volume of Ethereum options increased by 125.9% MoM, from $1.93 bn to a new all-time high of $4.36 bn.

On aggregate in 2020, Ethereum options traded a total volume of $7.7 bn. January alone accounts for 56.6% of total 2020 volume.

As tweeted yesterday, the monthly volume of Ethereum options increased by 125.9% MoM, from $1.93 bn to a new all-time high of $4.36 bn.

On aggregate in 2020, Ethereum options traded a total volume of $7.7 bn. January alone accounts for 56.6% of total 2020 volume.

13/14

You can find more information about the January metrics here: https://twitter.com/theblockres/status/1356629484078776325?s=21

You can find more information about the January metrics here: https://twitter.com/theblockres/status/1356629484078776325?s=21

14/14

Furthermore, you can find many of the above metrics, as well as more metrics and live data on our free Data Dashboard:

https://www.theblockcrypto.com/data

Furthermore, you can find many of the above metrics, as well as more metrics and live data on our free Data Dashboard:

https://www.theblockcrypto.com/data

Read on Twitter

Read on Twitter