. @M_Avaro starts today's #oxeshgradseminar on GBP in the Bretton Woods period with a suitably undead  image #econhist #EconTwitter

image #econhist #EconTwitter

image #econhist #EconTwitter

image #econhist #EconTwitter

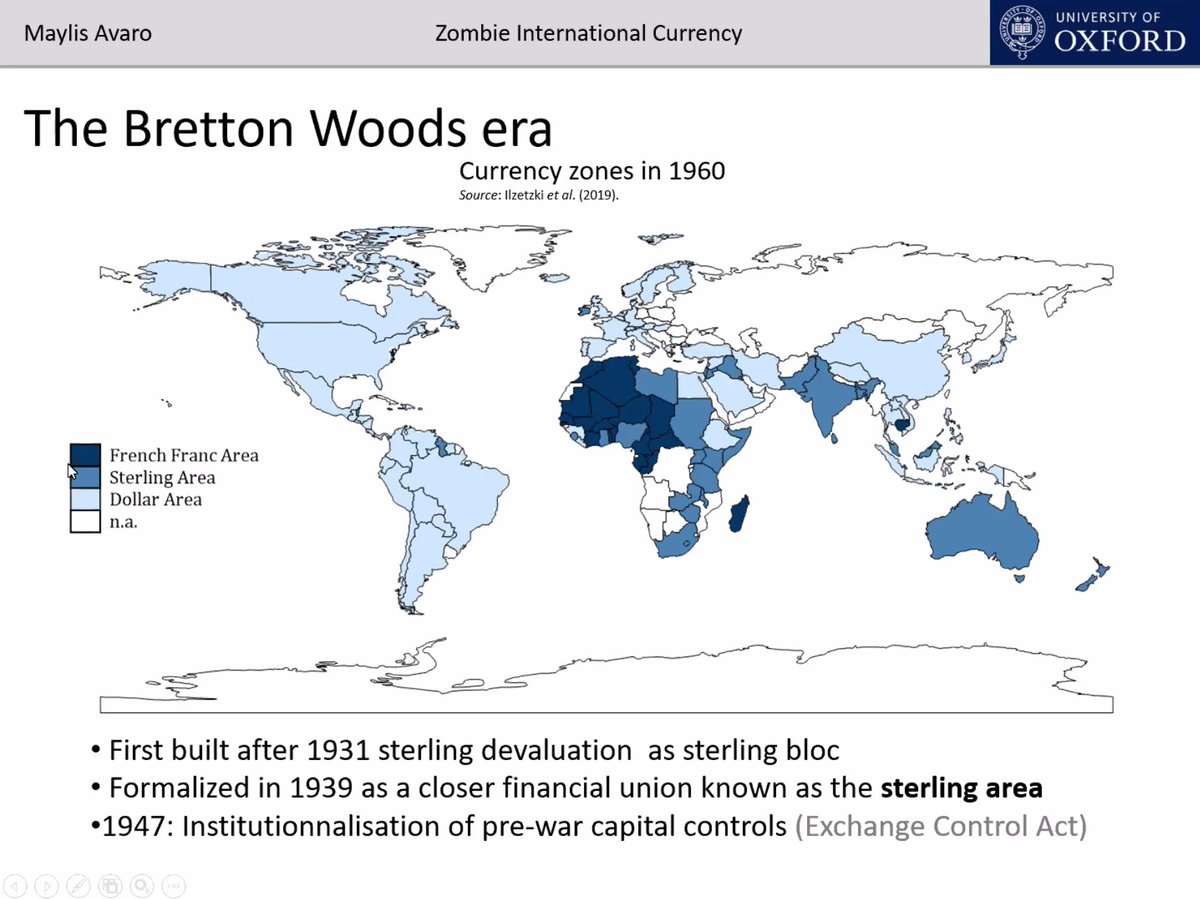

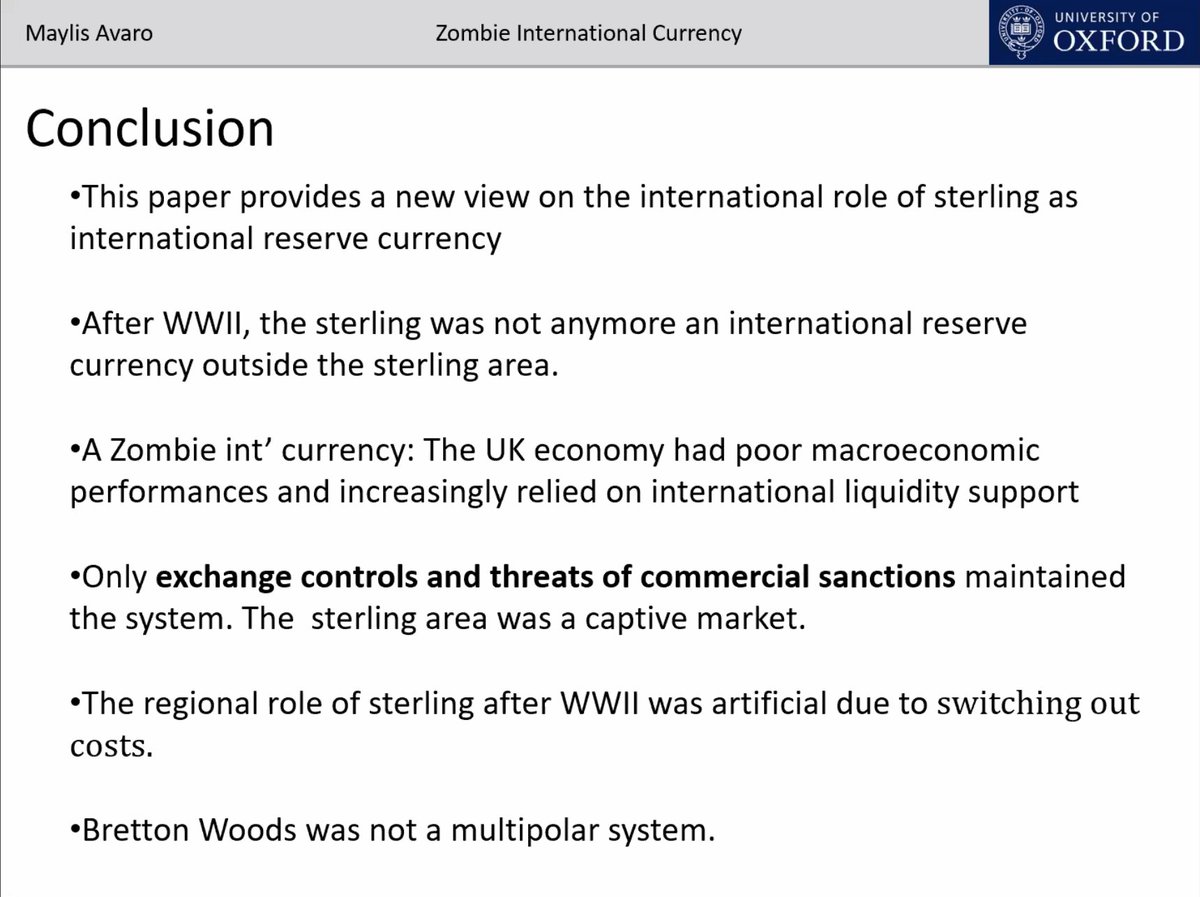

. @B_Eichengreen and colleagues have argued that Bretton Woods was a multipolar monetary world. Several currency zones. #oxeshgradseminar #econhist #EconTwitter

. @M_Avaro argues that there had already been a shift away from  by the end of WWI, so central banks that could shift away did. However,

by the end of WWI, so central banks that could shift away did. However,  pressured Commonwealth countries to remain in the

pressured Commonwealth countries to remain in the  area. #oxeshgradseminar #econhist #EconTwitter

area. #oxeshgradseminar #econhist #EconTwitter

by the end of WWI, so central banks that could shift away did. However,

by the end of WWI, so central banks that could shift away did. However,  pressured Commonwealth countries to remain in the

pressured Commonwealth countries to remain in the  area. #oxeshgradseminar #econhist #EconTwitter

area. #oxeshgradseminar #econhist #EconTwitter

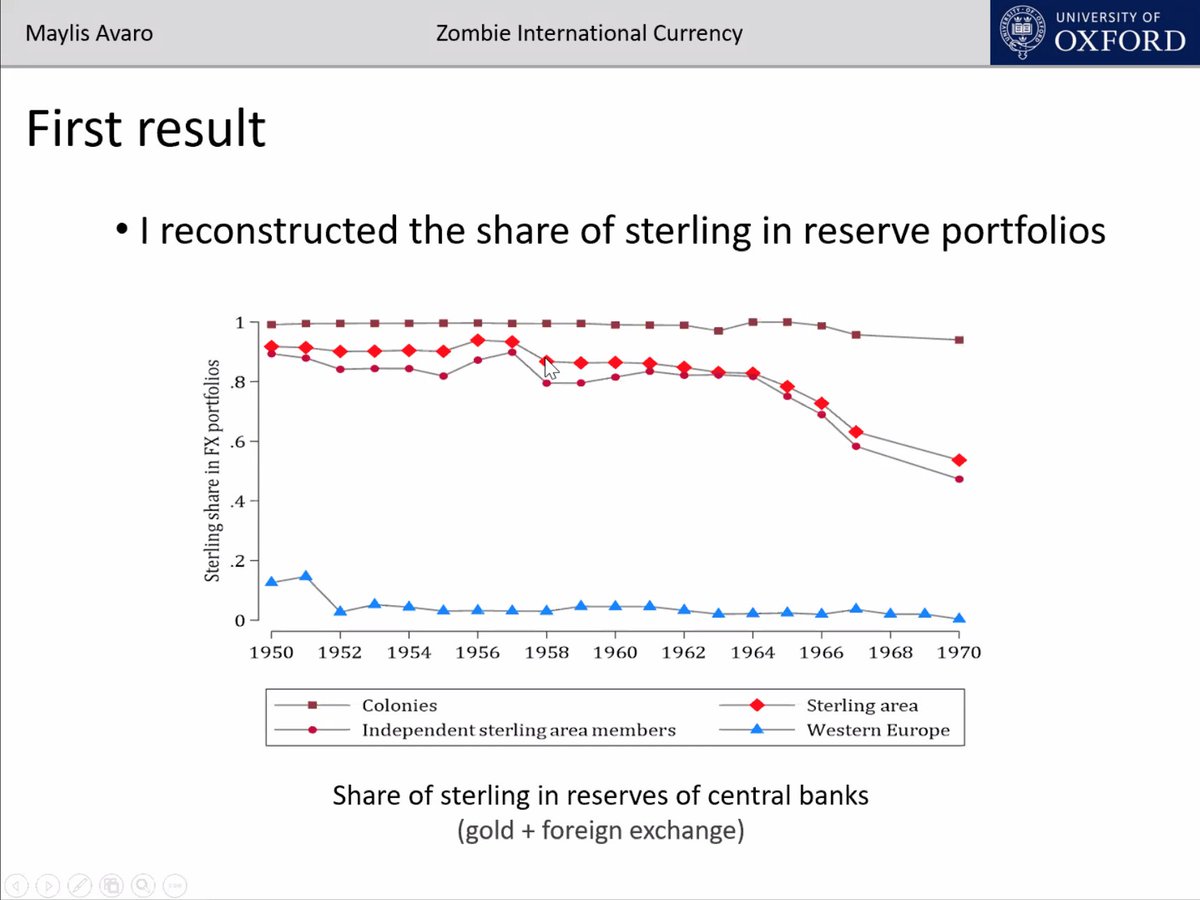

New data on  holdings for different countries sketches out the durability and then decline of GBP. #oxeshgradseminar #econhist #EconTwitter

holdings for different countries sketches out the durability and then decline of GBP. #oxeshgradseminar #econhist #EconTwitter

holdings for different countries sketches out the durability and then decline of GBP. #oxeshgradseminar #econhist #EconTwitter

holdings for different countries sketches out the durability and then decline of GBP. #oxeshgradseminar #econhist #EconTwitter

Why does @M_Avaro call  a

a  currency? There were two devaluations and frequent deficits after WWII. Mediocre macro performance and decline of London as a financial center (rise of NYC, capital controls, competition from Paris, Berlin). #oxeshgradseminar #econhist #EconTwitter

currency? There were two devaluations and frequent deficits after WWII. Mediocre macro performance and decline of London as a financial center (rise of NYC, capital controls, competition from Paris, Berlin). #oxeshgradseminar #econhist #EconTwitter

a

a  currency? There were two devaluations and frequent deficits after WWII. Mediocre macro performance and decline of London as a financial center (rise of NYC, capital controls, competition from Paris, Berlin). #oxeshgradseminar #econhist #EconTwitter

currency? There were two devaluations and frequent deficits after WWII. Mediocre macro performance and decline of London as a financial center (rise of NYC, capital controls, competition from Paris, Berlin). #oxeshgradseminar #econhist #EconTwitter

The  worked to control the activities of

worked to control the activities of  area members, e.g. through exchange controls with non-members.

area members, e.g. through exchange controls with non-members.  receipts (oil sales, development loans) had to be exchanged for

receipts (oil sales, development loans) had to be exchanged for  ! #oxeshgradseminar #econhist #EconTwitter

! #oxeshgradseminar #econhist #EconTwitter

worked to control the activities of

worked to control the activities of  area members, e.g. through exchange controls with non-members.

area members, e.g. through exchange controls with non-members.  receipts (oil sales, development loans) had to be exchanged for

receipts (oil sales, development loans) had to be exchanged for  ! #oxeshgradseminar #econhist #EconTwitter

! #oxeshgradseminar #econhist #EconTwitter

strong-armed

strong-armed  area members to remain in the area, which allowed the Bank of England to delay devaluation. #oxeshgradseminar #econhist #EconTwitter

area members to remain in the area, which allowed the Bank of England to delay devaluation. #oxeshgradseminar #econhist #EconTwitter

Read on Twitter

Read on Twitter