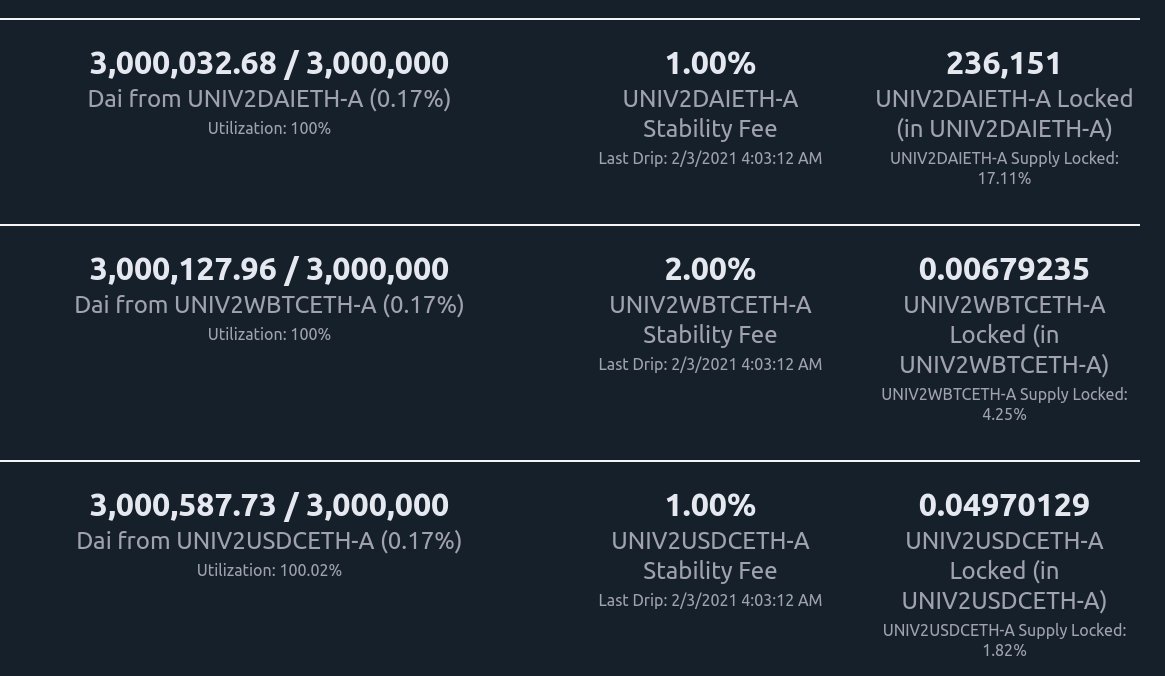

Looking at these maxed out DAI vaults:

1. ugh, let me in!

2. pretty neat that the DAI generated exceeds 100% utilization of the cap, since the cap limits debt generated but not debt accrued.

I wonder if this has any weird effects over time?

1. ugh, let me in!

2. pretty neat that the DAI generated exceeds 100% utilization of the cap, since the cap limits debt generated but not debt accrued.

I wonder if this has any weird effects over time?

3. Dope how quickly these are maxed. I can't wait for a revolution of treating more LPs as first class assets.

I wonder how generalized this process will become or will certain pairs reign supreme?

4. Those rates , 1% is fire.

, 1% is fire.

I wonder how generalized this process will become or will certain pairs reign supreme?

4. Those rates

, 1% is fire.

, 1% is fire.

5. What will LPs direct newfound leverage potential into?

We are seeing competition here between Maker and Alpha in enabling leveraged to different degrees, costs, and incentives. While Alpha can only go deeper, Maker can buy options or whatever.

Will be an interesting to watch

We are seeing competition here between Maker and Alpha in enabling leveraged to different degrees, costs, and incentives. While Alpha can only go deeper, Maker can buy options or whatever.

Will be an interesting to watch

6. I suspect LPs may have a longer time preference than single asset CDPs inherent to a longer term volatility farming strategy. I'm quite curious to see if the debt churn rates differ for LP generated DAI vs single assets.

Read on Twitter

Read on Twitter