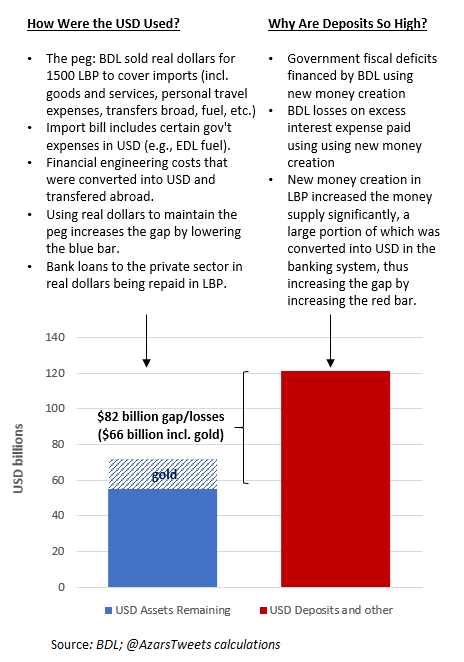

1/ The Leb financial crisis in one chart. We tend to focus on the blue bar (how the $ were spent to maintain the peg), but that misses half the story. It's not only about why the blue bar decreased, but why the red bar increased (why deposits are so high)? The ratio is the story

2/ The problem is that the ratio of dollars remaining in the system is low *relative to* the amount of deposits that those dollars are needed to cover. It's not that dollars are low in some absolute sense, it's the ratio of the two.

3/ Why are deposits (red bar) so high? Mainly the gov't fiscal deficit financed by BDL and BDL losses due to excessive interest it paid banks on their deposits. BDL had to create new LBP to cover these expenses and this caused the amount of deposits to explode.

4/ Even though that money creation was in LBP, a big chunk of the new money was eventually converted into USD in the banking system, thus increasing the red bar. Therefore, contrary to what BDL says, it did not have to lend the gov't in USD for this problem to be created.

5/ BDL never had $100+ bn of people's deposits to spend on the peg/fuel/etc. It had maybe closer to $40 bn real dollars (exact figure unknown, that's why we need the audits). The rest is LBP that was converted into USD on paper in the banking system.

6/ We can't ignore the fiscal deficit in this debate, it's half the story, half the reason why deposits are impaired, why the LBP is losing so much value, why prices are increasing. Using up the real $ to support the peg is the other half.

7/ BDL holds nearly $40 bn of gov't debt (in LBP). That by itself would increase the red bar enough to cause a crisis. Add to it the impact of the peg (reduction in the blue bar as BDL sold dollars at 1500 and further increase in the red bar due to BDL interest losses...)

8/ The circumstances of this govt lending is questionable, morally and legally, and the responsibility falls on the parliament, previous governments, and BDL. When politicians question BDL about the peg policy, remember that their reckless spending had the same negative impact.

9/ If we never had a peg, we could still be facing a financial crisis! A central bank financing so much of the gov't deficit results in the exchange rate weakening/inflation. The peg & dollarization in the banking system only delayed the inevitable and then made it MUCH worse.

Read on Twitter

Read on Twitter