Have you ever found yourself unable to sell a stock at a loss once you have bought?

You may be a victim to one of the less discussed phenomenon in behavioral economics.

Put your reading glasses on.

In this thread,

I'll help you understand the Endowment Effect.

You may be a victim to one of the less discussed phenomenon in behavioral economics.

Put your reading glasses on.

In this thread,

I'll help you understand the Endowment Effect.

1/ A couple of years back, I tried selling a DSLR I owned.

I'd bought it for 35000, used it only for a year, very sparingly that too.

I'd have taken only 300-400 photos with that.

I wanted to sell it and get a better camera.

I'd bought it for 35000, used it only for a year, very sparingly that too.

I'd have taken only 300-400 photos with that.

I wanted to sell it and get a better camera.

2/ But when I listed it on olx for 30k, most people were bidding 20-23k for that.

Some were bidding 10-15k too, saying it's second hand so it should be at least half price.

I questioned myself if I was having unrealistic expectations for the sale price.

Some were bidding 10-15k too, saying it's second hand so it should be at least half price.

I questioned myself if I was having unrealistic expectations for the sale price.

3/ I tried holding on to the same price for over 6 months without any takers.

Then I reduced the price, got it sold at 22k with a lot of pain.

This is classic endowment effect at work.

Then I reduced the price, got it sold at 22k with a lot of pain.

This is classic endowment effect at work.

4/ Sellers of items require a higher price to part with an object than buyers are willing to pay.

Sellers usually value an item more than it's worth.

Buyers usually value an item less than it's worth.

Sellers usually value an item more than it's worth.

Buyers usually value an item less than it's worth.

5/ Why does this happen?

The seller is attached to the item due to ownership.

The buyer doesn't own the item yet, so he/she is unattached, and couldn't care less if he didn't end up buying it.

The seller is attached to the item due to ownership.

The buyer doesn't own the item yet, so he/she is unattached, and couldn't care less if he didn't end up buying it.

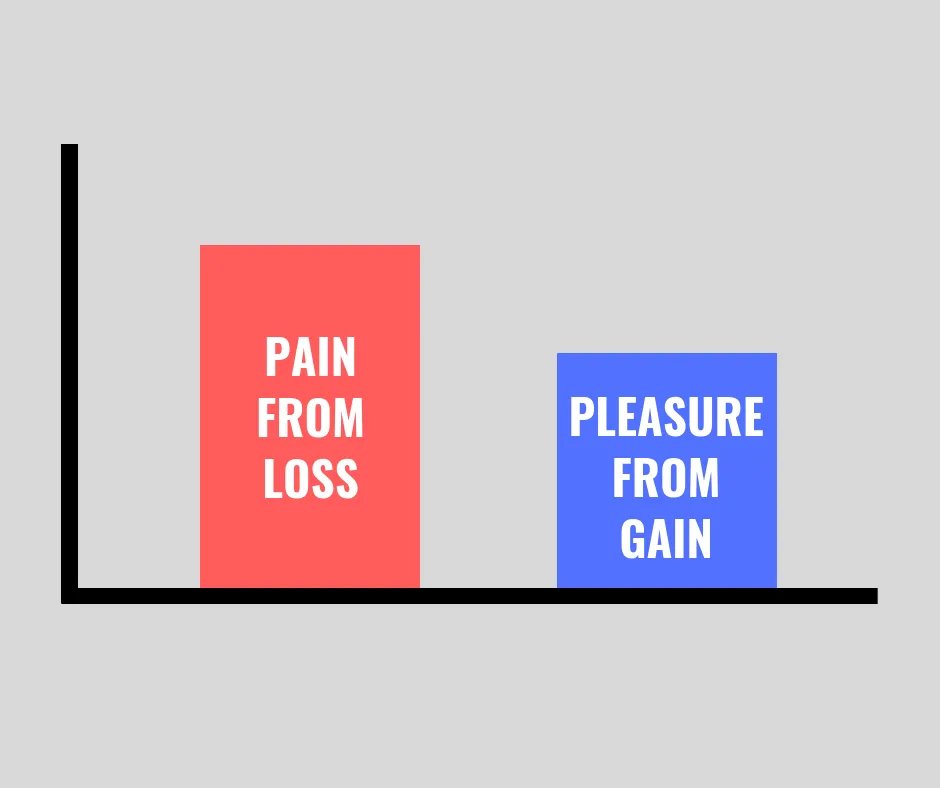

6/ Once a person owns an item, forgoing it feels like a loss.

Humans are by nature loss-averse.

Reason: The amount of pain you feel on losing something is infinitely higher than the pleasure you feel on getting the same thing.

Humans are by nature loss-averse.

Reason: The amount of pain you feel on losing something is infinitely higher than the pleasure you feel on getting the same thing.

7/ For ex: making $1M is not nearly as pleasurable as it is painful to lose $1M.

In the 1970s, Daniel Kahneman ran an experiment to test this.

He gave the participants of the experiment a mug.

He offered them a chance to sell that mug or trade it for equally valued pens.

In the 1970s, Daniel Kahneman ran an experiment to test this.

He gave the participants of the experiment a mug.

He offered them a chance to sell that mug or trade it for equally valued pens.

8/ The amount that participants demanded as compensation to let go of the mug (once they owned it) was at least 2x the amount they were willing to pay to acquire the mug.

9/ The buyer usually wants to buy something at less than the item's price.

The seller usually wants to sell something more than what an item's price should be.

There is a range of prices in which neither buyers nor sellers have much incentive to trade.

The seller usually wants to sell something more than what an item's price should be.

There is a range of prices in which neither buyers nor sellers have much incentive to trade.

10/ In Kahneman's experiment, buyers were willing to pay only $3 for the mug on average.

Sellers demanded $7 on average to sell the mug once they owned it.

The price range between $4 to $6 was the range in which neither the buyers nor the sellers had any incentive to trade in.

Sellers demanded $7 on average to sell the mug once they owned it.

The price range between $4 to $6 was the range in which neither the buyers nor the sellers had any incentive to trade in.

11/ Where is this knowledge handy in the stock markets?

Once you buy a stock, you tend to value your own shares higher than you would have if you didn't own the shares.

Once you buy a stock, you tend to value your own shares higher than you would have if you didn't own the shares.

12/ What are the implications?

Sellers usually place order on average further from the market price than buyers.

So, whenever you place your sell orders, this is why you tend to place orders at higher than the market price.

Sellers usually place order on average further from the market price than buyers.

So, whenever you place your sell orders, this is why you tend to place orders at higher than the market price.

13/ Another way endowment effect affects you is by making you enamored with a company.

Say you bought Apple stock.

You're also enamored with Apple's products and services.

You won't be ready to sell your AAPL shares even if it is time to let go.

Say you bought Apple stock.

You're also enamored with Apple's products and services.

You won't be ready to sell your AAPL shares even if it is time to let go.

14/ When this endowment effect affects you as a shareholder, you tend to ignore the negative news and only look at the positive news.

You also speak only about the positives of the company, wholly or partially ignoring the negative aspects.

You also speak only about the positives of the company, wholly or partially ignoring the negative aspects.

15/ If you're an Apple Fanboy holding AAPL shares, you're going to fall in love with all the new products, designs, etc.

You'll ignore the outrageous things that Apple does.

You'll also ignore the things they do that turns customers away.

You'll ignore the outrageous things that Apple does.

You'll also ignore the things they do that turns customers away.

16/ Also, even small good news about Apple would make you hyped. It will make you fantasize that your stock will outperform in the long term.

You will discount significant bad news as not significant enough for the long term as you "believe" in the company's potential.

You will discount significant bad news as not significant enough for the long term as you "believe" in the company's potential.

17/ What does this mean for your portfolio? Usually disaster.

An investor must never fall in love with a stock.

You must be the harshest critic of your portfolio stocks.

You should be like the mother-in-law of a newly wedded woman.

An investor must never fall in love with a stock.

You must be the harshest critic of your portfolio stocks.

You should be like the mother-in-law of a newly wedded woman.

18/ How do you avoid the endowment effect on your portfolio and stockpicking performance?

Receive all new information without bias.

If better information presents itself, be willing to change your thesis.

Receive all new information without bias.

If better information presents itself, be willing to change your thesis.

19/ The endowment effect makes you focus on the positive features of a company and its products.

It makes you disregard potential negative changes in earnings outlook, revenue growth, etc.

So, the key is to be objective.

Always be wary of potential negative factors.

It makes you disregard potential negative changes in earnings outlook, revenue growth, etc.

So, the key is to be objective.

Always be wary of potential negative factors.

20/ Create an investing plan and stick to it.

Even before you enter any position, draw out an objective plan of when you should exit an investment.

This cuts out emotion from your investment and signals you when it's time to exit.

Even before you enter any position, draw out an objective plan of when you should exit an investment.

This cuts out emotion from your investment and signals you when it's time to exit.

21/ The same thing happens if you're a trader too.

Going into budget on Feb 1, 2021, a lot of people were short.

Some popular traders started shorting call options in the morning heavily.

Those who saw the price action and quickly changed their position made a lot of money.

Going into budget on Feb 1, 2021, a lot of people were short.

Some popular traders started shorting call options in the morning heavily.

Those who saw the price action and quickly changed their position made a lot of money.

22/ Some traders kept selling calls and got hammered a lot.

It's never good to fall in love with any position you put on.

As a trader, it is important to follow your trading system and exit when it says so.

It's never good to fall in love with any position you put on.

As a trader, it is important to follow your trading system and exit when it says so.

23/ You may not want to take a loss and hold on to your position in hope that it will come back up, that you could exit at cost.

Just that, it almost never happens.

Hope is not a solid strategy.

Just that, it almost never happens.

Hope is not a solid strategy.

24/ Usually you're going to take a bigger loss, unwilling to forego your trade at a smaller loss.

So, devise a trading strategy, know where your exit is well before your entry.

Otherwise you'll be like Abhimanyu in Chakravyuh.

So, devise a trading strategy, know where your exit is well before your entry.

Otherwise you'll be like Abhimanyu in Chakravyuh.

25/ Endowment effect not only prevents you from selling your losers but also creates an opportunity cost for you.

In the time you hold on to your losers, you could have invested in better investments and made money.

In the time you hold on to your losers, you could have invested in better investments and made money.

26/ The other way endowment effect tricks you: shorting a company's shares if you face an issue with their product or service.

I’ve literally had people tell me that they want to sell the stock because they have received bad service at one of the publicly listed restaurants.

I’ve literally had people tell me that they want to sell the stock because they have received bad service at one of the publicly listed restaurants.

27/ If the service is always bad, or if their product quality is consistently bad, that's something to think about when selling a stock.

But don't let one personal incident or situation keep you from reaping the benefits of a great performing stock.

But don't let one personal incident or situation keep you from reaping the benefits of a great performing stock.

28/ People consistently ask analysts whether they should buy, sell, or hold a stock.

What the hell is a "hold"?

Why would you ever hold but also not be willing to buy a stock?

What the hell is a "hold"?

Why would you ever hold but also not be willing to buy a stock?

29/ Does it mean that the stock is good enough to keep in your portfolio if you have it already, but not good enough to buy more?

If a stock isn't good enough to buy, why is it in your portfolio?

The answer is endowment effect.

If a stock isn't good enough to buy, why is it in your portfolio?

The answer is endowment effect.

30/ "Hold" rating means the stock has upside, just not right now.

Or maybe that the stock has limited upside.

If I'm comparing among different stocks, I'd want to choose something that has upside immediately, i'd choose that.

Or maybe that the stock has limited upside.

If I'm comparing among different stocks, I'd want to choose something that has upside immediately, i'd choose that.

31/ "HOLD" means SELL.

Move that money into a high performing stock or a better investment that has a long runway.

Don't be stuck to an investment with nonsensical ratings and ideas just because you own it.

Move that money into a high performing stock or a better investment that has a long runway.

Don't be stuck to an investment with nonsensical ratings and ideas just because you own it.

32/ The smarter we are, the more likely it is that we'll convince ourselves that we're being objective.

We'll think we are beyond these psychological biases and that we can escape them.

We are only fooling ourselves that way.

We'll think we are beyond these psychological biases and that we can escape them.

We are only fooling ourselves that way.

33/ The longer you own something, the harder it gets to get rid of that.

So, it's better to periodically review your portfolio.

The free-ness of sitting on a pile of cash and free of any baggage is powerful.

So, it's better to periodically review your portfolio.

The free-ness of sitting on a pile of cash and free of any baggage is powerful.

34/ The same thing applies to your life, and why you hoard things.

You'll find that your home gets cluttered and has many things you don't use.

But when you review what all you wanna throw away, each item has some memory attached to it and you don't want to get rid of them.

You'll find that your home gets cluttered and has many things you don't use.

But when you review what all you wanna throw away, each item has some memory attached to it and you don't want to get rid of them.

35/ This behavior is in-line with the endowment effect.

The only way to declutter life is to periodically review if something is useful.

If you haven't used something for a year or two, most likely you won't use it ever.

So, throw it out, sell it off, declutter your life.

The only way to declutter life is to periodically review if something is useful.

If you haven't used something for a year or two, most likely you won't use it ever.

So, throw it out, sell it off, declutter your life.

36/ The endowment effect affects the smartest of us in sneaky ways.

So don't feel bad if you have been a victim of this.

It's not easy to identify.

Once identified, it's not easy to get rid of either.

So don't feel bad if you have been a victim of this.

It's not easy to identify.

Once identified, it's not easy to get rid of either.

37/ With conscious evaluation & introspection of what you're doing, you should be able to stop the endowment effect at its tracks.

Taking back control from a strong psychological bias is not easy.

It's a process.

Give yourself time.

With awareness, and you'll get there.

Taking back control from a strong psychological bias is not easy.

It's a process.

Give yourself time.

With awareness, and you'll get there.

Read on Twitter

Read on Twitter