In just a few months, an online stock trading community has become the center of the world of finance.

For the last week, it has led a meme-centric movement against Wallstreet which is changing the way we think about investing.

This is the story of Wallstreetbets

For the last week, it has led a meme-centric movement against Wallstreet which is changing the way we think about investing.

This is the story of Wallstreetbets

WSB was founded in 2012 and quickly become synonymous with aggressive trading strategies. Its members reject traditional financial analysis and instead make highly speculative, leveraged options plays on #robinhood.

“Like 4chan found a Bloomberg terminal” as they put it.

“Like 4chan found a Bloomberg terminal” as they put it.

WSB has been a driving force of the much talked about short squeeze of #GameStop (cheers to @Ryancohen and @TradingMoneyman who have made millions) which has been a momentous occasion as it has shown that the average investor can win against Wallstreet.

But just looking at the GameStop event alone doesn’t do WSB justice. WSB, while not lacking political undertones, is really more about investing itself rather than trying to start a movement.

During the financial panic in March of 2020, WSB members were in the trenches, buying puts on airlines, cruise lines, and the S&P 500.

When Tesla felt overvalued WSB bought naked calls.

And when oil dropped to a negative price, WSB saw nothing but a buying opportunity.

When Tesla felt overvalued WSB bought naked calls.

And when oil dropped to a negative price, WSB saw nothing but a buying opportunity.

At the forefront of this was @wallstreetbetsgod. For the last year, WSBG posted screenshots of his portfolio where it seemed he could do no wrong, playing $TSLA and the March crash to perfection. Many believe his successes to be fabricated but he symbolizes what this community is

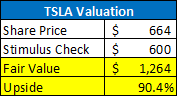

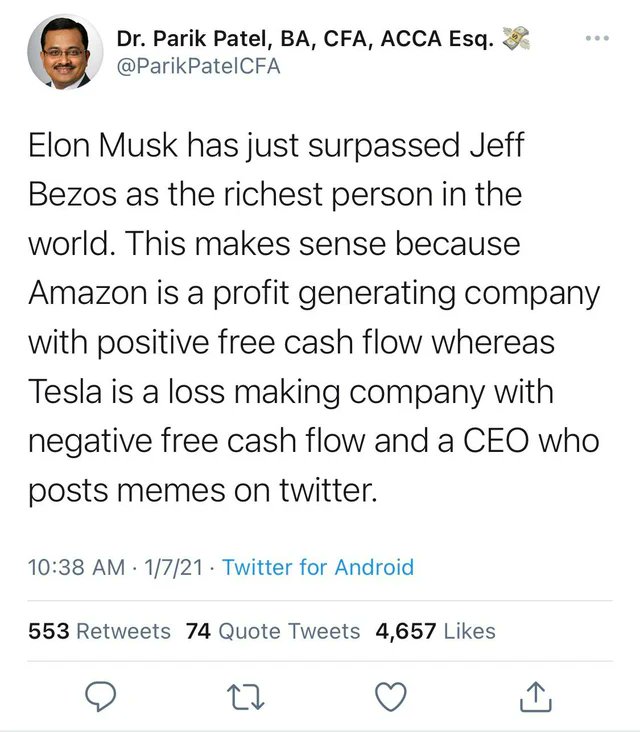

Memes aside, WSB has been a part of quite a few wins. Hindsight is 2020 but the community brought a lot of attention to $SQ, $AMD, $TSLA (thank you to @parikpatelcfa for the above analysis), $NVDA, and $SPCE long before they were wins. @jimcramer even uses it as a research tool.

WSB has had its share of issues over the years including an SEC investigation or two. The community regularly celebrates individuals who take out student loans in order to play the market ( @sacca) and is a breeding ground for pump and dump schemes.

WSB also acts as investing 101 for many first-time investors which is just about the scariest thing about the community and where the most harm can be done.

It was this kind of community that inspired me to start @Echomarkets. We're building a community platform designed for investors. We want to recreate the success Reddit has had hosting the WSB community and take it further while mitigating some of the described issues

Also thank you to @APompliano and @JoePompliano for the tweet structure!

Read on Twitter

Read on Twitter