@0xProject is the most misunderstood, underestimated project in all of DeFi.

Its story is one of confusion, misinformation, and FUD.

I'm starting w/ @matchaxyz because as @MessariCrypto points out "value accrues to the aggregators." (link below), but there's much more.

1/

$ZRX

Its story is one of confusion, misinformation, and FUD.

I'm starting w/ @matchaxyz because as @MessariCrypto points out "value accrues to the aggregators." (link below), but there's much more.

1/

$ZRX

0x debuted in 2017 to solve problem of each dapp needing to bootstrap its own liquidity. The issue? Not many dapps w/ traction

To scratch its own itch, 0x launched 0x Labs, which spun out @matchaxyz, a DEX aggregator. Now, Matcha offers the best prices

2/ https://blog.0xproject.com/a-comprehensive-analysis-on-dex-liquidity-aggregators-performance-dfb9654b0723

To scratch its own itch, 0x launched 0x Labs, which spun out @matchaxyz, a DEX aggregator. Now, Matcha offers the best prices

2/ https://blog.0xproject.com/a-comprehensive-analysis-on-dex-liquidity-aggregators-performance-dfb9654b0723

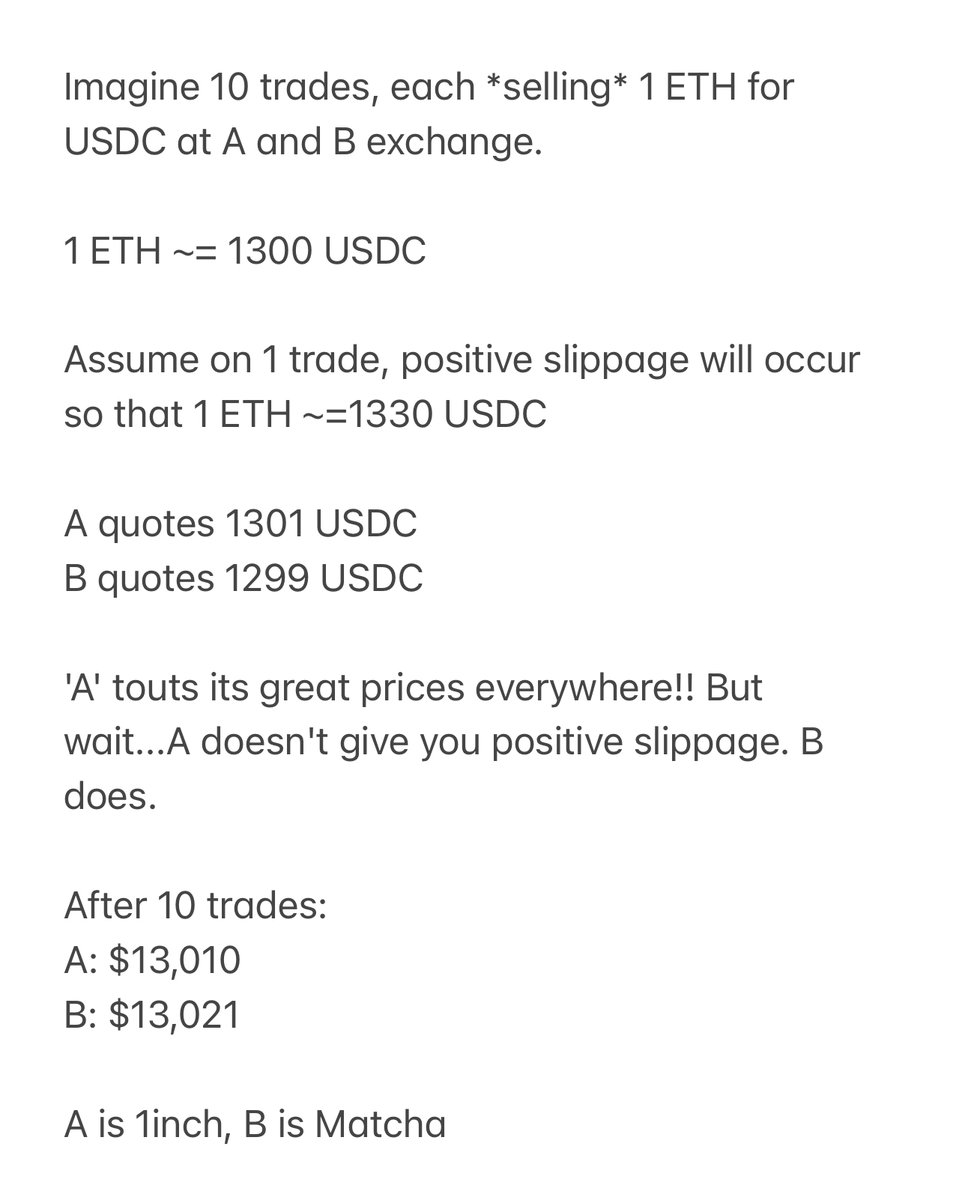

1inch sometimes has better quotes but prices/gas are only estimates, and 1inch keeps positive slippage (PS)

So you'll sometimes get slightly better quotes on 1inch, but then you'll lose all those trades' gains by losing 1 trade's PS.

This is 'hidden fee', bank behavior.

3/

So you'll sometimes get slightly better quotes on 1inch, but then you'll lose all those trades' gains by losing 1 trade's PS.

This is 'hidden fee', bank behavior.

3/

Not exaggerating: see 8 ETH in PS on a 38 ETH trade

As # and size of your trades increases, likelihood of PS on at least 1 trade approaches 100%.

So it's likely you've given up PS to 1inch, erasing any gains you perceived from using it over @matchaxyz

4/ https://twitter.com/HeadieXBT/status/1356126840092569604?s=20

As # and size of your trades increases, likelihood of PS on at least 1 trade approaches 100%.

So it's likely you've given up PS to 1inch, erasing any gains you perceived from using it over @matchaxyz

4/ https://twitter.com/HeadieXBT/status/1356126840092569604?s=20

This is 1inch's explicit fee strategy.

@MessariCrypto: "1inch aggregation protocol provides 1INCH fees through what’s known as positive slippage (or as 1inch calls it “Spread Surplus”)."

Note the euphemism and how casually this is mentioned!

5/ https://messari.io/article/1inch-defi-s-leading-aggregator?utm_source=messaricrypto&utm_medium=tweet1&utm_campaign=1inch

@MessariCrypto: "1inch aggregation protocol provides 1INCH fees through what’s known as positive slippage (or as 1inch calls it “Spread Surplus”)."

Note the euphemism and how casually this is mentioned!

5/ https://messari.io/article/1inch-defi-s-leading-aggregator?utm_source=messaricrypto&utm_medium=tweet1&utm_campaign=1inch

The strategy literally depends on traders not being smart enough to know that you might sometimes get a better quoted price on 1inch, but you would get better overall *execution* prices elsewhere once you factor in PS.

As traders wise up, 1inch is the emperor with no clothes

6/

As traders wise up, 1inch is the emperor with no clothes

6/

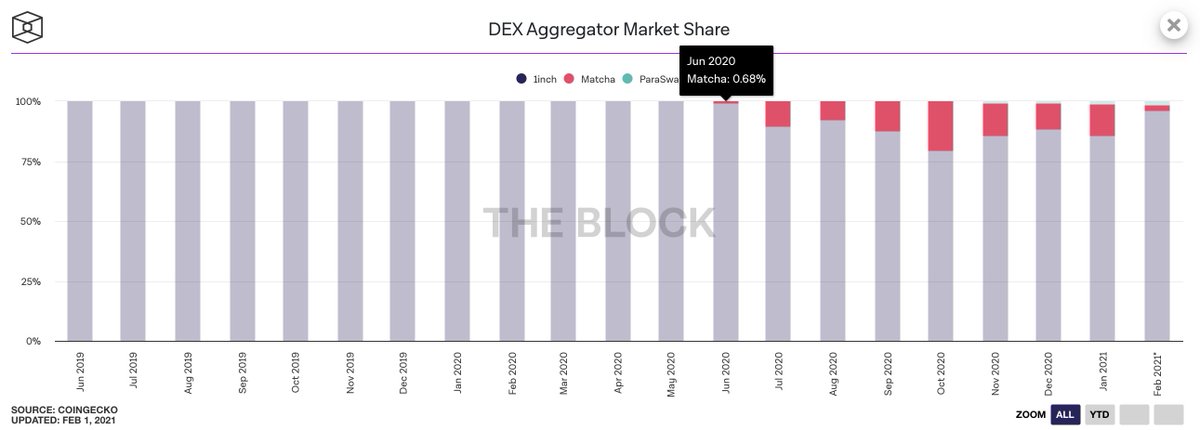

Bottom line: @matchaxyz is a superior product.

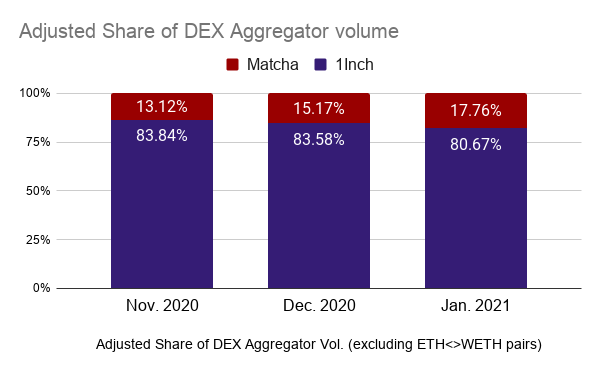

Has that translated to market share? It's grown quickly (see graph).

Here is the 2nd example of confusion.

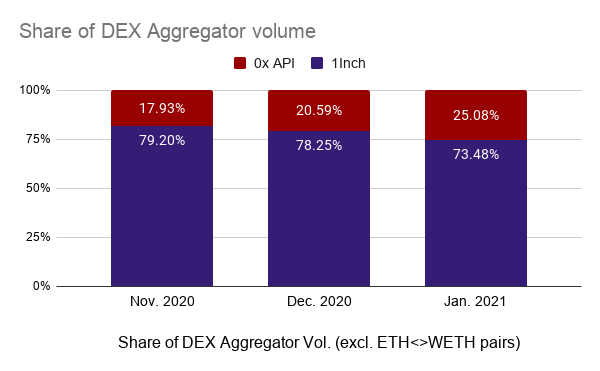

See how 1inch is hovering around 85% market share in the charts? Well, that's not quite right.

7/

https://www.theblockcrypto.com/data/open-finance/dex-non-custodial

Has that translated to market share? It's grown quickly (see graph).

Here is the 2nd example of confusion.

See how 1inch is hovering around 85% market share in the charts? Well, that's not quite right.

7/

https://www.theblockcrypto.com/data/open-finance/dex-non-custodial

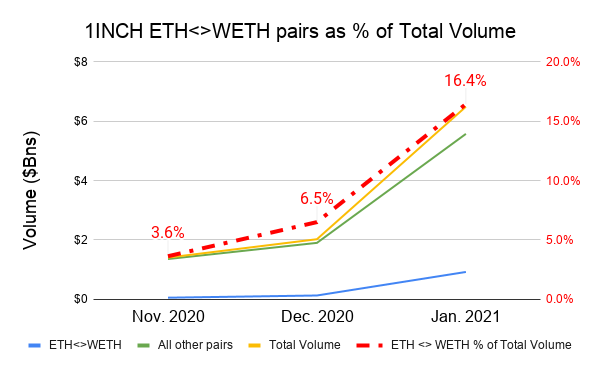

1inch includes ETH wrapping as 'volume' but @matchaxyz doesn't.

@coinbase doesn't include USD-USDC in its volume, why count ETH-WETH?

In January, ETH<>WETH pairs are approaching 20% of 1Inch monthly "volume"!

8/

https://docs.google.com/spreadsheets/d/1U5ppevrPxybSsDmJSpPIBnBI1gnqLtsBomO4WKsgVc8/edit?usp=sharing

@sui414's Dune dashboard in sheet

@coinbase doesn't include USD-USDC in its volume, why count ETH-WETH?

In January, ETH<>WETH pairs are approaching 20% of 1Inch monthly "volume"!

8/

https://docs.google.com/spreadsheets/d/1U5ppevrPxybSsDmJSpPIBnBI1gnqLtsBomO4WKsgVc8/edit?usp=sharing

@sui414's Dune dashboard in sheet

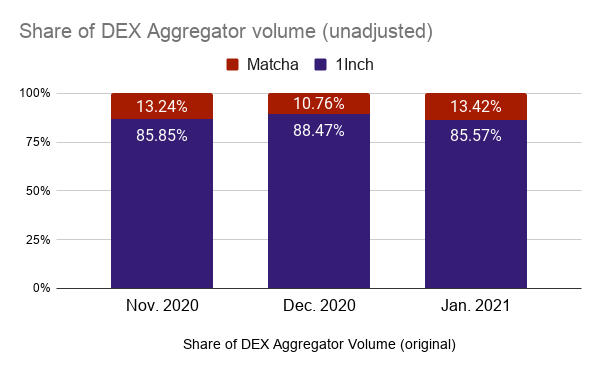

Second, as @theogonella points out, for an apples-to-apples comp., we need to compare 0x API volume to 1inch. This is the only sensible way to compare the two aggregators: 0x API volume is the analog to all of 1inch's integrations' volume.

9/ https://twitter.com/theogonella/status/1354473372835483648?s=20

9/ https://twitter.com/theogonella/status/1354473372835483648?s=20

We can redo the chart to account for both of the above.

Now see how the chart changes from 1st to 3rd pictures.

Note this excludes ParaSwap (~1% of volume) for a direct comparison.

10/

Now see how the chart changes from 1st to 3rd pictures.

Note this excludes ParaSwap (~1% of volume) for a direct comparison.

10/

So, counting ETH<>WETH as volume & the flawed comparison hid the enormous growth in Matcha/0x API's market share.

It is DOUBLE what's reported (e.g. ~25% vs. ~13% in Jan.).

Now consider that 1inch had a 1 yr head start on Matcha.

That covers @matchaxyz. There's more.

11/

It is DOUBLE what's reported (e.g. ~25% vs. ~13% in Jan.).

Now consider that 1inch had a 1 yr head start on Matcha.

That covers @matchaxyz. There's more.

11/

There's a sense that 0x is a 'dinosaur'. CMC calls Uniswap a "modern alternative" to 0x

How's it a modern alternative? 0x sources from Uniswap. They're complementary. @MessariCrypto: "In short its aggregators who compete for traders, while its AMMs that compete for trades."

12/

How's it a modern alternative? 0x sources from Uniswap. They're complementary. @MessariCrypto: "In short its aggregators who compete for traders, while its AMMs that compete for trades."

12/

But even Messari has stale/incomplete info. See attached.

0x in fact manages @matchaxyz, and 0x Launch Kit is long retired

When the most viewed sources like CMC and Messari have incomplete info, it's a good sign a project is being misunderstood.

13/

https://messari.io/article/1inch-defi-s-leading-aggregator?utm_source=messaricrypto&utm_medium=tweet1&utm_campaign=1inch

0x in fact manages @matchaxyz, and 0x Launch Kit is long retired

When the most viewed sources like CMC and Messari have incomplete info, it's a good sign a project is being misunderstood.

13/

https://messari.io/article/1inch-defi-s-leading-aggregator?utm_source=messaricrypto&utm_medium=tweet1&utm_campaign=1inch

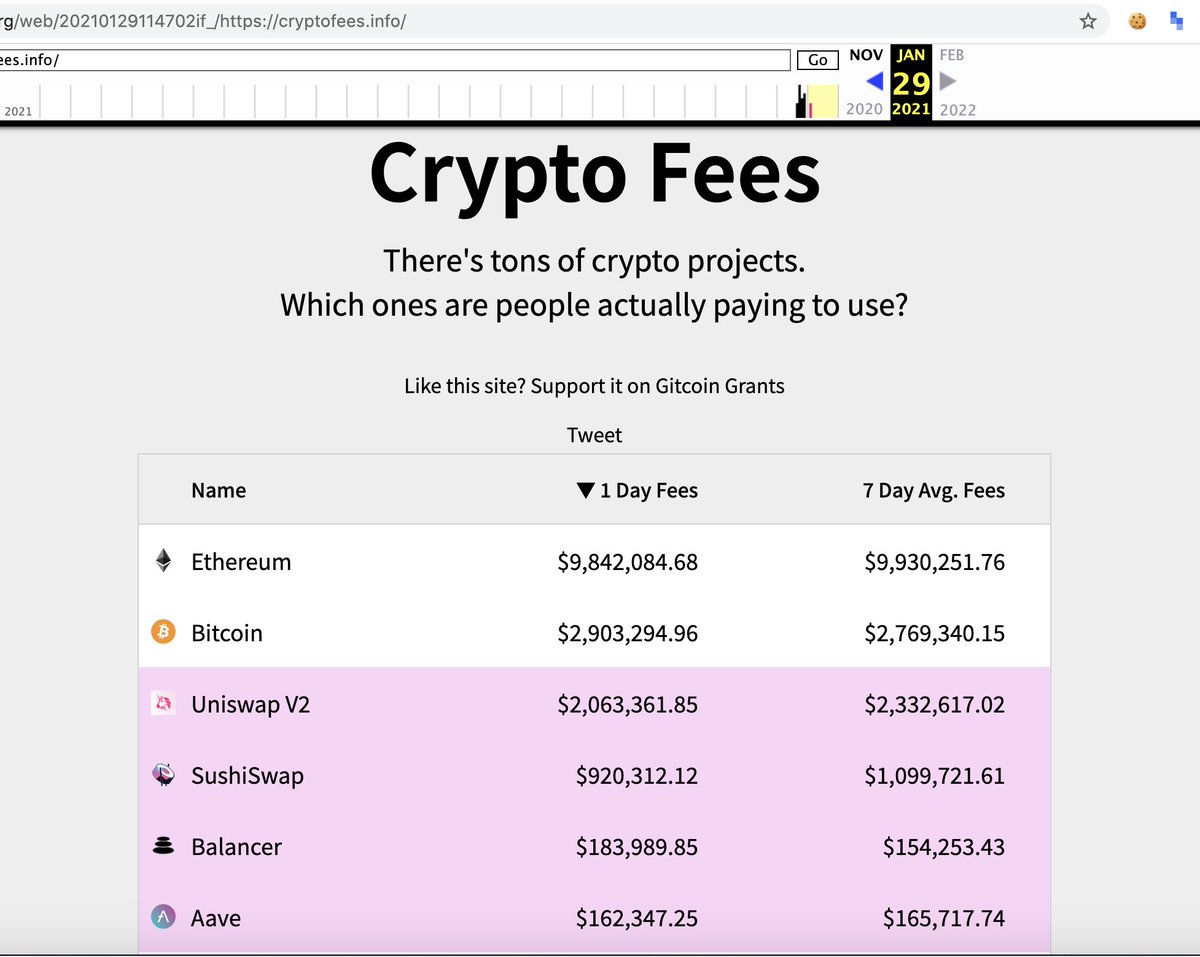

Next, the popular site http://cryptofees.info . We often see its screenshots posted on crypto twitter showing projects with the most fees generated.

But as @abandeali1 points out, this doesn't work with the 0x fee model because so much is off-chain.

14/ https://twitter.com/abandeali1/status/1355598874446979072?s=20

But as @abandeali1 points out, this doesn't work with the 0x fee model because so much is off-chain.

14/ https://twitter.com/abandeali1/status/1355598874446979072?s=20

If you correct for this, in that example 0x participants earned ~$510K in 24hr, which is good enough for the 5th spot behind only Bitcoin, Ethereum, Uniswap & Sushiswap.

This is a 32x difference(!) compared to whats on http://cryptofees.info

15/

https://twitter.com/abandeali1/status/1355598878033145856?s=20

This is a 32x difference(!) compared to whats on http://cryptofees.info

15/

https://twitter.com/abandeali1/status/1355598878033145856?s=20

Finally, more abstract but equally important:

0x is confused w/ open orderbook-only model, when in fact it sources from a superset of liquidity models (RFQ, aggregation, etc.) --> 0x is well-positioned to serve a variety of traders and MMs.

So?

16/ https://twitter.com/theogonella/status/1340398428115767296?s=20

0x is confused w/ open orderbook-only model, when in fact it sources from a superset of liquidity models (RFQ, aggregation, etc.) --> 0x is well-positioned to serve a variety of traders and MMs.

So?

16/ https://twitter.com/theogonella/status/1340398428115767296?s=20

@hosseeb: "Fully algorithmic AMMs will always have a place in DeFi... but... I expect the majority of DeFi volume will become dominated by professional market makers..."

As DeFi matures, AMMs and professional MMs will each have their place in DeFi.

17/ https://medium.com/dragonfly-research/unbundling-uniswap-the-future-of-on-chain-market-making-1c7d6948d570

As DeFi matures, AMMs and professional MMs will each have their place in DeFi.

17/ https://medium.com/dragonfly-research/unbundling-uniswap-the-future-of-on-chain-market-making-1c7d6948d570

Professional MMs will show up in DeFi as it grows - there is too much opportunity to make $. See @willwarren89's chart.

When that happens, @0xProject will be well-positioned to serve professional MMs. It's inevitable - the only question is when.

18/ https://twitter.com/willwarren89/status/1316622355947425794?s=20

When that happens, @0xProject will be well-positioned to serve professional MMs. It's inevitable - the only question is when.

18/ https://twitter.com/willwarren89/status/1316622355947425794?s=20

@0xProject has been misunderstood by crypto 'press', traders, & basically everyone. Just as there is bagholder bias, there is reverse-bagholder bias.

Many lost money after $ZRX 2017 peaks and since then discounted the project. As investors we can and should do better.

19/

Many lost money after $ZRX 2017 peaks and since then discounted the project. As investors we can and should do better.

19/

As the market sheds its reverse-bagholder bias, $ZRX will get the recognition it deserves, and like all things in crypto, it'll be quick.

/fin

/fin

Read on Twitter

Read on Twitter