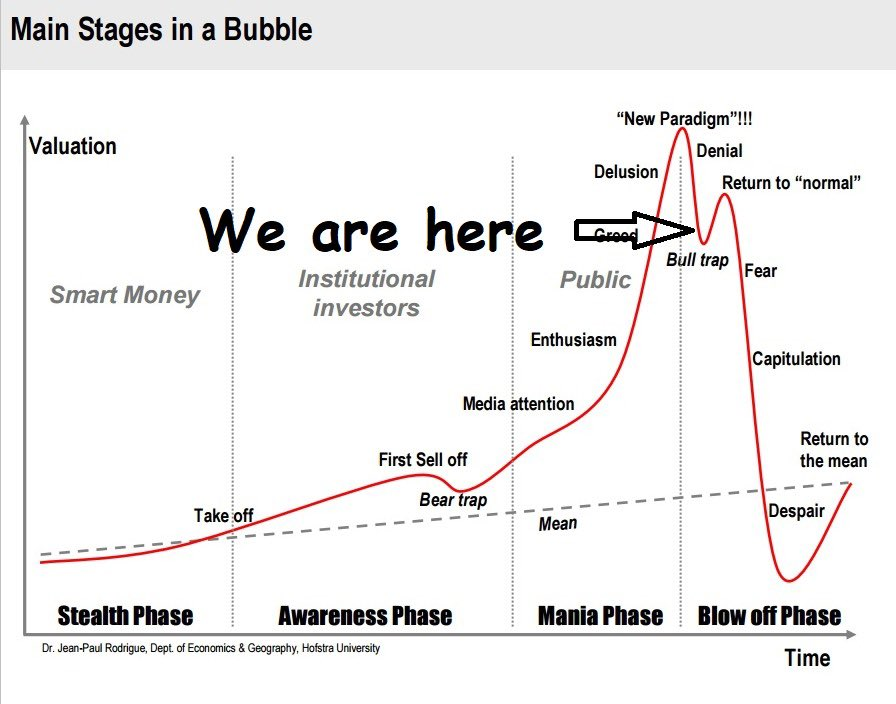

I predict that we'll see a pretty intense bounce on $GME and the other meme stonks. This pattern is so common it's in the classic bubble chart. I believe we're nearing the bottom of the trough as below:

1/6

1/6

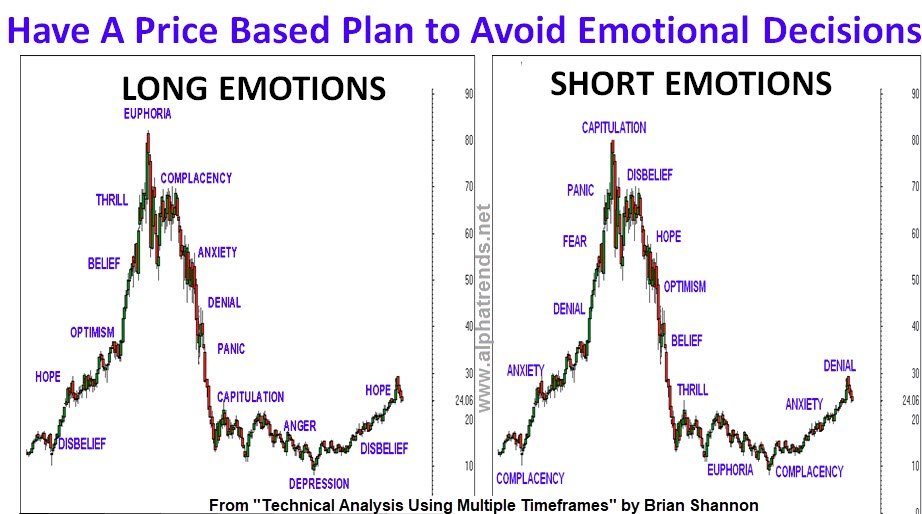

With $GME and the meme stonks I believe there's some possibility for the bounce to be rather intense due to the famous short interest. As @alphatrends pointed out "emotions go both ways in the market"

(buy this book!)

6/7

(buy this book!)

6/7

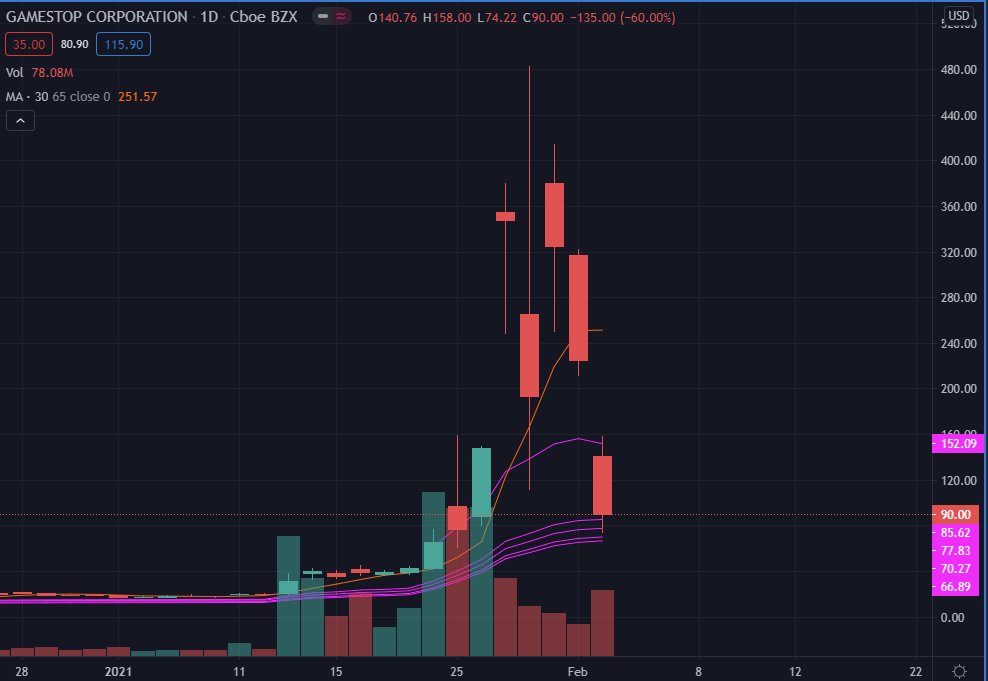

Clues about a bottom:

- Daily range compression

- Doji candle (or long wicks) from a battle between buyers & sellers

- Precrash AVWAPs price range

- 3-5 days after peak

- High SI ;)

There is of course the risk of no bounce!

(And this is obviously a risky thing to trade!)

7/7

- Daily range compression

- Doji candle (or long wicks) from a battle between buyers & sellers

- Precrash AVWAPs price range

- 3-5 days after peak

- High SI ;)

There is of course the risk of no bounce!

(And this is obviously a risky thing to trade!)

7/7

Current $GME chart (last price $85.20 in afterhours)

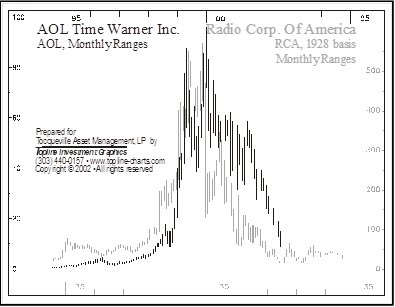

Counterpoint: looking at the $VW chart there was no second peak after the top

Still believe in a $GME bounce due to speculation whereas $VW was orchestrated by Porsche hence crowd psychology was not a significant factor

(or perhaps the REAL squeeze hasn't happened yet )

)

Still believe in a $GME bounce due to speculation whereas $VW was orchestrated by Porsche hence crowd psychology was not a significant factor

(or perhaps the REAL squeeze hasn't happened yet

)

)

Read on Twitter

Read on Twitter