Does central bank capital matter? How may it lead to fiscal-monetary tensions & what would implications on central bank independence be? A  on the risks of negative equity in the @ecb & Eurosystem national central banks and how to manage them. 1/n

on the risks of negative equity in the @ecb & Eurosystem national central banks and how to manage them. 1/n

on the risks of negative equity in the @ecb & Eurosystem national central banks and how to manage them. 1/n

on the risks of negative equity in the @ecb & Eurosystem national central banks and how to manage them. 1/n

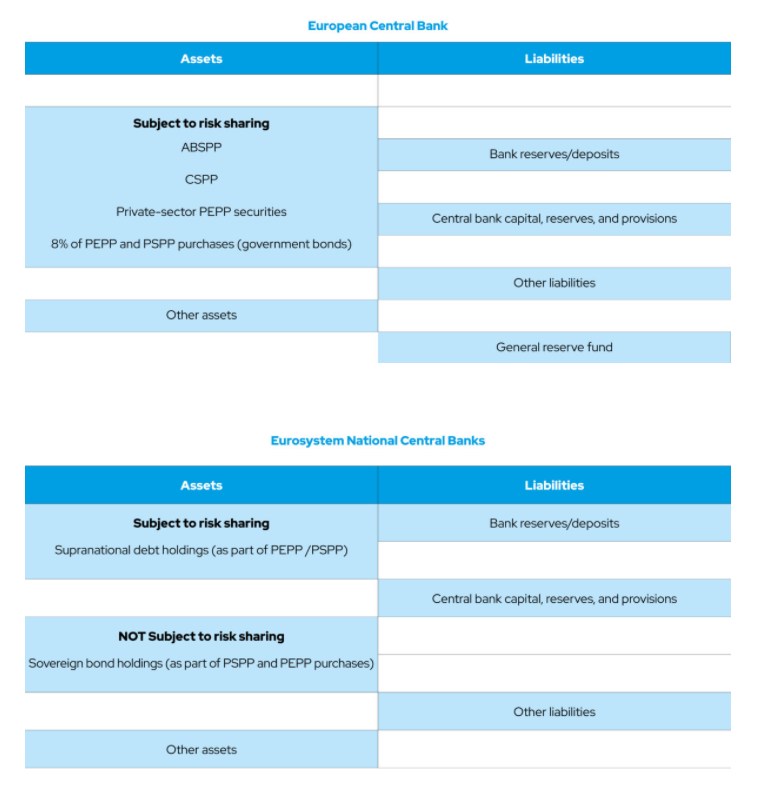

First, a look at risk-sharing in the @ecb & NCBs balance sheets: @ecb holdings are all risk-shared. This includes all of CSPP and some of PSPP/PEPP. On NCB balance sheet, only supras are subject to risk-sharing. Govt bonds in PSPP/PEPP are not (this is ~80% of entire PSPP) 2/n

This creates a potential sovereign-NCB nexus: the riskier the assets, the higher the danger. The longer QE persists, the more likely the @ecb will move to add riskier assets on its balance sheet. NCBs now hold 92% of PSPP (12pp is supras, the rest are govt bonds) 3/n

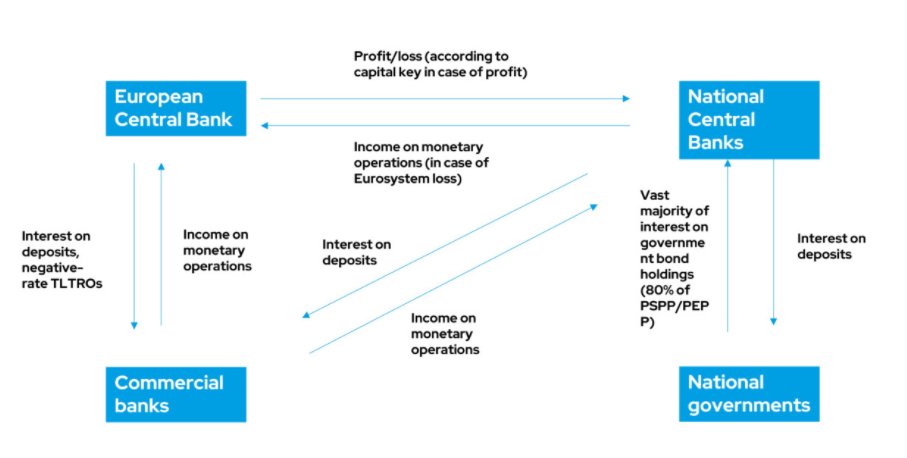

There is also a flow dimension: interest payments among @ecb, NCBs, commercial banks & govts. These typically result in profit for NCBs which is shared according to capital key. As rates rise the gap bw the rising cost of funds on liabilities & low/-ve return on assets widens 4/n

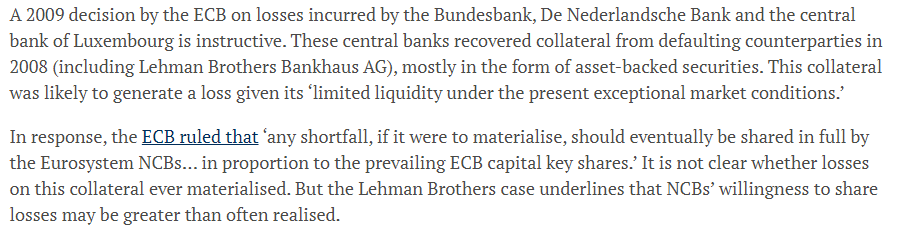

Unlike commercial banks, CBs cannot take offsetting measures or hedge against such losses. @ecb has framework for how to offset losses but what happens with NCBs is less clear. In practice, losses may be shared as '09 @bundesbank @DNB_NL Lux experience w/ Lehman losses shows 5/n

On to how the risks can be managed. First, important to distinguish bw material vs unrealised losses. Losses on govt bonds would only materialise in the case of default (unlikely) OR if they were sold to the mkt at a loss (e.g. as part of balance sheet unwinding) 6/n

This is because NCB asset purchases are held at amortised costs, not marked-to-market. So unless sold, losses would remain unrealised 7/n

Second, from flow perspective, loss-making transfers to commercial banks would likely happen in environment where inflation & returns on inv assets are also higher - so they would be partially offset by higher seigniorage 8/n

Third, NCBs are already on the case & have been increasing risk provisions to pre-empt potential losses from unconventional monetary policy. E.g. see this @bundesbank Weidmann notes on '19 annual report: https://www.bis.org/review/r190227b.htm @banquedefrance has also increased provisions 9/n

Fourth, Lehman precedent noted above means it would be politically difficult for the @ecb not to step in in case of serious capital losses which would threaten the insolvency of an NCB - this would be de facto loss-sharing 10/n

And even if -ve equity were to materialise, they could seek recapitalisation from the national treasury or seek to borrow against share of future seigniorage per capital key as suggested Willem Buiter. Here's where the potential risk of fiscal-monetary tensions kicks in 11/n

Would it be reasonable for the central bank to expect recapitalisation from the govt if it makes a loss as a result of extended QE in the interest of good econ policy? QE has also brought lower borrowing costs for govts afrer all (quote is from @riksbanken's DG Floden '06) 12/n

Do central banks then have to worry 'Should we go on w/ QE if this may lead to losses & need to be recapitalised by the govt? Could this risk fiscal-monetary tensions & loss of independence?' EU Treaty has clear answer: don't be tempted to worry, this would be wrong! 13/n

You can read our full @OMFIF analysis with @pierreppo here in two parts: https://www.omfif.org/2021/01/does-central-bank-capital-matter/ & https://www.omfif.org/2021/01/does-central-bank-capital-matter-part-2/ END

Read on Twitter

Read on Twitter