"2% of accounts control 95% of all #Bitcoin  "

"

Wrong.

BTC ownership is much less concentrated than often reported – and has dispersed over time.

Meanwhile, whale supply has increased – suggesting institutional investors arriving.

Report: http://insights.glassnode.com/bitcoin-supply-distribution

THREAD

"

"Wrong.

BTC ownership is much less concentrated than often reported – and has dispersed over time.

Meanwhile, whale supply has increased – suggesting institutional investors arriving.

Report: http://insights.glassnode.com/bitcoin-supply-distribution

THREAD

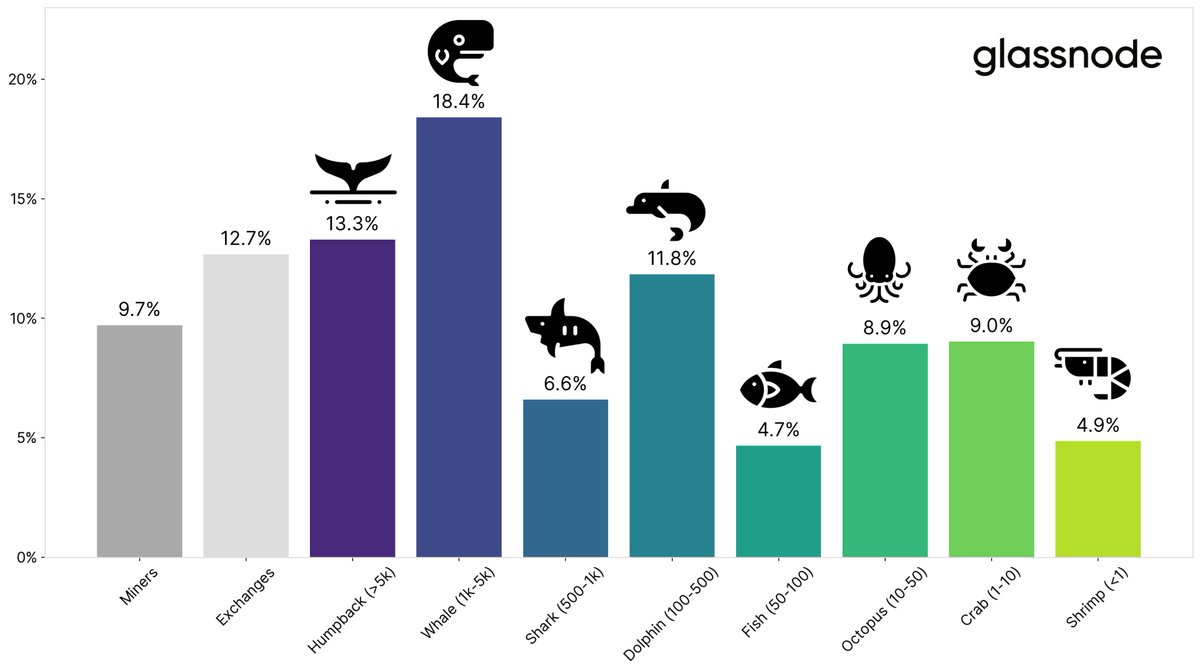

1/ We split the #Bitcoin  supply into network participants of varying sizes, treating miners & exchanges separately.

supply into network participants of varying sizes, treating miners & exchanges separately.

Our estimates:

- Whale, humpback (>1k BTC): ~31%

- Fish, dolphin, shark (50-1k BTC): ~23%

- Shrimp, crab, octopus (<50 BTC): ~23%

- Exchanges: ~13%

- Miners: ~10%

supply into network participants of varying sizes, treating miners & exchanges separately.

supply into network participants of varying sizes, treating miners & exchanges separately.Our estimates:

- Whale, humpback (>1k BTC): ~31%

- Fish, dolphin, shark (50-1k BTC): ~23%

- Shrimp, crab, octopus (<50 BTC): ~23%

- Exchanges: ~13%

- Miners: ~10%

2/ Importantly, over the past years we've seen a continuous dispersion of the #Bitcoin  supply distribution, shifting more BTC towards smaller holders – a trend that continues to endure.

supply distribution, shifting more BTC towards smaller holders – a trend that continues to endure.

supply distribution, shifting more BTC towards smaller holders – a trend that continues to endure.

supply distribution, shifting more BTC towards smaller holders – a trend that continues to endure.

3/ Specifically, the #BTC  supply held by the smallest participants (shrimp + crab) has increased by 130% since 2017, the 2nd smallest (octopus + fish) by 14%.

supply held by the smallest participants (shrimp + crab) has increased by 130% since 2017, the 2nd smallest (octopus + fish) by 14%.

Large entities (dolphins + sharks, whales + humpbacks) have decreased their $BTC holdings by -3% and -7%, respectively.

supply held by the smallest participants (shrimp + crab) has increased by 130% since 2017, the 2nd smallest (octopus + fish) by 14%.

supply held by the smallest participants (shrimp + crab) has increased by 130% since 2017, the 2nd smallest (octopus + fish) by 14%.Large entities (dolphins + sharks, whales + humpbacks) have decreased their $BTC holdings by -3% and -7%, respectively.

4/ Nonetheless, on a more short-term time window, we have seen a significant increase of #Bitcoin  whales (and their supply) since 2020.

whales (and their supply) since 2020.

This suggests that institutional investors, funds, family offices, and other HNWI have been entering the space.

Yes, this is bullish.

whales (and their supply) since 2020.

whales (and their supply) since 2020.This suggests that institutional investors, funds, family offices, and other HNWI have been entering the space.

Yes, this is bullish.

5/ Below are the number of estimated network participants in each bucket.

Not much surprises there, the distribution is heavily skewed towards small #Bitcoin holders.

holders.

Not much surprises there, the distribution is heavily skewed towards small #Bitcoin

holders.

holders.

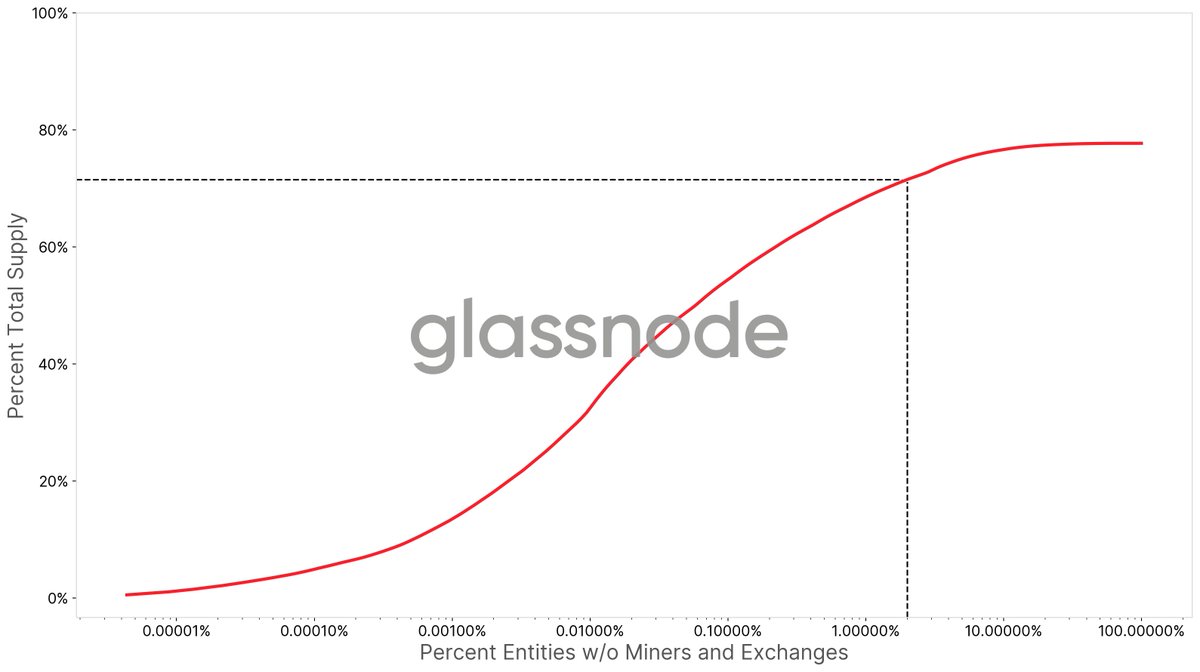

6/ Relating the number of participants to the supply they hold, leads us to the distribution curve below suggesting that 2% of entities control at most ~71% of #Bitcoin  – significantly lower than the high concentrations usually reported, and likely and upper bound (see article).

– significantly lower than the high concentrations usually reported, and likely and upper bound (see article).

– significantly lower than the high concentrations usually reported, and likely and upper bound (see article).

– significantly lower than the high concentrations usually reported, and likely and upper bound (see article).

7/ These numbers are estimates, and to the best of our knowledge the most accurate to date. Many aspects are not considered in this analysis – please refer to the discussion in the article.

All data from @glassnode.

Big shout-out to Kilian and @woonomic for invaluable feedback!

All data from @glassnode.

Big shout-out to Kilian and @woonomic for invaluable feedback!

Read on Twitter

Read on Twitter