There are two basic ways for small businesses to improve cash flow.

Thread.

Thread.

You can either bring in revenue through increasing sales or you can reduce expenses.

Increasing sales is usually the chief objective of businesses but it's largely outside your control and there are also indirect factors at play.

Increasing sales is usually the chief objective of businesses but it's largely outside your control and there are also indirect factors at play.

The second method is much more under your control. You can trim or remove expenses at will. Tips;

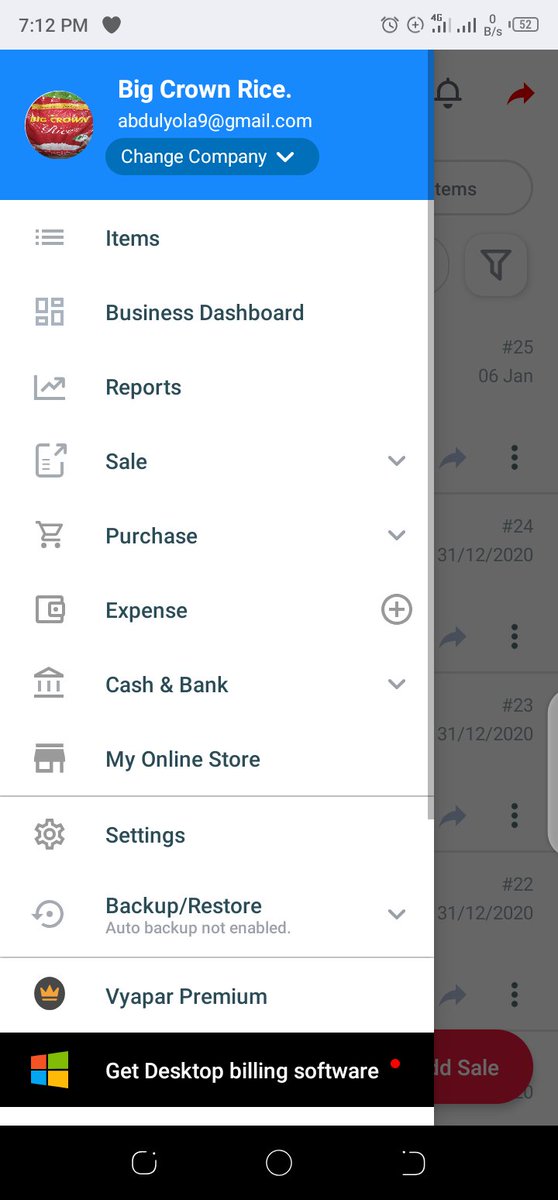

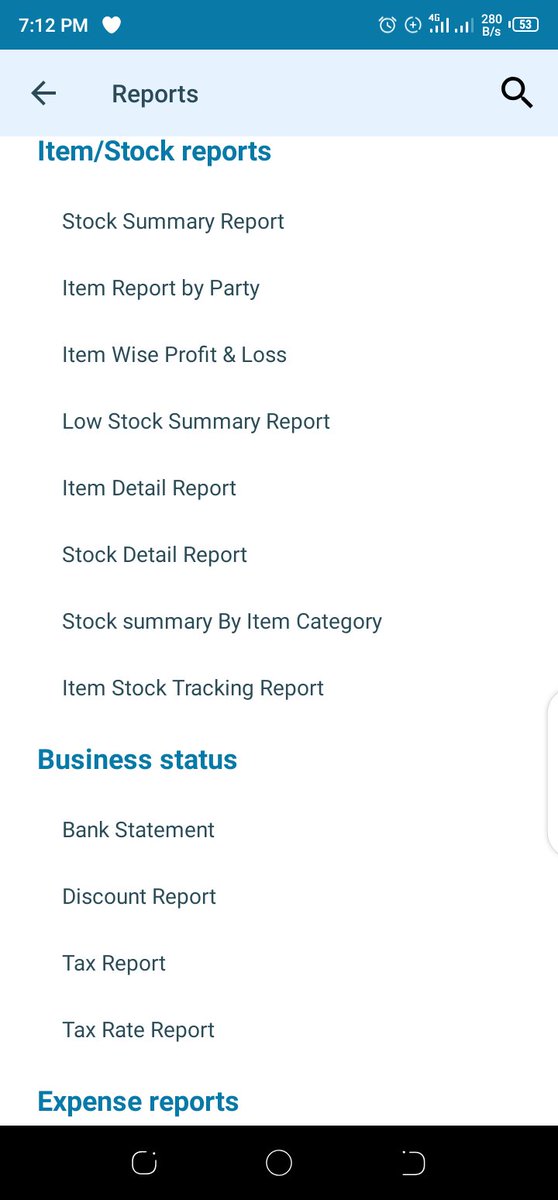

1. Digitize your business.

My background is engineering and I cannot afford to hire an accountant for my Record Keeping and other finances. I am using app for all finances. I also send e-receipt to my customers via WhatsApp. That help me in saving the cost of printing receipts

My background is engineering and I cannot afford to hire an accountant for my Record Keeping and other finances. I am using app for all finances. I also send e-receipt to my customers via WhatsApp. That help me in saving the cost of printing receipts

Another example is going 100% paperless. This can save money, lower storage cost and greater efficiency. That way, you can also avoid data loss because all your record is saved on cloud storage. You can access your data anywhere and anytime.

2. Buy generic or used items.

Used items usually cost 50-70% less than brand new items even if they're in perfect working condition. Nobody is judging you on how new your equipment is and it becomes used as soon as you operate it the first time. Why not save cost?

Used items usually cost 50-70% less than brand new items even if they're in perfect working condition. Nobody is judging you on how new your equipment is and it becomes used as soon as you operate it the first time. Why not save cost?

3. Regularly revisit your budget.

The reality is that you should be managing and tweaking your budget in real time. By staying on top of it, you reduce the risk of falling behind and finding yourself in a situation where you have to dig and claw your way out.

The reality is that you should be managing and tweaking your budget in real time. By staying on top of it, you reduce the risk of falling behind and finding yourself in a situation where you have to dig and claw your way out.

Read on Twitter

Read on Twitter