Long $MGPI

Bad stuff first: commodity contract distiller, dependency on bourbon boom continuing (bourbon sales are up 4x since 1999)

Now, the good parts:

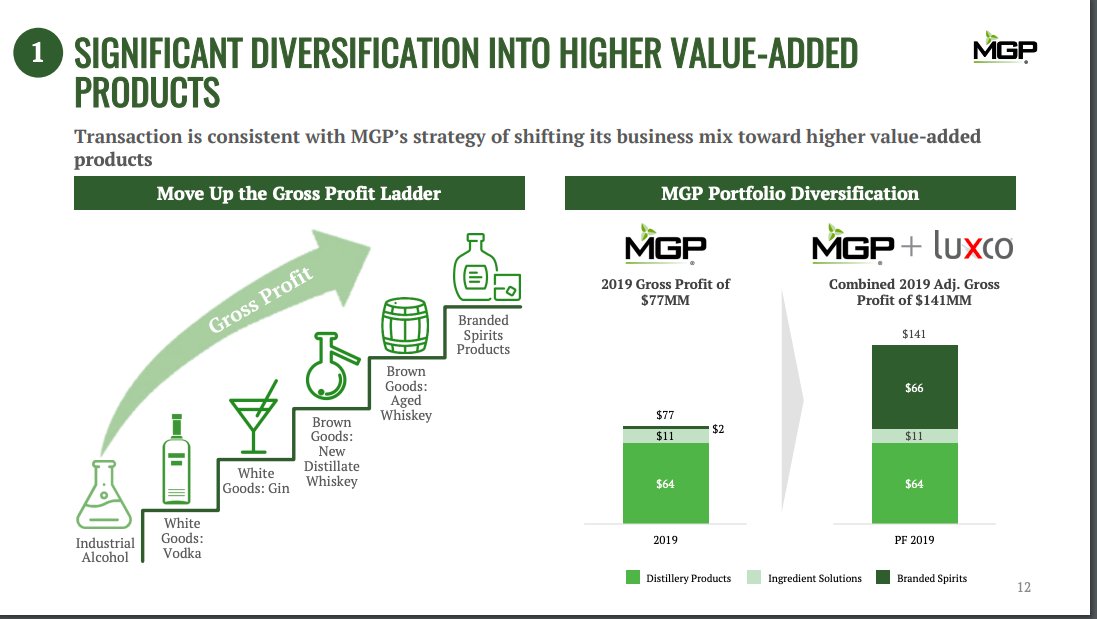

1. I've wanted to buy this for long, but the recent transaction with Luxco really made this attractive

Bad stuff first: commodity contract distiller, dependency on bourbon boom continuing (bourbon sales are up 4x since 1999)

Now, the good parts:

1. I've wanted to buy this for long, but the recent transaction with Luxco really made this attractive

2. now MGPI has both contract distilling (that powers several well known brands), plus they have brands (Ezra Brooks, Rebel Yell, Yellowstone) and most importantly distribution relationships.

Here's the brand line up

Here's the brand line up

3. Moving upstream is the right move - MGPI can go from mid-20s gross margin distilled products to mid-30s gross margin branded spirits

So they can continue to arm the "bourbon startups" with contract distilling while powering their own brands with heritage

So they can continue to arm the "bourbon startups" with contract distilling while powering their own brands with heritage

4. there's bunch of possibilities here -- MGP's own brands could take off with the enhanced distribution, international expansion for Luxco brands, post-Covid cocktail boom in bars (bourbon sales are up 8% in 2020 despite 40% drop in restaurant / bar sales)

5. the biggest potential upside, but also the least likely / hardest to do is MGPI building on the heritage brands even more..

Big thanks to @Arquitect3 for highlighting this to me.

Also, thanks to @guhlo and @hareng_rouge for their insights and thoughts here.

Big thanks to @Arquitect3 for highlighting this to me.

Also, thanks to @guhlo and @hareng_rouge for their insights and thoughts here.

Read on Twitter

Read on Twitter