Some thoughts on the Dasgupta Review and what central banks & financial supervisors can draw from it in terms of nature-related financial risks.

A thread of key quotes: https://twitter.com/katie_kedward/status/1356526288333377536

A thread of key quotes: https://twitter.com/katie_kedward/status/1356526288333377536

From the outset, the report acknowledges finance as non-neutral:

"Finance plays a role in determining both the stock of natural capital and the extent of human demands on the biosphere" (p.467)

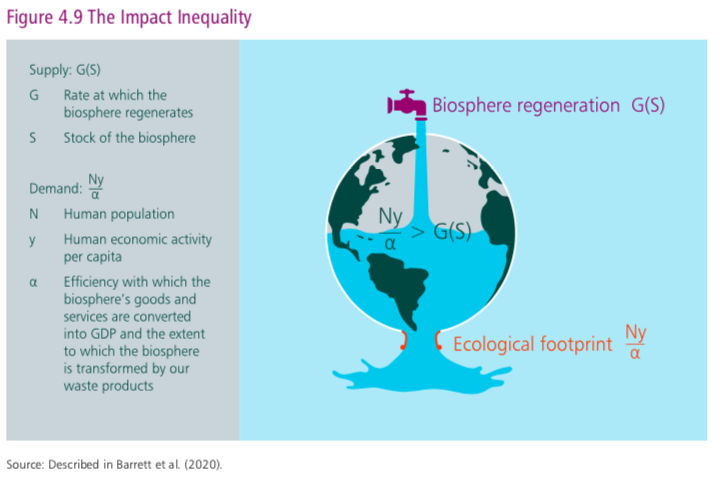

i.e. it influences both sides of this impact inequality:

"Finance plays a role in determining both the stock of natural capital and the extent of human demands on the biosphere" (p.467)

i.e. it influences both sides of this impact inequality:

It's not just about green but also harmful finance:

"Existing private financial flows adversely affecting the biosphere outstrip those that are enhancing natural assets & there is a need to identify and reduce financial flows that directly harm & deplete natural assets" (p.472)

"Existing private financial flows adversely affecting the biosphere outstrip those that are enhancing natural assets & there is a need to identify and reduce financial flows that directly harm & deplete natural assets" (p.472)

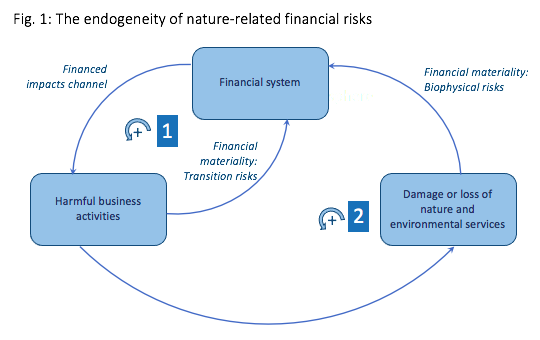

Yet the report critiques existing green/ESG approaches for being "primarily concerned with the impact of the environment on financial returns as opposed to the investment’s impact on the environment" (p.479)

In other words, double materiality is relevant: https://twitter.com/katie_kedward/status/1304426965848514561

In other words, double materiality is relevant: https://twitter.com/katie_kedward/status/1304426965848514561

Hence importantly for financial authorities:

"An assessment of a financial institution’s impacts, in addition to its dependencies, on natural capital is important in understanding exposures to both transition and physical risks" (p.428)

Note the TCFD currently neglects impacts.

"An assessment of a financial institution’s impacts, in addition to its dependencies, on natural capital is important in understanding exposures to both transition and physical risks" (p.428)

Note the TCFD currently neglects impacts.

Dasgupta doesn't shy away from uncertainties in pricing nature:

"Nature-related risks are characterised by deep uncertainty ... related to tipping points and regime shifts, complex transmission channels, and potentially far-reaching impacts on all agents in the economy." (p.423)

"Nature-related risks are characterised by deep uncertainty ... related to tipping points and regime shifts, complex transmission channels, and potentially far-reaching impacts on all agents in the economy." (p.423)

Chapters 3-5 deal with this topic in depth - demonstrating the economic rationale for quantity-based policies over price-based mechanisms.

The quote below encapsulates a precautionary policy approach. The implications of this for financial policymaking are worth dwelling upon.

The quote below encapsulates a precautionary policy approach. The implications of this for financial policymaking are worth dwelling upon.

Indeed citing our @IIPP_UCL research

"There is a role for precautionary policy intervention by govts & financial regulators to compensate for the inability of markets to react in the face of potentially catastrophic losses related to tipping points" p425 https://twitter.com/katie_kedward/status/1296386555456741381

"There is a role for precautionary policy intervention by govts & financial regulators to compensate for the inability of markets to react in the face of potentially catastrophic losses related to tipping points" p425 https://twitter.com/katie_kedward/status/1296386555456741381

Dasgupta is clear that managing NRFR is relevant to financial authorities due to systemic potential of risks, but it also states they "can play a key role in the necessary shift [in finance] by changing their own assessment horizons and using their regulatory powers." (p.494)

The report has gained attention for its advocacy of natural capital accounting & other 'pricing nature' approaches. But delving into it, there is also a lot of nuance in terms of the variety of instruments needed to tackle nature loss, including the renewed role for regulation.

There is lots for central banks & financial supervisors/regulators to draw from its insights into double materiality, deep uncertainty, limitations of price-based mechanisms, and a precautionary approach to avoiding harm... in their design of green-supporting financial policy.

And with that... over to @NGFS_ @bankofengland @banquedefrance @DNB_NL @despresmorgan @GoulardSylvie @FrankElderson @Lagarde @Isabel_Schnabel

I look forward to future discussions! [END]

I look forward to future discussions! [END]

Read on Twitter

Read on Twitter