NatWest, Barclays, Midlands, Lloyds. Black horse apocalypse? Or vital tools of prosperity!

Today in pulp I'm looking at money. Lots of it...

Today in pulp I'm looking at money. Lots of it...

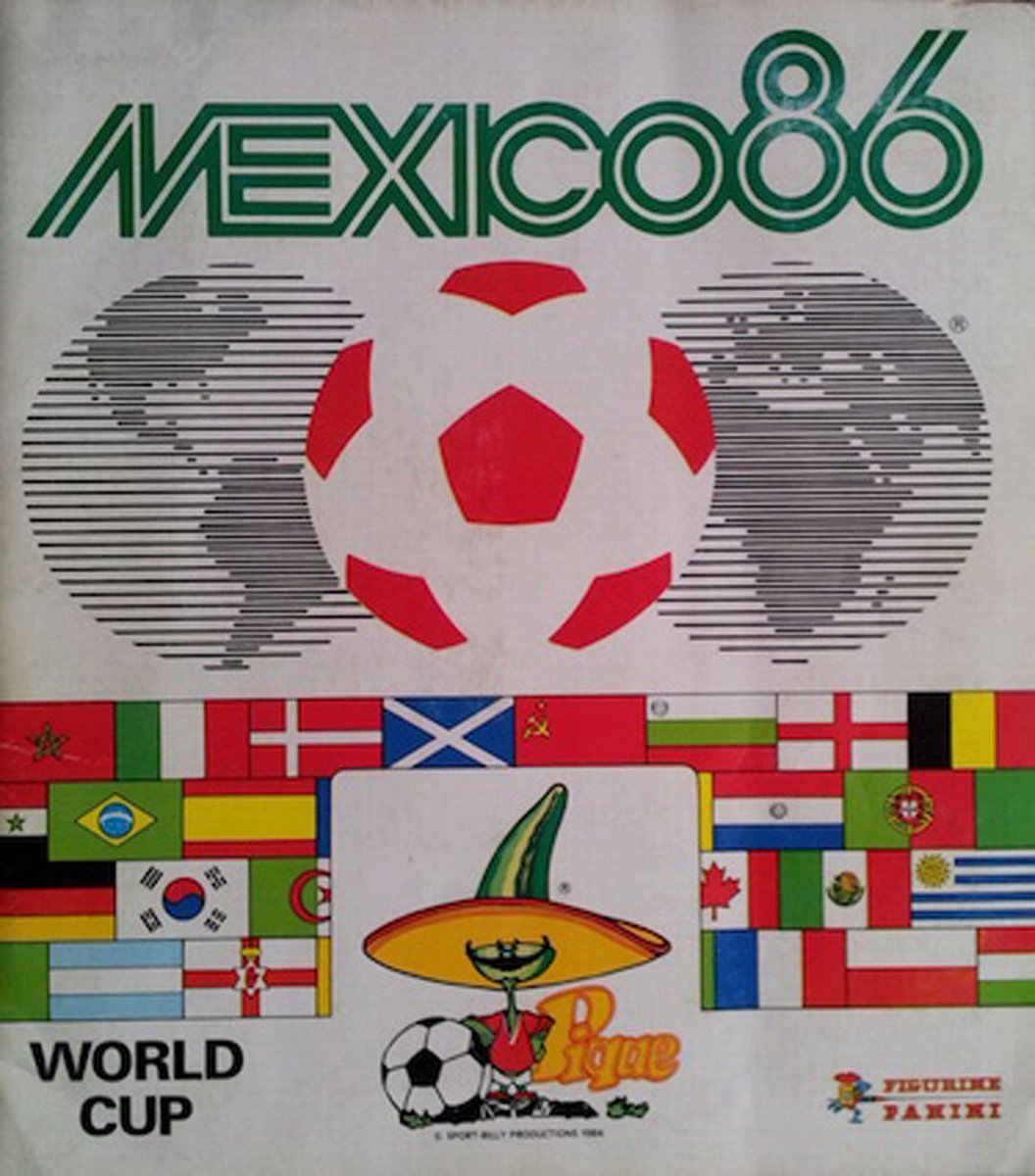

Money is just a token, like a Panini football sticker. In itself it has no intrinsic worth. However it is desirable because, well, football!

Initially the value of all stickers is the same, because there's an abundant supply...

Initially the value of all stickers is the same, because there's an abundant supply...

However as you fill up your Panini album the value of your existing stickers drops and the value of your missing ones rises. This is due to scarcity: the law of supply and demand starts to determine worth and value, rather than number of completed passed or shots on target.

Finally you fill up your Panini album and you no longer swap spare stickers for other ones - now you can swap them for cigarettes instead. This is because you now posess capital, so you can move into commodity swaps.

Then a new Panini album arrives and it's back to square one...

Then a new Panini album arrives and it's back to square one...

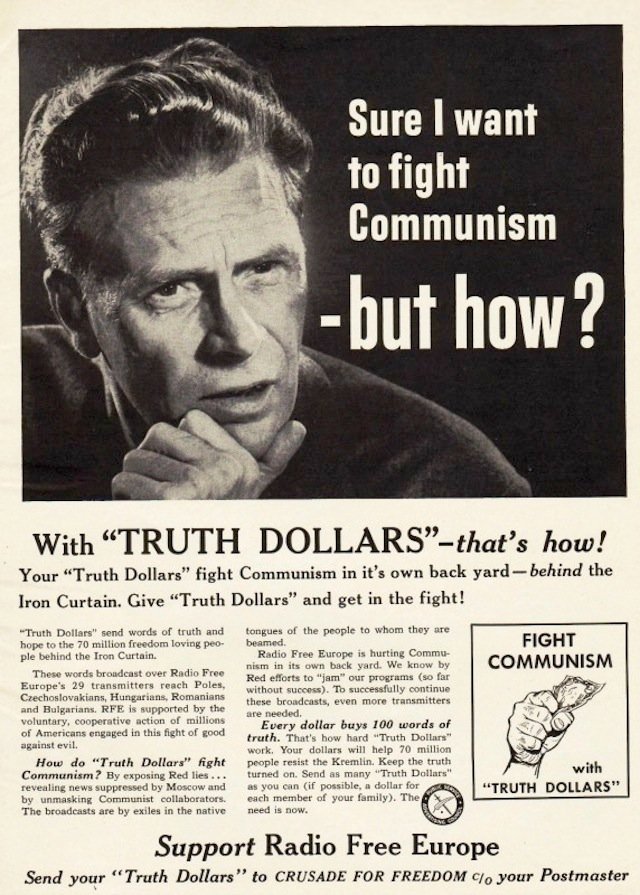

The fact that modern money isn't linked to anything of worth greatly annoys some people. They want us to go back to the Gold Standard.

History suggests this often ends badly...

History suggests this often ends badly...

Instead we now have fiat* money: it's linked to a promise to, er, swap it for some more money, backed by all the assets a nation owns. Which your taxes bought.

Money is in fact a confidence trick, which is why market confidence is such a valuable commodity!

(*file photo)

Money is in fact a confidence trick, which is why market confidence is such a valuable commodity!

(*file photo)

Now at this point I should mention cryptocurrency. This is private imaginary money based on algorithms and voodoo. It's backed up by maths rather than banks and is either the future of everything or the new tulip mania. Either way I'm sure it will all end well.

It's often said that money can be 'made' on the stock exchange. Normally this involves gambling, which should only be attempted with other peoples' money. For a fee. Plus tax.

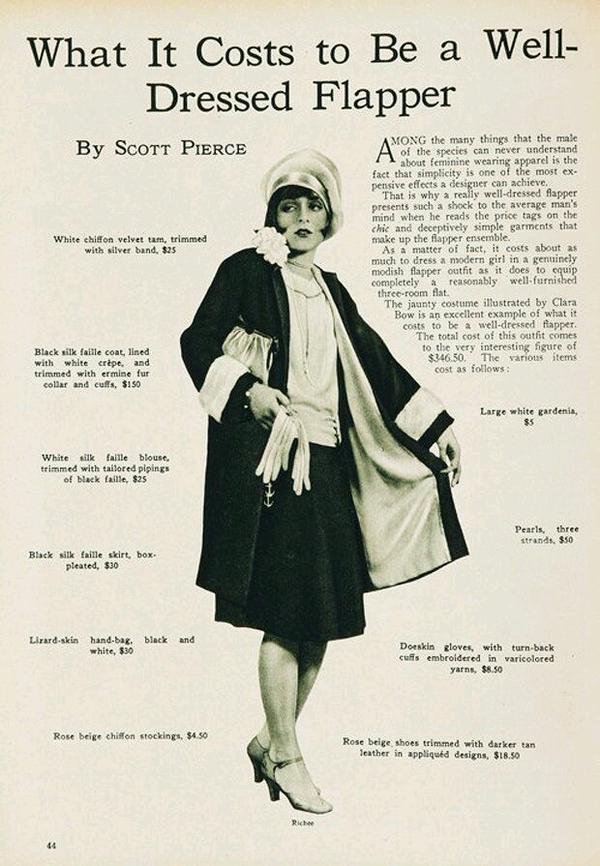

Basically it costs money to make money. Even if you don't have any. That's why people borrow to invest.

Basically it costs money to make money. Even if you don't have any. That's why people borrow to invest.

Stocks aren't the only way you can make money for your broker: you can also invest in commodities, futures, derivatives, go short, go long and take part in the Yen carry trade.

Whatever you do the outcome is uaually the same...

Whatever you do the outcome is uaually the same...

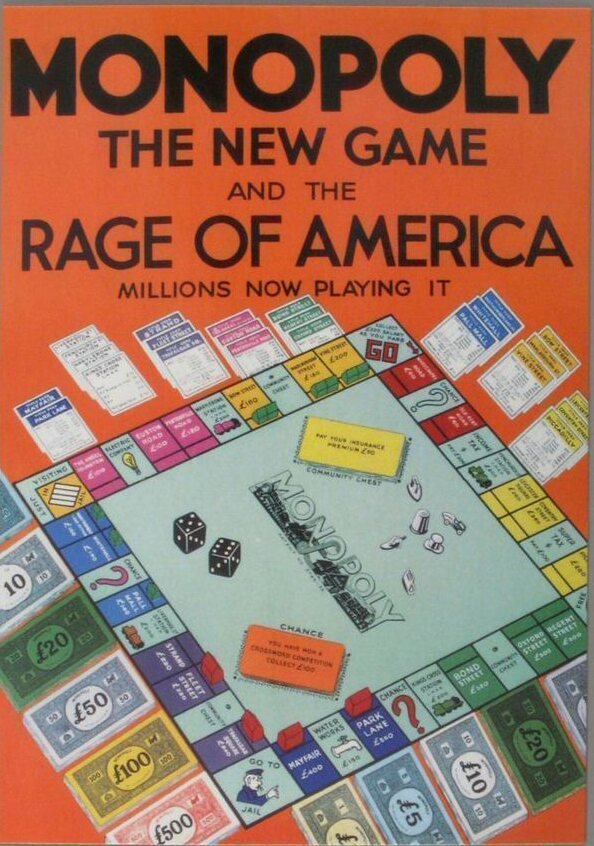

Most of us are first introduced to money through the game Monopoly. Here the strategy is to buy up property by taking money from the bank when mum isn't looking, then trying to land in jail whilst everyone else lands on your streets.

This explains a lot about modern finance.

This explains a lot about modern finance.

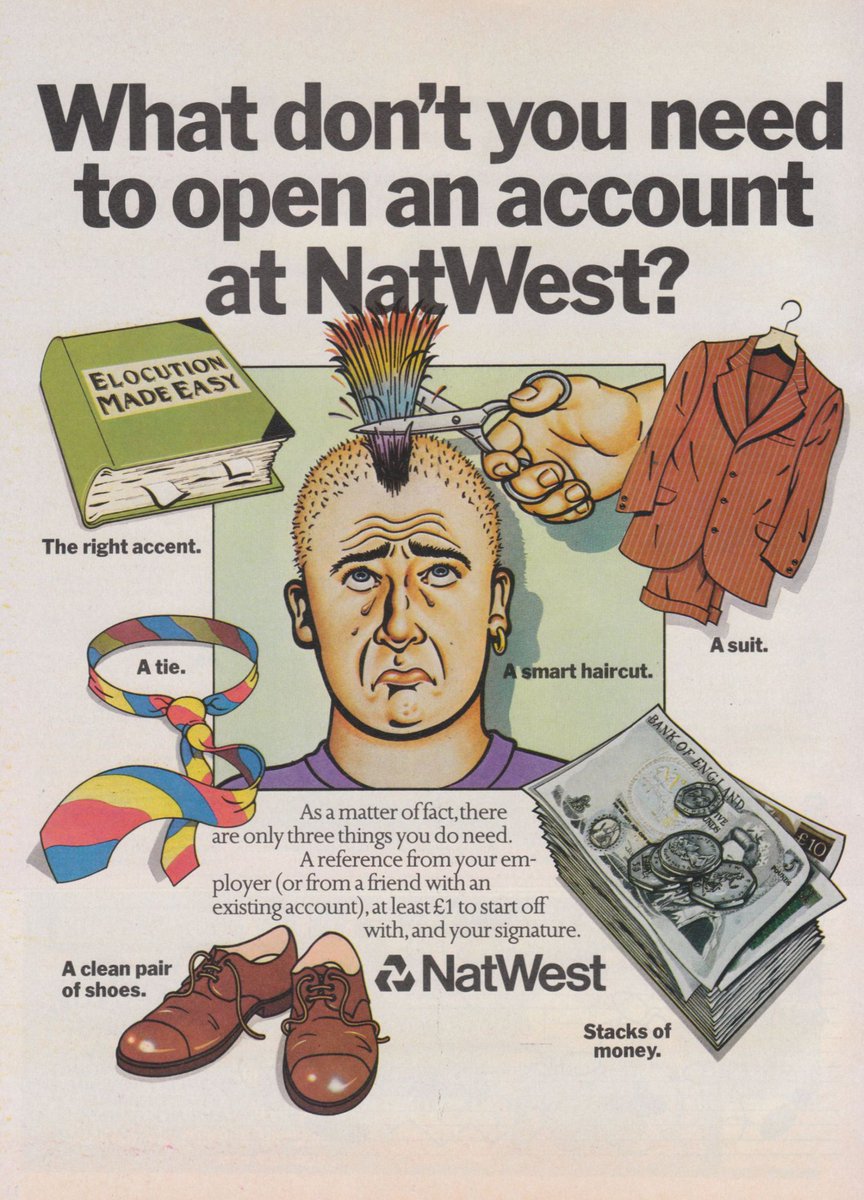

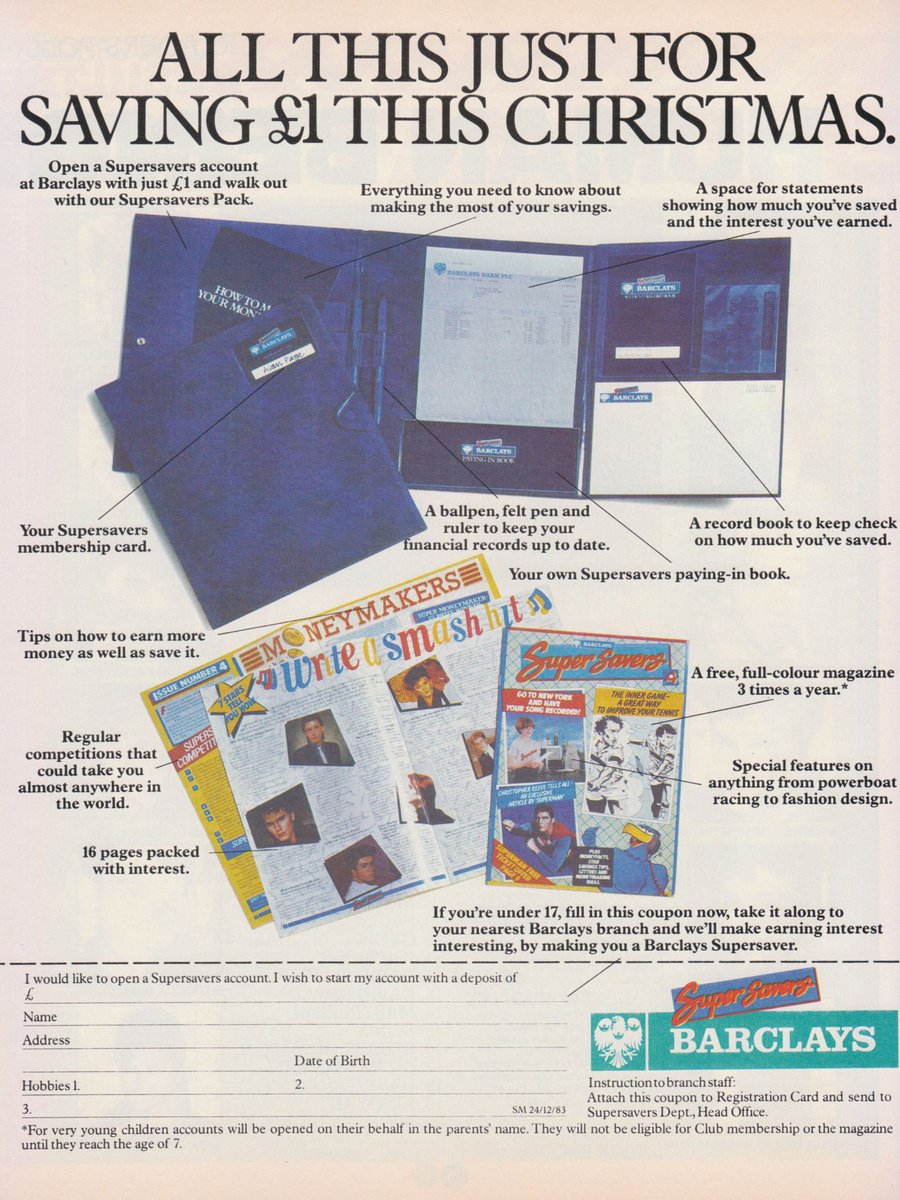

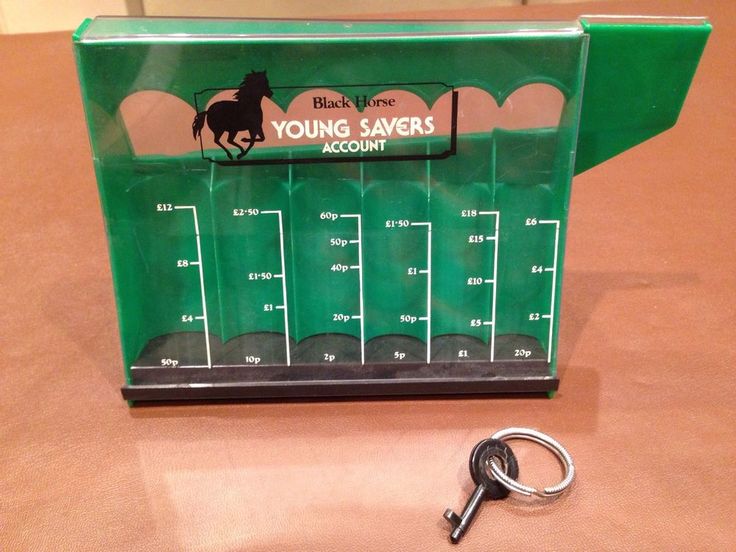

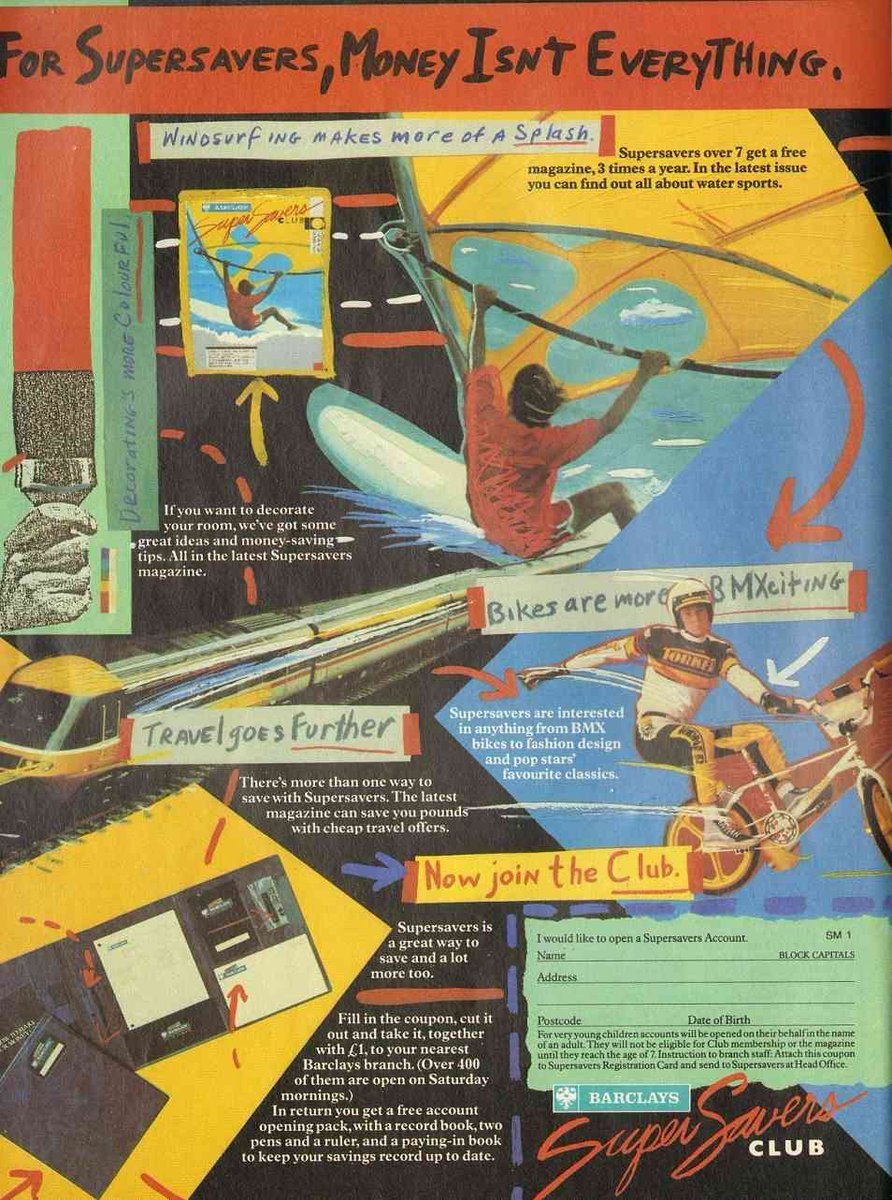

Then as we get older banks try to lure us into giving them our money, in return for a free sports bag or money box. They're hoping we'll later give them our first pay packet when we start work, rather than investing it in Benson and Hedges or pints of snakebite and black.

Fortunately for those easily confused about money there's no shortage of financial advice out there. Often it phones you up unannounced. It is literally a buyer's market.

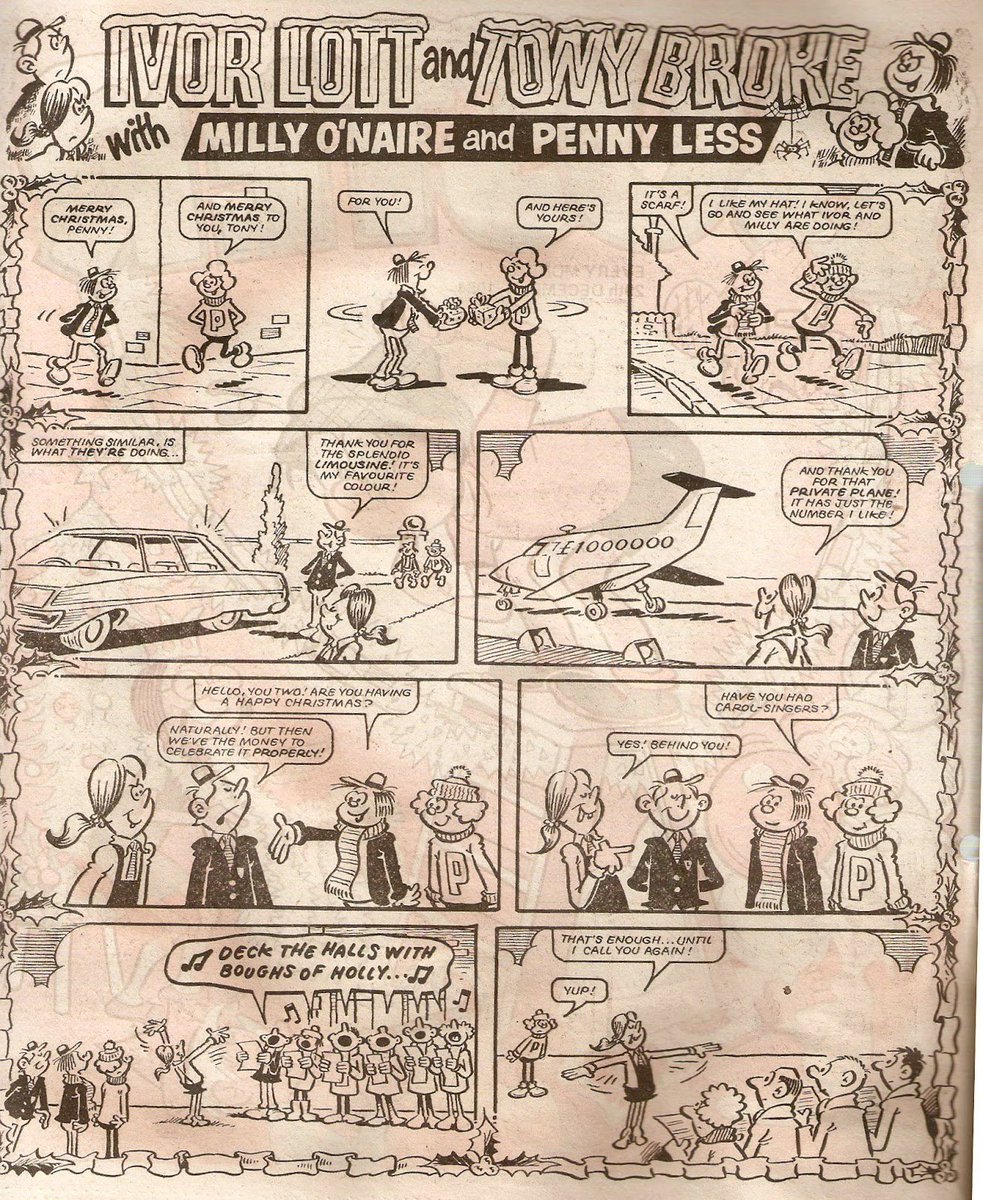

Part of money's allure it that it confers status. We're all anxious about our position in the pecking order and money seems like a short-cut to advancing our social rank and gaining the approval of our new wealthier peers.

Psychologists suggest that we only need enough money to satisfy our basic needs; anything over that does not hugely extend our happiness.

Fortunately 'basic needs' is an elastic concept, especially when marketing is involved.

Fortunately 'basic needs' is an elastic concept, especially when marketing is involved.

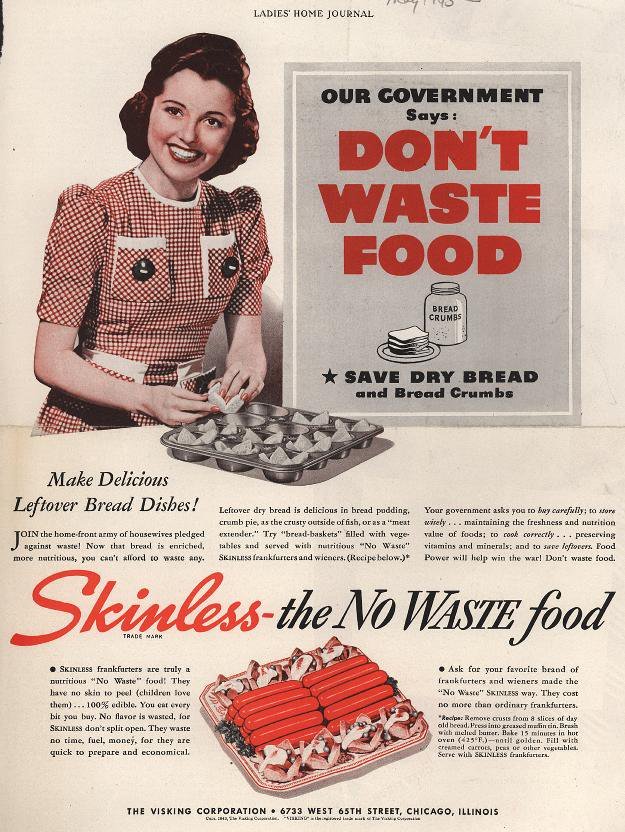

Alternatively we can try to be frugal, making our money go further. Taken to extremes this can become addictive for some people: fights over discounted Breakaway biscuits at Asda may be unseemly, but for others this is simply capitalism red in tooth and claw!

Sadly we can't just sit on our money: inflation nibbles away at its value reducing it to mere loose change over time. The main measure of UK inflation is the cost of a Freddo bar: I bought mine for 2p in 1975 and I'm not selling !!

In the end the only way to stop worrying about money is to stop worrying period. Fortunately there are many ways to do this. Unfortunately they all cost money. So it goes.

More #fintech another time...

More #fintech another time...

Read on Twitter

Read on Twitter