1/ With markets riveted by the action in $GME, attention has been turned to evil short sellers, which is natural. The action in $GME is made more compelling by the breathless reporting in the media that it was so heavily shorted, with more than 100% of its float short. Ooohhh.

2/ You know why investors get involved in heavily shorted names, and keep shorting them?

Because it works.

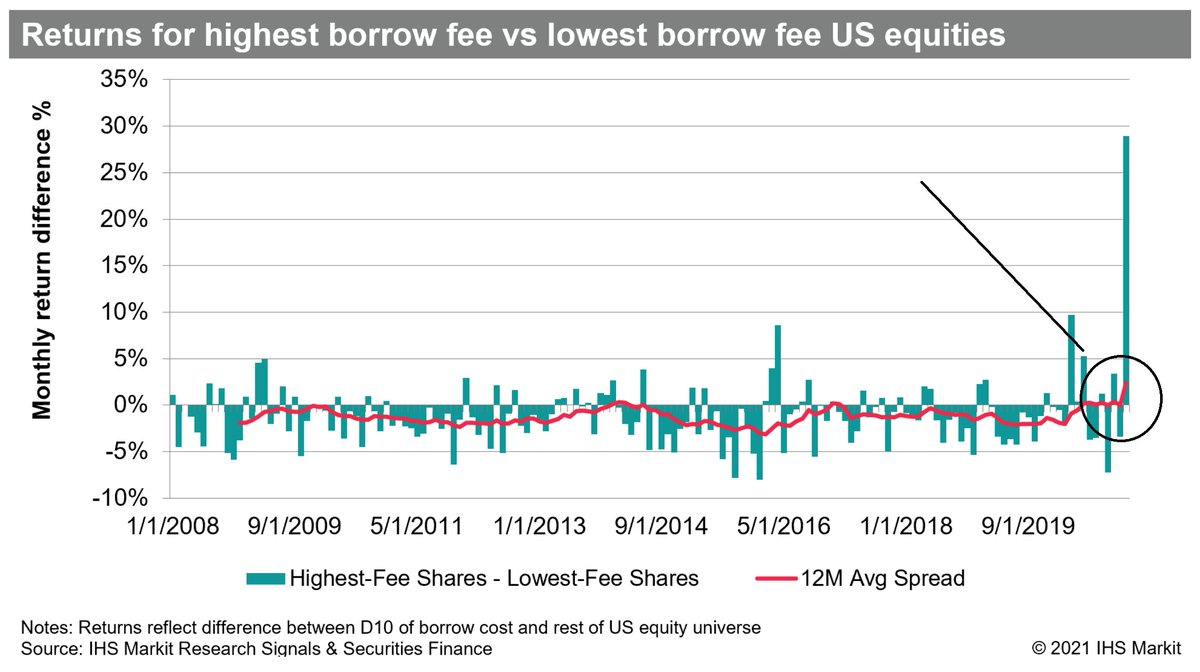

From March '08 through March '20, the most expensive to borrow US equities underperformed the least expensive to borrow shares by an average of 1.3% per month.

Because it works.

From March '08 through March '20, the most expensive to borrow US equities underperformed the least expensive to borrow shares by an average of 1.3% per month.

3/ Except for now. January 21 was the worst month in history for the most-heavily-shorted stock factor. And it hasn’t just been January. The rolling 12m average spread between high and low fee shares turned positive recently for and has remained there since.

4/ Including the MTD return through January 28th, the highest fee (in terms of borrow cost) US equities have outperformed by 2.6% per month on average over the past rolling 12 month period.

5/ This most recent 12-mos period is the only instance in the last 12 yrs when shorting the most shorted basket has hurt, as you can see from the chart below.

6/ In every other rolling 12 month period, you were rewarded by shorting the most shorted basket. Gee, what’s happened in the last twelve months that would change things?

7/ According to IHS Markit, the most heavily shorted names outperformed the least shorted by 23.9% MTD through January 28th.

8/ The nearest competition for "worst month for short factors" consists of April 2009 when the most shorted outperformed +15%, and April 2020 (most shorted outperformed by +21%), per the IHS Markit Research Signals database.

9/ Ranking by the percentage of shares on loan yields a similar result for January, with most-borrowed outperforming by 23.6% MTD. This is record outperformance, never seen before. And I’ve got a secret for you: it ain’t just $GME and $AMC.

10/ If both $GME and $AMC were removed from the analysis, the relative outperformance of high-fee US equities would still be more than 25% for MTD January as compared with the lowest-fee shares, according to HIS Markit.

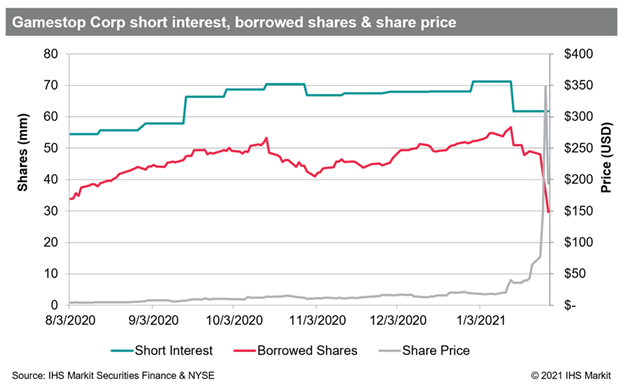

11/ “GameStop” and “short squeeze” are now inextricably linked in lore. GME was at $19 on Jan 12th, $31 on Jan 13th, $43 on Jan 21st, and $347 on Jan 27th. According to IHS, the 5.6m share reduction in shares on loan tied to settling Jan 13th trading. . .

12/ . . .had only declined slightly in reaction to this first large single day increase in price, suggesting short covering wasn’t that big of a catalyst.

13/ In other words, the majority of the short position remained in place as of Jan 15th. The number of shares on loan declined by another 19m shares from Jan 22 - 28, suggesting that a larger portion of the short position was covered amid the surging share price during that week.

14/ Total short interest (or shares on loan) for GME was only a tiny fraction of the traded volume during this time. Clearly, short covering in GME had AN impact at specific points in time, but short covering (as usual) can only go so far in explaining the sharp jump in price.

15/ This wasn’t a stick-it-to-the-man-short-squeeze. No no. It was the man, in the form of a mid-sized hedge fund and institution, jumping on the momo train and flipping shares to unsuspecting retail who performed it’s role as buyer of last resort perfectly. Congrats Reddit!

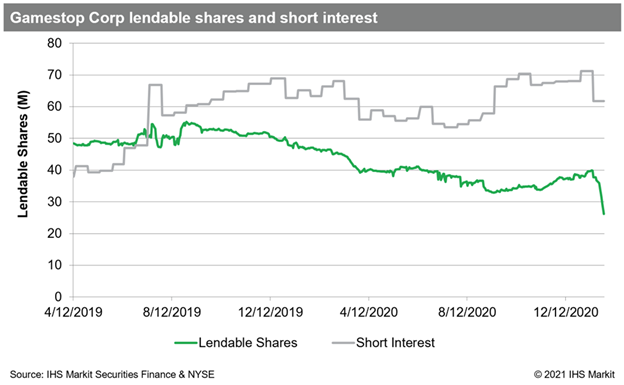

16/ Wait, it gets better. “The supply of shares from beneficial owners in securities lending programs can be tracked as a real-time indication of availability from institutional owners of shares. . .

17/ . . . while the gap between the exchange short interest and borrowed shares provides an indication of shares sourced by broker dealers away from the traditional securities finance channel.” They mean retail.

18/ As institutions sold into the insane rally, they called their shares back from stock loan and the gap was made up from retail brokers and customers supplying shares into the short. I.e., buying at the top. Thanks Guys!

19/ DDD is another example of when short covering may be a catalyst, but is rarely the lasting catalyst. On January 7, shares on loan in DDD declined by 14.8m shares (out of 197m shares of traded volume that day).

20/ But DDD share price has increased by another 65% since January 7th, with only a 5m share reduction in borrowing, suggesting that short covering has had rather minimal impact on the trend higher after the initial squeeze. Thanks Retail!

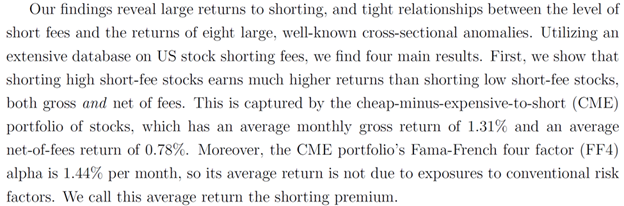

21/ Back to my original point: The academic research on the outperformance of shorting the most expensive basket is deep and compelling. Here are a few snippets from just two papers, which show that on average, the most shorted basket has outperformed by 1.3% gross PER MONTH.

22/ And it’s only the most shorted basket that works like this. Shorting the average stock is pointless, or at least it has been for the past twelve years. Thanks Vanguard! Thanks Blackrock!

23/ And our old pal Merton Miller explained a long time ago, that doing away with shorting results in, get this, overpriced securities, yuk, yuk. Who knew?

24/ And for you media types, the academic research even looks at returns from companies that ACTIVELY TRY AND FIGHT BACK AGAINST SHORTS. You’ll never guess, but the firms that put up the biggest fight against evil shorty perform even worse than the average highly shorted name.

So in this day of Alice in Wonderland, where up is down and down is up, there is only one answer:

Get Shorty.

Or, maybe better: get short, preferably a high cost basket of names. . .

Get Shorty.

Or, maybe better: get short, preferably a high cost basket of names. . .

Read on Twitter

Read on Twitter